Taxes

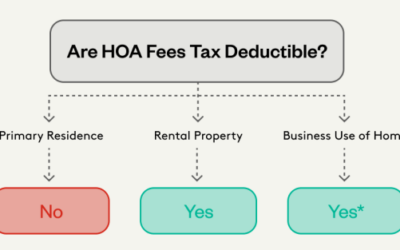

Are HOA Fees Tax Deductible? It Depends

For some homeowners and renters, HOA fees are unavoidable yearly expenses. Depending on the home and location, HOA fees may be a steep cost at hundreds of dollars or as much over $1,000 each month for certain high-end communities. With such a big cost associated with...

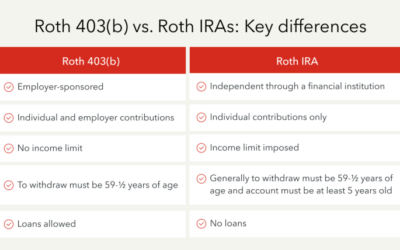

403b vs. Roth IRA: Understanding Your Investment Options

Putting together a plan to save for retirement can be a bit confusing with all the options that are available. In addition to employer-sponsored plans, there are individual plans, which further complicates the process of figuring out what’s right for you. Two popular...

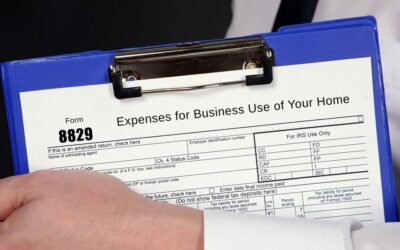

Using Form 8829 to Write-Off Business Use of Your Home

As a business owner, you can take advantage of deductions and write-offs to lower your tax liability when you file — but there are rules. If you use your home for business, you may be eligible for a deduction for the percentage of your home that you use exclusively as...

Essential Tax Tips for Maximizing Investment Gains

Investing is one way to build wealth. But, understanding the tax implications is key for maximizing your returns. By managing your taxes well, you can keep more of your hard-earned gains. This guide provides essential tax tips to help you navigate investment taxation...

TurboTax is Elevating Hoop Dreams in Atlanta

TurboTax is here to make your moves count. That’s why we’re partnering with the Atlanta Entertainment Basketball League (AEBL) to elevate up-and-coming basketball hoopers. TurboTax will be sponsoring the AEBL’s 8-week basketball season and their mission of using sport...

Small Business Owners: Optimize Your Taxes with a Mid-Year Check-In

It’s official: we’re more than halfway through the year. Time flies, but don’t let your taxes sneak up on you. If you’re a small business owner, now is the perfect moment for a mid-year tax check-in. This isn’t just a routine task—it keeps your business on track and...

Are Olympics Winnings Taxed? – Intuit TurboTax Blog

When you think of the Olympics, you probably think about the prestige of competing on the world stage. These athletes, having trained for most of their lives, get a chance to showcase their abilities to the world. For many, it is the apex of athletic achievement. As...

IRS Name Changes for Businesses in Just a Few Steps

When you file taxes, the name on your tax return has to match your Social Security number (SSN) or employer identification number (EIN). The IRS checks this information to verify your identity. If you’re considering changing your name or the name of your business, you...

What are Alston Awards and the Tax Implications?

By now, you have probably heard that high school and college athletes can use their Name, Image, and Likeness (NIL) to make money while playing college sports, but there is a second form of compensation for NIL athletes called Alston Awards. You may be wondering,...

14 Money Management Tips for Beginners

Anyone can improve their finances by taking them seriously and making informed decisions. Conducting a financial check-up on yourself every six months can help you stay on track and prevent problems before they get out of control. Once you complete your semi-annual...

First Time Investors, Here’s What You Need To Know About Taxes

The number of people investing in stocks has increased over the years, especially when it comes to Millennials and Gen Z. Investing for your future or retirement is important, but the tax implications can often be unpredictable. Here are some helpful tips to guide you...

Tax Filing Tips for Bloggers

Welcome to our tax filing tips blog specifically designed for bloggers! Understanding the various ways you can earn income from blogging and determining your eligibility to deduct business expenses are crucial steps to filing an accurate tax return. Whether you’re a...

The Difference Between a Tax Credit and a Tax Deduction

Tax deductions and tax credits both reduce your overall tax burden, but do so in different ways. Because they both save you a significant amount of money on your taxes, it is important to take advantage of all the eligible deductions and credits available to you....

QBI Deduction: What It Is & Who Qualifies for This Write-Off

The qualified business income (QBI) deduction — also called the “Section 199a deduction” — is one of the many write-offs available to lower your tax bill and save money as a business owner. When you file business taxes, you may be eligible to deduct a portion of your...

How to Boost Your Back-to-School Savings

If you’re looking to mitigate back-to-school shopping costs, you might want to consider taking advantage of the”tax-free weekend” offered in many states. Let’s take a look at how these weekends work, which states offer them, and what type of purchases are eligible....

5 Ways to Boost Next Year’s Tax Refund Now

With the tax deadline behind you, you have likely put taxes out of your mind. But it’s the perfect time to be proactive and start planning for the next tax season! If you want to maximize your tax refund next year, here are some things you can do now: Adjust your W-4...

The Unexpected Benefit of Self-Employment: Tax Savings

Being self-employed provides one with freedom, flexibility, creativity, contentment, and also the chance to make more money. Being your own boss is definitely a bonus! However, there is one more very important benefit that comes with self-employment, and it’s an...

What is FAFSA & How to Apply? (FAFSA Help Guide)

Reminder: The deadline to file your FAFSA application for the 2023-2024 academic year is 11:59 p.m. CT on June 30, 2024. Ensure your application is submitted on time to secure your financial aid. Any corrections or updates must be submitted by 11:59 p.m. CT on...

When is Tax Season? How to Get Ahead Before it’s Here

While you won’t find tax season on your usual calendars, it can be a financially significant time of year for American families. A major reason for this importance is those tax refunds that you might qualify for. With the average tax refund at $3,167, that money can...

Tax Tips for Gen Z: 12 Ways to Start Saving Early

Navigating taxes might seem daunting, but understanding how to find every dollar you deserve during life’s major transitions can make a huge difference. Whether you’re wrapping up your degree, starting your first job, or figuring out tax filing basics, these tips are...

Starting a Business? (How to Start a Business Guide)

If you are now the proud owner of your own business, congratulations! By now, I’m sure you’ve experienced some ups and downs which usually comes with running your own show. But as you start to find your bearings and navigating your way as a new business owner, it’s...

How To Manage Your Self-Employment Deductions Year Round

Managing your self-employment tax deductions year-round is crucial for your financial success. Not only can you maximize your tax benefits, but you can maintain financial stability. In addition, you can avoid your last-minute tax season stress. Managing and tracking...

5 Popular Tax Myths, Busted

People come up with the craziest theories about taxes, but some of the rumors you may hear just aren’t true. By clearing up these myths and providing you with accurate information, you may have a more efficient tax season. Let’s answer a few tax myths to improve your...

4 Ways to Save for Retirement When You Work in the Gig Economy

Saving for retirement while working in the gig economy can help secure your future while also reducing your income taxes. There are several options for retirement contributions. While some contributions do not result in a tax deduction, investment earnings accumulate...

Tax Considerations for College Students

With college classes starting throughout the year, it’s important to consider your taxes year-round because there are several tax credits that can help reduce your tax burden. Because these tax credits can lower your tax liability, it’s important to look ahead during...

Tax Tips for Coaches – Intuit TurboTax Blog

Coaching comes in many different forms, from volunteer roles to independent contractors and employees. Each type of coach has different tax considerations. The type of coach you are determines how taxes will affect you. Let’s take a look at some tax tips for different...

How to Start a Side Hustle

n 2023, the average direct deposit tax refund was approximately $3,000. If you are expecting a tax refund this tax season and you’ve been thinking about starting a side hustle or self-employed business, that kind of money can come in handy. Sometimes, a few thousand...

Understanding NIL Rights & Tax Prep for College Athletes

College athletes have been able to pay their college expenses through scholarships, grants, financial aid, and even part-time jobs. However, prior to July 1, 2021 under NCAA rules, college athletes were not allowed to engage in NIL (Name, Image, and Likeness)...

Solo 401(k): Guide to Self-Employed Retirement Plans

When people talk about 401(k)s and retirement plans, they’re usually talking about employer-sponsored plans. But how can you plan for retirement if you’re self-employed? Luckily, you have options if you’re self-employed and want to save for retirement. There are a...

Name, Image, and Likeness (NIL) Payments: The International Student-Athletes Guide

If you’re a college athlete — a United States citizen or from another country — engaging in NIL (Name, Image, and Likeness) activities, you will need to file taxes in the U.S. That’s in addition to studying, practicing, competing, and earning NIL-related income....

Roth IRA Conversions (Converting IRA to Roth IRA)

Understanding the difference between Roth and Traditional IRAs can be confusing, but it is critical for retirement planning. In this article, we will discuss the difference between both types of IRAs and which may be best suited for you. We will also consider the...

How Changes in Your Life Can Save You Money

Whether you got married last year or purchased your first home, major life changes can bring about many questions and uncertainties. Although you may have questions about how life events affect your finances, one thing is certain: life-changing events can save you...

Student Loan Options When You’re Self-Employed

Student loans can be a huge financial burden when you first start working, especially if you are self-employed. Paying off your student loans is just one of the cornerstones of managing your money after graduation. Fortunately, there are several payment plans for low...

Planning for Retirement: Roth IRA or 401(k)

It’s easy to get overwhelmed by the plethora of options to choose from when it comes to trying to save for retirement. What’s the difference between opening a Roth IRA or 401k? Are there benefits to having multiple retirement accounts in order to achieve your...

Estate Planning in 8 Steps + Tips

If the idea of estate planning confuses or overwhelms you, you’re not alone. Many people know very little about estate planning and rarely think about it, understandably. Estate planning is one of those tasks in life that isn’t glamorous but is important to consider,...

What Are the Standard Mileage Rates?

Whenever you drive for business, medical reasons, or in support of a charitable organization, you may be able to get a mileage deduction and save money on your taxes. The IRS has announced the 2024 standard mileage rates to help you write off some of the costs of...

Happy National Children’s Day! Here’s What Having a Child Means For Your Taxes

Whether your child is a newborn or a teenager almost ready to head off to college, children have an impact on your taxes. In honor of National Children’s Day, celebrated this year on June 9, 2024, here are some things you should know! Get That Number You probably were...

Tax Benefits for Having Dependents

Even though the dependency exemption was eliminated under the tax reform, there are still some tax benefits you can take advantage of to maximize your tax refund if you have dependents. These tax benefits can significantly reduce or even eliminate your tax liability....

5 Money Saving Tax Tips for the Self-Employed

Self-employment can be hard, but if it was easy, everyone would do it, right? Whether you are trying to get ready to file your taxes, figuring out estimated taxes, or are gearing up for next tax season, take a look at these tax tips for the self-employed. You won’t...

Travel Write-offs for the Self Employed (What Can I Write-Off)

When you run your own business, travel is inevitable. Yet, when it comes to deducting that business travel on your taxes, you may feel like you are dealing with a lot of unclear rules and gray areas. If you ask a dozen friends who are business owners, you will likely...

401k Contribution Limits for 2024: Everything You Need to Know

Contributing to a 401(k) can be a smart way to start preparing for retirement — but there are a few rules to keep in mind. 401(k) contribution limits tell you how much you can contribute in a calendar year. There’s also a combined contribution limit for you and your...

Self-Employed Tax Tips & Summer Jobs

Summer is the time of year when some people dive into entrepreneurship. Whether it’s a summer job, a part-time gig, a side-hustle or a small business, your new found business venture may result in your being classified as self-employed. If that’s you or someone you...

Charitable Giving and Your Taxes

With so many people facing difficult times due to the high cost of living and recent natural disasters, there are many ways to help those in need. Whether you already gave to charity or you are considering giving, you may be wondering what charitable donations are tax...

How to File Taxes in Multiple States After Moving

If you moved from one state to another, you probably registered to vote in your new state and got a new driver’s license. And when it’s time to file your taxes, there’s more you need to do. While you still have one federal tax return to file, you will probably need...

Understanding Your Withholding Allowance on Your Form W-4

If you have filed your taxes, you may wonder what to expect and what moves you should make now. One of the most critical moves you can make is to do a check-up and make sure you have the correct amount of withholding taken out of your paycheck. TurboTax has you...

401(k) Rollover Rules & How It Works

Planning for retirement is a great way to stay ahead of the game, but what do you do when you find a new job and start investing in a separate retirement plan? 401(k) rollovers allow you to transfer the funds from your old 401(k) to a new retirement plan or account....

Do I Need a Social Security Number to File My Taxes?

When filing your taxes, you might wonder whether or not you need a Social Security number to file your return. Surprisingly, the answer is not always yes. Those ineligible for a Social Security number can still fulfill their tax obligations. To learn about another...

How to Lower Your Property Taxes

Owning a home can come with many benefits, but it also means you are liable for property taxes. Although property taxes may be inevitable, there are strategies you can use to potentially reduce them. But before we get into these strategies, let’s first consider some...

Tax-Exempt Forms: Applying for Tax-Exempt Status

Most individuals and organizations have to file and pay taxes each year — but that’s not the case if you qualify for tax-exempt status. Tax-exempt status is common for charitable and religious organizations. Certain nonprofit organizations can complete a tax exemption...

Fun in the Sun: Summer Day Camp Expenses May Qualify for a Tax Credit

Summer is all about fun in the sun, but for parents, it may mean the need to arrange daycare for their children. Although spending more money is never a comforting thought, there is light at the end of the tunnel. There is a potential tax credit that can trim your tax...

Who Can I Claim as a Tax Dependent?

The question, “Who can I claim as my dependent?” has remained a top question for many taxpayers. It is an area where tax deductions and credits are often overlooked or inaccurately reported on tax returns. Under tax reform, you can no longer claim the dependent...

Nanny Tax Rules: How do they work?

For many families, spending time with their loved ones along with juggling work obligations means something has got to give. A solution that some families have found to be helpful in keeping up with their obligations is to hire a nanny, a housekeeper, or other type of...

How To Do Your Taxes for the First Time: An Intro Guide

Once you get your first job and you’re making your own money, you will receive a W-2 shortly after the new year begins. Suddenly, you are thrust into the world of taxes and might not know what you’re supposed to do. If you find yourself in this situation, read on,...

How Long Do You Have to Pay Taxes? Due Dates, Extensions, & More

As a taxpayer, you have to file and pay your taxes by the IRS deadline — but tax deadlines vary based on the type of taxes you’re paying. There are different deadlines for personal income tax, estimated tax, estates and trusts, and farmers and fishermen. So, how long...

Do Babysitters Have to Report Income on Taxes?- Intuit TurboTax Blog

Working from home has been a wonderful way for parents to have more time with their children. The relative flexibility of a remote schedule allows people to earn money and avoid paying for daycare. Even so, there are times when some assistance from a babysitter is...

Guide to Small Business Tax Forms, Schedules, and Resources

If you’re a small business owner, filing taxes can be intimidating. There are tax forms with unique due dates and schedules that you need to file, and it can be overwhelming. Small business owners also need to avoid mistakes that incur penalties and stay on top of...

Are Overnight Camps Tax Deductible?

Summertime can be relaxing, but if you have kids on summer break, you might also struggle with how to keep them entertained and engaged while you work or are busy with the day-to-day events of life. That’s when you realize there are a lot of summer camps offered....

What Is the Inheritance Tax? 6 States That Have It & How to Avoid It

While it’s certainly not easy to discuss estate planning, learning how to establish a trust and getting your affairs in order before death can make things much easier for both yourself and the loved ones you’ll leave behind. That includes knowing if your state...

Real Estate Employment Taxes Explained

Did you become a self-employed real estate agent last year? If so, you now own your own business and can take advantage of many tax benefits related to running your own business. It’s important to realize that becoming a real estate agent isn’t just about selling...

Form 3520: Reporting Gifts and Inheritances from Foreign Countries

In this increasingly global world, many of us are finding ourselves caught in the complexities of tax reporting related to income or assets that are held outside of the United States.Taxpayers who receive a gift or bequest (inheritance) from a nonresident alien or...

What Does My New Health Insurance Mean for My Taxes?

In an effort to keep health insurance premiums more affordable, switching policies has become practically an annual event. This is true with many employer-sponsored plans, but you might even make a switch to an individual plan. Chances are, you began 2024 with a new...

FSA or HSA: Which Offers the Best Tax Advantages?

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) are two types of programs designed to provide tax advantages while paying for healthcare costs. These programs allow you to pay qualifying out-of-pocket expenses for health care with tax-free dollars. ...

How to Use Form 8832 to Select Your Business Classification

When you start a business, choosing the right organizational structure is key. Your business structure determines how your business is owned and operated. Filing Form 8832 may be part of the process of starting a new business. However, even if your business is several...

What Income is Taxable and Non-Taxable?

Although our tax system can be complex in some situations, it can also be quite straightforward. You are liable for taxes on your taxable income, and how much you owe is based on the kind of income you have. Most income is taxable income, but there is non-taxable...

What Is Form 2553? Become an S-Corp

As a business owner, you have many responsibilities, especially when you’re starting a new business. One of the first things you have to do is select a tax classification for your business or entity. If you want to classify your business as an S corporation (known as...

3 Ways to Look Up Your EIN Number

The IRS identifies taxpayers by their Social Security numbers, but what about businesses? From small businesses to corporations, every business has an Employer Identification Number — or EIN. When tax season arrives, you need your EIN number to file your business...

Residential Clean Energy Credit 101: A Comprehensive Guide

From hybrid cars to solar power, clean energy is becoming commonplace. More homeowners than ever are investing in solar power and other clean energy sources. The cost of solar panel installation is an obstacle for many homeowners. Fortunately, you can save with the...

Intro to Health Savings Accounts & Your Taxes

Unexpected medical costs without proper savings–including health insurance deductibles themselves, which have even gone up in recent years–can really leave you in a bind. One of the ways you can ensure you’re better prepared is with a health savings account (HSA). An...

FSA 101: All Your Questions Answered

Maintaining your physical and mental health can be costly, especially if your insurance plan doesn’t cover everything you need. Luckily, there’s a way to reduce your taxable income and ensure that you have money put aside to help cover these costs. A flexible spending...

The Retirement Saver’s Credit – Intuit TurboTax Blog

Starting a retirement account or plan is one of the best retirement tips, but it’s not always easy. Budgeting for retirement account contributions can be hard — especially for people in lower tax brackets. The saver’s credit is designed to reward you for contributing...

Business Networking Tax Deductions For Self-Employed

One of the most important parts of being self-employed and starting your own business is building a network of people around you filled with clients, advisers, influencers, and supporters. While meeting new people may seem difficult at first, it can also be extremely...

Tax Write Offs & Deductions Explained

Have you ever wondered what a ‘write-off’ is? Well, a write-off is any legitimate expense that can be deducted from your taxable income on your tax return. For many, this is the trickiest part of filing their taxes, particularly because there is a fine line between...

Tax Tips for Those Renting Their Home on Airbnb

As Airbnb’s popularity continues to rise, more and more people are renting out their homes and learning about the tax implications that come with it. When you rent your home, or a room in your home, as a short-term rental, you may be able to keep your income taxes to...

How to Amend Your Tax Return: Update Income & Correct Mistakes

If you made a mistake on your tax return, it’s not the end of the world. The IRS allows you to file an amended tax return to correct any mistakes that weren’t caught. In some cases, amending a tax return may be a requirement. You can amend your tax return to save...

Prep for Post-Grad Life With These 5 Financial And Tax Tips

Congratulations, Class of 2024 — you did it! While graduation is a major milestone that should be celebrated, it is also a time to prepare, both mentally and financially, for your shift into the “real world.” As you transition into this next phase of your life, here...

7 Tax Deductions for Wedding Planners

Are you a wedding planner? While wedding planning may be a unique business to be in, the business expenses they incur can often be quite typical. Any expense – whether it is specific to the work you do or typical to all types of industries, can lower your taxable...

Tax Breaks for Teachers – Intuit TurboTax Blog

While teaching is a very noble profession, sometimes it can be difficult and, at times, financially draining. However, the good news is that there are some tax benefits that teachers may qualify for. For all the teachers out there, here are a few benefits that can...

4 Tax Benefits If You’re Taking Care of Children and Elders

Being an in-home caregiver can be a difficult job, emotionally and financially. Being responsible for someone else’s well-being can be stressful, and it is often expensive. Fortunately, the IRS has some tax benefits available if you take care of and support a family...

How to Avoid Self-Employment Tax & Ways to Reduce It

Throughout its history, America has been the land of self-made men and women. But, America’s self-employed must contend with a unique burden every April 15: the self-employment tax. Simply being self-employed subjects one to a separate 15.3% tax covering Social...

5 Tax Tips for Starting a New Business

If you are venturing out on your own, congratulations! Starting your own business can be tremendously rewarding if you do it right. From business plans to market strategies, there are a lot of important financial decisions ahead. So, let’s start you off on the right...

Recent Grad? Here are Four Reasons to Start Saving Now Rather Than Later

Congratulations on your graduation! If you recently graduated, whether it’s from college or high school, there are some important decisions ahead of you. Many of these decisions don’t necessarily have right or wrong answers. However, one great decision you can make is...

5 Tax Deductions and Credits for Working Moms

If you’re anything like me, being a working mom means your work doesn’t stop at the office. Rather, it continues well after the end of each workday. Being a working mom can be both rewarding and challenging. You certainly get the satisfaction of being able to provide...

Should I Amend My Tax Return for A Small Amount?

What if you’ve already filed your taxes well before the deadline but realized after tax day that you accidentally left something out? If that’s the case, you might find yourself wondering when exactly you are required to amend your return, especially if the change is...

Can I Deduct My Summer-Time Moving Expenses?

Summer is a popular time to move – and with that comes added expenses. Between gasoline, packing materials, moving assistance, and insurance, the costs can really add up. And oftentimes, you also have to come up with closing costs or security deposits at the same time...

What Tax Forms to File as a First-Time Business Owner

Congratulations on starting your new business. As a new business owner, taxes are probably the last thing on your mind. But since there’s no getting around them, here is some basic information about the forms you’ll need to file as a new business owner. In general,...

Volunteering This Summer? Find Out if Your Work is Tax Deductible

Besides donating money, one of the best ways you can support a worthy cause is to volunteer. Many organizations are limited by what they can do because they don’t have the support staff and leaders to help them grow. Through volunteer work, you can lend your expertise...

Your Tax Extension Options (and How To Take Advantage of Them)

Tax extensions are common. IRS data shows approximately 10% to 15% of taxpayers file an extension per year. If you file the proper forms, you could get six more months to file your tax return. However, there are some specific rules and requirements to be aware of —...

Your Summer Travel Can Save You at Tax Time

How would you like to take a tax-deductible vacation this summer? That can’t be possible, can it? Well, there is a way that you could embark on some travel or a vacation and end up saving money come tax time if you are self-employed. Although you can’t fly your family...

13 Tax-Deductible Donations That Aren’t Clothes

Non-profit thrift stores like Goodwill and The Salvation Army operate exclusively from donations of people in their community just like you. Most people usually think about donating clothes, but there are many more items stores are happy to take off your hands –...

Capital Gains Tax Explained & How to Avoid Capital Gains Taxes

When you invest your money, your goal is to build wealth or savings. This means that you likely want to keep as much of the money you’re earning as possible and pay fewer capital gains taxes. As an investor, it’s important to understand how capital gains are taxed and...

Can I Claim My Parent as a Dependent?

Claiming dependents can help you reduce your tax liability, but there are rules regarding who you can claim. You may be wondering, “Can I claim my parents as dependents?” While the answer may be yes, it ultimately depends on your circumstances. Sorting it out on your...

Are Parking Tickets Tax Deductible?

Let’s say you’re driving for Lyft or Uber, and need to grab a coffee before picking up your next customer. The line is longer than expected, you are unable to get to the parking meter to feed in a few more quarters, and you get a parking ticket. Since you drive for a...

Facts About the Failure to File or Pay Penalties

If you haven’t filed your tax return yet, you are not alone. Since people who are due refunds rush to file early, I’m guessing that you might be waiting to file because you know you will owe taxes. Well, delaying filing because you owe can be more costly for you. The...

7 Wedding Expenses That Are Tax Deductible

Weddings are expensive, so it’s unfortunate that they aren’t tax-deductible! But wait, though tax write-offs may not be top-of-mind when you are planning your wedding, with careful planning, there are some ways you may be able to garner a tax deduction as you prepare...

How to Get a Tax Break for Summer Child Care

“Summer time, and the living is easy,” goes the song. Even though tax day has come and gone, it is never too early to begin planning out your summer vacation! Easy if you are a kid, that is. For working parents, the additional burden of summer child care is far from...

Did You Miss the Tax Deadline? 3 Steps You Can Take Next

The April 15th tax deadline has come and gone. If you missed the tax deadline, don’t worry, you can still file. Here are 3 steps to get your taxes done today and get your refund. File Now – Don’t wait any longer! If you haven’t filed your taxes yet, don’t panic. You...

Residential Clean Energy Credit: What It Is & What Qualifies

Clean energy plays a key role in protecting the environment, and the Residential Clean Energy Credit makes clean energy more accessible for homeowners. If you’re thinking about installing solar panels on your home or investing in a geothermal heat pump, you can...

Earth Day 2024: Going Green Saves You Green on Your Taxes

Earth Day 2024 is April 22, and this year’s theme is Planet vs. Plastics. Taxes may not be the first thought when you think about the environment, but it’s important to highlight the benefits of some environmental taxes and credits such as gasoline tax by state or the...

Is Workers’ Comp Taxable?- Intuit TurboTax Blog

If you were injured on the job or became ill as a result of your workplace, you might be entitled to workers’ compensation benefits. In addition to navigating the complex worker’s compensation claims process, you may have questions about how your benefits will affect...

Summer Home Improvement Projects That Pay You Back

In the summer, many of us take on home improvement projects, ranging from minor repairs to major remodeling. Though all home improvements cost money, many don’t improve the value of the home. Here are some ways to remodel your home while you recoup the maximum that...

#TaxGFX: TurboTax Is Celebrating Designers And Illustrators

Tax Day 2024 is nearing, and we’re commemorating the occasion with some unique art and animations. TurboTax is teaming up with up-and-coming designers and illustrators to celebrate and support their big moves. Our logo, check! Be sure to follow our brand-new series...

TurboTax Makes Tax Education Fun for College and NIL Students

TurboTax is helping Gen Z like never before, offering tax education and events from coast to coast tailored for college students, student-athletes, and the greater Gen Z population. As college students experience constant life changes, they face financial and tax...

IRS Announces Tax Relief for Hawaii Wildfire Victims

Update Mar 27, 2024: The Internal Revenue Service further postponed until Aug. 7, 2024, various tax-filing and tax-payment deadlines for individuals and businesses affected by the Aug. 8, 2023, wildfires in Hawaii. Previously, the deadline was Feb. 15, 2024. In...

Here’s Tax Deductions And Credits You Can’t Claim On Your Tax Return

During tax time, information is always spreading about what types of deductions are available. Maybe you heard of someone who wrote off their brand-new pool, and you might be wondering how that is possible. Or can you deduct time you contributed to charity? As you...

The Million Dollar Surprise: How One Football Fan Won Big with TurboTax

Meet Solangel, a Las Vegas resident and winner of The TurboTax Super Bowl File million dollar sweepstakes! Before a medical condition forced her to stop working last year, she worked part-time at Allegiant Stadium, host of Super Bowl LVIII. Medical expenses have been...

Intuit TurboTax April Tax Trends Report: A Look at Refunds and Shifts in the Child Tax Credit

Intuit TurboTax April Tax Trends Report: A Look at Refunds and Shifts in the Child Tax Credit - Intuit TurboTax Blog Skip to main content

How to File an Extension: A Step-By-Step Guide

Unexpected things happen in life, and sometimes you can’t get your taxes filed on time. If you can’t file your taxes by the April deadline, you can file an extension to get more time to file your taxes. The IRS can work with you to find solutions to your tax problems,...

Intro to Form SS-4: What It Is, Why It’s Used, & More

If you’re starting a new business, you may need to file Form SS-4, which is an Application for an Employer Identification Number (EIN). Your EIN is used as a unique identifier for your business when you file and report business taxes, so generally, every business...

Tax Credits for Hybrid Cars and Electric Vehicles: An Intro Guide

If you’re thinking about buying a new car, you should be aware of the list of vehicles that are eligible to increase your tax refund. Federal tax credits for hybrid cars and electric vehicles include specific EV vehicles that are qualified for a tax credit of up to...

File Your Taxes: You May Have Unclaimed Refunds Waiting

Did you know that the IRS reports over 1 billion dollars in unclaimed tax refunds every year? That’s right, more than a billion dollars of money that is owed to taxpayers across the country is reported by the IRS every year and tax filers who didn’t file their 2020...

April 15 is the Tax Deadline: 6 Things You Need to Know to File on Time

According to the IRS, there are millions of tax refunds that still need to be issued for this tax season. If you still haven’t filed, it’s time to hop to it. Here’s how: Get your tax documents in one place Gather your W-2s and 1099s! And don’t forget receipts and...

Unable to Pay Your Tax Bill? Here’s What To Do

Another bill, oh no! It doesn’t feel great to file your tax return and find out you owe money. It’s like heading out the door and discovering your car won’t start! But don’t worry, you actually have several options if you owe money on your taxes. Here is some...

What Are Tax Credits & How Do They Work

There are several ways that doing your taxes can actually put more money back into your pocket. Federal tax credits are kickbacks from the government to incentivize certain behaviors or provide relief for certain expenses. Whether you’re a seasoned taxpayer looking to...

How to Know if You Should Invest in Business Insurance

By Karen Doyle, Hiscox The following content is for general informational purposes only and is not intended to provide legal or other professional advice. Individuals should consult with their professional advisors for advice on their obligations. Starting a...

What Is the Standard Tax Deduction for 2023 – 2024?

What Is the Standard Tax Deduction for 2023 – 2024? The Standard Deduction is a fixed dollar amount that reduces the amount of income you get taxed on. Think of it as tax-free income that you get to keep before taxes are applied to the rest. The amount you can claim...

Should You Use Your 401k or Retirement to Pay Off Debt?

Paying interest on a credit card loan can be frustrating and expensive. In some cases, the desire to become debt-free is so great that you might be willing to do just about anything to get rid of the credit card debt hanging over your head – even take money out of...

What Happens If You Don’t File & Pay Taxes?

Tax season can feel like stepping into a labyrinth without a map. It’s totally natural to feel nervous about the consequences of not filing or paying taxes on time. After all, nobody wants to deal with unnecessary stress or penalties. But don’t worry, because you’re...

Family Taxes: Credits, Exemptions, & More

Tackling family taxes may seem like a puzzle, but have no worries—it’s also a new journey with new perks you may be able to take advantage of. Navigating the landscape of your family’s income taxes can be smoother going than you think, especially when you uncover the...

How Much Do You Have to Make to File Taxes?

Feeling a bit confused about tax filing? You’re not alone. How much do you have to make to file taxes? Do you have to file taxes every year? When do you start paying tax? These are common questions during this time of year, and we’ve got you covered. Understanding the...

What Is a Dependent? Who Qualifies & Requirements- Intuit TurboTax Blog

We all know that supporting a dependent can cost you a bundle. You may not realize, however, that claiming a dependent can help you at tax time. Both related and non-related dependents can save you money. Even though you may be shelling out thousands for food, shelter...

It’s Pi Day! Have Your Pi and Eat it Too with These Money Saving Tax Tips

Geeks, nerds, and math lovers unite – it’s time to celebrate Pi Day! In honor of all things 3.14159, March 14 is the day to embrace both your sweet tooth and your inner arithmetic aficionado. Pi is a mathematical constant. You know what else remains constant? Taxes....

What Health Care Forms Should I Have When Filing My Taxes?

When tax season arrives, it can be hard to make sure you’re filling out the right forms and doing your taxes properly. That includes forms for your health insurance. Did you know that there are actually a few health insurance tax forms you might need to file depending...

What You’ll Need to File Your Business Taxes Before March 15

Is this your first year filing taxes for your business? Are you ready now? The filing deadline for Partnerships (1065), S-corp (1120-S), and multi-member LLCs is March 15, 2024. If you still need time to get your paperwork in order, you can file an extension by March...

Oscars and the Taxation of “Swag Bags”

The outfits are picked, parties are planned, and the votes for the 2024 Oscar winners are almost tallied. Hollywood’s nominees will gather this weekend for the 96th Academy Awards ceremony. And while most hopefuls will not be walking away with the coveted...

Get $100 Back Instantly When You File Your Taxes With TurboTax Full Service Experts

The tax deadline is approaching – but if you file now with an expert until March 31, you can get $100 back instantly with TurboTax Full Service. With TurboTax Full Service, customers will be matched to a tax expert with experience in their unique situation, who will...

Your Guide to Filing Taxes as the Head of Household

If you’ve ever prepared your taxes, you may have been intrigued by this term – Head of Household. Head of Household isn’t just a fancy title; it’s a specific term that has tax implications, and knowing how to file your taxes can save you, or cost you, money on your...

Energy Efficient Improvements to Save Money at Tax-Time

Going green can make your home more energy efficient, and certain tax credits will also help you save money at tax time. Before we get into specifics, one positive thing to note for your taxes is these tax benefits are credits, so unlike deductions, they reduce the...

Quarterly Tax Date Deadlines for Self-Employed

If you’ve taken the plunge into self-employment, congrats on being your own boss! Whether you’re working as a contractor or making money in the fast-growing sharing economy, don’t forget you may need to pay quarterly estimated taxes. The next quarterly estimated tax...

Can I File Exempt & Still Get a Tax Refund?

Last tax season, more than 75% of taxpayers received a tax refund, and the average refund was over $3,000. You can get started now with TurboTax and get closer to your tax refund, and if you have questions on your taxes, you can connect live via one-way video to a...

Life Events Series: How Will Buying My First House Help My Taxes?

A great milestone of your financial life is the purchase of your first home. While less exciting, the tax implications of that achievement are no less critical. After all, home ownership creates several new opportunities for you to save on your taxes. Mortgage...

Your Top Tax Questions About Working Remotely, Answered

Let’s take taxesoff your mind We’re ready to help you getyour taxes done right, No matter your career, recent years have changed all of our working routines in one way or another. Whether it means wearing a mask to work every day, staying home and working from your...

What is a Refundable Tax Credit?

You may be familiar with what tax credits are, but you may be wondering: What are refundable credits? What are non-refundable credits? These terms have been thrown around a lot lately, especially when it comes to the latest recovery rebate credit or some of the...

Do You Qualify for the Clean Vehicle Tax Credit?

With the Clean Vehicle Credit, under the Inflation Reduction Act, not only do you have a chance to save money on gas by purchasing an electric car, but this credit is a dollar-for-dollar reduction of the taxes you owe by $7,500 if you purchase a new electric vehicle...

Buy or Lease Your New Business Vehicle?

Recently I had dinner with friends who run a business, and the conversation turned to buying new cars. The “buy versus lease” question was asked of me, the so-called tax expert at the table. As always, I don’t answer any tax questions until I have time to double-check...

The American Opportunity Tax Credit: Benefits for Students

Considering going back to school? The quest for higher education can be a worthwhile but costly pursuit. On top of tuition and fees, hidden costs and supplies add financial and emotional challenges to the many lower-income students who already have debt burdens. With...

Can I Take a Tax Deduction for a Bad Investment?

If you are an investor, it is likely that you have made an investment that went bad at some point. The IRS won’t give you back the money you lost, but Uncle Sam will let you take a deduction for the loss. But there are some rules you must know. You can’t report it...

All The Single Ladies…Put Your Tax Deductions Up!

Valentine’s Day is here! And besides celebrating that we only have one month of winter left, there are a couple of other things we can celebrate – including taxes. Yeah, you read that right – tax season is upon us as well, and with it, a great opportunity to give our...

Self Employed: Living and Working Abroad? Here’s What You Need to Report to the IRS

One of the more popular trends these days is being a digital nomad. If your work can be done remotely and not at an office, why not travel the world at the same time? You can often live in an exotic location that has a significantly lower cost of living, all while...

Are State Tax Refunds Taxable?

For those who itemize their deductions, it’s one of the stranger parts of the tax code. First, you get to take a deduction of your state and local taxes, then all of a sudden the next year you get a Form 1099-G from your state and you’re paying taxes on your state and...

What is a Tax Bracket?

Did you know not everyone or every dollar earned is taxed the exact same amount? This is because the United States tax system aims to be progressive. A progressive tax system tries to collect more tax from those who earn more. In essence, a million dollar earner pays...

Where’s My Tax Refund? How to Check Your Refund Status

The average direct deposit tax refund was close to $3,100 last tax season, and with tax season well underway, it’s no surprise that the most common tax season-related question we’re now hearing is: “Where’s my refund?” The time it takes the IRS to process your tax...

Go Behind the Scenes of the TurboTax Super Bowl File Commercials

The big game has come and gone, and while the dust might have settled on the field between San Francisco and Kansas City in Las Vegas, the buzz around the commercials is still in full force. TurboTax’s commercials feature award-winning multi-hyphenate Quinta Brunson –...

TurboTax QR Code – The TurboTax Super Bowl File Sweepstakes

What if now, through February 15, the biggest move of the Super Bowl is taxes – yes, even Quinta Brunson says so (the proof is below)! Some moments are too big to miss. But if you did not catch the QR Code featured in the TurboTax Super Bowl File $1,000,000...

Are You Ready for Some Football Tax Tips?

The biggest game of the year is almost here! Just as the new tax season is beginning to ramp up, football players are also kicking into high gear as their teams compete for a chance to win the most important showdown of the season. In celebration of the big game and...

Do I Qualify for the Home Office Deduction?

So, you have a nice work setup at home. Does that mean you get to write it off on your taxes? If you’re new to working remotely or running a small business from home, it’s understandable that you have some questions about how that impacts your taxes and which...

Can You Deduct 401K Savings From Your Taxes?

The contributions you make to your 401(k) plan can reduce your tax liability at the end of the year as well as your tax withholding each pay period. However, you don’t actually take a tax deduction on your income tax return for your 401(k) plan contributions. This is...

Tax Tips for “The Sharing Economy”

How we perform our daily tasks and interact with one another is constantly changing. Many entrepreneurs and companies have been able to capitalize on these technology-driven opportunities and have created a movement around sharing instead of owning. You may have heard...

4 Errors to Avoid at Tax Time

Although I am not a fan of doing my taxes each year, using tax software makes it easy and helps avoid mistakes. I certainly don’t ever do them by hand, you’re just asking for trouble. When preparing your taxes there are a lot of simple and easy errors you can avoid...

3 Reasons It’s Great to Be Coupled Up at Tax Time

Happy Valentine’s Day week to all of the lovebirds out there! Whether you’re enjoying a night out on the town or staying in for a movie night, we want to give you even more reasons to celebrate with your loved one with…you guessed it: tax benefits! So, grab your...

Standard vs. Itemized Deduction Calculator: Which Should You Take?

You may have itemized your tax deductions in the past if you are, for instance, a homeowner. But now, you may benefit from taking the standard deduction if the new standard deduction amount for your filing status is more than your itemized tax deductions. If you’re...

Taxes Done? Find Out Which Tax Records You Should Keep

Before you throw all of your tax documents up in the air after filing to celebrate the occasion, we need to discuss just how long you should keep that info in a safe and secure place. That’s right, you should store your tax information and documentation, including a...

5 Tips to Help You Plan for Next Tax Season Now

The tax season is underway, and if you have already filed your 2023 taxes, congratulations! So wait, why should you still care about your 2024 taxes (the ones you will file in 2025)? Believe it or not, what you do now throughout 2024 can make a difference in your tax...

A Parent’s Guide to NIL

If your son or daughter is a college athlete, they are allowed to participate in NIL (Name, Image, and Likeness) activities without impacting their NCAA eligibility. This policy change will mean changes to their finances, and they will need to file taxes because of...

Gambling Winnings Taxes: Do You Pay Taxes on Gambling Winnings?

If you’ve recently struck gold at the casino, hit the jackpot in a poker tournament, or experienced the thrill of the lottery or any other gambling activity, you’re probably wondering about the potential tax implications. Spoiler alert: all your winnings, big or...

Love and Taxes: Tax Benefits of Marriage

When those wedding bells start ringing, phrases like “tax bracket” and “married filing jointly” are probably the last thing on your mind. However, once the couple eats the cake, the newlyweds toss the bouquet, and the next chapter of your life officially begins, it’s...

What Medical Expenses are Tax Deductible?

Even with good insurance and a low deductible, no one truly enjoys paying medical bills. One bright side to big bills is the opportunity to claim your medical expenses as a deduction on your tax return, as long as your bills are greater than 7.5% percent of your tax...

Are Work-Related Devices a Tax Write Off?

You may have heard tax reform eliminated tax deductions for unreimbursed employee business expenses beginning with your 2018 taxes. If you own your own business, however, you can still deduct business expenses. So what high-tech toys (oops, excuse me, necessary...

E-File is Now Open: Why You Should File Your Taxes Early

Today, January 29, the Internal Revenue Service (IRS) officially kicked off the opening of the 2024 tax filing season and is now accepting and processing tax year 2023 e-filed tax returns. As we all know, some taxpayers wait until the last minute to file their taxes,...

TurboTax Answers Most Commonly Asked Tax Questions

Although the federal tax deadline is April 15, taxpayers are encouraged to file their taxes now to get their refund ASAP. Most people receive a tax refund each year, and last year, the average federal tax refund was more than 3,000. As taxpayers continue to file their...

What is an Earned Income Tax Credit & Do You Qualify for It?

Today is National Earned Income Tax Credit Awareness Day! The Earned Income Tax Credit (EITC) is the country’s largest program for working people with low to moderate income. According to the IRS, about 23 million eligible filers received the EITC as of December 2023,...

What Are Tax Deductions? – The TurboTax Blog

What are tax deductions? Deductions are used to reduce taxable income. And a lower taxable income reduces what you owe. Deductions are different from tax credits. Tax credits directly cut your tax bill by reducing the actual taxes owed. Both contribute to lowering...

Roth IRA Withdrawal Rules and Penalties

Having a Roth IRA account in place for retirement is a responsible plan for the future. After all, you wouldn’t want to worry about your financial security when you’ve finally reached an age to enjoy the fruits of your labor. If you’re contributing to this type of...

What is the Child Tax Credit and How Do I Qualify?

You may be hearing various information about the Child Tax Credit and you may have questions like, “How much is the child tax credit this year?” and “How do I qualify for the child tax credit?” You may have also heard about a possible change to the Child Tax Credit,...

Is This Tax Deductible? Tax Tips for Landlords and Vacation Rental Hosts

Owning a rental property is a fantastic way to boost your income and secure your financial landscape. You’ll also have a golden opportunity for some serious tax breaks. Rental properties – both full time, part time, and vacation homes – can be a wealth of tax savings....

Overpayment of Taxes: Everything You Need to Know

While some might think that taxes are an inconvenience, they actually serve many good uses, including funding health programs, food stamps, disability benefits, and defense programs. When you pay too much in taxes, however, it creates an interest-free loan to the...

What Is the IRA Withdrawal Age?

While planning for your future, you might be wondering where to invest your money for safekeeping and growth. After all, you’ve worked hard throughout your life to collect a nest egg for when you retire; you want to make sure you are making the most out of it. When...

Can You Claim a Tax Credit For a Pet? Pet Deductions 101

Some people consider pets to be a lot like children. They’re cute, loving, playful, attention-craving, and they can’t wait for you to get home. Like children, pets rely upon you to support them, which can get expensive. Add to that veterinary bills, grooming,...

Tax Audits Explained (Not As Scary As You Think)

In movies, tax audits are always scary. Big, burly, intimidating men in dark suits and glasses. Over-sized clipboards. The sound of pens furiously scratching paper. Handcuffs. You know the deal. But are tax audit visits really that frightening in real life? Not so. In...

Moving from Employee to Self-Employed? Here’s What it Means to Your Taxes

Whether your hobby became your main business or you began working a side hustle to supplement your income, starting your own self-employed business can be an exciting time. It can also be an uncertain time as you try to navigate an area of your business that you...

Do You Financially Support Your Family Living Abroad? See If You Qualify for Any Deductions and Credits on Your Income Tax

Do You Financially Support Your Family Living Abroad? See If You Qualify for Any Deductions and Credits on Your Income Tax - The TurboTax Blog Skip to main...

6 Reasons it Pays to File Your Taxes Early

As the saying goes, “the early bird gets the worm.” Or is it the tax refund? Well, whether you file early or you are a tax procrastinator, you still may get a tax refund, but here are six reasons it pays to file early. Get your tax refund ASAP Last tax season, the...

Tax Guide for the Self-Employed: Everything You Need to Know

You’ve just stepped into the world of entrepreneurship. Whether you opened your own online boutique, began freelancing your graphic design skills, or drove for a ride-share company, you have a variety of tax implications to consider – and some of them can slim down...

Student Loan Debt Relief Announced: Here’s What it Means For You

Update: January 19, 2024: Today the Biden-Harris Administration announced an additional $4.9 billion in student debt relief for 73,600 borrowers. This additional debt relief will go to teachers, social workers, and other public servants like firefighters and nurses...

Sports Gambling and How Your Winnings are Taxed

Sports gambling has become a popular year-long hobby. Did you just win your football fantasy league (or come in second place and get some winnings)? You might be surprised to learn that Uncle Sam has his fingers crossed for your good fortune as well. That’s because...

7 Common Tax Problems (With Solutions)

When it comes to doing your taxes, it’s natural to feel stressed out. Although most people can breathe a sigh of relief after filing their annual returns, tens of millions of taxpayers face a variety of tax problems that extend the stress every year. We go over the...

Top Fun #TaxFacts You Need to Know

The words taxes and fun rarely go together in the same sentence, but here are a few fun state tax facts and federal scenarios…we promise they’re fun! Within your own state there are plenty of interesting tax rules that you might not know existed — below, we’ve rounded...

What Is a Personal Exemption & Should You Use It?

Untangling tax laws can feel like navigating a maze, especially when you’re trying to decipher what feels like an entirely new language. When filling out your tax form, one term that used to play a major role in individual tax returns was “personal exemption.” This...

The Benefits of Employing Your Children and the Tax Breaks Involved

As a parent, you want to do everything possible to set your child up for success, including instilling a solid work ethic and helping them learn about financial responsibility. One way to accomplish these goals is by employing your child and taking advantage of the...

Mail Call: Common Tax Forms to Expect in the Mail

A new year, a new tax return! It’s time to get started on your taxes. If you haven’t received all your tax forms, don’t worry. The IRS gives companies a deadline, so you should be receiving your tax forms soon if you haven’t already. You may also be able to easily...

Enter the #MakeYourMovesCount Sweepstakes – The TurboTax Blog

Whether you got married, moved into your first place, or started your second side-gig, we want to celebrate your big life moves. Tell us about the big moves you made last year for the chance to win a trip to Super Bowl LVIII in Las Vegas! That’s right – share the...

W-2 Arrival: All You Need to Know about Tax Forms

If you were employed during 2023, you should receive your Form W-2 (officially known as the Wage and Tax Statement) from your employer soon since employers are required to send them out by January 31, 2024. If you were self-employed or worked on a contract basis with...

Roth IRA Withdrawal Rules and Penalties

Having a Roth IRA account in place for retirement is a responsible plan for the future. After all, you wouldn’t want to worry about your financial security when you’ve finally reached an age to enjoy the fruits of your labor. If you’re contributing to this type of...

Can I Claim My Girlfriend or Boyfriend as a Dependent?

Under tax reform, you can no longer claim a dependent exemption beginning with tax year 2018, but you still need to know who qualifies as your dependent for other tax benefits like the Other Dependent Credit worth up to $500 for dependents who are considered...

I Started Investing This Year, What Do I Need to Know Come Tax Time?

When I first started investing in the stock market, I wasn’t quite sure what I was doing. I wasn’t sure if my purchases would lose value the moment I bought them or if they would grow into exponential figures. I was also scared that my hard-earned money was going to...

Maximize Your Business Tax Efficiency with the TurboTax Business Tax Center

Attention all business owners: a new and exciting offering from TurboTax is now available! Introducing the TurboTax Business Tax Center, a curated content hub focused on topics including business income, self-employment, and much more. After a successful launch in tax...

TurboTax Offers Free Tax Filing for Military Active Duty and Reserve

Through our Intuit Military and Veteran Initiative, we are committed to creating job opportunities and fueling financial empowerment for military families and veterans with programs woven within the fabric of our company. As a part of this commitment, we’re proud to...

Bonus Tax Calculator: Estimate Federal Tax Withholding

If you received a bonus you’re likely curious about taxes. You might be asking, “how taxes are withheld from your bonuses when you receive them?” Receiving a holiday bonus is exciting, but it can be confusing to calculate your bonus tax. Learning how your bonus is...

IRS Announces E-File Open Day! Be the First In Line for Your Tax Refund

Today the IRS announced Monday, January 29, 2024 as the beginning of the nation’s 2023 tax season when the agency will begin accepting and processing 2023 tax year returns. Don’t wait to file. File today with TurboTax, and be first in line for your tax refund!...

How to File Small Business Taxes

If you’re new to filing taxes as a small business owner, you might feel a little intimidated by the process. You may find yourself asking questions like: How can I be sure I’m using the correct forms? How do I prepare my business financial statements for tax season?...

Golden Globe Swag Bags: What Are the Tax Implications?

The 81st Golden Globe Awards celebrated the best in film and television productions of 2023. While everyone can’t walk away with the coveted trophy from the Hollywood Foreign Press Association (HFPA), the winners and presenters received a pretty special (and pricey)...

10 Commonly Overlooked Tax Deductions and Credits

With the tax filing deadline about 3 months away, now is a good time to start thinking about money you shelled out for tax-deductible expenses last year. Start gathering your receipts in order to make an impact on your taxes by increasing your tax refund or lowering...

Ways to File your Taxes with TurboTax For Free

What could be better than paying $0 to do your taxes? Over the past ten years, Americans filed approximately 124 million tax returns completely free of charge using TurboTax, more than all other tax prep software companies combined. Find out all the ways you may be...

Common and Complex Taxcroynms Decoded

Anyone who has ever looked at the tax code knows about the alphabet soup of acronyms associated with taxes. In addition to the big one—IRS a.k.a. Internal Revenue Service—I’m guessing that there are more than 100 taxcronyms out there. Here’s a guide to decoding some...

Should Married Couples File Jointly or Separately?

Like many of the decisions made in a marriage, the choices couples make are related to their specific situation. The same goes for the filing status you choose when you get married. After marriage, your filing status will shift from either single or head of household...

TurboTax is Open and Accepting Tax Returns Now!

It’s that time of the year again – tax time! There is no denying that feeling when you see the size of your tax refund (which was over $3,000 on average last year). To help you get ready for the tax season, we have some good news — TurboTax is officially open and...

Schedule K-1, Taxes, and You

Tax season is here and every season we see questions about how to enter a Schedule K-1 in TurboTax, as well as what happens if you don’t receive your Schedule K-1 until after the tax deadline. If you have questions about what a Schedule K-1 is, please check out our...

How to Report Self-Employment Income When You Have Multiple Side Gigs

Millions of people have diversified the way they earn income and joined the gig economy. This could be a side gig to help them meet financial goals, running their own small business, a second job, or even multiple side gigs. Like any income, you must report income...

Tax Year 2023: Does Your State Have an Extended Deadline?

Navigating tax obligations while facing unforeseen challenges posed by a natural disaster can make for especially difficult times. If you were a victim of a natural disaster in an area designated as a federal disaster by the Federal Emergency Management Agency (FEMA)...

Roth IRA: Who Can Contribute?

If you’re planning for your future retirement, chances are you’ve looked into a retirement account to provide for your golden years. While there are many different options to choose from, a common choice that is often provided by employers is a Roth IRA account. ...

Best Money Moves to End the Year Strong

The end of the year is a busy time for most people. There’s buying gifts, decorating your home for the holidays, and finishing up last-minute work projects. The last thing you need is one more thing on your daunting to-do list. Unfortunately, the end of the year is...

IRS Grants Penalty Relief for 5 Million Tax Returns from 2020-2021

Look who’s getting into the holiday spirit! The IRS announced a new penalty relief to help those who owe back taxes. This will impact approximately 4.7 million individuals, businesses, and tax-exempt organizations that were not sent automated collection reminder...

5 Ways to Avoid Going Into Holiday Debt

Ho ho ho, happy holidays! If you are like me, you end up eating a little too much, drinking a little too much, and spending a little too much over the holidays. And it is so easy to overspend if you buy on credit — people spend about 15 percent more on purchases they...

Gen Z Homeownership: Are They Buying More or Less

As generations age, the refrain seems to be the same: young people aren’t buying houses anymore. And even though home prices are higher than they’ve ever been in many locales, the stats paint a vastly different picture: Gen Z is, in fact, buying homes. Many reasons...

Are Your New Year’s Resolutions Tax Deductible?

It’s almost the new year, and many of us are looking forward to accomplishing something new in 2024. Some of the most common resolutions include: Lose Weight Get Out Off Debt Learn Something New Travel More Volunteer All of these goals have something in common, too:...

Self-Employed Tax Deductions Calculator 2023-2024

Many turned to self-employment in the wake of the pandemic. People jumped into everything from being online merchants to content creators and influencers on platforms like TikTok, OnlyFans, and Instagram. If this is you, you may be wondering, “Now that I am making...

Do Renters or Homeowners Have the Winning Edge?

For decades, traditional personal finance advice has said that if you want to build wealth, you should buy a home. Owning a home is part of the American dream – even for Gen Z. But nowadays, buying a house may not be the wise decision it used to be. In fact, it may...

School’s Out for the Holidays! How Holiday Daycare Can Save You on Your Taxes

The holidays are usually a welcome time of year… unless you have children and need someone to watch them! If you have pre-school-aged children, your regular care will be just fine. But if they’re between five and 12, where they attend school most of the time may be...

How Holiday Bonuses are Taxed for Contract Workers

Are you expecting a year-end bonus for your contract work this year? If so, think of everything you can spend that money on: holiday gifts, paying off credit card debt, a big-screen TV. However, if you’re a contract worker, you should take your time thinking about how...

1099-K Form Reporting Threshold Delay Announced For Tax Year 2023

Today the IRS announced another delay in reporting thresholds for third-party settlement organizations (TPSOs) set to take effect for the upcoming tax filing season. As a result of this delay the TPSOs will not be required to report tax year 2023 transactions on a...

Experience Unmatched Tax Preparation with TurboTax’s New Tax Year 2023 Products and Services

Tax day is in a few months (Monday, April 15, 2024), and TurboTax’s new and latest offerings will transform the tax filing experience like never before. Today, Intuit announced the latest evolution of the TurboTax Live Full Service offering, which will launch on...

Holiday Donations and Tax Savings

Every year around this time, we start thinking about what we plan to do in terms of charitable contributions. For most, there are a few organizations we like to support with cash, and a few we like to support with time. Regardless of how you decide to give, it’s...

The IRS, TurboTax, and Industry Partners Announce National Tax Security Awareness Week 2023

Beginning on Cyber Monday, the Internal Revenue Service (IRS) and Summit Partners, which includes TurboTax, state tax agencies, and other tax industry partners, kicked off the 8th National Tax Security Awareness week from November 27 through December 1 with...

I’m Donating to Charity This Winter, Will I Still Get a Deduction?

If you plan to donate to a charity before year-end, you may be wondering how your donation affects your charitable contribution deduction. Here’s the scoop! Don’t be fooled by scammers — especially in the wake of all of the charitable opportunities following the...

Understanding Wage Garnishment: What It Means for Your Paycheck

They say ignorance is bliss. However, ignoring your debts can lead to an unimaginable consequence: a lower paycheck. If you don’t respond to payment requests and refuse to show up in court, then your unpaid debts may end up with you having your wages garnished. And,...

5 End of the Year Tax Tips for Newly Married Couples

As a personal finance writer, we’re always focused on the dollars and cents of life so it’s nice to be reminded of what we’re working towards (especially when it’s an event like a wedding)! Sadly, once the cake and champagne have been consumed and the DJ shuts off the...

Save the (Tax) Dates! – The TurboTax Blog

In order to help you plan for your tax year 2023 taxes (the ones you file in 2024) and other important tax dates, we’ve compiled a list of key tax deadlines for you to keep in mind and mark on your calendar. Open Enrollment for Marketplace Insurance: November 1, 2023...

A Guide for Self-Employed Filers that Haven’t Tracked Their Expenses This Year

I still remember the first year I did my taxes and had self-employment income. Similar to many first-time self-employed people, I didn’t go into the year knowing that I’d have self-employment income. One common mistake that many first-time self-employed filers...

The Importance of “Clean Books”

If you’re a business owner, keeping financial records clean and organized can be daunting, but it’s one of the most crucial aspects of running a successful business. So, what does it mean to have “clean books”? In short, having “clean books”...

Tax Tips for Unemployment Income If You’ve Been Laid Off or Furloughed

As of November 2023, unemployment rates have changed little in America, with an estimated 6.3 million unemployed persons and the national unemployment rate at 3.7 percent due to job loss or being furloughed. These measures have shown little net movement since early...

Holiday Gift Giving and Tax Deductions for Business Gifts

There are many wonderful reasons for buying gifts for your customers and business associates: maintaining good work relations, opening doors for opportunities, professional networking, and a thank-you for a job well done. There’s also one more incentive to make those...

TurboTax Offers Refund Advance to Taxpayers

Last tax season, close to 70% percent of taxpayers received a tax refund, and the average federal tax refund was over $3,000. For many, their refund could be the biggest lump sum of money they receive all year, and with the holidays, those funds could be a great way...

TurboTax Tax Trends Report: Tax Year 2022 Lookback

Our Tax Trends Report takes a look back at tax year 2022 and provides unique, data-driven insights into finance, tax, and economic trends for consumers, analysts, policymakers, and the general public. The report provides education, insights, and calls out proactive...

Are Your Holiday Parties Tax Deductible?

Tis the season to celebrate the holidays – with a good party! There’s just something about the music, the food, and the excellent company that brightens our spirits. However, sometimes, it’s important to consider the practical side of things, like taxes. So, the big...

Stocks, Bonds and Other Ways to Make Your Money Grow

Investing your money can seem intimidating because it’s so much different from working. When you work, you get paid for your time, your expertise, and your experience. You put in an hour of work; you get paid an hour of wages. With investing, you simply put your money...

How Do Game Show Winnings Affect Your Taxes?

Imagine this: you’ve made it to the final showcase of a popular game show – and the grand prize is the largest lump sum of cash in TV history. Suddenly, the host announces that you have just nabbed the top spot! Thousands of people win big on game shows every year....

Business Owners Should Take Advantage of These Travel and Biz Deductions

As a business owner, I’m always looking into tax laws for any new credit and deductions that I’m able to claim. Plus, the tax code could change each year, so that’s why it’s important to stay on top of your finances and know what you’re eligible for because you could...

TRUMP Act would put Trump’s New York tax returns online

Some Democratic state senators in New York are trying an end run to get Donald Trump's taxes into the public view by introducing legislation that would reveal his state tax returns for the last five years. The legislation -- dubbed the Tax Returns Uniformly Made...

Big Oil wants to tax itself and give cash to Americans

Here are two shockers: Big Oil wants to tax itself to fight climate change. And it wants the proceeds to go to American families. Major oil companies including ExxonMobil (XOM), BP (BP), Royal Dutch Shell (RDSA) and Total (TOT) backed a carbon tax proposal on Tuesday...

How tax reform could affect your 401(k) tax break

Republicans in Congress are gearing up to fight for lower tax rates. But how do you pay for those cuts? One possible solution on the table: Taxing you on your retirement savings up front. Several people in the retirement savings industry fear that lawmakers will...

3 smart ways for investors to cut their taxes

High returns aren't the only factor to consider when choosing your investments. A tax-efficient portfolio can save you enough on your tax bill to nicely compliment your investment returns. Take a look at your own portfolio to see if you've implemented the following...

Trump’s tax plan isn’t as big of a threat to H&R Block as he says

President Donald Trump may talk a lot about creating jobs, but there's one kind he wants to eliminate: Tax preparers. "I want to put H&R Block out of business," Trump said on the campaign trail. "H&R Block probably won't be too happy," he said again in...

Trump promises tax reform won’t impact 401(k) plans

President Trump vowed Monday that the tax break for 401(k) plans will be kept in place under the administration's tax reform proposal, despite reports to the contrary. "There will be NO change to your 401(k). This has always been a great and popular middle class tax...

House tax bill would scrap deduction for medical expenses

The tax bill unveiled by Republicans in the House on Thursday would not, as had been rumored, eliminate the tax penalty for failure to have health insurance. But it would eliminate a decades-old deduction for people with very high medical costs. The controversial bill...

Britain’s corporate tax rate is 19%. Many businesses don’t want a cut

Britain plans to cut its corporate tax rate to 17% over the next three years. But many businesses say they're happy with the current 19%, thank you very much. Make no mistake: Business leaders want to reduce their total tax burden. But they're asking U.K. Treasury...

Whatever happened to Trump’s crackdown on ‘the hedge fund guys?’

Donald Trump vowed during the campaign to get rid of a tax loophole used by some millionaire and billionaire investors to slash their bills. "The hedge fund guys won't like me as much as they like me right now. I know them all, but they'll pay more," he said during a...

Here’s what’s in the Senate tax bill

Republicans crossed another major hurdle in their effort to get a tax bill to President Trump's desk by Christmas. In the early hours of Saturday morning, the Senate passed a sweeping tax overhaul bill in largely party-line vote. Just one Republican, Tennessee Senator...

Senate and House differ on key points

The tax overhaul bills passed by the Senate and House would likely to change your tax return in ways large and small -- which credits you can take, what you can deduct, how much you pay. But they differ on key points. You'll be hearing a lot about those differences in...

How the GOP tax bills hurt undocumented immigrants

The tax bills passed by the House and the now the Senate include slightly more generous benefits for parents. Unless their children are undocumented immigrants. Currently, non-citizens filing taxes using an Individual Taxpayer Identification Number, or ITIN, are...

This is how tax reform could hinder corporate innovation in the U.S.

In its frenzied rush to write a tax bill that could win enough votes, the Senate inadvertently weakened a powerful tool for promoting innovation. The research and development tax credit allows companies to write off a portion of their spending on experimentation for...

Deduction for teachers who buy classroom supplies survives

It's better than nothing. Lawmakers have decided not to touch a tax deduction for teachers who spend their own money on school supplies -- effectively splitting the difference between competing proposals. Currently, teachers can deduct up to $250 for classroom...

Tax bill and your tuition: Here’s what to expect