FundedNext Review: Uncovering the Future of Innovation and Entrepreneurship

FundedNext provides a funding opportunity of up to $300,000 to support novice traders in their initial stages and assist them in progressing on their trading journey. Traders are offered a choice among four distinct funding options, namely the Evaluation Model, Express Model, One-Step Stellar Challenge, and Two-Step Stellar Challenge.

Having undergone two and a half years of development, FounderNext is a reputable firm that offers funding solutions to individuals worldwide. Operating from various locations, they specialize in arranging funding options for aspiring traders.

Pros of FundedNext

In development for 2.5 years before the launch

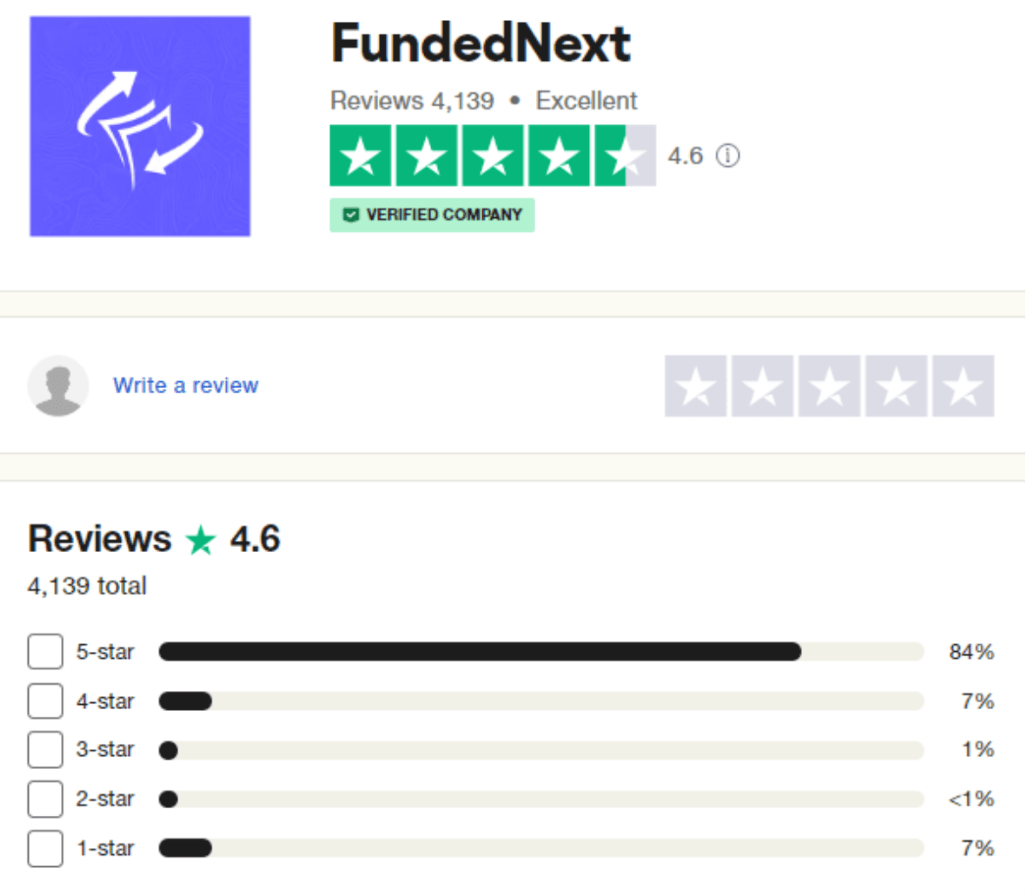

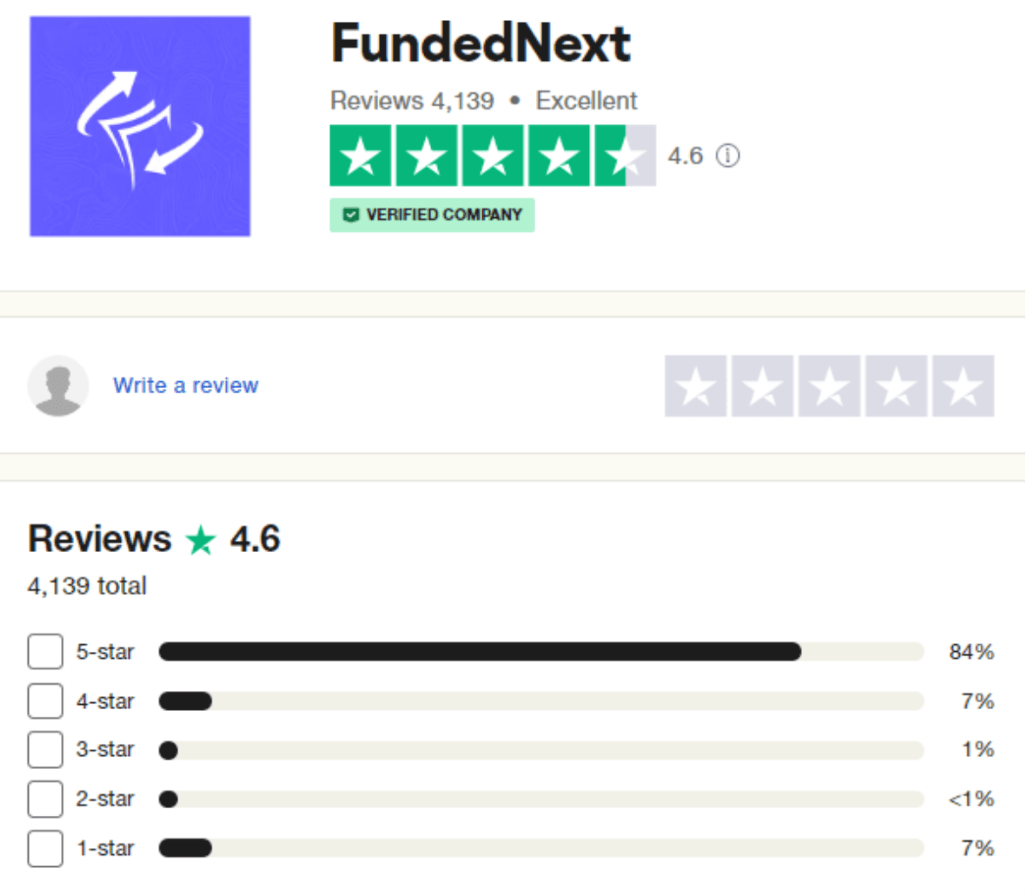

Excellent Trustpilot rating of 4.7/5

Developed their own mainline MT5 Server ”GrowthNext Server”

Instant Phase 1 & Phase 2 account credentials

Unlimited evaluation free retries

Maximum balance of $4,000,000

Balance-based drawdown

No time limitations

Profit split of 15% for evaluation stages

Up to 90% profit split

Profit sharing even if account is breached

No restrictions on trading style

Overnight and weekend holding allowed

Scaling account option

Leverage 1:100

Swap-free accounts with raw spreads

A large variety of trading instruments (forex pairs, commodities, indices)

No commission costs on indices

Free trading psychologists

Cons of FundedNext

No news trading with Express model accounts

Consistency rule for express model accounts

FundedNext encourages its customers to aspire to become accomplished traders, with a primary emphasis on disciplined individuals who possess risk management capabilities and a focus on long-term objectives. This dedication to excellence is exemplified through the scaling plan offered, which allows traders to potentially access substantial opportunities with a cap of $4,000,000. Based on the selected founding option, traders have the potential to earn a profit split ranging from 60% to 90%. Such impressive outcomes can be attained through trading activities involving forex pairs, commodities, and indices.

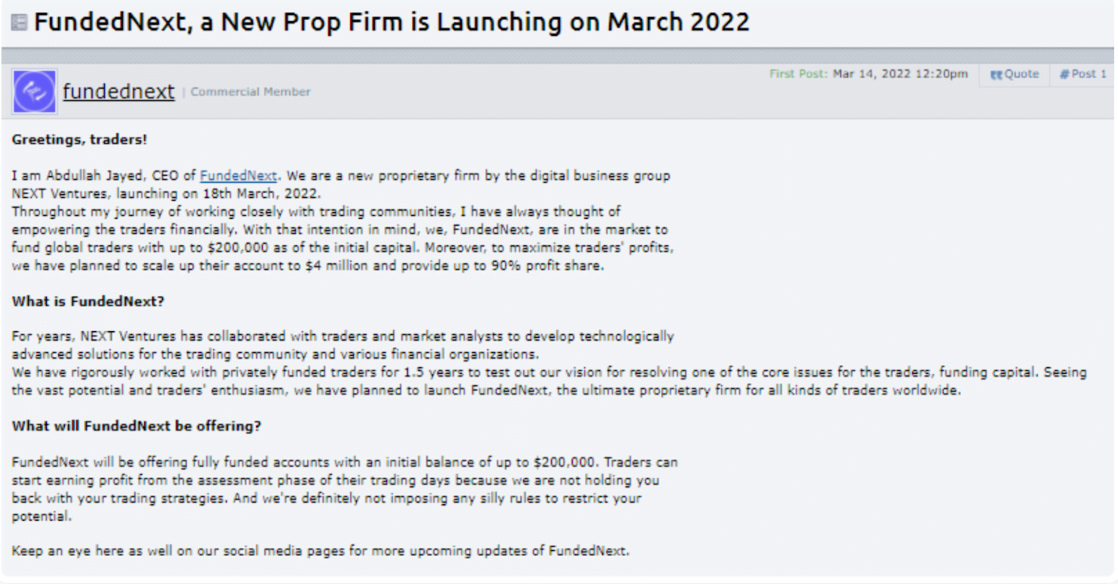

Who are FundedNext?

FundedNext is an exclusive proprietary trading firm that was officially established on March 18, 2022. With the objective of providing customers with a conducive and advantageous trading environment, the company offers a range of four distinct funding models: Two-step Stellar, One-step Stellar, Evaluation, and Express. Notably, FundedNext maintains physical offices in various global locations, including the United Arab Emirates, the United States, the United Kingdom, and Bangladesh. Their trader capital allocation extends up to $4,000,000, with a maximum profit split of 90%. As a strategic partner, FundedNext collaborates with the esteemed brokerage company Eightcap. The company’s headquarters is situated in the United Arab Emirates, precisely at the address AI Robotics HUB, C1 Building, AFZ, Ajman, United Arab Emirates.

Who’s the CEO of FundedNext?

Abdullah Jayed, the CEO of FounderNext, a highly successful proprietary trading firm with a substantial financial standing, has gained global recognition as an accomplished young entrepreneur in both the digital sector and the retail trading industry. Established in 2016, FounderNext was created with the purpose of generating employment opportunities worldwide and the ambition of simplifying people’s lives.

Jayed’s entrepreneurial prowess is evident through his notable ventures, namely Growth Alliance, MoneyBackFX, and eComChef, which rapidly emerged as leading companies in their respective markets. FounderNext, under his leadership, has also garnered considerable acclaim as an appealing entity within the trading firm industry.

Central to Jayed’s philosophy is his belief that every aspiring individual should pursue their dreams wholeheartedly to attain their objectives. This principle is exemplified within FounderNext, where he actively encourages young and inexperienced traders to test their abilities through well-defined trading strategies, fostering their success in the process.

For those interested in gaining further insights into Jayed and his company, his daily activities and updates can be followed through his social media profiles, particularly Instagram and LinkedIn.

The founding program options:

As mentioned previously there are four different types of funding options:

-

- Two-step Stellar challenge model

- One-step Stellar challenge model

- Evaluation model

- Express model

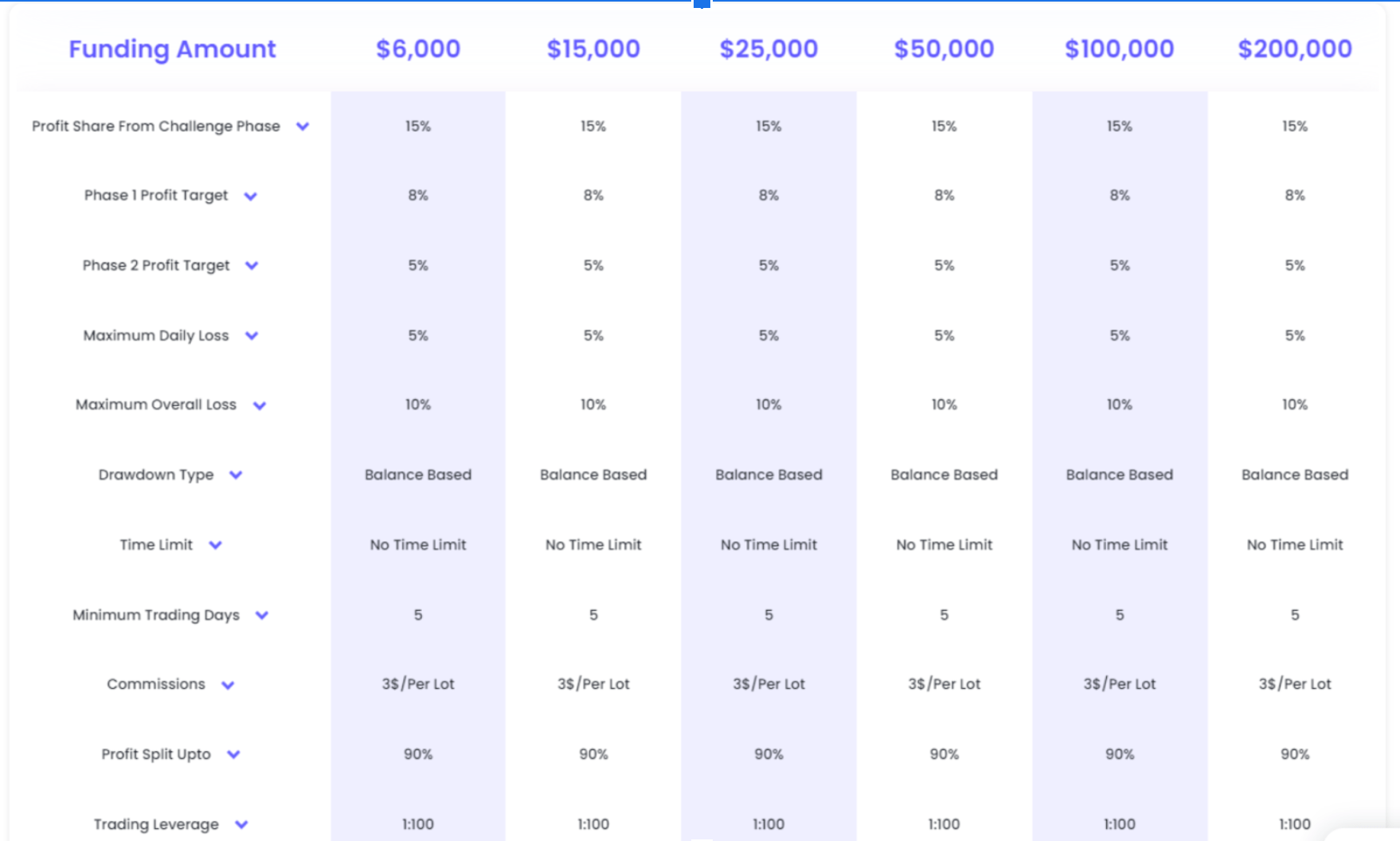

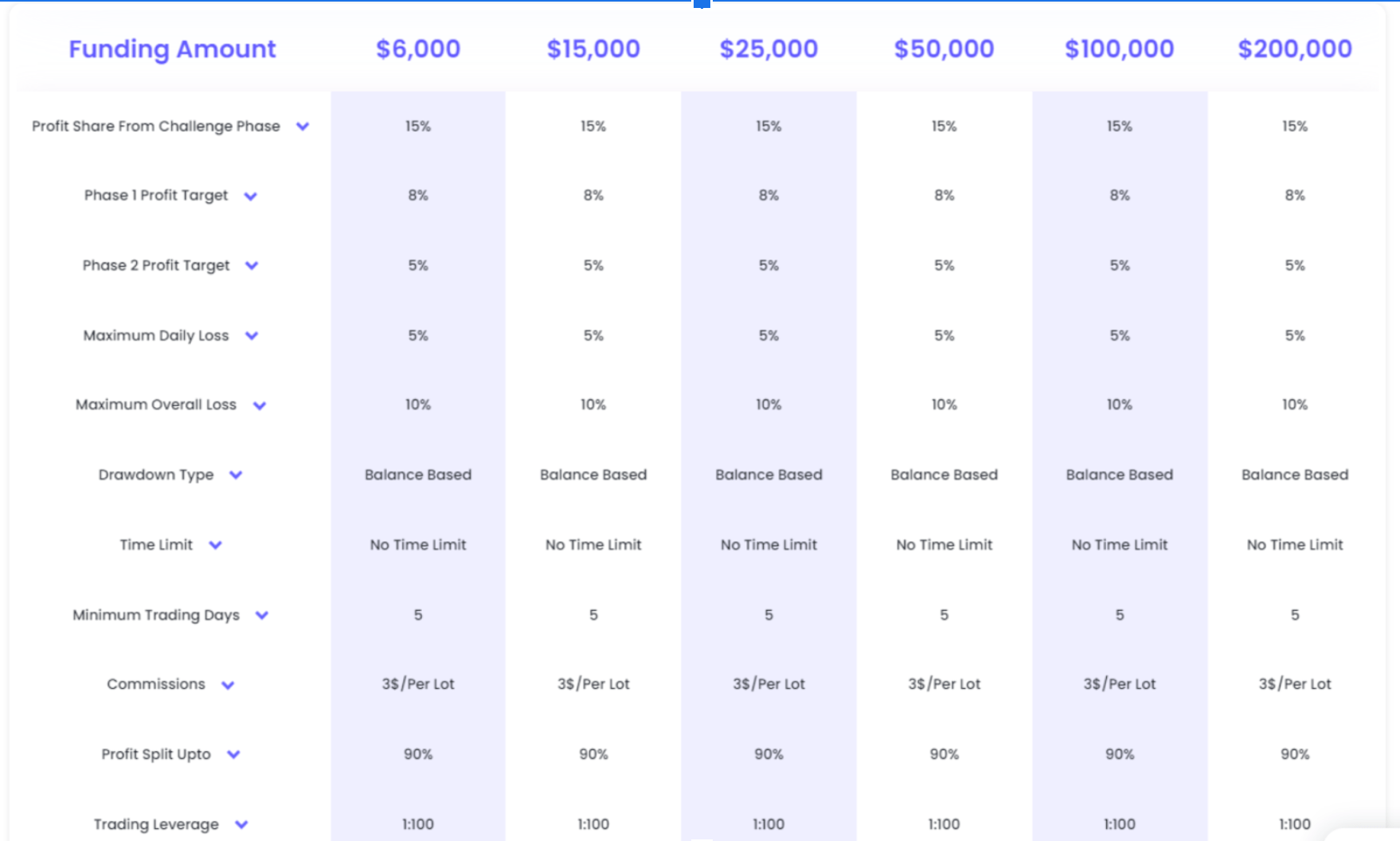

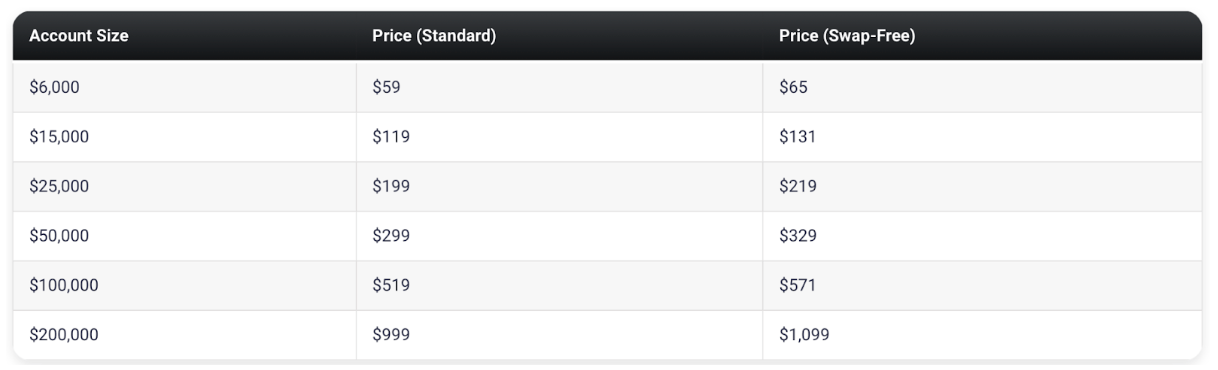

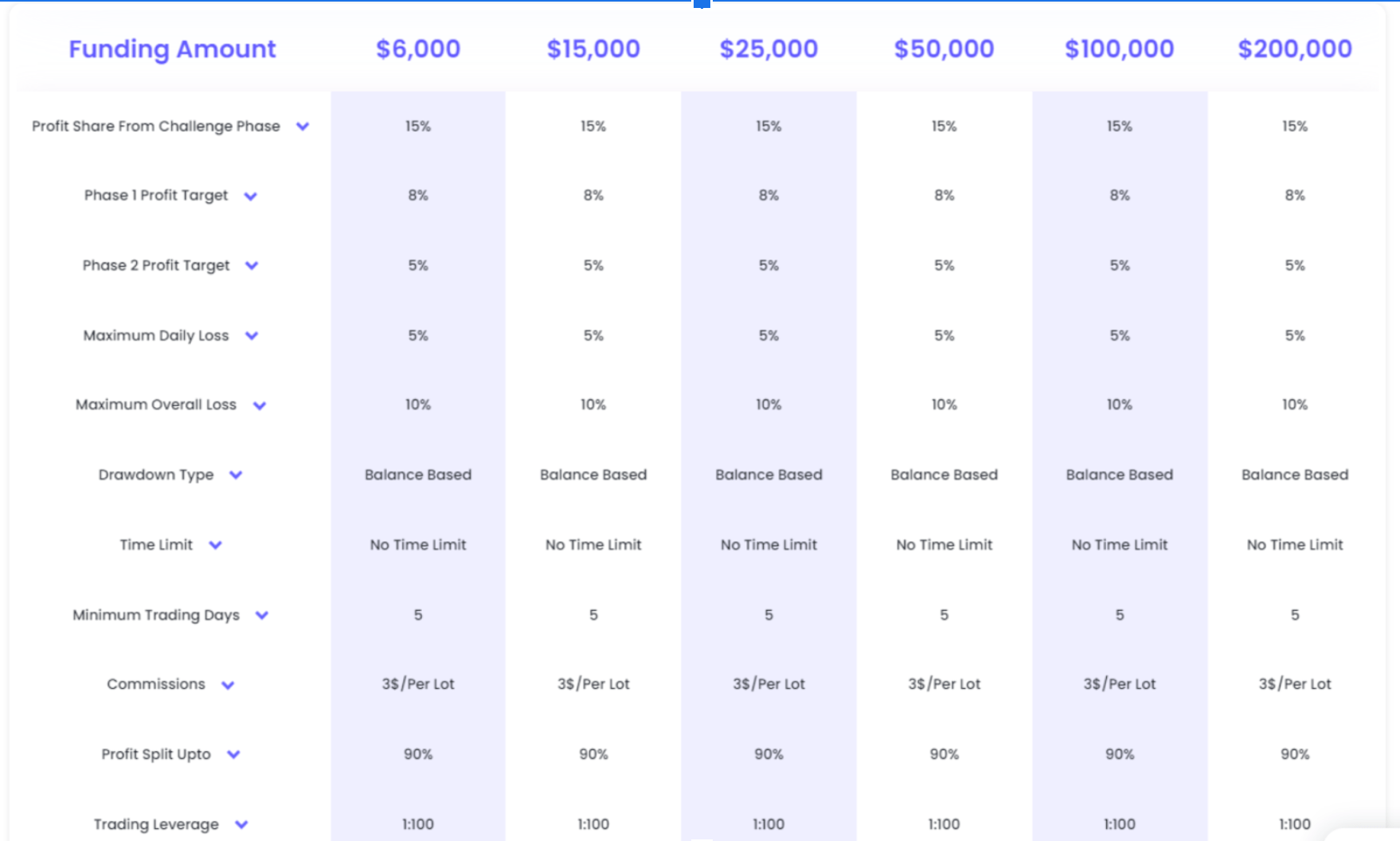

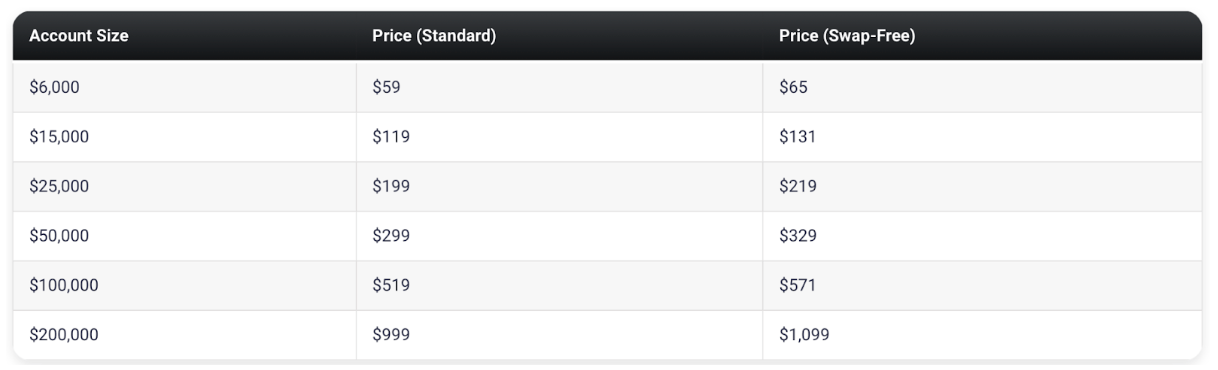

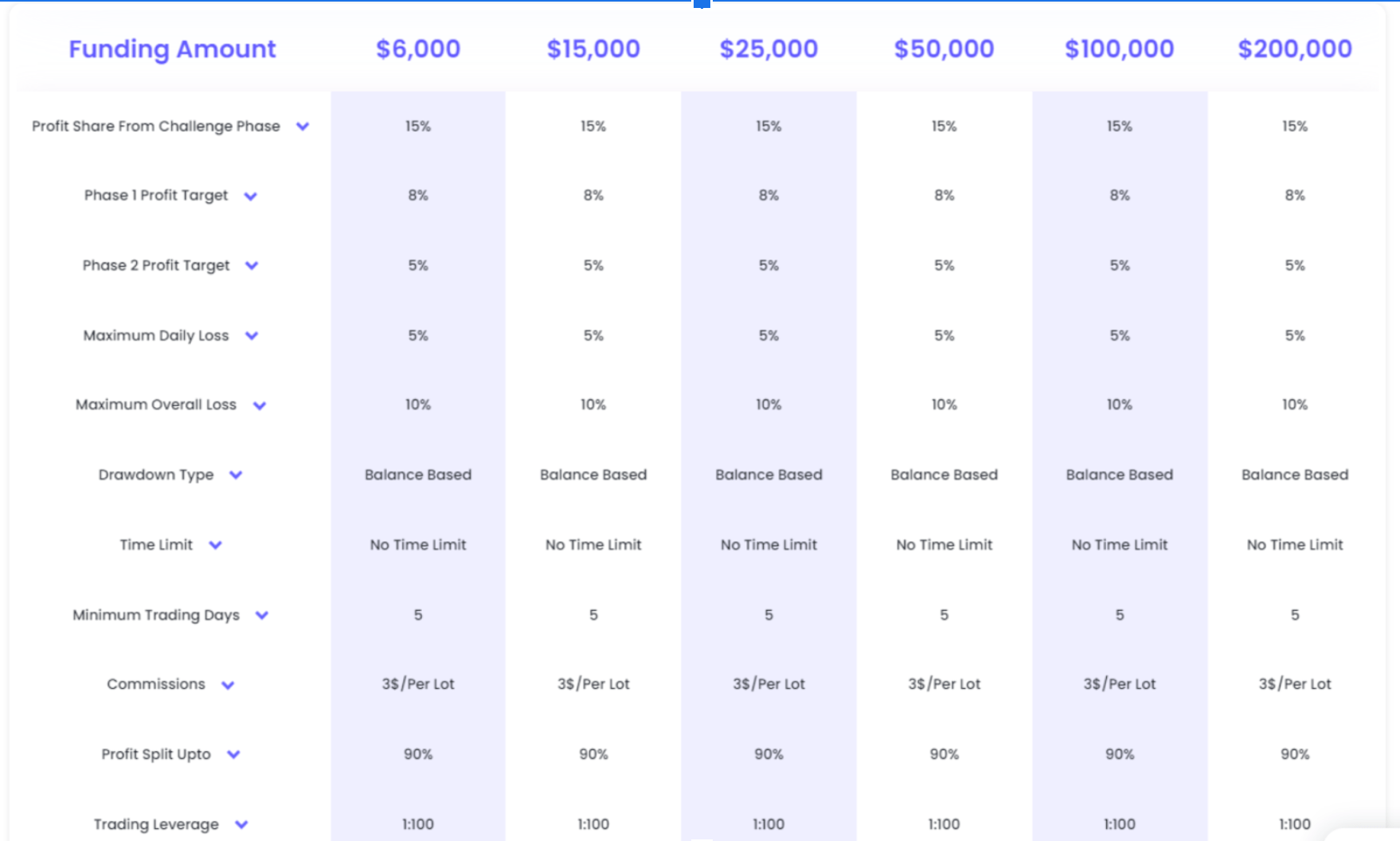

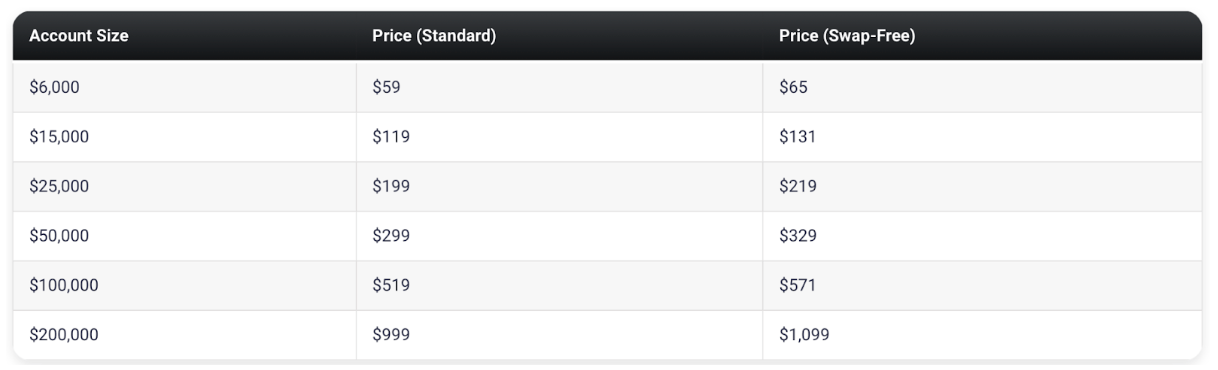

Two-step Stellar challenge model:

phase one, requires the trader to reach a profit target of 8% while not surpassing the 5% maximum daily loss or 10% maximum losses rule. In this phase there is no maximum day trading requirement, however to access phase two you are required to trade a minimum of 5 trading days.

phase two, requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. As well as it was in phase one you have no minimum trading day requirement, but in order to revive a founded account you will need a minimum of 5 trading days.

Once you complete both challenges, you are awarded with a founded account where you have no profit target, but you are required to respect the 5% maximum daily loss and 10% maximum loss rules. The first profit split is 80% based on the profy you made, plus you will be rewarded with a 15% profit share based on the profit you made on the two phase challenge in addition you will receive your first payout. From there then you will receive your payouts on a bi weekly basis.

The scaling plan of this challenge is that you need to reach a profit target of 10%or more within a four month period where two months are profits and the last month needs to end in profit. Then you will receive an account increase of 40% of the original with the possibility to increase the account balance all the way up to $4,000,000, then your profit slip will increase up to 90% when you scale your account for the first time.

Example:

After 4 months: If you have a $200,000 account, your account balance will increase to $280,000.

After next 4 months: Balance of $280,000 increases to $360,000.

After next 4 months: Balance of $360,000 increases to $440,000.

And so on…

Trading instruments for the two-step Stellar challenge model accounts are forex pairs, commodities, and indices.

Rules for two steps Stellar challenge mode:

-

- The profit target refers to a specific percentage of profit that must be achieved by a trader in order to successfully complete an evaluation phase, withdraw profits, or expand their account. During Phase 1, the profit target is set at 8%, while Phase 2 has a profit target of 5%. It is important to note that funded accounts are not subject to profit targets.

- The maximum daily loss represents the highest allowable loss a trader can incur within a single day before the account is considered in violation. Across all account sizes, there is a uniform maximum daily loss limit of 5%.

- The maximum loss indicates the highest permissible overall loss that a trader can experience before the account is deemed in violation. Similar to the maximum daily loss, all account sizes adhere to a maximum loss threshold of 10%.

- The minimum trading days denote the minimum duration that traders must actively engage in trading before they are eligible to complete a challenge phase or request a withdrawal. Both phases require a minimum of 5 trading days to be fulfilled.

One-step Stellar challenge model:

The one-step Stellar challenge model phase necessitates traders to attain a profit target of 10% while ensuring compliance with the stipulated maximum daily loss of 3% and maximum overall loss of 6%. This account type does not impose any constraints on the maximum number of trading days, allowing traders to take as much time as needed. However, during the trading period, a minimum requirement of 5 trading days per month must be fulfilled. It should be noted that this account type does not enforce any consistency rules, granting traders considerable flexibility to trade with minimal limitations and work towards achieving their profit target.

Upon successful completion of the one-step Stellar challenge model phase, you will be granted a funded account without any profit targets. However, it is important to adhere to the prescribed guidelines of a maximum daily loss of 3% and a maximum loss limit of 6%. Notably, this account type does not impose any consistency rules, affording you significant trading freedom. Nevertheless, it is mandatory to engage in trading activities for a minimum of 5 trading days within each monthly trading cycle.

Under this arrangement, your initial profit split will be 80% based on the profits generated. Additionally, you will be entitled to a 15% profit share derived from the profits obtained during the challenge phase, which will be disbursed as your first payout. It is worth noting that your profit split will increase to 90% following the first scaling of your account.

The One-step Stellar challenge model accounts include a scaling plan that necessitates achieving a profit target of 10% or higher within a four-month timeframe. To meet this criterion, two of the four months must yield profitable results, and the final month must conclude with a profit. Upon meeting these requirements, traders will receive an account increase equivalent to 40% of the initial account balance, with the potential to augment their account balance up to a maximum of $4,000,000.

Example:

After 4 months: If you have a $25,000 account, your account balance will increase to $35,000.

After next 4 months: Balance of $35,000 increases to $45,000.

After next 4 months: Balance of $45,000 increases to $55,000.

And so on…

Trading instruments for the one-step Stellar challenge model accounts are forex pairs, commodities, and indices.

rule for the one-step stellar model:

-

- The profit target represents a predetermined percentage of profit that traders must achieve in order to successfully conclude an evaluation phase, initiate profit withdrawals, or expand their trading accounts. During the challenge period, the profit target is set at 10%, whereas funded accounts do not have specific profit targets.

- The maximum daily loss denotes the upper limit of loss that traders can incur within a single day before their account is deemed in violation. Across all account sizes, there is a standardized maximum daily loss threshold of 3%.

- The maximum loss signifies the highest permissible aggregate loss that traders can experience before their account is considered in violation. Similarly, all account sizes adhere to a maximum loss limit of 6%.

- The minimum trading days requirement mandates the minimum duration for which traders must engage in trading activities before they are eligible to conclude a challenge phase or initiate a withdrawal. A minimum of 5 trading days is required during the challenge period, and an additional minimum of 5 trading days must be fulfilled within each monthly trading cycle.

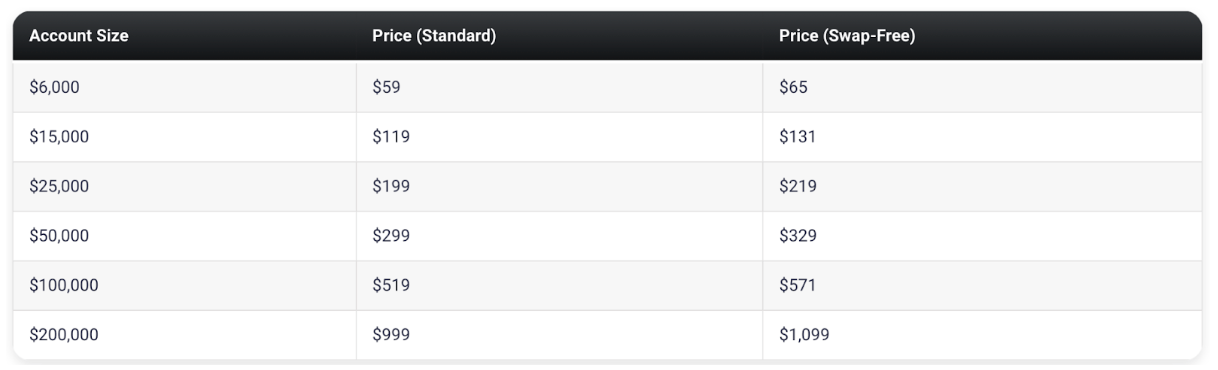

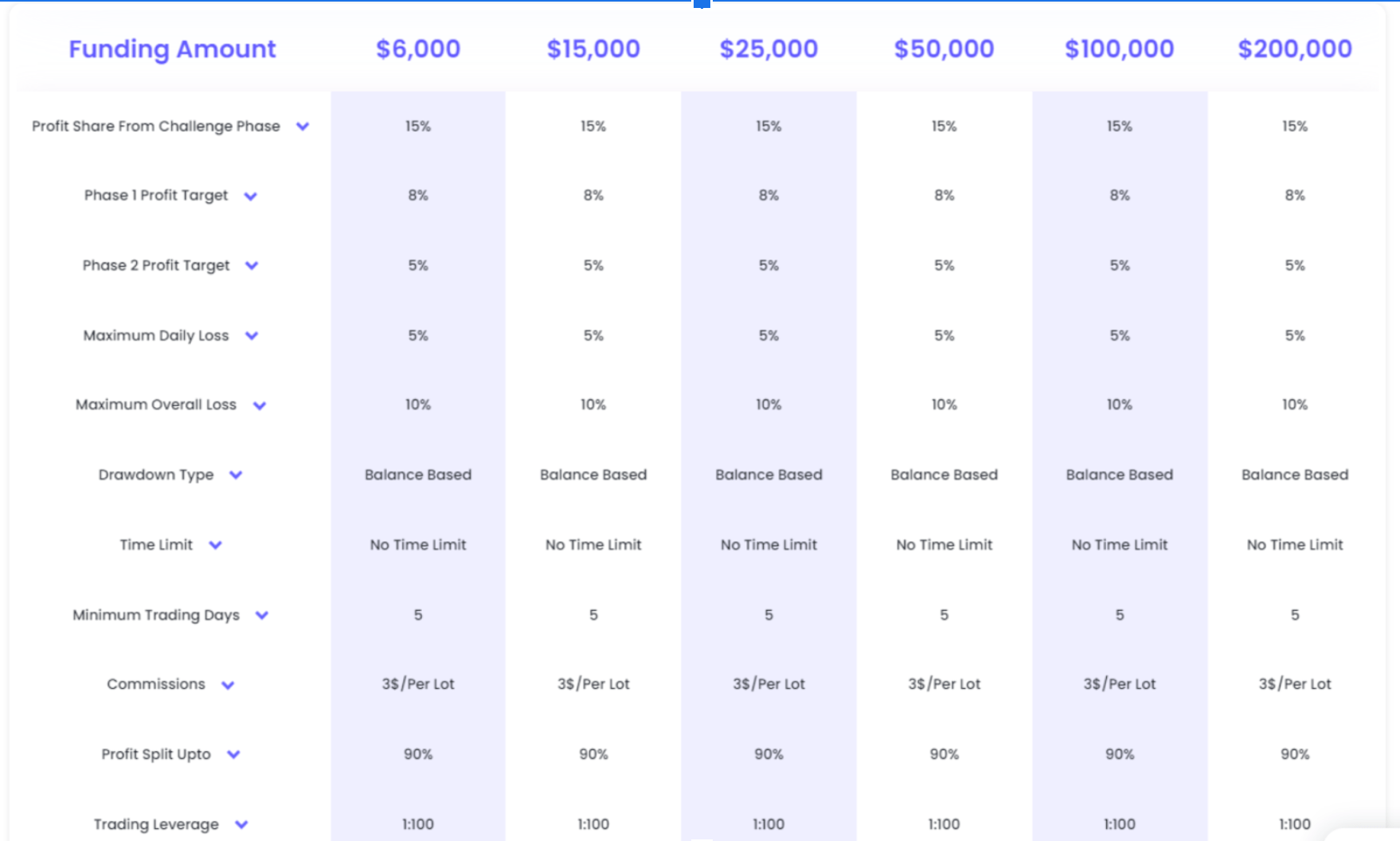

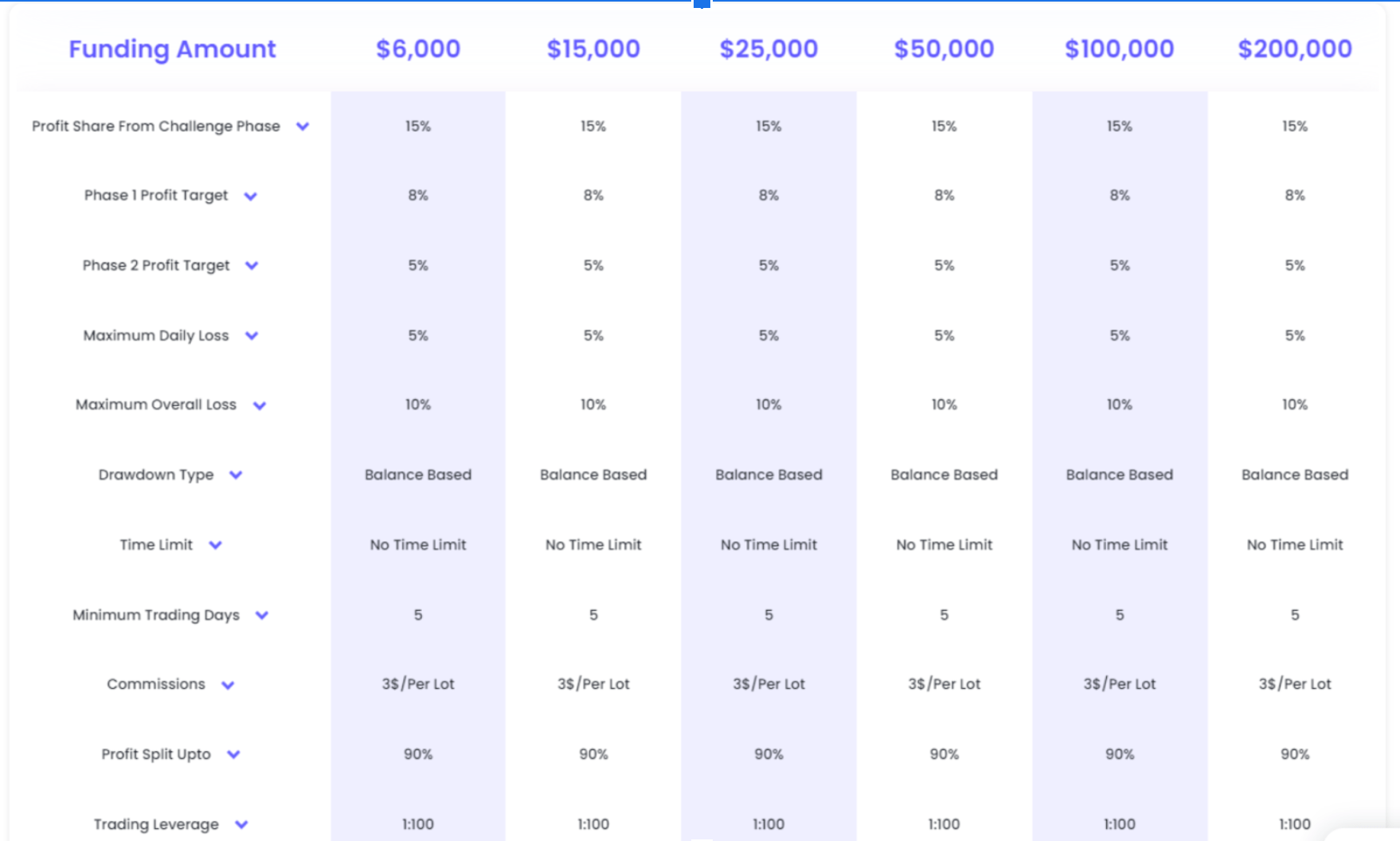

Evaluation model account:

During the evaluation phase, traders are expected to achieve a profit target of 10% without exceeding the prescribed limits of 5% for maximum daily loss or 10% for maximum loss. The profit target must be attained within a 30-calendar day period starting from the initiation of the first trade on the evaluation account. Furthermore, a minimum of five trading days must be completed in order to progress to phase two.

In the subsequent evaluation phase, traders are required to attain a profit target of 5% while adhering to the 5% maximum daily loss and 10% maximum loss regulations. The profit target must be met within a 60-calendar day duration commencing from the placement of the initial position on the evaluation account. Similarly, a minimum of five trading days must be fulfilled to advance to a funded account.

Upon successful completion of both evaluation phases, traders are rewarded with a funded account in which profit targets are no longer applicable. However, the 5% maximum daily loss and 10% maximum loss thresholds must still be respected. Initially, traders will receive 80% of the profits they generate as their first profit split. Additionally, a 15% profit share based on the profits achieved in each evaluation phase will be granted as part of the first payout. Subsequently, payouts will be disbursed bi-weekly.

The evaluation model accounts also incorporate a scaling plan. Traders must achieve a profit target of 10% or more within a four-month timeframe, during which at least two of the four months must be profitable, and the final month must end with a profit. Upon meeting these criteria, the trader’s account balance will be increased by 40% of the original amount, with the potential to further elevate the account balance up to $4,000,000. Moreover, the profit split will be raised to 90% following the first account scaling.

Example:

After 4 months: If you have a $200,000 account, your account balance will increase to $280,000.

After next 4 months: Balance of $280,000 increases to $360,000.

After next 4 months: Balance of $360,000 increases to $440,000.

And so on…

Trading instruments for the evaluation program accounts are forex pairs, commodities, and indices

Evaluation Model Account Guidelines

The profit target represents a predetermined percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or expand their account. Phase 1 requires a profit target of 10%, while Phase 2 sets a target of 5%. It is important to note that funded accounts do not have profit targets.

The maximum daily loss refers to the highest allowable loss that traders can incur within a single day before their account is considered in violation. For all account sizes, there is a uniform maximum daily loss limit of 5%.

The maximum loss indicates the highest permissible overall loss that traders can experience before their account is deemed in violation. Similar to the maximum daily loss, all account sizes adhere to a maximum loss threshold of 10%.

The minimum trading days denote the minimum duration during which traders are required to actively engage in trading before they become eligible to complete an evaluation phase or request a withdrawal. Both phases necessitate a minimum of 5 trading days.

Moreover, there are maximum trading day limits, which require traders to achieve a specific profit target or withdrawal target within a defined period. Phase 1 allows a maximum trading period of 30 days, while Phase 2 grants a maximum trading period of 60 days.

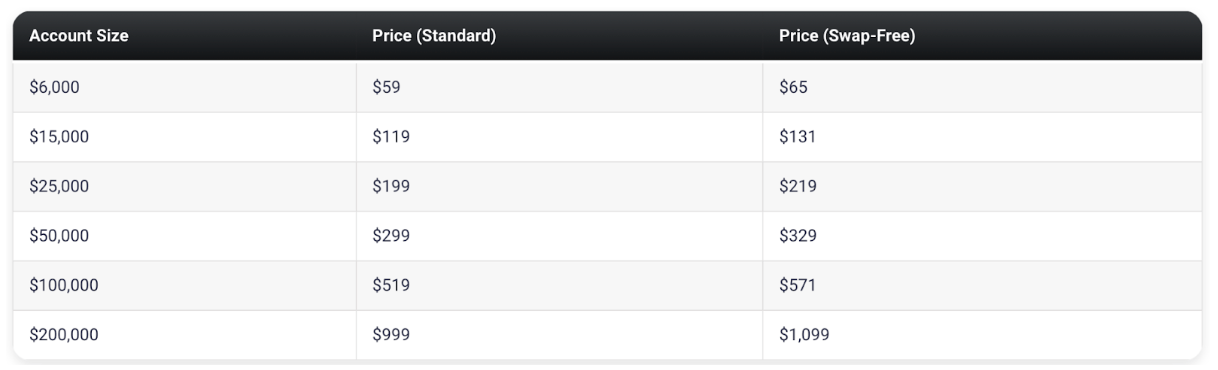

Consistency expresses model account:

The consistency Express model account allows traders to meet the one-step evaluation requirements with no maximum trading day requirements and up to 1:100 leverage.

The evaluation phase of the Consistency Express model necessitates traders to achieve a profit target of 25%, while strictly adhering to the maximum daily loss and maximum loss thresholds of 5% and 10% respectively. There are no specific requirements regarding the duration of the evaluation phase; traders can take as much time as needed. However, it is mandatory to engage in trading for a minimum of 10 trading days per month during this period. Furthermore, traders must observe the consistency rule, which aims to cultivate consistent trading practices and ensure that profits are generated steadily until the profit target is reached.

Upon successful completion of the Consistency Express model evaluation phase, traders are rewarded with a funded account. In this funded account, there are no profit targets to be met. However, traders must still comply with the 5% maximum daily loss and 10% maximum loss rules. It is important to note that the consistency rule remains in effect even after transitioning to a funded account. Additionally, traders are obliged to trade for a minimum of 10 trading days during each monthly trading cycle. Initially, the profit split stands at 60% based on the profits generated. Moreover, traders receive a 15% profit share from the profits achieved during the evaluation phase as their first payout. Subsequently, the profit split increases to 75% after the first withdrawal and reaches a final profit split of 90% after the second withdrawal.

The Consistency Express model also entails a scaling plan. Traders are required to attain a profit target of 10% or more within a four-month period, during which two of the four months must yield profits, and the final month must conclude with a profit. Upon meeting these criteria, traders are eligible for an account increase equal to 40% of the original account balance, with the possibility of further increasing the account balance up to $4,000,000.

Example:

After 4 months: If you have a $100,000 account, your account balance will increase to $140,000.

After next 4 months: Balance of $140,000 increases to $180,000.

After next 4 months: Balance of $180,000 increases to $220,000.

And so on…

Trading instruments for the Consistency Express model accounts are forex pairs, commodities, and indices.

Consistency in Express Model Account rules

The profit target represents a specific percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or expand their account. During the evaluation period, the profit target is set at 25%. However, funded accounts do not have profit targets.

The maximum daily loss denotes the highest allowable loss that traders can incur within a single day before their account is considered in violation. Across all account sizes, there is a uniform maximum daily loss limit of 5%.

The maximum loss indicates the highest permissible overall loss that traders can experience before their account is deemed in violation. Similar to the maximum daily loss, all account sizes adhere to a maximum loss threshold of 10%.

The minimum trading days specify the minimum duration during which traders must actively engage in trading before they are eligible to complete an evaluation phase or request a withdrawal. During the evaluation period, a minimum of 10 trading days is required. Furthermore, in each subsequent monthly trading cycle, traders are also expected to trade for a minimum of 10 days.

The “no weekend holding” policy strictly prohibits traders from maintaining open positions during weekends.

The “no news trading” policy restricts traders from participating in trading activities during high-impact news releases. During both the evaluation period and funded status, traders are prohibited from opening or closing any trades within a 5-minute window before and after news releases.

The consistency rule is a fundamental requirement that mandates traders to maintain consistency in various aspects, such as position sizes, risk management, losses, gains, and more. This rule necessitates that account results exhibit a level of consistency, without drastic variations in their characteristics.

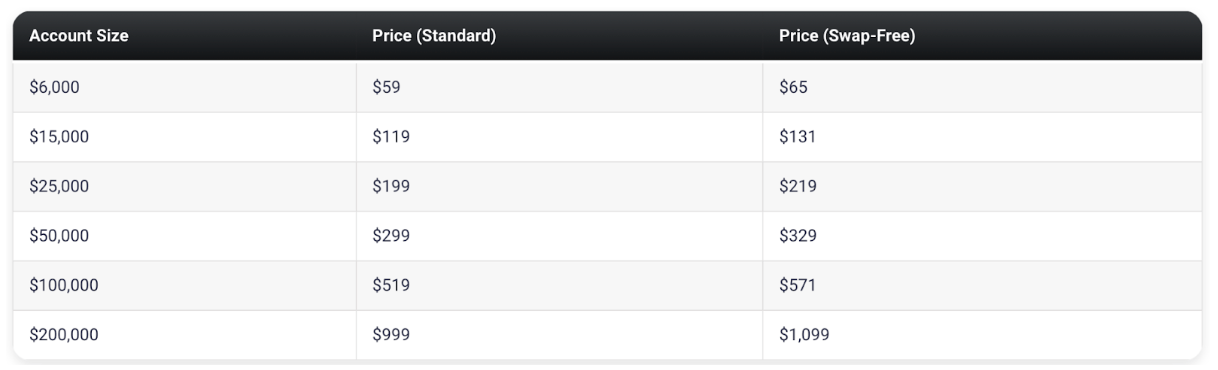

Non-Consistency express model account:

The non-consistency Express model account allows traders to meet the one-step evaluation requirements with no maximum trading day requirements and up to 1:100 leverage

The Non-consistency Express model evaluation phase necessitates that traders achieve a profit target of 25% while adhering to the 5% maximum daily loss and 10% maximum loss regulations. Unlike other account types, there are no specific requirements regarding the number of trading days, allowing traders to determine the duration of their trading activities. However, a minimum of 10 trading days per month is mandated during the trading period. It is important to note that this account type does not impose any consistency rules, granting traders significant flexibility to trade with the aim of attaining their profit target.

Upon successful completion of the Non-consistency Express model evaluation phase, traders are rewarded with a funded account size equivalent to 25% of the challenge amount. In practical terms, if a trader passes the $100,000 Non-consistency Express model evaluation, they will receive a funded account worth $25,000. In this account type, there are no profit targets to be met. However, traders must observe the 5% maximum daily loss and 10% maximum loss rules. Similar to the evaluation phase, there are no consistency rules governing trading activities. Nevertheless, traders are obliged to engage in a minimum of 10 trading days during each monthly trading cycle.

During the initial profit split, traders are entitled to 60% of the profits they generate. Additionally, they receive a 15% profit share based on the profits earned during the evaluation phase as their first payout. Following the first withdrawal, the profit split increases to 75%, and after the second withdrawal, it reaches the final profit split of 90%.

Scaling plans are also applicable to Non-consistency Express model accounts. Traders must achieve a profit target of 10% or more within a four-month timeframe, where at least two of the four months must be profitable, and the final month must conclude with a profit. Upon meeting these requirements, traders receive an account increase of 40% of the original account balance, with the possibility of further augmenting the account balance up to $4,000,000.

Example:

After 4 months: If you have a $25,000 account, your account balance will increase to $35,000.

After next 4 months: Balance of $35,000 increases to $45,000.

After next 4 months: Balance of $45,000 increases to $55,000.

And so on…

Trading instruments for the Non-consistency Express model accounts are forex pairs, commodities, and indices.

non-consistency express model rules:

The profit target represents a predetermined percentage of profit that traders must achieve in order to successfully conclude an evaluation phase, withdraw profits, or expand their trading account. During the evaluation period, the profit target is set at 25%, whereas funded accounts are exempt from profit targets.

The maximum daily loss signifies the highest permissible loss that traders can incur on a daily basis before their account is deemed to be in violation. Regardless of account size, a uniform maximum daily loss of 5% is applied.

The maximum loss refers to the upper limit of overall loss that traders can sustain before their account is considered in violation. Similar to the maximum daily loss, all account sizes adhere to a maximum loss threshold of 10%.

The minimum trading days denote the minimum duration that traders are required to actively engage in trading before they become eligible to complete an evaluation phase or request a withdrawal. A minimum of 10 trading days is mandatory during the evaluation period, and the same requirement applies to each subsequent monthly trading cycle.

The restriction on news trading prohibits traders from engaging in trading activities during periods of high-impact news releases. Specifically, during the evaluation period as well as when holding a funded status, traders are prohibited from opening or closing any trades within 5 minutes before and after the release of news events.

What makes FundedNext different from other prop firms?

FundedNext distinguishes itself from other prominent proprietary trading firms by providing a range of four distinct funding models: Two-step Stellar, One-step Stellar, Evaluation, and Express. Furthermore, FundedNext implements trading rules that are relatively straightforward and flexible in nature.

In comparison to typical prop firms, FundedNext’s two-step Stellar challenge model stands out as a funding structure that necessitates traders to successfully complete two sequential phases before becoming eligible for payouts. Phase one entails achieving an 8% profit target, followed by phase two with a 5% profit target. These phases are accompanied by rules that impose a maximum daily loss of 5% and a maximum overall loss of 10%. Notably, there are no specific requirements concerning the maximum number of trading days. However, a minimum trading period of 5 calendar days is mandatory. Additionally, the two-step Stellar challenge model incorporates a scaling plan. FundedNext’s profit targets are relatively modest compared to other leading proprietary trading firms, and they do not impose any restrictions on the maximum number of trading days.

In comparison to other proprietary trading firms, FundedNext offers a distinct one-step Stellar challenge model account that functions as a comprehensive evaluation program. Traders must successfully complete a single phase to qualify for payouts. Within this evaluation phase, the profit target is set at 10%, while adherence to a maximum daily loss of 3% and maximum loss of 6% is mandatory. It is important to note that there are no restrictions on the number of trading days. However, a minimum trading duration of 5 calendar days is required.Furthermore, the one-step Stellar challenge model accounts provided by FundedNext include a scaling plan. When comparing FundedNext with other prominent proprietary trading firms, it becomes evident that they uphold average maximum loss rules and do not impose any limitations on the number of trading days.

On the other hand, FundedNext’s evaluation model follows a two-phase structure, necessitating the completion of both phases to become eligible for payouts. Phase one requires traders to attain a profit target of 10%, while phase two has a profit target of 5%. Compliance with maximum daily loss of 5% and maximum loss of 10% is mandatory in each phase. Additionally, traders are expected to engage in a minimum of 5 trading days during each phase before becoming funded. Similar to the one-step Stellar challenge model, the evaluation programs offered by FundedNext incorporate a scaling plan. In comparison to other industry-leading proprietary trading firms, FundedNext sets profit targets and minimum trading day requirements at average levels.

FundedNext sets itself apart from other prominent proprietary trading firms by providing a unique evaluation program known as the FundedNext Express model accounts. These accounts consist of a single-phase assessment process, where traders must achieve a specified profit target in order to qualify for payouts. Traders have the option to select either a Consistency or Non-consistency Express model account, based on their preferences.

During the challenge phase of the evaluation, traders are required to reach a profit target of 25%, while adhering to rules that limit maximum daily loss to 5% and maximum overall loss to 10%. It is important to note that for Express Non-Consistency Challenges, traders are not permitted to hold trades over the weekend. Additionally, both variants of the Express Challenge prohibit trading during high-impact news releases.

In terms of trading duration, a minimum of 10 trading days is mandated, without any specified maximum limit. Furthermore, the Express model accounts include a scaling plan that allows traders the opportunity to operate with capital amounts of up to $4,000,000.

To summarize, FundedNext distinguishes itself from other leading proprietary trading firms by offering a diverse range of funding programs. Additionally, their trading rules are comparatively relaxed and straightforward, making FundedNext an excellent choice for traders of various styles and preferences.

Is getting FundedNext capital realistic?

When assessing prop firms that align with your forex trading style, it is crucial to evaluate the feasibility of their trading requirements. While the allure of a prop firm offering a high percentage profit split on a generously funded account may seem enticing, it is essential to consider whether they expect substantial monthly percentage gains coupled with minimal maximum drawdown percentages. Such demanding expectations significantly diminish the likelihood of achieving success.

Receiving capital through the two-step Stellar challenge model can be regarded as realistic primarily due to its below-average profit targets of 8% in phase one and 5% in phase two, along with moderate maximum loss regulations of 5% for daily losses and 10% for overall losses.

Likewise, receiving capital through the one-step Stellar challenge model can be deemed realistic mainly because it features an average profit target of 10% and maintains standard maximum loss rules of 3% for daily losses and 6% for overall losses.

Furthermore, obtaining capital via the evaluation model can be considered realistic primarily due to its industry-average profit targets of 10% in phase one and 5% in phase two, as well as the implementation of maximum loss rules of 5% for daily losses and 10% for overall losses.

Despite the profit target of 25% in the express model, receiving capital from this program remains realistic due to the absence of limitations on maximum trading days. This allows traders to gradually accumulate profits, reach their profit target, and secure funding. Additionally, traders can choose between Consistency and Non-consistency Express model accounts based on their preferred trading style.

Taking all these factors into consideration, FundedNext emerges as an excellent choice for obtaining funding, as it offers four distinct funding programs: Two-step Stellar, one-step Stellar, Evaluation, and Express. Each program sets realistic trading objectives and establishes conditions for receiving payouts.

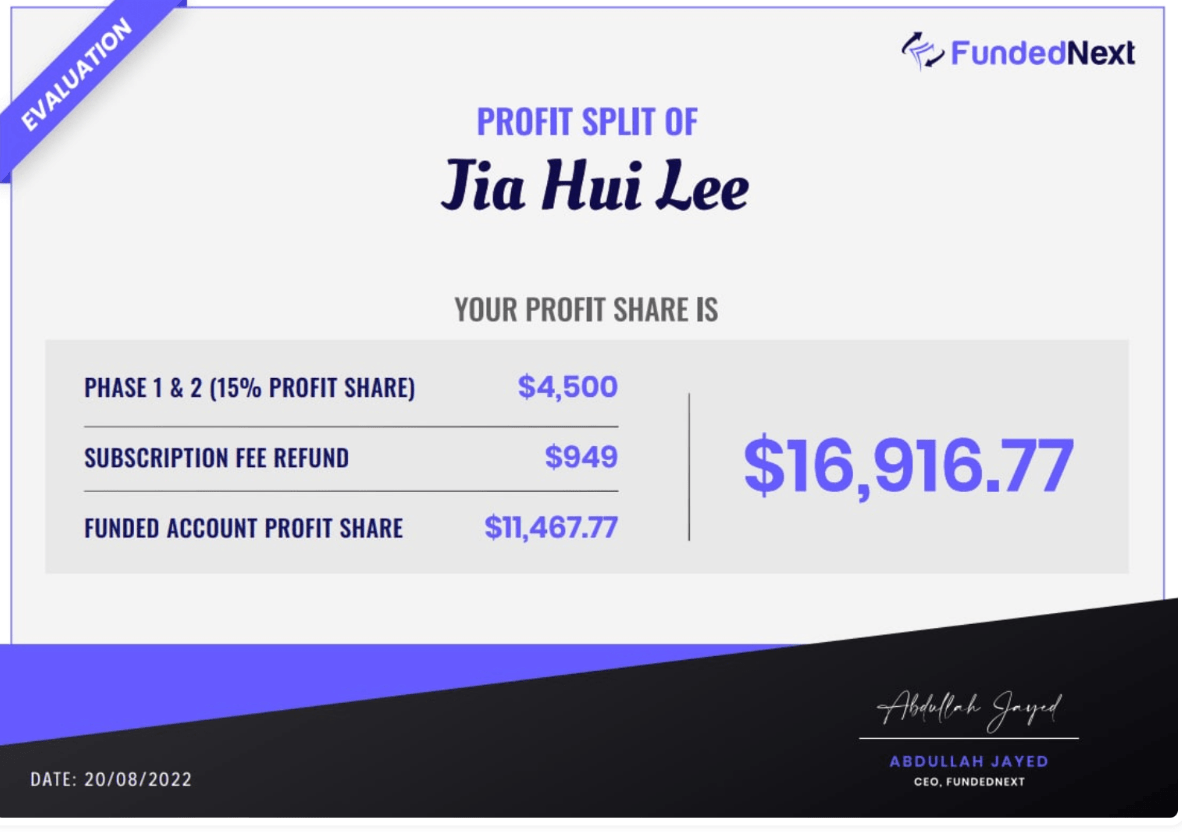

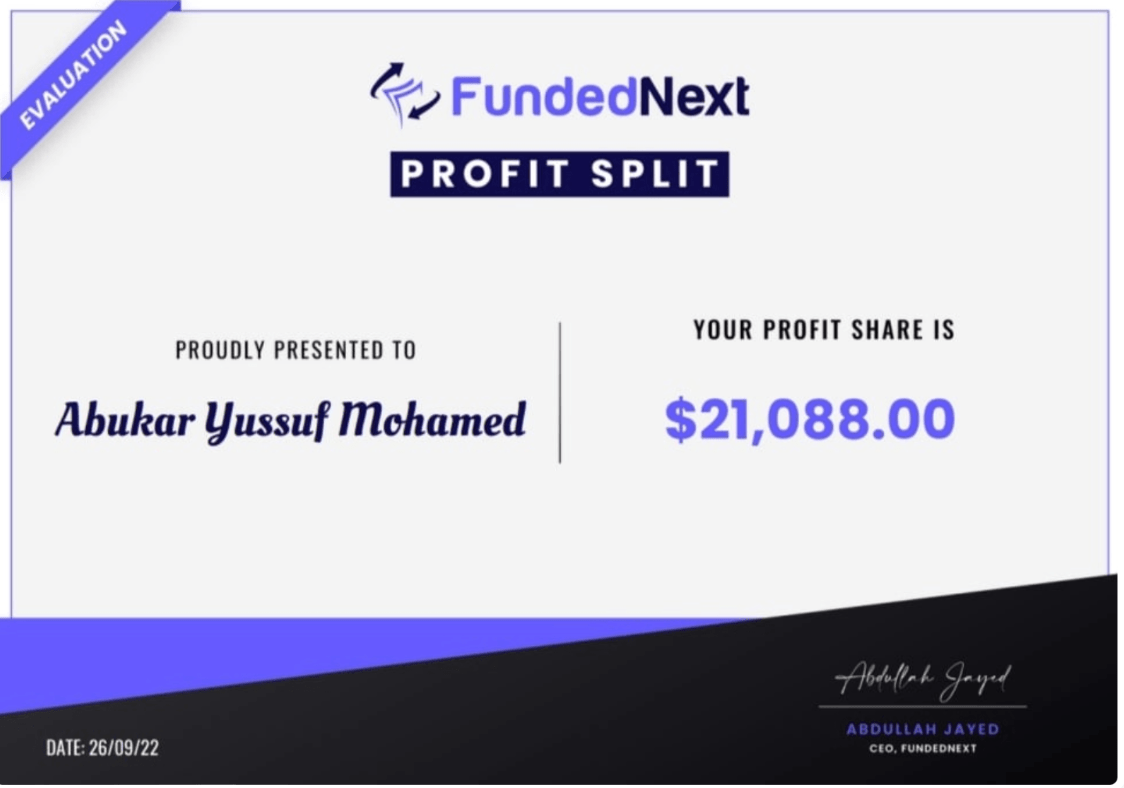

Payment proof

FundedNext was incorporated on the 18th of March, 2022. They have now been running for more than a year and are continuing to develop into one of the best while also being the fastest-growing proprietary trading firms in the industry.

Additional evidence of successful payouts is predominantly available within posts on their official Instagram account. Furthermore, a substantial collection of payout proofs can be found within designated channels, namely “payout-proof” and “5-digit payouts general,” within their Discord server. Additionally, their Telegram channel features illustrative instances of payouts, conveniently located within the pinned posts section, resembling the provided examples below.

Which brokers do FundedNext use?

FundedNext has successfully integrated its technology with Eightcap, a reputable broker based in Melbourne, Australia, that is regulated by the Australian Securities and Investments Commission (ASIC). Eightcap was established in 2009 with a clear and unwavering objective of delivering outstanding financial services to its clientele. With a global presence spanning five office locations, Eightcap adheres to regulatory frameworks in various jurisdictions, thereby granting clients from around the world the opportunity to engage in trading activities across a diverse range of markets, including foreign exchange (FX), indices, commodities, and shares.

Eightcap is considered average-risk, with an overall Trust Score of 73 out of 99. They have the following features:

- Forex Trading

- CFD Trading

- Cryptocurrency Trading

- Social Trading/Copy-Trading

- A total of 326 Tradeable Symbols

- A total of 45 Forex Pairs

The brokerage provides clients with a choice between two account types: Raw and Standard. The applicable commissions and fees vary depending on the selected account type. For Standard accounts, fees are embedded within the spread, while Raw accounts incur separate commissions. Additionally, it is essential to consider the overnight fee, which represents the interest charged for holding positions overnight during trading.

As an exclusive MetaTrader broker, the company offers access to the MetaTrader 4 and MetaTrader 5 platforms developed by MetaQuotes Software Corporation.

The company strives to provide a tailored trading experience and has established a highly efficient technological framework to facilitate your trading activities. In recognition of their efforts, they were honored with the prestigious title of Best Global Forex MT4 Broker in 2020 at the esteemed Global Forex Awards.

It is important to note that FundedNext operates its own dedicated server, known as the “GrowthNext Server,” within the MT5 platform. Additionally, traders have the flexibility to choose between two popular trading platforms, namely MetaTrader 4 and MetaTrader 5.

Trading instruments:

FundedNext allows you to trade forex pairs, commodities, and indices with a 1:100 leverage.

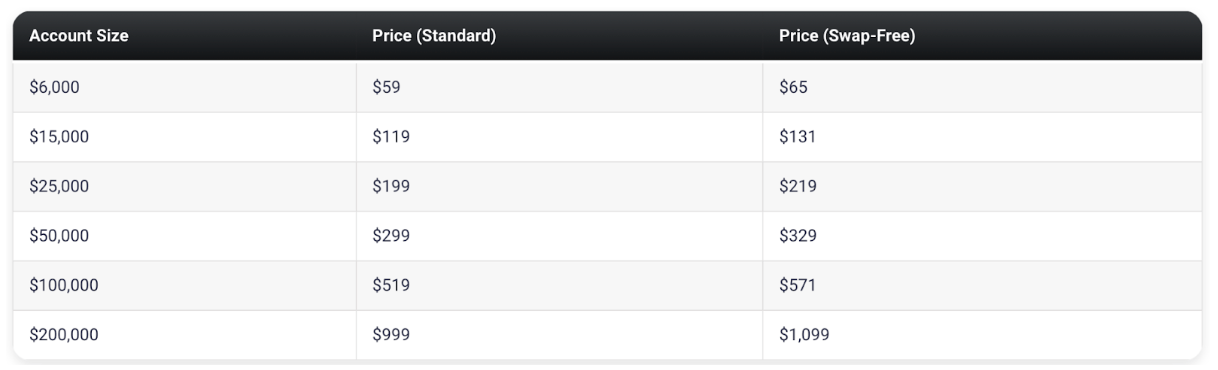

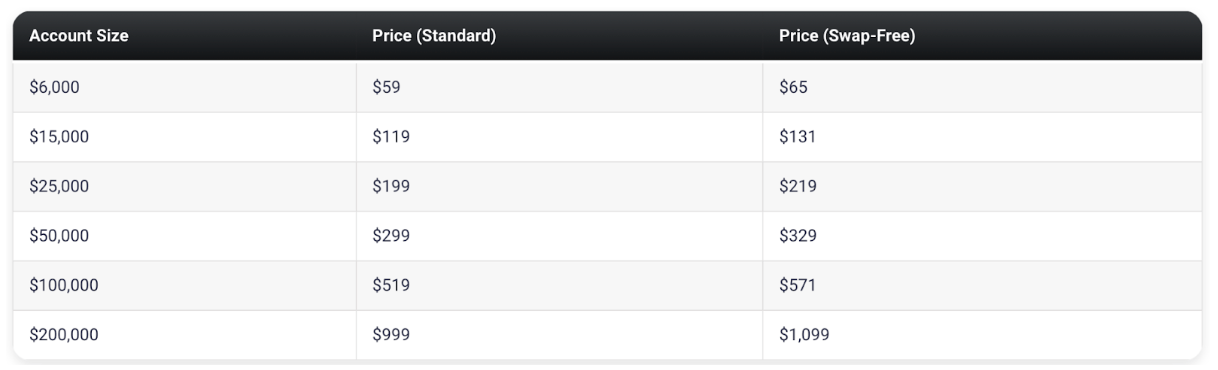

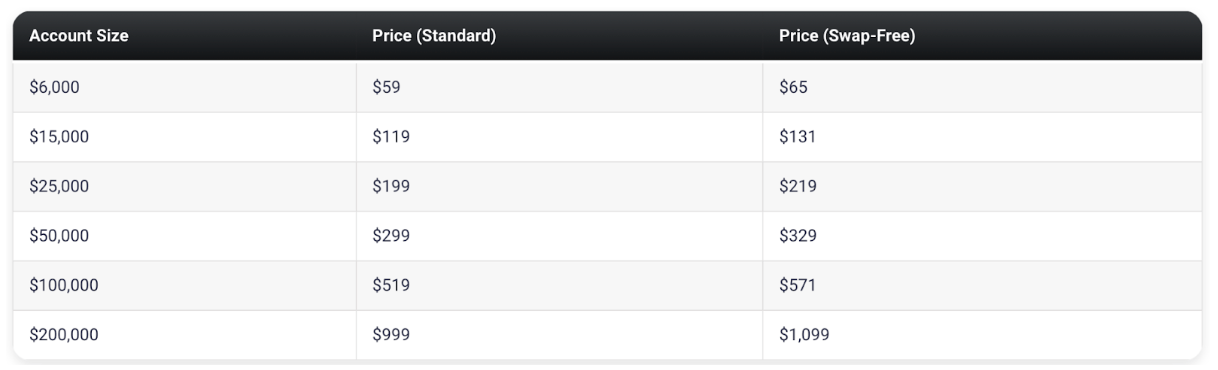

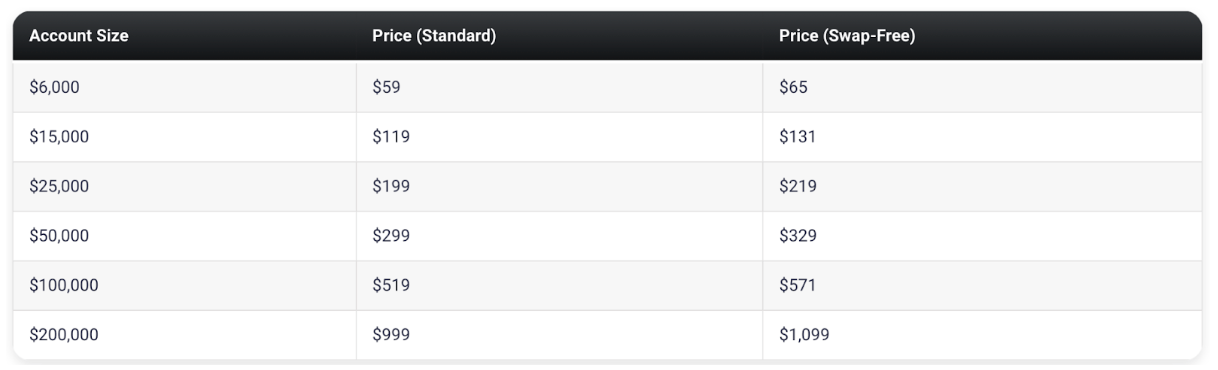

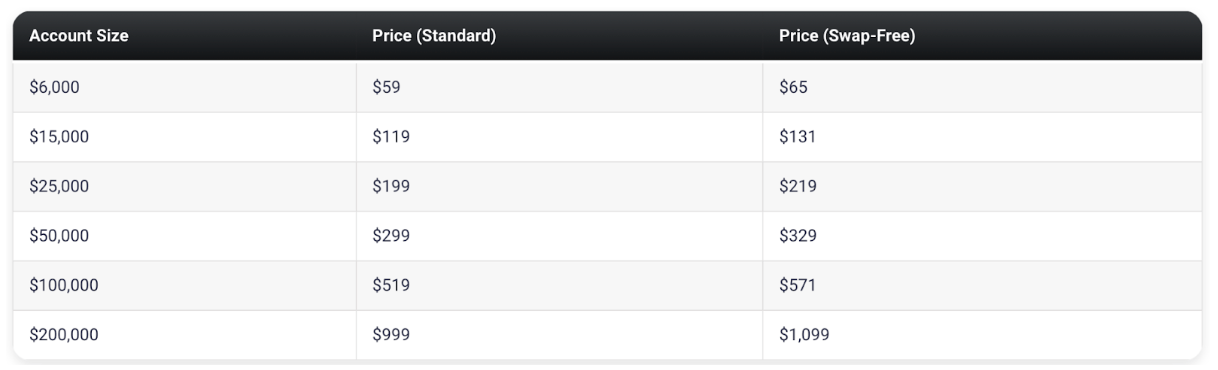

Trading fees

Education and support for traders

FundedNext does not offer any educational resources or content on its official website. However, there is an active discussion thread dedicated to the company on Forex Factory, where users can engage in conversations regarding the firm and its various features and offerings.

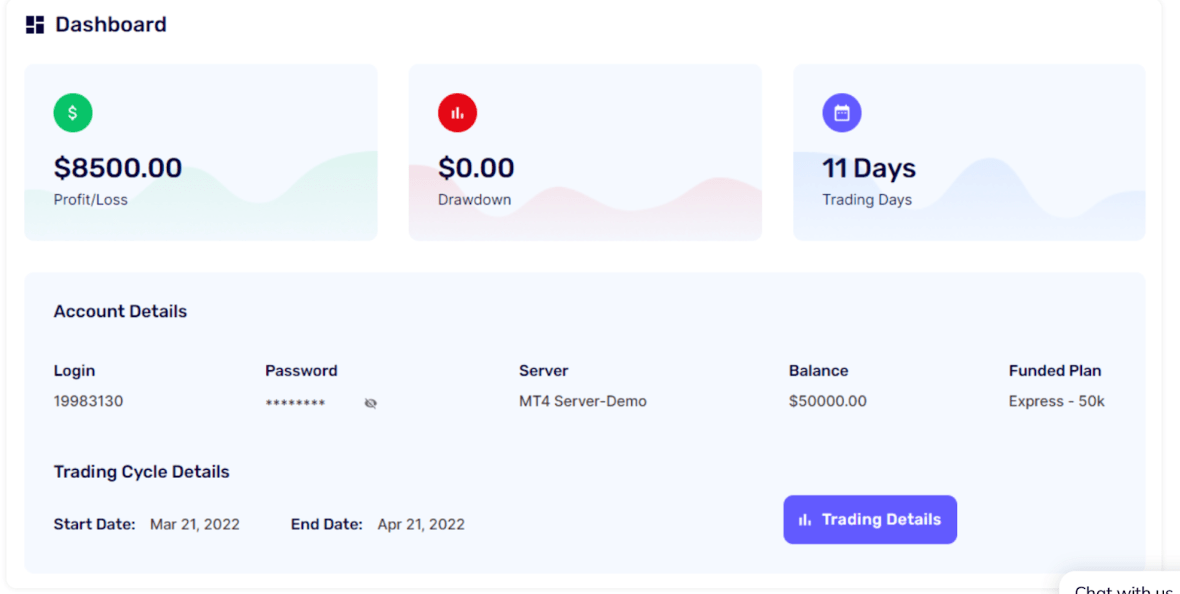

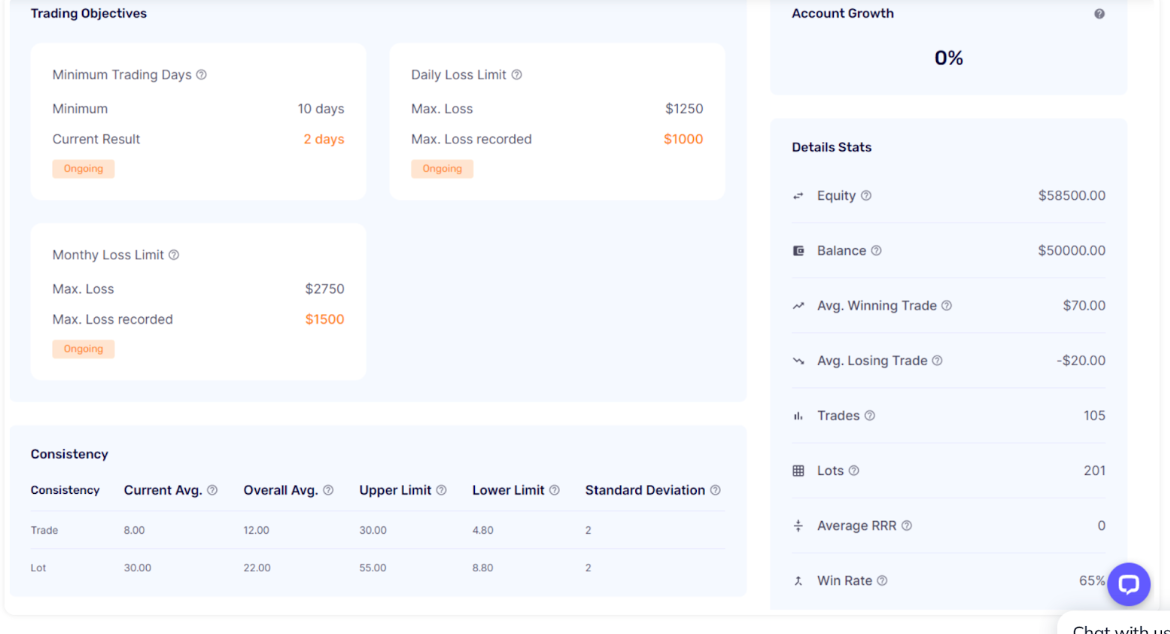

FundedNext offers its traders a meticulously designed dashboard that grants universal access to its clients. This platform facilitates the effective management of risk in conjunction with their statistical objectives, thereby enhancing the overall trading experience.

Traders’ Comments about FundedNext

Foundednext has an excellent review from his community

Trustpilot has garnered a commendable rating of 4.6 out of 5 based on an impressive number of 4,139 reviews. It is noteworthy to mention that their platform was launched relatively recently, specifically on March 18, 2022, indicating a remarkable achievement in amassing a substantial and devoted user base within a relatively brief timeframe.

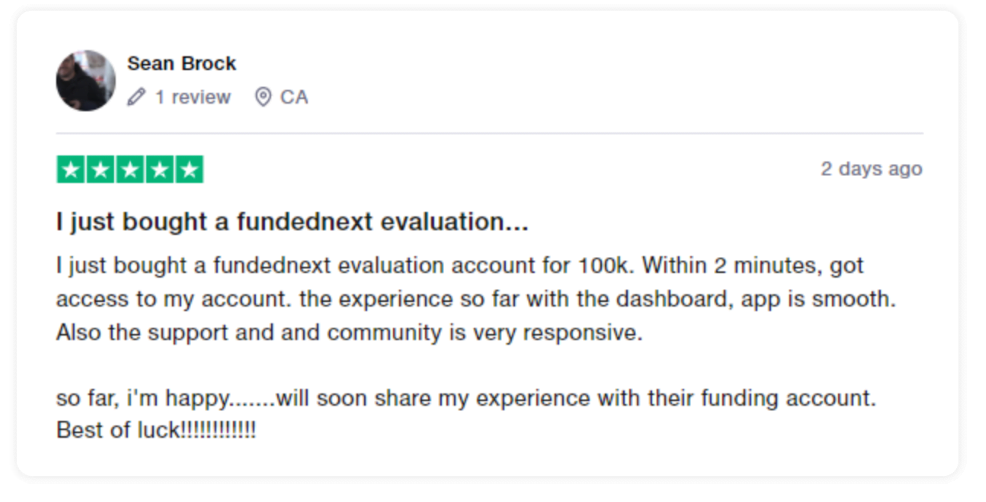

FundedNext’s community mostly praises its responsive customer support team and the smoothness of its well-structured dashboard

Social media statistics

FundedNext can also be found on social media.

They have a:

- Facebook page with 54k followers,

- Twitter account with 34k followers,

- Instagram account with 30k followers, and

- Youtube channel with 26k subscribers and 154 uploaded videos.

In addition, FundedNext also has a Telegram channel with 12k members and a Discord channel with 45k members

Support

FundedNext offers a comprehensive FAQ page that serves as a valuable resource for accessing the necessary information. Furthermore, their support team can be reached through various channels such as social media or via direct email communication at support@fundednext.com.

For real-time assistance, FundedNext provides a live chat support team that operates around the clock. Additionally, users have the option to submit a support ticket on their website by utilizing the provided link.

Conclusion

In conclusion, FundedNext stands out as a reputable proprietary trading firm in the industry, providing traders with various models to choose from, including the Two-step Stellar, one-step Stellar, Evaluation, and Express models. Additionally, their trading rules are relatively lenient and straightforward.

For the Two-step Stellar challenge model accounts, traders must complete two phases to become funded and eligible for profit splits. FundedNext sets realistic profit targets of 8% in phase one and 5% in phase two, aligning with the 5% maximum daily loss and 10% maximum loss rules. By opting for this model, traders can earn profit splits ranging from 80% to 90% and have the opportunity to scale their accounts.

On the other hand, the one-step Stellar challenge model accounts require the completion of a single phase to become funded and eligible for profit splits. FundedNext sets a profit target of 10% for this model, which again aligns with the 3% maximum daily loss and 6% maximum loss rules. With one-step Stellar challenge model accounts, traders can earn profit splits ranging from 80% to 90% and have the opportunity to scale their accounts.

The Evaluation model accounts follow the industry-standard two-phase challenge, requiring traders to complete both phases to become funded and eligible for profit splits. FundedNext sets profit targets of 10% in phase one and 5% in phase two, which are considered realistic objectives in light of the 5% maximum daily loss and 10% maximum loss rules. By participating in the evaluation programs, traders can earn profit splits ranging from 80% to 90% and have the opportunity to scale their accounts.

Lastly, the Express model accounts offer a one-step challenge, requiring the completion of a single phase to become funded and eligible for profit splits. FundedNext sets a profit target of 25% for this model, while maintaining the 5% maximum daily loss and 10% maximum loss rules. Moreover, traders can choose between Consistency and Non-consistency Express model accounts based on their trading preferences. With a minimum trading period of 5 calendar days and no maximum trading days limitation, traders have the flexibility to gradually accumulate profits. Express model accounts allow for profit splits ranging from 60% to 90% and the option to scale accounts.

Based on their transparent rules and trading objectives, FundedNext is highly recommended for traders seeking a legitimate prop firm. Despite being relatively new in the industry, they have established themselves as a trustworthy and secure choice for traders looking to obtain capital. Furthermore, they offer favorable conditions to accommodate a diverse range of traders with unique trading strategies. Considering their comprehensive offerings, FundedNext currently stands as one of the leading proprietary trading firms in the industry.