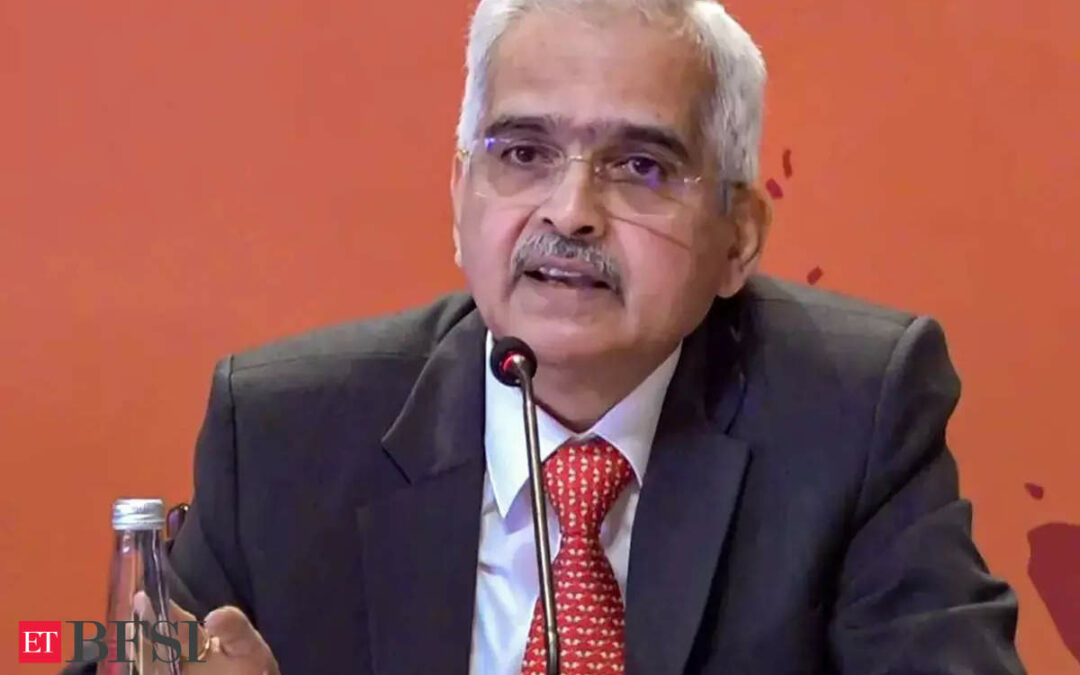

The Reserve Bank of India Governor Shaktikanta Das gave three suggestions for significant progress for the G20-led initiatives such as the Common Framework for Debt Treatment and the Debt Service Suspension Initiatives.

He said that it is essential that debt sustainability analysis for countries is realistic on growth and fiscal projections are fully founded on accurate and comprehensive debt data.

“A global debt data-sharing platform can help in this regard. Establishing such a platform could be very challenging and may take several years. In the interim, therefore, we may examine the possibility of constructing suitable proxies for debt flows,” Das said at a G20 meeting.

Such proxies may be derived from data on capital flows and vocational banking statistics from sources such as the Institute of International Finance and the Bank for International Settlements, he said, listing three suggestions for reducing high and unsustainable debt levels that have severely constrained many countries.

Multilateral debt relief programme

“The second suggestion I would like to make is that a multilateral debt relief programme providing targeted assistance to low-income countries with high levels of debt needs to be considered on a priority basis. This initiative can be designed with a clear focus on the utilisation of debt relief for sustainable development projects and poverty reduction efforts.

To this end, instruments such as Debt for Development Swaps and Green Debt Relief Programs could be employed, he said.

Third, the crucial role of the International Monetary Fund and the World Bank in addressing global debt vulnerabilities cannot be overstated, Das said, adding, “These institutions are at the centre of international monetary and financial systems. Hence, it is incumbent upon them to do more for countries in debt distress.