The year 2023 was full of surprises for investors. The first shocker came when an amendment to the Budget did away with the indexation benefit that debt funds enjoyed. Capital gains from debt funds, which used to be taxed at 20% after indexation, were now to be taxed at the slab rate applicable to the individual. In one fell swoop, the Finance Act 2023 removed the tax advantage that debt funds had over fixed deposits.

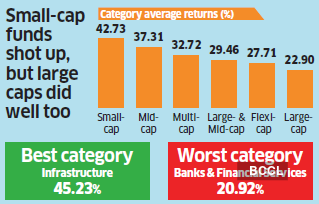

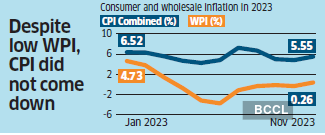

The other developments were not as jarring. The stock market remained in the doldrums for almost nine months, with the Nifty delivering insipid returns of 5% between January and October. Then it took a shot of adrenaline and rose 15% over the next three months as political uncertainty dissipated. Small- and mid-cap stocks were in the limelight, with the small-cap index shooting up almost 54%, and the mid-cap index rising almost 45%.

Investors in gold were also pleasantly surprised when the first tranche of the Sovereign Gold Bonds (SGBs) matured in November. Issued in 2015 at Rs.2,684 per gram, the SGBs were redeemed at Rs.6,132, delivering tax-free compounded annual returns of nearly 11%. Investors also received 2.5% interest per year on their holdings, though it was taxable.

Report card 2023

How investments fared during the year.

What’s in store for investors in the new year? Equity markets are on a roll, and it appears that sustained buying will take the Nifty beyond the 22,000 milestone soon. The bond market is also expecting good news. Though the RBI has kept the rates unchanged, analysts believe there will be rate cuts in 2024.

We reached out to experts to know what investors should do now. While most are optimistic about equity markets, they also advise restraint and tempering of expectations. Earning reasonable returns from the stock markets is fairly easy if you are disciplined and patient. A recent study by Sharekhan shows that both these qualities are missing in the new investors playing the F&O market. Prudent investors should stay away from these weapons of mass wealth destruction. Based on what the experts have told us, we have put together 10 smart money moves that can safeguard your finances and help you grow wealthier in the new year. We hope you will find these useful. Wishing you good health, prosperity and safety in 2024.Rebalance portfolio to reduce risk

The stock market rally would have skewed your asset allocation. Restore it by booking some profits.

Equity investors had a dream run in 2023, and it seems the rally will continue this year as well. At the same time, it’s a good idea to take some of the gains off the table. This is especially true for small- and mid-cap stocks that may be running ahead of their fundamentals.

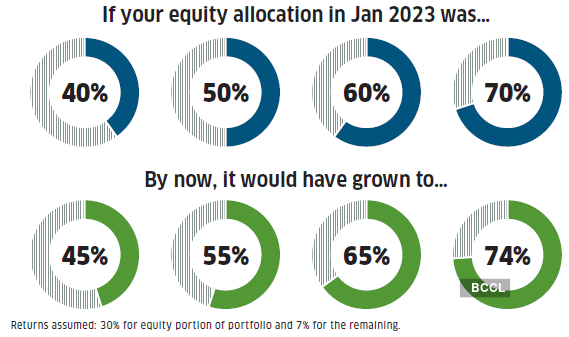

Profit booking is also required if you need to rebalance your portfolio to reduce the risk it is exposed to. Experts say rebalancing should be done once in 1-2 years to restore the desired asset allocation. However, they also say rebalancing is needed only if the allocation to an asset class has changed by more than 10 percentage points.

The rally in equities in 2023 would have certainly changed your asset mix, but not too much. Assuming 30% growth in the equity portfolio and 7% returns in the fixed income portion, an investor with 70% in equities at the beginning of 2023 would have roughly 74% allocated to stocks now (see graphic). That’s not a very worrisome level. So, if you rebalanced at the beginning of last year, you don’t really need to do anything now. However, if you have not reviewed your portfolio in a while, assess the asset mix and make appropriate changes.

Rebalancing is also not required if you hold dynamic asset allocation funds. Unlike balanced funds, which maintain a 65% exposure to equity and invest the rest in debt, dynamic asset allocation funds can invest between zero and 100% in equities, depending on the market conditions.

Some funds depend on the fund managers’ ability to read the situation, while others follow a rule-based approach. When the market valuation is high, these funds will reduce the exposure to equities and shift to the safety of debt. When the markets decline, they ramp up the allocation to equities, while slashing the exposure to debt.

It may seem like a win-win situation for the investor, there is also a downside. Dynamic asset allocation funds tend to lose out if the markets continue rising when they have reduced the equity exposure. Also, given that they do not maintain a 65% exposure to equities, they do not qualify for the favourable tax treatment to equityoriented funds.

Did your asset mix change in 2023?

The rally in stocks may have changed your allocation, but not too much.

Reduce exposure to mid and small caps; focus on large caps

The outperformance by mid caps and small caps has set the stage for reversion to mean in 2024.

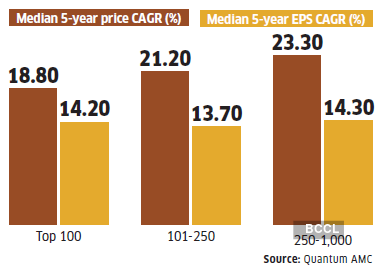

Mid- and small-cap stocks ran the show in 2023, with the broader indices gaining 41.75% and 45.2%, respectively, during the year. Large-cap stocks, on the other hand, lagged far behind, with the BSE 100 index inching up 19.3%. This sharp outperformance by mid and small caps has set the stage for a reversion to mean heading into 2024.

Though not cheap, valuations in the large-cap segment are now far more benign. The BSE 100 index is trading at a PE multiple of 24.7 times, compared to 28 and 26.5 times, respectively, for the mid- and small-cap indices. Even as several mid- and small-cap stocks have seen sharp cuts, the correction is rather modest compared to the meaty rise witnessed in their stock prices over the past 6-7 months. It has hardly made a dent in the lofty valuations for some of the high-flying stocks in these two baskets.

Further, the earnings growth for businesses in the mid- and small-cap universes has sharply lagged the price appreciation in the space over the past few years. Analysts at Kotak Securities observe, “Several low-quality mid caps and small caps, in general, are in a bubble market, with the market attaching unrealistic narratives to many stocks.”

Owing to the above reasons, analysts reckon that large-cap stocks are better positioned to deliver outperformance in the future. Analysts at Kotak Securities observe that large-cap stocks offer a better risk-reward balance given more reasonable valuations compared to the lofty valuations of most mid- and small-cap stocks. “We find the valuations of the Nifty 50 index to be more reasonable in the context of moderate earnings growth and muted performance over the past two years,” point out the analysts. They prefer mega-caps, noting their reasonable valuations and greater immunity in the event of any negative development in the next few months.

Apart from the comfort of valuations, large-caps could also benefit from the return of foreign portfolio investors to the Indian markets as global risk appetite improves. These flows will mostly be pumped into the large-cap basket. The investors who are underweight in large caps may consider rejigging their allocation to take advantage of this shift.

However, it is critical that you continue to allocate a portion of your portfolio to mid- and small-cap stocks. While the nearterm outperformance may be driven by large caps, the long-term growth dynamics in the country favour the mid caps and small caps. These segments will continue to offer a higher potential for wealth creation for those who have a longer investing time horizon.

Frontline stocks offer better riskreward proposition

Many mid caps and small caps have raced far ahead of the fundamentals.

Invest in infrastructure sector stocks and funds

Massive capex spending by government spells strong order books and healthy balance sheets.

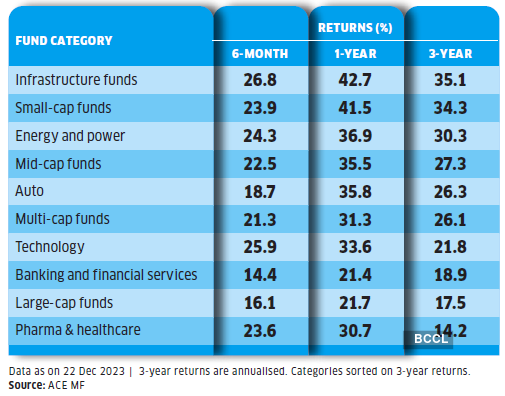

The prospects of the infrastructure sector are buoyant as the government sharpens its focus on development of roads, railways and urban infrastructure (irrigation, airports, telecom). Schemes like NIP, PM Gati Shakti, National Monetisation Pipeline and Bharatmala Pariyojana, introduced in recent years, are providing strong support to the sector.

In the Union Budget 2023-24, the government raised capital expenditure outlay by 33% to Rs.10 lakh crore. An October 2023 CRISIL report expects India’s infrastructure spending to double to Rs.143 lakh crore between 2023-24 and 2029-30.

In 2023, the Nifty Infrastructure Index significantly outperformed the market benchmark by delivering over 37% returns, compared to the Nifty 50 with 19.5% returns. Among the NSE sector indices, the infrastructure index is the third best performer after the realty and auto indices.

The sector holds significance as the creation of new infrastructure and upgrading of existing infrastructure is expected to raise the country’s competitiveness. Moreover, the investments in the sector and the resultant increase in employment will fuel domestic demand and contribute to economic growth. In the past four years, infrastructure investments have clocked a compounded annual growth of 10%.

Segment-wise, roads and power are expected to remain major contributors to infrastructure development in the future, whereas EVs, solar, wind, and hydrogen will gradually pick up pace, adds the CRISIL report. Though the order books of road construction players are strong and provide good revenue visibility, the project awarding by NHAI between April and October 2023 remained subdued. It fell by over 48% in the first seven months of 2023-24 over the same period last year. The awarding is expected to improve over the next few quarters, state analyst reports from Centrum Broking and Motilal Oswal.

While the NHAI awarding was weak, awarding activities were better from state governments in segments such as roads, irrigation, metro, water and mining. Strong opportunities are expected in some states, including Maharashtra, Uttar Pradesh, Bihar and Telangana, states a Phillip Capital report.

The moderating input prices will further provide support to the sector. The margins and profitability for road construction companies are expected to improve in the second half of 2023-24 due to the decline in steel and aluminium prices, states the Motilal Oswal report. Steel prices have fallen close to 25% and aluminium prices by 32% since April 2022.

Analysts believes that companies with strong order books, healthy balance sheets and diversified operations are likely to perform better in the future. Analyst reports from Centrum Broking, HDFC Securities and Phillip Capital are bullish on PNC Infra and HG Infra, whereas Motilal Oswal and Nuvama reports are optimistic about KNR Constructions.

While the infrastructure sector provides good investment opportunities, some investors may not be comfortable investing in stocks directly. They can opt for infrastructure mutual funds. Such funds are a good alternative as investing through the mutual fund route provides benefits of diversification and minimises or eliminates company-specific or internal risks.

Infra funds are the best performers

Despite the heady performance, there is still a lot of steam in the category

Lock into high-yield NCDs

Interest rates are at their peak. Invest in bonds or non-convertible debentures before they recede.

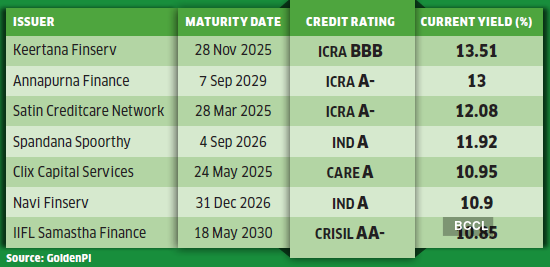

Experts believe that interest rates are near their peak and expect them to recede in 2024. They suggest using this window to lock into the prevailing high yields via individual bonds or nonconvertible debentures (NCD). Top-quality NBFCs are offering more than 8% yield right now. Lower grade issuers are offering around 10-11% returns. Rather than wait to catch the peak rates, it may be a good idea to lock into longer tenures of, say, five years right away. This will allow you to fetch the higher yield for longer and avoid the risk of having to reinvest the maturity proceeds at lower yields if rates fall in the interim.

However, do not chase yields blindly. Higher yields are typically accompanied by higher risk. Investors must enforce strict hygiene rules when picking individual bonds and NCDs. Make sure you are diversified across a minimum of 4-5 different issuers, with no single issuer accounting for more than 5% of your total portfolio. Go for issuers with lower leverage, or debt-equity ratio. Stick with listed NCDs. In case of NCDs with longer tenure or cumulative payout, it may help if it is accompanied by a put option, as it will allow you an early exit if you perceive elevated risks.

Be wary of opting for longer tenure bonds of lower rung issuers. Default risk can get more pronounced over longer maturities if business conditions deteriorate over time. Stick with short-term bonds if the issuer is not in the top rung. An issuer’s 60-month NCD offering 11% may actually carry a far higher risk than its own 24-month NCD offering 10%.

Likewise, in case of lower grade issuers, skip bonds that offer cumulative or bullet payout and stick with regular coupon paying bonds, suggests Anshul Gupta, Co-Founder and CIO, Wint Wealth. “In case of bonds paying both principal and interest only at the end, your entire money can get stuck if the entity defaults. With regular coupon paying bonds, if the monthly payout stops, you can still exit,” he says.

Several listed bonds offer high yields

Investors must assess creditworthiness of issuers carefully and not chase yields blindly. High yields come with higher risk.

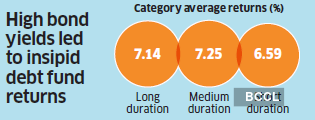

Add duration to debt fund portfolio

Bond yields are expected to cool off in 2024,which bodes well for long duration bonds.

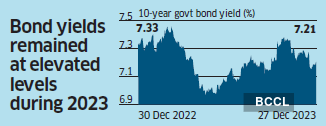

The fixed income market spent last year trying to figure out when the rate hike cycle in the Western world would hit its ceiling, and whether it would achieve a soft or hard landing in the aftermath. As the bond market kept recalculating expectations, bond yields also kept bouncing off a narrow range of 7-7.5%. The market appeared to get its answers towards the end of the year.

“As the year turns, the market hopes of a soft landing have revived with gusto and the expectation is of significant rate cuts over 2024,” indicates Suyash Choudhary, Head, Fixed Income, Bandhan AMC. “The dovish stance of the Fed meeting has effectively ended the rate tightening cycle and can thus be considered as the long-awaited ‘pivot’ in the global monetary tightening cycle,” suggests Puneet Pal, Head, Fixed Income, PGIM India Mutual Fund.

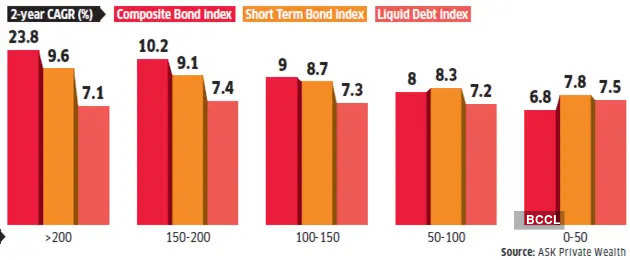

This sets the stage for cooling of bond yields over the next year, which bodes well for portfolios geared towards long duration bonds. When interest rates start falling, bond prices rise. Longer maturity bonds gain more in such a scenario as these are more sensitive to rate changes. Dynamic bond funds and gilt funds are likely to benefit from the higher price appreciation in 2024. Experts insist that it is time investors shifted to duration strategies for the coming year. Pankaj Pathak, Fund Manager, Quantum AMC, asserts, “With a high yield at the start and expectations of a fall in rates, we believe that long-term government bonds offer investors a rewarding opportunity.”

Choudhary maintains, “The past 18 months of interest rate volatility have led to an active avoidance of duration risk in favour of shorter duration, higher carry assets. However, it’s time to flip from the stance of avoiding duration risk to actively thinking about plugging the reinvestment risk from investments maturing over the next year or so.” He adds that investors will need to make incremental investments of sufficiently long maturities to be able to lift the average maturity of the entire portfolio and, thereby, partly counter the reinvestment risks arising from the investments maturing in the future.

At the same time, investors should not be swayed into opting for an unduly aggressive duration play. The markets are pricing in the possibility that other major central banks will toe the dovish line after the Fed’s pivot. However, the former have not been as explicit in their commentaries. Pal cautions, “While the rate cutting cycle has ended, rate cuts are still some time away and are likely to see some retracement in yields as the markets are already pricing in 125 bps rate cuts for 2024.” Investors need to have a longer holding period of at least 2-3 years to ride through the intermittent volatility, insists Pathak.

Long-dated sovereign bonds offer high upside

Investors could possibly earn a double-digit return on bonds if the yield drop is substantial.

Note:Interest rate drop (in basis points)

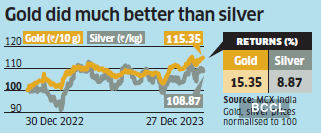

Maintain your allocation to gold

It could be useful to hold the yellow metal in 2024, but be ready for higher volatility.

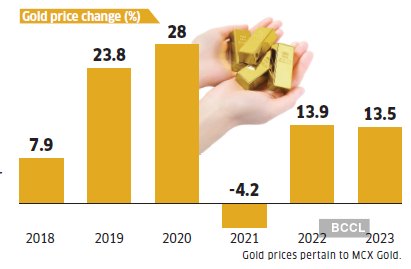

Despite the US Fed’s continued hawkish stance, gold prices showed resilience in 2023 due to persistent buying by central banks. Going forward, a complex interplay of economic factors will continue to influence the precious metal’s trajectory.

Kotak Securities analysts remark, “The prevailing geopolitical environment, slowing global growth, and economic uncertainties further enhance the appeal of gold as a safe-haven asset.” Chirag Mehta, CIO, Quantum AMC, reckons, “While a soft-landing scenario can be troublesome for gold, we assign a lower probability for such a delicate balance to be achieved. Hence, it is highly probable that the US Fed will either overtighten or under-tighten its policy, keeping gold relevant both from a risk mitigating and return enhancing perspective.”

However, after the sharp price uptick over the past two years, it makes sense to one’s temper return expectations from the yellow metal. Even as the market has priced in rate cuts in 2024, there could be negative surprises. Investors should not take a higher exposure to gold than dictated by their risk profiles.

Mehta reckons gold can be useful in 2024, but warns about higher volatility amid uncertainty over timing and extent of rate cuts. “Markets can oscillate between optimism and pessimism, creating wild short-lived swings. Use these swings wisely to build your allocation to gold,” he adds.

Gold continues to fetch healthy returns

Investors must temper return expectations from the yellow metal in the future.

Don’t bet too big on IPOs

The secondary market offers better opportunities for wealth creation.

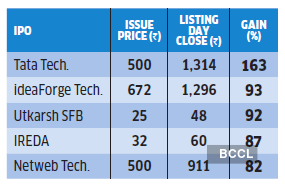

Spectacular gains

These IPOs made big listing gains in 2023.

Initial public offers raised close to Rs.50,000 crore in 2023. Some of these IPOs had spectacular listings (see table). Investors in Tata Technologies made a killing with 163% listing gains. However, don’t let these enormous gains make you forget the past IPO debacles, such as Paytm and LIC. Both stocks are still trading below their issue prices. The stocks of many new companies that had listed in recent years are also trading in the red.

Several IPOs are lined up in 2024. If you plan to invest in any of these, keep in mind that during a bull run, a lot of companies try to raise money through public issues. As an investor, you need to separate the chaff from the grain because no two IPOs are the same. Assess the stock on its fundamentals, not on the grey market premium that it commands. Keep in mind that if the price is very high, even a good company can be a bad investment. “Each stock should be considered independently and not without adequate research,” says Vinit Bolinjkar, Head of Research, Ventura Securities.

As a rule, check how the money raised is intended to be used. If the company is raising money for expansion and growth, then it is a positive thing, but if the issue has a very high offer for sale (OFS) component, it indicates that private equity and early stage investors are trying to cash out.

For all the hype surrounding IPOs, the opportunity they offer is limited. On the other hand, there are plenty of opportunities for wealth creation in the secondary market. Not only are the stocks better researched, but there are enough metrics to assess and benchmark these. Many of the multibaggers that have created wealth in the past 25 years did not shoot up on the day they got listed. These bluechips have risen steadily over the years.

Right time to buy home insurance

The rise in natural calamities in the past few years means it is crucial to insure your home at the earliest

With the rise in frequency and intensity of natural and man-made disasters, it is imperative to buy home insurance this year. “For both the landlord and tenant, it is crucial to buy the right insurance. It also provides living allowance during repairs, mitigating the financial strain of temporary relocation,” says Parthanil Ghosh, President, Retail Business, HDFC ERGO General Insurance.

There are two basic types of home covers, one for building and the other for contents. While the former covers the structure and permanent fixtures, the latter protects personal belongings. You can also opt for both in a comprehensive plan. The cost is not too high: Rs.15-30 per Rs.1 lakh for insuring the building, and Rs.30-50 per Rs.1 lakh for contents. Here are some things to consider before buying a plan.

Correct valuation: “Undervaluing the cost of reconstruction or repurchase may result in out-of-pocket expenses during a claim. So seek assistance from an assessment company to determine the accurate worth of your property,” says Ghosh.

Actual cash or replacement cash value:You can insure your house for either actual cash value (amount you’ll need after depreciation )or replacement cash value (without depreciation).

Install safety equipment: “Safety measures like installing CCTV or burglary alarms can help you earn a discount,” says Ghosh. So don’t forget to inform the insurer about these.

Policy updation: If you have renovated or modified your house, the size of cover and premium may be impacted. So make sure that you update the policy regularly.

How much home insurance do you need?

The following factors will influence the size of insurance for your home.

1.Reconstruction cost

Find out the approximate cost of reconstructing the house, not the market value of property. To know the building value, multiply the built-up area of your home with the rate of construction per square foot. So, if the built-up area is 1,500 sq ft and the construction cost is Rs.2,000 per sq ft, you will need a cover of Rs.30 lakh.

2.Location & type of house

Take a bigger cover if you live in a highrisk area that is prone to floods, quakes or other natural disasters. The type of house, whether a standalone or an apartment, will also decide the cover size.

3.Inflation

Since inflation will increase the cost of construction material over the years, take it into account while deciding on the cover.

4.Cost of contents

Prepare an inventory of the items you want to insure, such as electronic devices, home appliances, jewellery, furniture, art work, etc. List the year of purchase, model number and cost. Insurers use a standard depreciating formula to arrive at the depreciated value of the item.

5.Alternative living expenses

In case you are forced to live elsewhere due to the destruction of your house or ongoing repairs, account for the alternative or additional living expenses, such as rent, meals, etc.

6.Deductible

If you opt for a high deductible, the sum insured and premium will go down.

How to ‘career cushion’ your job

Opt for this latest workplace trend to ensure you are not caught on the wrong foot in case of a job loss this year.

Despite the optimistic hiring trend predicted for 2024 by some surveys, the job uncertainty created by mass layoffs in the past year is likely to continue for some time. With the hiring pause by Big 6 (Meta, Google (Alphabet), Amazon, Apple, Microsoft and Netflix) likely to continue, it’s best for employees to career cushion their jobs. This term refers to proactively taking steps and being prepared for an unexpected layoff. It involves networking, upskilling, updating resumes, etc.

Revive network: “This is a good time to revive all the professional contacts you’ve built over the years instead of struggling to figure out where they are if you suddenly lose your job,” says Devashish Chakravarty, CEO & Founder, SalaryNext. com. So call up people, attend events, seminars and workshops, make online connections and stay in touch.

Acquire digital & AI skills: “Digital literacy and AI skills will be required in every role and sector. If you don’t acquire these, your team is going to get ahead of you because youngsters are learning it very fast,” says Neeti Sharma, Co-Founder and President, TeamLease Edtech.

Take on more responsibility: The more widespread your responsibilities and work influence, the tougher it will be to disengage and fire you. So take on as much work, across verticals, if necessary.

Strengthen soft skills: “Strengthen your relationships across departmental functioning because it’s a known fact that between two people, the one who has weak ties across teams, will be let go of,” says Chakravarty.

Be flexible: This is not the time to be rigid about how, where and what type of work you do. “Fall in line, follow the policies, do what the company is asking you to do,” says Sharma.

Don’t jump jobs: During a job slump, it’s best to stick to your current job. “This is because if the new company resorts to cost cutting, newer employees will be the first to go,” says Chakravarty.

Stay away from option trading

Derivatives are hedging instruments meant for reducing risk. Don’t use these for speculation and wealth creation.

Option trading has assumed epidemic proportions in India. The average daily premium turnover of index and stock options is Rs.80,000 crore on the NSE alone. Why are investors pouring in so much money into this high-risk segment?

Sharekhan asked new investors in the F&O segment and got answers that are as ridiculous as they are bizarre. As many as 44% respondents are looking for a second source of income, while 40% are there to make quick money. Very few have knowledge of F&O strategies (see graphic). “Derivatives are meant to mitigate risk, but small investors tend to use these to acquire risks,” says Rajat Khullar, a financial consultant whose firm does proprietary trading in options. Options are priced low, so the loss is small and individuals don’t feel the pain.

F&O is a zero sum game. For somebody to make money, someone must lose. While savvy investors, institutions and brokerages make money on derivatives, retail investors are usually the losers. Sebi studied trading data from top 10 brokerages and found that 89% of individual traders had suffered losses in the F&O segment. The average loss per individual retail investor was `1.1 lakh during 2021-22. “We are concerned about the lack of required discipline when it comes to trading. We urge everyone to not take a casual or short-cut approach,” says Jean-Christophe Gougeon, Chief Marketing Officer of Sharekhan. Let these words be your wake-up call in 2024.

Newcomers in F&O are clueless and vulnerable

Why did you enter the F&O segment?