“FTUK Review: Unbiased Analysis, Expert Insights & Latest Updates”

“FTUK: Empowering Traders Worldwide with Affordable Trading Opportunities, Trust-based Growth, and Global Support for All Skill Levels”

FTUK holds the belief that equal opportunities should be afforded to all individuals, thereby ensuring accessibility to trading for aspiring individuals seeking success in this field. As clients demonstrate proficiency in trading and showcase commendable outcomes, their level of trust is reinforced, leading to a proportional increase in their trading capital. It should be noted that FTUK extends its support to traders across the globe, irrespective of their prior experience.

Established in February 2021, FTUK embarked on a mission to elevate the realm of proprietary trading. They aim to provide superior services to proficient traders on a global scale, enabling them to achieve financial success.

Pros of FTUK

Instant funding

Excellent Trustpilot rating of 4.6/5

Single-phase Evaluation process

reliable support

Weekend and overnight position allowed

News Trading allowed

Zero commission or swap fees

fast payment procedures

Profit share of 80%

leverage up to 1:100

one-time fee

Manage up to 3x $5,760,000 capital

Cons of FTUK

2% Max stop loss risks limit

Lot size consistency rule

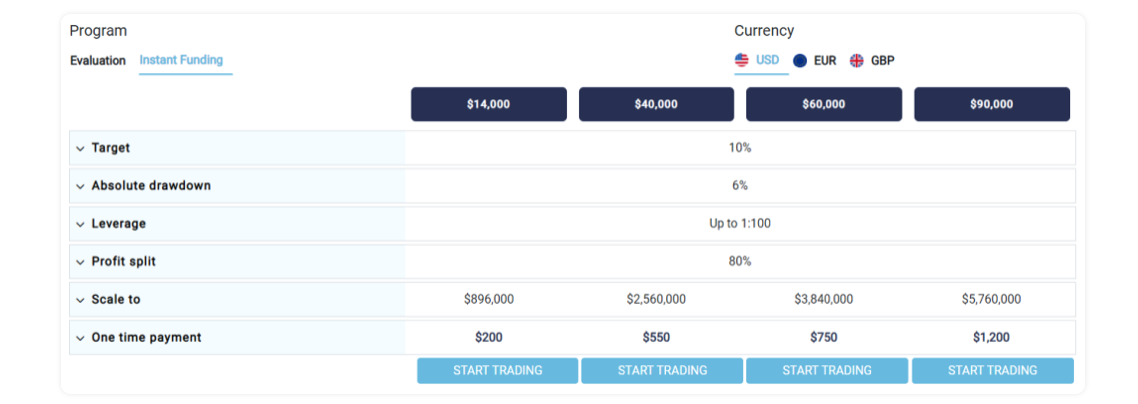

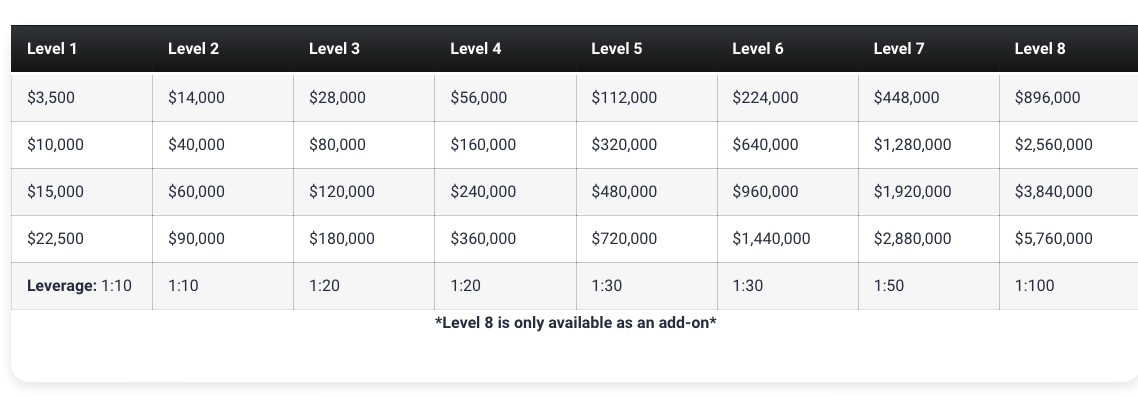

FTUK actively supports and empowers traders in their professional growth, facilitating enhanced profitability through the provision of three trading accounts, each with a maximum balance of $5,760,000. Traders have the option to select either the instant funding program or the evaluation program. To secure funding through the evaluation program, traders must successfully navigate the 1-Phase Evaluation Process. Once accomplished, specific Profit Targets are established as milestones to elevate their account balance. Successful completion of these targets entitles traders to 80% profit splits and a doubling of their account balance as a reward.

Who are FTUK?

FTUK is a proprietary firm with an office based in the UK, London. They offer their traders up to three accounts with a $5,760,000 balance in size and use Eightcap as their broker.

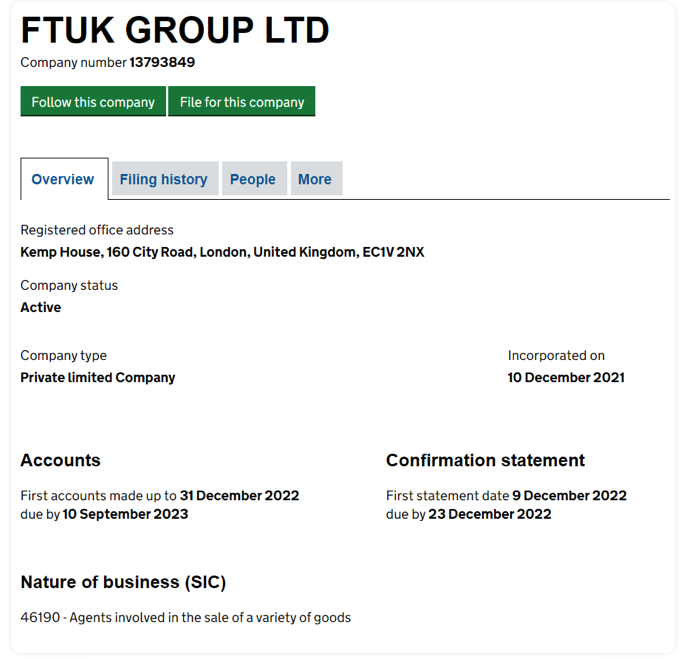

They are a registered UK company under FTUK Ltd, with company number 13793849.

FTUK was incorporated on the 10th of December 2021 and is registered under Kemp House, 160 City Road EC1V 2NX London, UK.

The founding program options:

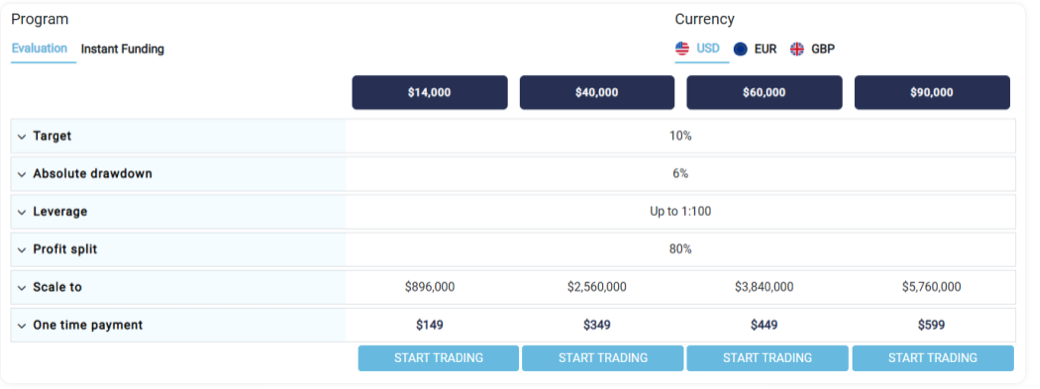

FTUK offers two different programs to choose from:

- Evaluation program accounts

- Instant funding program accounts

Evaluation program accounts:

The evaluation program offered by FTUK provides traders with an opportunity to meet the specified requirements within an unlimited time frame. Traders are permitted to trade with leverage of up to 1:100 and have the flexibility to choose their account funding currency, which includes options such as USD, EUR, and GBP.

During the evaluation phase, traders must achieve a profit target of 10% while adhering to a maximum loss limit of 6%. This phase has no time restrictions and does not impose any minimum trading day requirements. It is important to note that traders must establish a maximum stop-loss risk of 2% per position while engaging in trades.

Upon successfully completing the evaluation phase, traders are granted a funded account with no specific profit targets. However, they are still obligated to comply with the 6% maximum loss rule and maintain a maximum stop loss risk of 2% per position. Traders can request payouts starting from level two or above at any time. It is crucial to understand that withdrawals do not impact account growth and do not require the funded trader to compensate for the distributed profits. Traders are entitled to an 80% profit split based on the profits they generate.

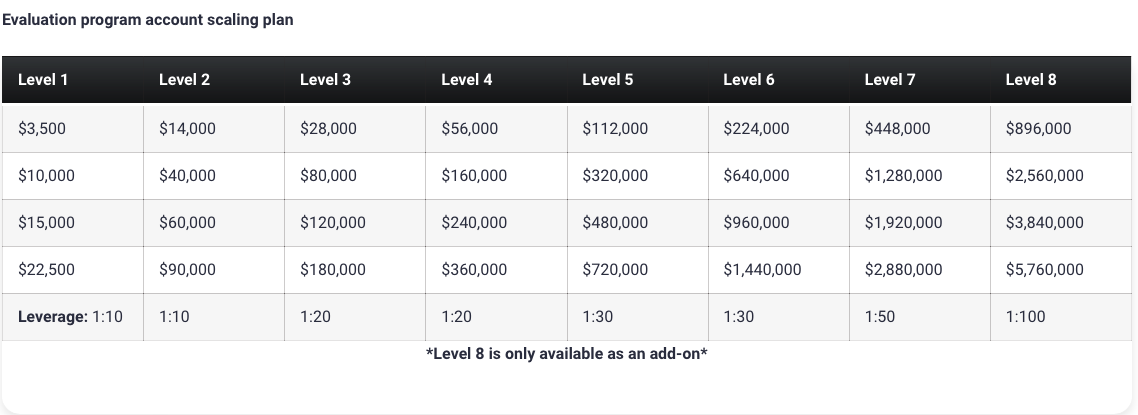

The evaluation program accounts include a comprehensive scaling plan, as outlined in the provided spreadsheet. Meeting a profit target of 10% is the sole requirement for qualifying to scale your account. Upon achieving this profit target, your account becomes eligible for scaling. It is noteworthy that any withdrawals you make will not hinder the scaling process of your account. Once your cumulative profits reach the designated 10% profit target, your account will be deemed eligible for scaling.

Example:

The profit target for this account type is 10%.

Week 1: You gain 4.2% and withdraw your profits.

Week 2: You gain 5.8% and withdraw your profits.

Your total profits have reached 10% which makes you eligible for a scale-up since you have reached the 10% profit target.

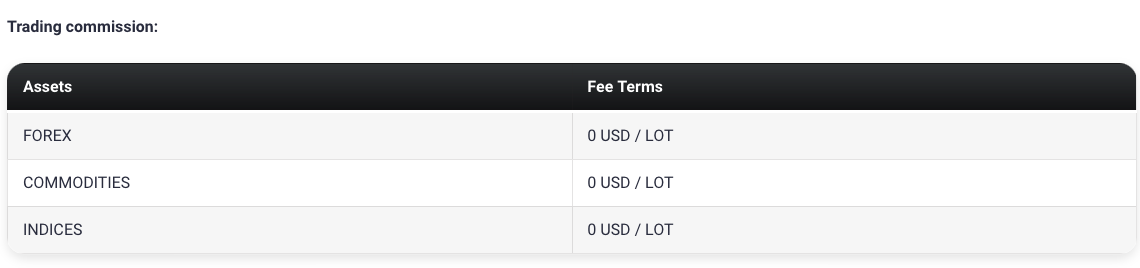

Trading instruments for the evaluation program account are forex pairs, commodities, and indices.

Evaluation program account rules

-

The profit target represents a specific percentage of profit that must be achieved by a trader before they can proceed with an evaluation phase, withdraw profits, or expand their account. In the evaluation phase, the profit target is set at 10%.

-

The maximum loss denotes the highest allowable loss that a trader can incur before their account becomes compromised. Regardless of the account size, the maximum loss limit is set at 6%.

-

Traders are required to implement a stop-loss order on each position before initiating a trade.

-

The concept of stop-loss risk per position necessitates that traders establish a predetermined percentage-based stop-loss for every position prior to entering a trade. A stop-loss risk of 2% is mandatory for each position.

-

Lot size consistency is a regulation that mandates traders to maintain consistent lot sizes for the positions they open. Typically, this is specified as a percentage indicating the acceptable deviation in lot sizes between positions.

-

The use of any form of martingale strategy is strictly prohibited for traders.

-

When considering the utilization of copy trading services provided by third parties, it is important to acknowledge that other traders may already be employing the same trading strategy through the same service. Consequently, utilizing such third-party copy trading services carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

Additional enhancements for FTUK’s evaluation program accounts

Enhancement 1: Unlock Scaling Level 8 – Experience a 10% price increase when acquiring your evaluation account.

Enhancement 2: No Mandatory Stop-Loss – Opt for a 20% price increase to eliminate the requirement of a stop-loss feature for your evaluation account.

Enhancement 3: Joining Fee Refund – Enjoy a 25% price increase, which grants you a refund of the joining fee upon purchasing your evaluation account.

Enhancement 4: Evaluation Retake – Embrace a 50% price increase that allows you to retake the evaluation for your account.

Please note that you have the flexibility to select one or multiple add-on options based on your personal preferences.

Instant funding program account:

The instant funding program accounts also incorporate a scaling plan, which is outlined in the accompanying spreadsheet. To qualify for scaling your account, the sole requirement is to achieve a profit target of 10%. Once you have reached this profit target, you become eligible to scale your account. It is worth noting that withdrawing funds from your account will not impede its scalability. As soon as your cumulative profits attain the 10% profit target, your account will qualify for scaling.

Example:

The profit target for this account type is 10%.

Week 1: You gain 4.2% and withdraw your profits.

Week 2: You gain 5.8% and withdraw your profits.

Your total profits have reached 10% which makes you eligible for a scale-up since you have reached the 10% profit target.

Trading instruments for the instant funding program account are forex pairs, commodities, and indices.

Instant funding program account rules

-

The profit target denotes a specific profit percentage that traders must achieve before they can successfully complete an evaluation phase, withdraw profits, or expand their accounts. In the case of the scaling plan, the profit target is set at 10%.

-

The maximum loss refers to the predetermined threshold beyond which a trader’s overall losses cannot exceed without violating their account. For all account sizes, the maximum allowable loss is capped at 6%.

-

Traders are required to set a stop-loss on every position before initiating a trade. This practice, known as stop-loss required, ensures that risk management measures are in place.

-

Before entering a trade, traders must establish a specific percentage-based stop-loss for each position, referred to as stop-loss risk per position. A minimum stop-loss risk of 2% is mandated for every trade.

-

Lot size consistency is a regulation that mandates traders to maintain uniformity in the sizes of the positions they open. Typically, it is defined by a specified percentage indicating the allowable deviation in lot sizes between positions.

-

The use of any form of martingale strategy is strictly prohibited for traders. The policy of “no martingale allowed” ensures that traders refrain from employing this particular strategy while engaging in trading activities.

-

Third-party copy-trading risk pertains to the potential hazards associated with utilizing copy-trading services provided by external parties. Traders should be aware that such services may already be used by other traders, resulting in identical trading strategies. Engaging in third-party copy trading runs the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is breached.

Additional enhancements available for FTUK’s instant funding program accounts

Access Level 8 expansion: Enjoy a 10% price increment for the acquisition of your instant funding account

The optional omission of compulsory stop-loss: Benefit from a 20% price increment for the acquisition of your instant funding account

Reimbursement of joining fee: Receive a 25% price increment for the acquisition of your instant funding account

Please note that you have the flexibility to select a single add-on option or combine multiple options to suit your individual preference.

What makes FTUK different from other prop firms?

What sets FTUK apart from other proprietary trading firms is its unique approach through two distinct funding programs: Evaluation and instant funding. FTUK’s evaluation program requires traders to successfully complete a one-phase evaluation and achieve a profit target of 10% with a maximum loss limit of 6%. Traders must adhere to specific risk management measures such as required stop-loss, stop-loss risk per position, and consistency in lot size. The evaluation program also includes a scaling plan to accommodate successful traders. Unlike many other prominent prop firms, FTUK does not impose any constraints on the number of trading days, allowing traders to focus on the evaluation process without undue time pressure.

Furthermore, FTUK offers instant funding program accounts as an alternative option. Similar to the evaluation program, traders in the instant funding program must meet a profit target of 10% with a maximum loss limit of 6%, and comply with the same risk management guidelines. The instant funding program also includes a scaling plan. Notably, FTUK distinguishes itself from other leading prop firms by removing any requirements regarding maximum or minimum trading days. This flexibility empowers traders to manage their evaluation period at their own pace, without the added stress of meeting specific time objectives. Additionally, traders have the option to bypass the evaluation altogether and begin earning profits immediately.

In summary, FTUK stands out from other prominent prop firms by providing two distinct funding programs, while also offering straightforward rules without imposing limitations on maximum or minimum trading days. Traders at FTUK enjoy the flexibility to trade during news events, hold positions overnight, and even trade on weekends.

Is getting FTUKcapital realistic?

When assessing prop firms that align with your forex trading style, it is crucial to evaluate the attainability of their trading requirements. While a company may offer a generous profit split on a well-funded account, it is important to examine whether they expect high monthly gains with minimal drawdowns. Failing to meet such demanding expectations would severely diminish your likelihood of success.

Obtaining capital from evaluation program accounts is generally realistic, as they typically have an average profit target of 10% coupled with a maximum allowable loss of 6%.

Likewise, securing capital through instant funding program accounts is also realistic, as these programs enable you to commence earning right away. The initial level of the program sets a profit target of 10%, which translates to quadrupling your capital. Furthermore, adhering to the maximum loss rule of 6% is a feasible condition for obtaining funding.

Taking all these factors into consideration, FTUK emerges as an excellent choice for securing funding. Their offering encompasses two distinct funding programs, each characterized by realistic trading objectives and conditions for payout eligibility.

Payment proof

FTUK was established on December 10, 2021. Traders have the option to initiate profit split withdrawals by submitting an invoice, and it is advised to allow a maximum of two business days for the payout processing. The duration for completion may differ based on the chosen payment method.

For credible payment verification, FTUK provides relevant evidence on their YouTube channel, where traders are interviewed. To gain insight into the payment process, two specific videos are recommended for viewing.

In addition, you can also find payment proof on their Discord channel which you can see below:

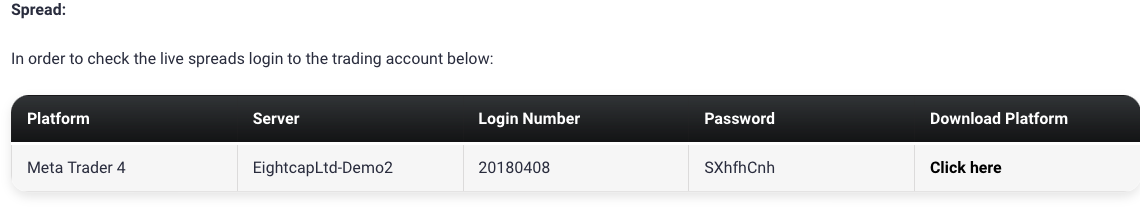

Which brokers do FTUK use?

FTUK uses Eightcap as their broker. Their headquarters are located in London, while their support and sales teams do business across Asia while covering all time zones with a global client base.

As for trading platforms, they allow you to trade on Meta Trader 4 and MetaTrader 5.

Trading instruments:

FTUK allows its clients to trade forex pairs, metals, indices, and commodities.

Trading fees

Education and support for traders

FTUK provides educational content on their website under their Blog. You can find four different subsections:

– General

– Traders mindset

– Technical strategy

– Traders interview

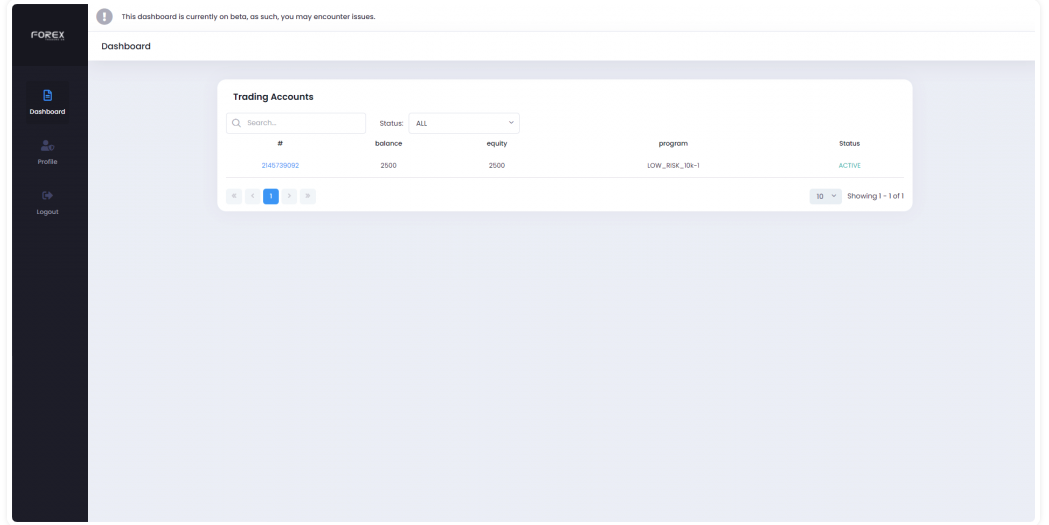

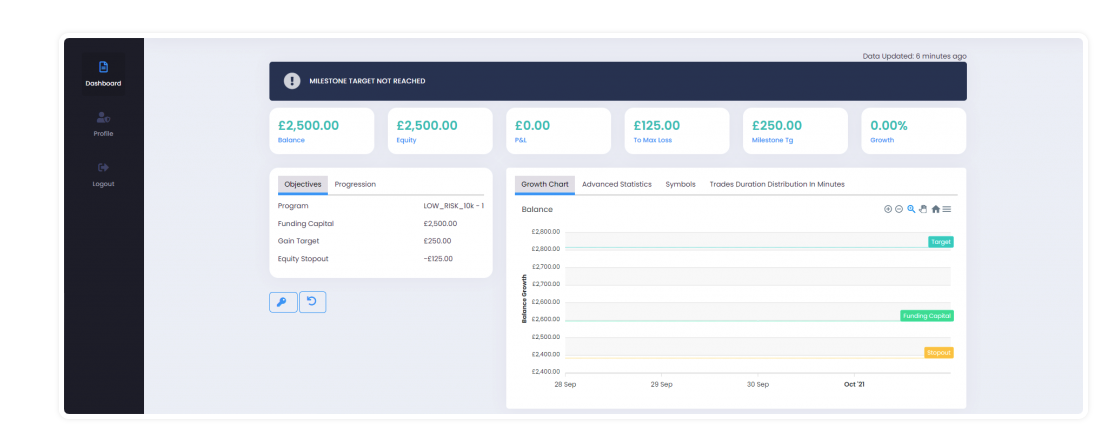

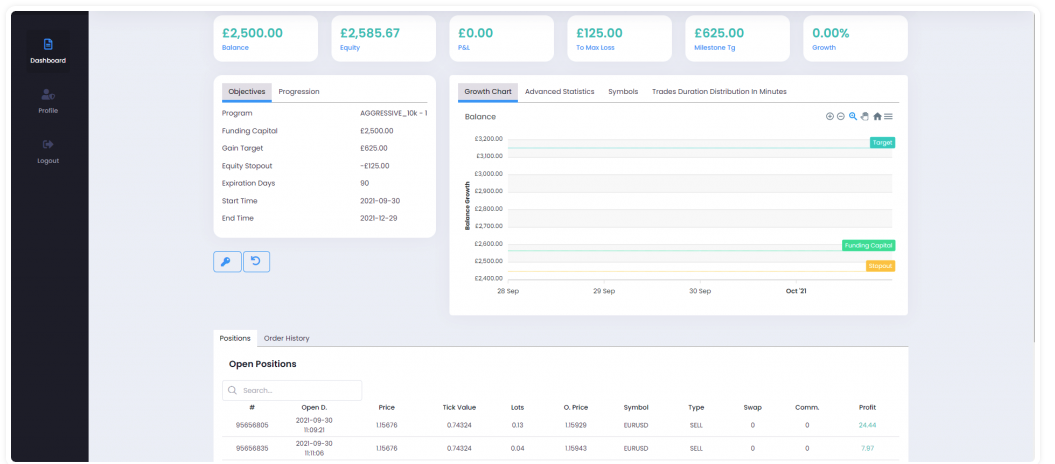

FTUK also provides a well-structured dashboard to all their clients, making it easier to manage risk with all the objectives of their statistics.

Trader dashboard – Home page

Trader dashboard – Statistics page with closed positions

Trader dashboard – Statistics page with open positions

FTUK offers a comprehensive FAQ page that houses pertinent information that may address any inquiries or uncertainties you might have.

To avail of assistance, their support team can be reached through their social media platforms or via direct communication using the email address support@ftuk.com.

The office operates during the standard business hours of Monday to Friday, from 09:00 to 18:00 GMT.

For additional inquiries or further clarification, FTUK can be contacted by telephone number +44 (20) 8798 2605.

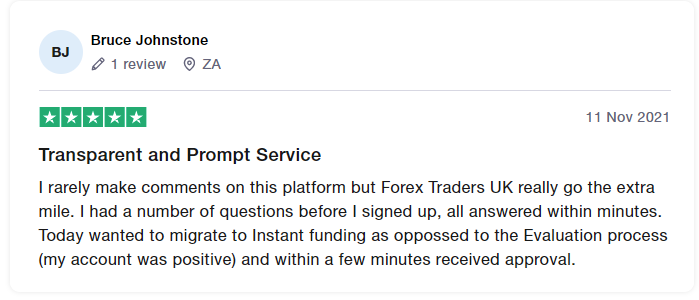

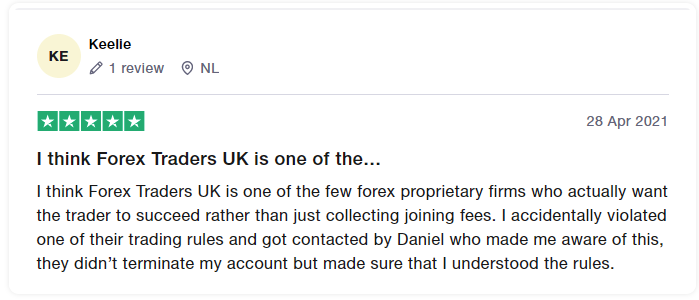

Traders’ Comments about FTUK

FTUK has an excellent review from his community

Trustpilot boasts an extensive array of community members who actively engage by providing positive feedback, resulting in an impressive score of 4.6 out of 5 based on 150 reviews. Additionally, their dependable support team is readily available to address any inquiries or uncertainties, ensuring comprehensive information is promptly provided.

Their clients mentioned how they provide a prompt support service for their needs, which is always great to have from any prop firm.

You also have a few soft violations about which you get notified if you break them, meaning that their clients don’t instantly lose their accounts but get another chance to learn from their mistakes

Social media statistics

FTUK can also be found on social media.

They have a:

Conclusion

In conclusion, FTUK is a reputable proprietary trading firm that provides traders with the opportunity to select from two distinct funding programs: evaluation and instant funding.

Under the evaluation program, traders are expected to achieve a profit target of 10% while ensuring that they do not exceed the maximum loss limit of 6%. There are no specific requirements regarding the number of trading days. However, traders must adhere to certain regulations, including the use of mandatory stop-loss, limiting the risk per position through stop-loss orders, and maintaining consistency in lot sizes.

On the other hand, the instant funding program allows traders to request withdrawals from level two or higher without any specific profit target requirements. Similarly, there are no constraints on the minimum or maximum number of trading days. However, traders must still comply with the prescribed rules, such as the utilization of mandatory stop-loss, limiting the risk per position through stop-loss orders, and ensuring consistency in lot sizes.

FTUK is highly recommended for individuals seeking a prop firm with clear and transparent regulations. As a well-established proprietary trading firm, they offer favorable conditions for a diverse range of traders with unique trading styles. After careful consideration of all that FTUK has to offer, it is undoubtedly one of the most appealing options within the proprietary trading firm industry.