Still not finished with your tax planning for the year? You need to submit the proof of tax-saving investments soon or face a higher TDS. Don’t feel complacent if your employer hasn’t asked for proof of investments yet. You might have been put under the new tax regime that offers no deductions or exemptions. No exemption for HRA and LTA, or deduction for tax-saving investments, medical insurance and interest paid on home and education loans. Unless an individual explicitly makes a choice, he will be put under the new tax regime by default.

A taxpayer who finds himself in the new regime can switch to the old tax regime at the time of filing tax returns. “However, taxpayers can claim deduction only if they make their tax-saving investments before 31 March,” says Sudhir Kaushik, CEO of tax filing portal TaxSpanner. com. The taxpayers who changed jobs during the year may not have been asked to submit proof of investments either. The new employer might not have taken into account the income from the previous job and would have calculated a lower tax. “They should also complete their tax-saving investments now,” says Kaushik.

Our annual ranking of tax-saving instruments helps such individuals make the right choices. We assessed 10 tax-saving options on eight key parameters—returns, safety, flexibility, liquidity, costs, transparency, ease of investment and taxability of income. Each parameter has equal weightage and the composite scores determine the place in the ranking.

RETURNS 8.16% in past five years

Lock-in: Till retirement

The additional deduction offered by the scheme is very useful for those with surplus funds.

The NPS continues to be the top tax-saver for the second year running. The NPS saves tax under three sections: contributions up to Rs.1.5 lakh can be claimed as deduction under Section 80C; there is an additional deduction of up to Rs.50,000 under Section 80CCD(1b); and if the employer puts up to 10% of the basic salary of the individual in the NPS, that amount is deductible under Section 80CCD(2).

Apart from tax deductions, the NPS has become more flexible and investor-friendly. The limit for equity allocation has been raised to 75%. Individuals can now change their asset mix up to four times in a year, and can invest in funds of multiple pension fund managers. The PFRDA has also introduced the systematic withdrawal option, which will let investors stagger withdrawals on maturity.

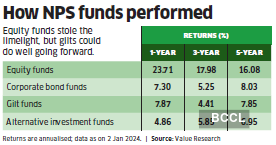

Equity funds of the NPS have done very well in the past year, and are expected to continue on the upward trajectory. This is because analysts expect large-cap stocks to do well in the coming months. Equity funds of the NPS are large-cap oriented, which bodes well for investors.

Even gilt and corporate bond funds have delivered decent returns in the past year. Their performance could improve in 2024 if the RBI cuts rates in the coming months. The 10-year bond yield is currently at 7.23% and analysts expect it to decline by at least 25-30 basis points.

At the same time, alternative investment funds have not done too well. It’s a good thing that there is a 5% investment limit for these funds. We suggest avoiding these funds altogether.

How NPS funds performed

ELSS funds

RETURNS: 18.24% Past five years

Lock-in: 3 years

With equity markets on a roll, ELSS funds, especially large-cap oriented schemes, are expected to do well in the near term.

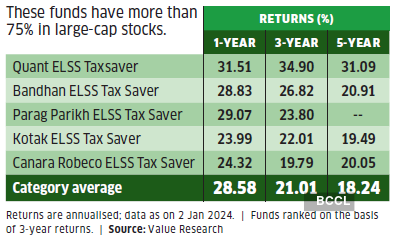

ELSS funds have moved up to second place in the ranking this year, buoyed by the improvement in the prospects of the stock markets. With large-cap stocks expected to outperform, ELSS funds with a larger allocation to this segment will obviously do better. Our top picks have more than 75% of their corpus in large-cap stocks.

Most promising ELSS funds

ELSS funds score high in our ranking because they are transparent, have very low costs and the three-year lock-in period is the shortest among all tax-saving options. However, they are equity funds and are exposed to market risks. Ideally, one should invest in these through monthly SIPs, but this is not possible if you have to show proof of Section 80C investments in a few days.

However, experts say that investors should not be overly worried about short-term significant underperformance. “For superior risk-adjusted performance and long-term returns, you have to withstand substantial poor performance for a brief period,” says Dhirendra Kumar, CEO of mutual fund tracker Value Research.

Taxpayers who are not able to stomach volatility in the markets can take the SIP route by staggering their investments over the next two months.

Ulips

RETURNS:8.15% in past five years

Lock-in: 5 years

As the tax net spreads, these insurance-cum-investment plans are a tax-free haven. However, these are not as flexible as ELSS.

Ulips continue to be a tax-efficient option. Gains from ELSS funds beyond Rs.1 lakh in a year are taxed at 10%, but in case of Ulips, the maturity proceeds are tax-free under Section 10(10d), provided the life cover is at least 10 times the annual premium. The policyholder can also switch from a debt fund to an equity fund, and vice versa, without any tax implication. However, ELSS funds don’t require a multi-year commitment and have shorter lock-in periods.

When it comes to flexibility, Ulips have an edge over the NPS. The money is not locked till retirement and a policyholder can make periodic withdrawals. However, unlike NPS, where the investor can change the pension fund manager and invest in more than one pension fund, here the buyer is stuck with the insurance company for the rest of the term. A Ulip, however, will not give you the life insurance you actually need. One needs a life cover of at least 7-8 times one’s annual income. Someone with an annual income of Rs.12 lakh must take a cover of at least Rs.85-90 lakh. Given that the life cover offered by a Ulip is only 10-12 times the annual premium, he will have to shell out almost Rs.8-9 lakh a year to get the required cover. When you buy a Ulip, keep in mind that it is a long-term investment. Buy only if you can continue with the plan for the full term.

Senior Citizens’ Savings Scheme

RETURNS: 8.2% in Jan-Mar 2024

Lock-in: 5 years

It’s the best way to save tax for senior citizens. A new rule that allows unlimited extensions makes it more attractive.

The Senior Citizens’ Savings Scheme (SCSS) is the best investment option for those above 60. The interest rate of 8.2% is better than that offered by most banks. Last year’s budget gave a bonanza to senior citizens by hiking the investment limit per individual to Rs.30 lakh. In November, the extension rules were also relaxed. Investors can also extend the SCSS account multiple times, in blocks of three years each. Earlier, one could extend it only once, and for three years, at the end of the original fiveyear term. However, an accountholder extending the scheme will not get tax deduction under Section 80C.

Though the interest earned is fully taxable as income, senior citizens enjoy tax exemption for interest up to Rs.50,000. This means up to Rs.6.25 lakh invested in the scheme will earn taxfree interest. The best part is that the scheme pays out pension at the start of each quarter.

However, the eligibility is restricted to those above 60 years. In some cases, where the investor has opted for voluntary retirement and has not taken up another job, the minimum age is relaxed to 58 years. There is also no age bar for defence personnel. They can invest in the scheme even before 60 as long as they satisfy the other requirements. These restrictions have brought down its score. An account can be opened in a Post Office or at designated branches of banks. It is better to open an account with a bank because operating it will be less cumbersome.

Sukanya Samriddhi Yojana

RETURNS: 8.2% in Jan-Mar 2024

Lock-in: Till child is 18

The recent hike in interest rate has made it an attractive option for parents with girl children. But it has a limited scope.

The interest rate of the Sukanya Samriddhi Yojana was raised to 8.2% last week, making it the most lucrative scheme in the small savings basket. The Senior Citizens’ Savings Scheme also gives 8.2%, but the income is fully taxable. The interest earned by the Sukanya scheme is tax-free. The only problem is that the scheme has a very restrictive entry. It is open only to taxpayers with daughters below 10 years. There is also an annual cap of Rs.1.5 lakh on the investment. These restrictions bring down the score of the scheme.

Accounts can be opened in any post office or designated banks with a minimum investment of Rs.250. A parent can open an account for a maximum of two daughters, but the combined investment in the two accounts cannot exceed Rs.1.5 lakh in a year. Do note that it is mandatory to make a minimum deposit every year for 15 years from the date of account opening, otherwise the account is deactivated. You can reactivate the account with a fine of Rs.50 per year of default.

Keep in mind that the interest rate is linked to the government bond yield and is subject to change every quarter. Bond yields are high right now, but are expected to decline when the RBI cuts rates. So, don’t expect the Sukanya interest rate to remain at this level for very long.

Even so, the scheme is a very good addition to the fixed income portfolio. It offers a higher rate than the PPF and gives assured returns.

Retirement mutual funds

RETURNS: 7-9% in past five years

Lock-in: 5 years

These hybrid funds invest in a mix of equity and debt. The debt portion gives stability to the portfolio, while the equity portion helps them generate good returns.

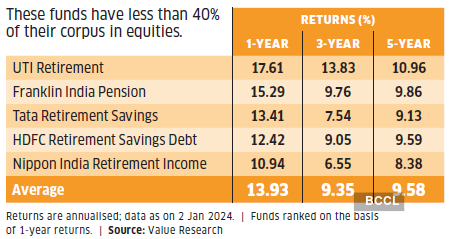

How retirement funds fared

Equity markets have been on a roll, but not everyone can stomach the risk. At the same time, the high inflation means that the real returns of fixed income portfolios will be very low. Some hybrid schemes give investors the best of both worlds by investing in a mix of debt and equity. Unlike ELSS funds, which invest their entire corpus in equities, retirement mutual funds invest in a mix of equity and debt instruments. The debt portion gives stability to the portfolio, while the equity portion helps them generate good returns (see table). They are also eligible for tax deduction under Section 80C.

We particularly like UTI Retirement Fund, which has given good returns at a significantly lower risk. The fund has less than 40% of its corpus in equities. Investors with a low risk appetite who want to save for the long term can go for these retirement funds. However, these funds have a lock-in period of five years. Also, some retirement funds, such as Franklin Pension Fund, levy an exit load if redeemed before you turn 58.

NSCs, tax-saving FDs

RETURNS:7-8%

Lock-in: 5 years

Good option only for late risers and senior citizens who may have exhausted the investment limit in SCSS.

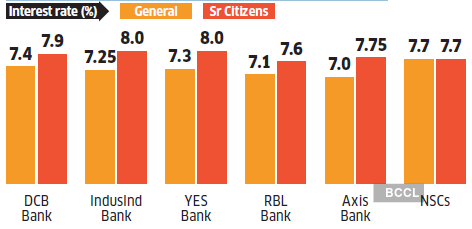

The 7-8% interest offered by tax-saving fixed deposits might look attractive, but tax eats into the returns. Interest is fully taxable at the slab rate applicable to the individual, so the post-tax return for investors in the 30% tax bracket is less than 5%. However, there are some plus points too. One big advantage is that the investment can be done very quickly with minimum effort. The taxpayer has to just log on to his Netbanking account, and complete the process.

Top tax-saving fixed deposits

Compared to bank deposits, NSCs are more attractive. They are offering 7.7%, and the interest earned on the NSC is eligible for deduction in the following years. Here’s how this works. If an investor buys Rs.50,000 worth of NSCs in January 2024, the investment would earn Rs.3,840 in a year. The investor can claim deduction for this Rs.3,840 in 2024-25. The next year, the Rs.4,000 interest can be claimed as a deduction in 2025-26.

Pension plans

RETURNS: 7-14% in past five years

Lock-in: Till retirement

Pension plans from insurance companies can’t match the NPS on costs, flexibility and tax benefits.

Pension plans from life insurance companies basically work like Ulips, but they can’t match the numerous tax advantages that the NPS and Ulips enjoy. Making pension plans eligible for deduction under Section 80CCD is one of the long-standing demands of the life insurance industry. However, it is unlikely that the coming budget will curtail the exclusive benefit enjoyed by the government-sponsored NPS.

The NPS also allows the investor to shift from one pension fund manager to another if he is not satisfied with the service or performance. However, in case of a pension plan, the investor is tied to the same insurance company till the plan matures. The problem of taxability of the pension income from annuity is something that both pension plans and the NPS have to contend with.

According to the experts, if annuities are made tax-free, it will be a game changer for the industry and will go a long way in making India a pensioned society.

Life insurance policies

RETURNS: 5-6%

Lock-in: Minimum 5 years

Insurance policies continue to be the worst way to save tax. Corpus is tax-free but flexibility and returns are very low.

Life insurance is the bulwark of a financial plan because it safeguards all other financial goals. However, these are the worst way to save tax in our ranking. The objective of life insurance is to provide financial support to a family if the breadwinner dies.

This purpose is best accomplished through a pure protection term plan with no investment component. These plans cost a fraction of what you pay for a traditional endowment policy or a money back plan. A 30-year-old man can buy a cover of Rs.1 crore for 30 years by paying an annual premium of Rs.12,000-14,000 per year.

In comparison, an endowment plan offering a cover of Rs.40-50 lakh will cost the buyer almost Rs.4-5 lakh per year. The only good thing about life insurance policies is the guaranteed returns and tax-free maturity corpus. But these benefits are far outweighed by the low returns and inflexibility of the instrument.

Last year’s budget made a fundamental change by bringing life insurance into the tax net. Now, if the annual premium of all new policies exceeds Rs.2.5 lakh, the maturity will not be tax-free.