The Reserve Bank of India (RBI) regulates NBFCs or Non-banking Financial Companies in accordance with the RBI Act of 1934. Due to the credit risk attached to NBFCs, they typically provide higher interest rates on their fixed deposits (FDs) than banks.

Safety frequently takes a backseat when pursuing higher interest rates, which results in defaults and repayment delays. It is therefore better to invest in a fixed deposit that has received the greatest safety ratings from reputable credit rating agencies.

Here are popular NBFCs offering best fixed deposit interest rates;

Bajaj Finance FD interest rates

Bajaj Finserv interest rate offers between 7.70% to 8.60% for non-cumulative deposits, for senior citizens on special deposit for deposits between 15 months to 44 months.

On regular deposits, Bajaj Finserv interest rate offers between 7.65% to 8.30% for senior citizens on different tenures.

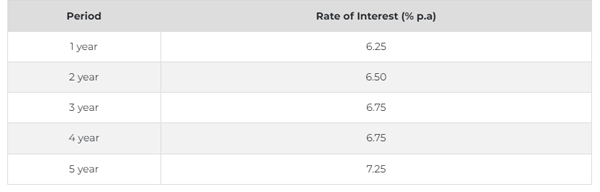

Muthoot Finance FD interest rates

Muthoot Finance offers interest under Muthoot Cap, for non-cumulative deposit with an annual interest plan it offers 6.25% to 7.25%.

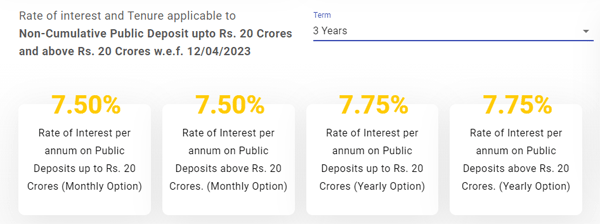

LIC Housing Finance FD interest rates

LIC Housing Finance offers interest rates of 7%to 7.75% on deposits up to Rs. 20 crore for non-cumulative deposits. For cumulative deposits, the LIC HFL offers 7.25% to 7.75%. The minimum amount to invest is Rs. 20,000.

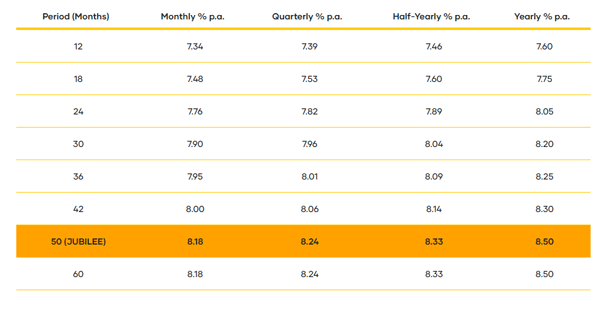

Sundaram Finance FD interest rates

This Finance offers fixed deposit interest rates between 7.60% to 8.50% for regular citizens and 0.50% higher for senior citizens which is 8% to 9% ( including Jublee FD). Can earn up to 9.10% p.a. including 0.50% p.a. for senior citizens and 0.10% p.a. for women.

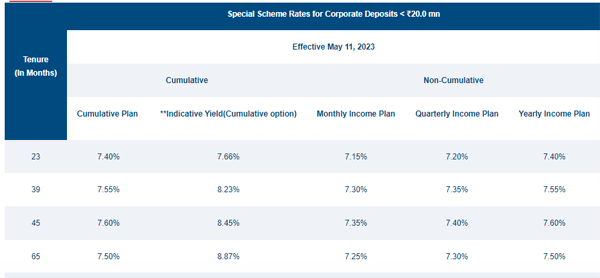

ICICI Home Finance FD interest rates

ICICI Home Finance offers fixed deposit interest rates between 7.25% to 7.75% for senior citizens in a yearly income plan for non-cumulative deposits. On special deposits7.65% to 7.85 for senor citizens non cumulative deposits under yearly plan.

Non-Cumulative FD

In a Non-Cumulative FD, the interest earned is distributed in accordance with your preferences at regular periods. You have a choice between monthly and quarterly interest payments.

Depending on your preferences for liquidity and investing objectives, you can choose between the cumulative and non-cumulative. The cumulative FD is an excellent choice if you wish to create a corpus for short- or long-term goals. However, the non-cumulative FD is better suited if you require consistent revenue to cover ongoing expenses.

According to the Axis Bank, “Keep in mind that a Cumulative FD can yield higher interest returns because of compounding but the interest is paid out at the end of the tenure. On the other hand, Non-Cumulative FDs offer a regular income through periodic interest payouts.”