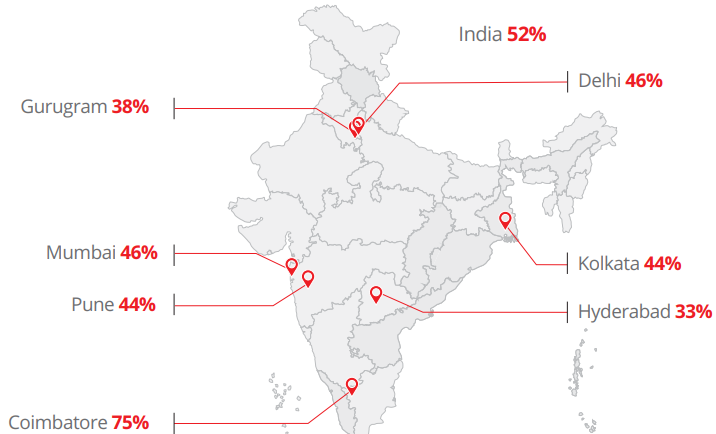

According to the Women and Finance report by DBS Bank India and CRISIL, 52% of self-employed women in Indian metros have implemented sustainability policies in their businesses. However, only 14% have approached banks for sustainability-linked finance.

Traditional banking preferences dominate

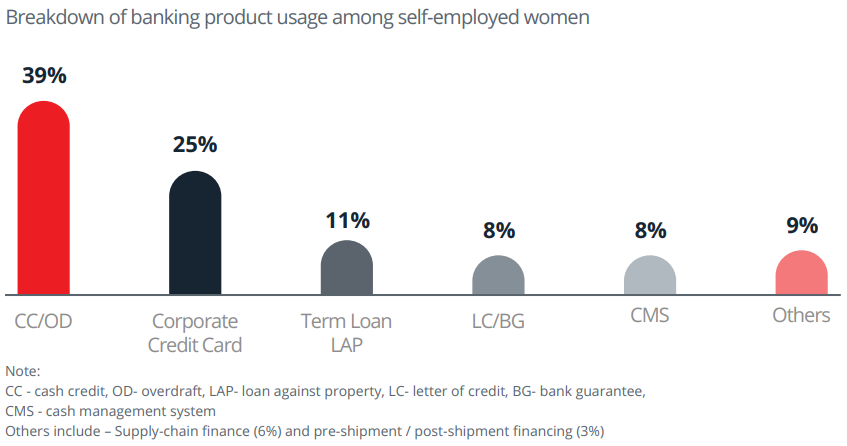

While sustainability-linked finance remains underutilised at 15%, many women entrepreneurs continue to rely on traditional banking products. The report reveals that cash credit (CC) and overdraft (OD) facilities are the most popular financial tools, with 39% of women entrepreneurs opting for these products. Corporate credit cards follow at 25%, and property-backed term loans are used by 11% of respondents.

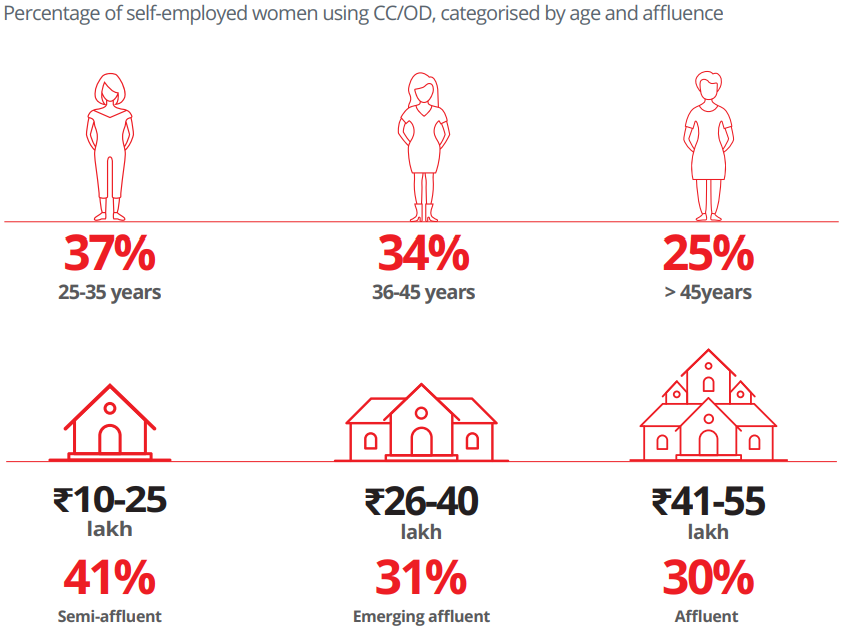

However, the use of these products declines with age and affluence. For instance, 37% of women aged 25-35 years prefer CC/OD facilities, while the figure drops to 25% among women over 45. Similarly, 41% of semi-affluent women (₹10-25 lakh annual income) rely on these products, compared to only 30% among affluent women (₹41-55 lakh).

Adoption of Green Finance

The Women and Finance report shows that there is a clear interest among women entrepreneurs in embedding sustainability within their business operations. In cities like Coimbatore, 75% of women entrepreneurs have already implemented sustainability policies, compared to only 33% in Hyderabad. Yet, these same women are often unaware of, or unable to access, financial products that could help scale their green initiatives.

Women insuring their businesses

The report also brings light on the importance of risk management for women entrepreneurs, 66% of self-employed women in Indian metros have insured their businesses.

Regional variations were observed, with 91% of self-employed women in Ahmedabad having insured their businesses, the highest in the country, while only 60% in Kolkata have done.

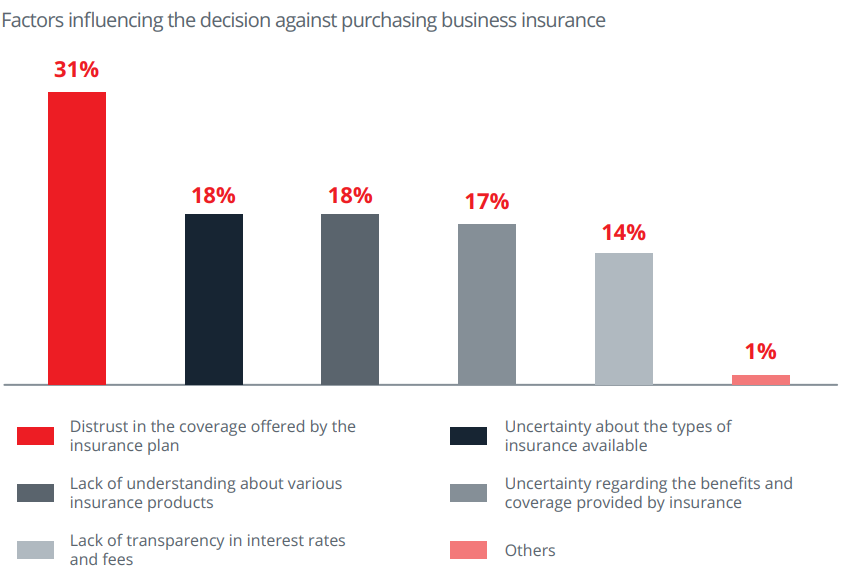

However, for the 31% of women who do not insure their businesses, the primary deterrent is a lack of trust in the coverage offered. Additionally, 53% of entrepreneurs cite uncertainty about the types of insurance available and a lack of understanding of how various products could benefit them.

Digital banking adoption

The adoption of digital banking doesn’t see a high number among the self employed women, standing at 24% of women preferring digital banking when selecting their primary account.

Factors such as convenient branch locations and a large ATM network govern the decision.