(Bloomberg) –US employers continued to add workers at a steady, yet more moderate pace, suggesting the economy has scope to avoid a recession despite higher interest rates.

The economy in the euro area eked out modest growth in the second quarter, while the Bank of England raised rates and indicated borrowing conditions may remain tight for an extended period to stifle inflation.

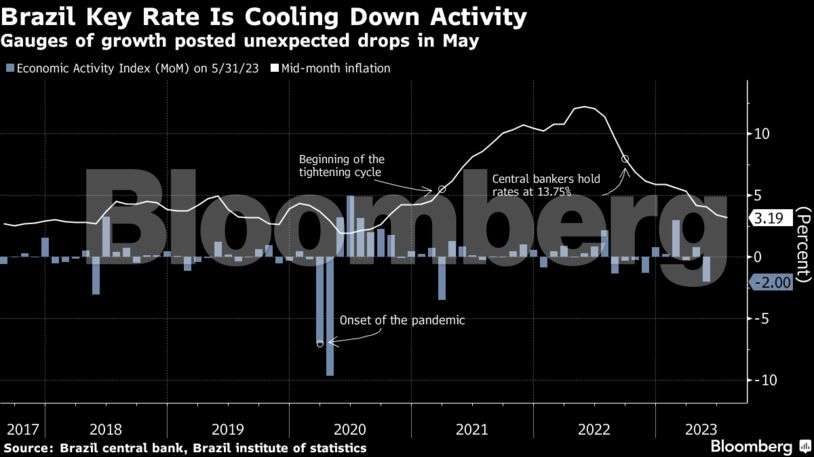

Brazilian central bankers reduced borrowing costs by more than forecast and said in a statement that the price outlook has improved while longer-term inflation expectations have retreated.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

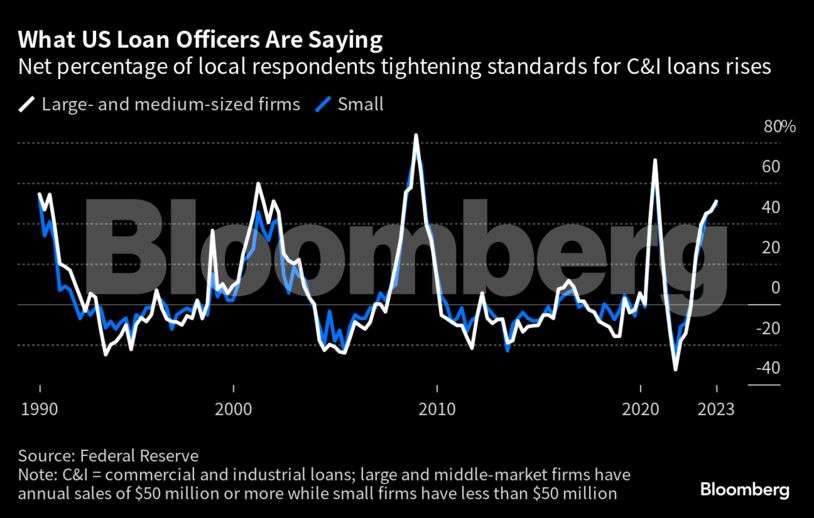

US employment increased at a solid pace in July while wages rose at a faster-than-expected clip, consistent with sustained labor demand that’s at the root of renewed momentum in the economy. Combined with inflation that’s running at the slowest pace in more than two years, the data support growing calls that the Federal Reserve can tame price pressures without inducing a recession.

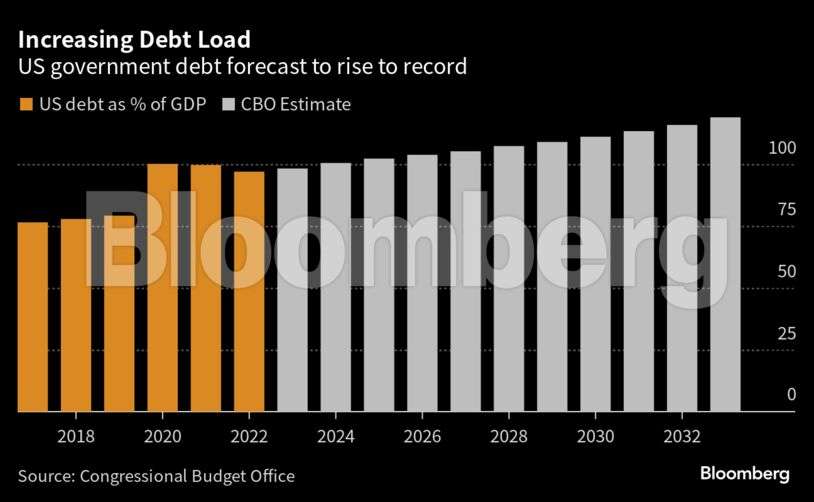

The move by Fitch Ratings to downgrade US government credit has put a renewed focus on the nation’s debt trajectory, just when the world’s largest economy is shaking off forecasts for a looming recession. Fitch forecasts US debt to reach 118% of gross domestic product by 2025, about three times higher than the median of 39% among countries awarded the top-of-the-class AAA rating.

Europe

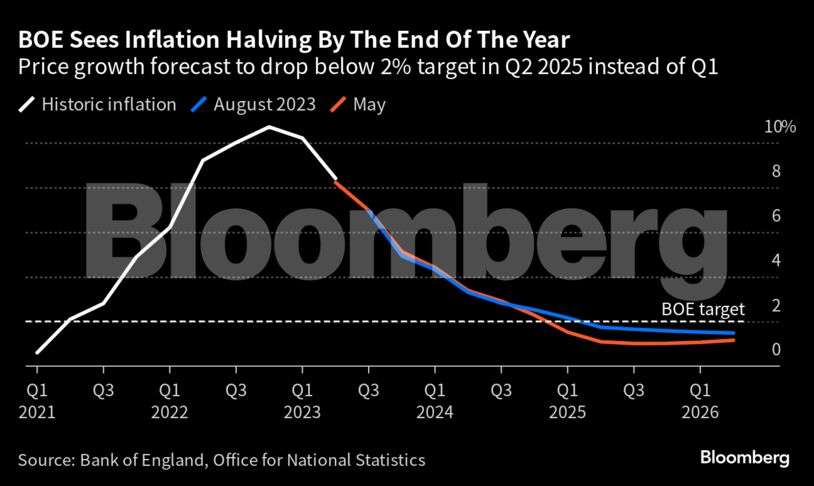

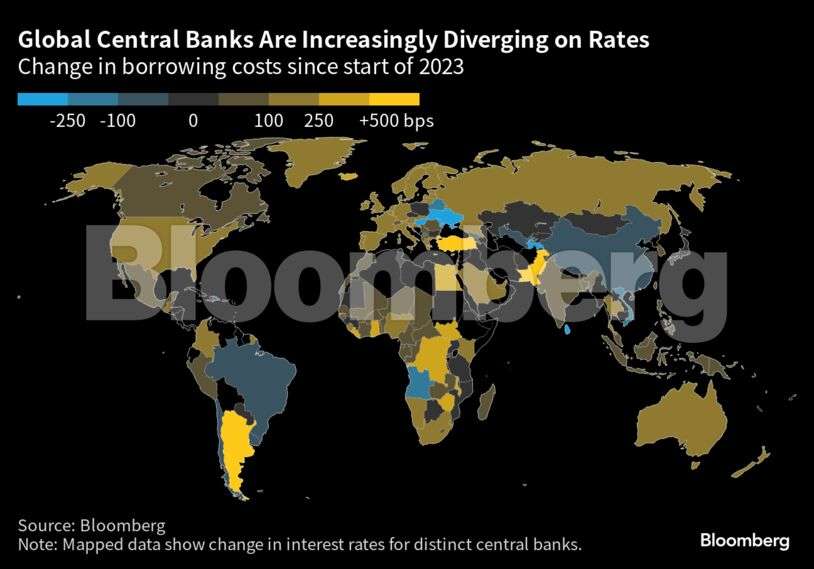

The Bank of England raised interest rates to a new 15-year high, warning that its fight against inflation may require tighter borrowing conditions for a prolonged period. The bank cut its forecast for growth over the next two years and raised its outlook for inflation over the medium term, signaling a bleak backdrop for the next general election, which must be held by early 2025.

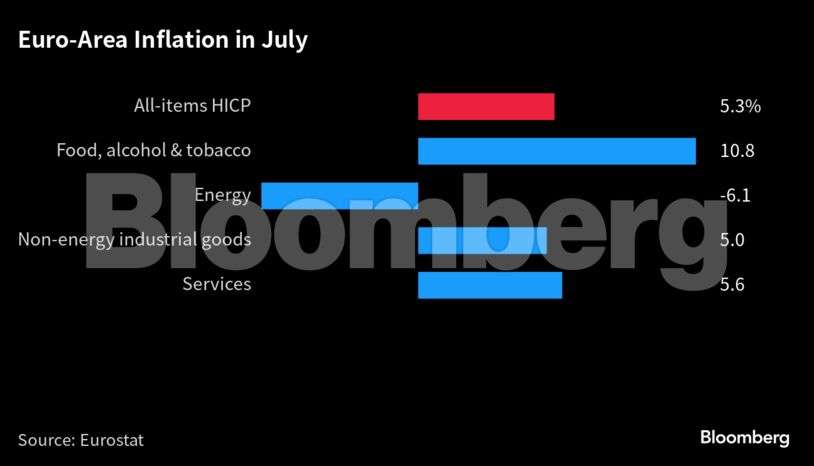

The euro-area economy returned to growth while underlying inflation pressures persisted — supporting early arguments for the European Central Bank to raise interest rates again. While the euro zone’s GDP number looks encouraging, it was buoyed by a bumper three months from Ireland. Looking ahead, the region’s outlook is far gloomier.

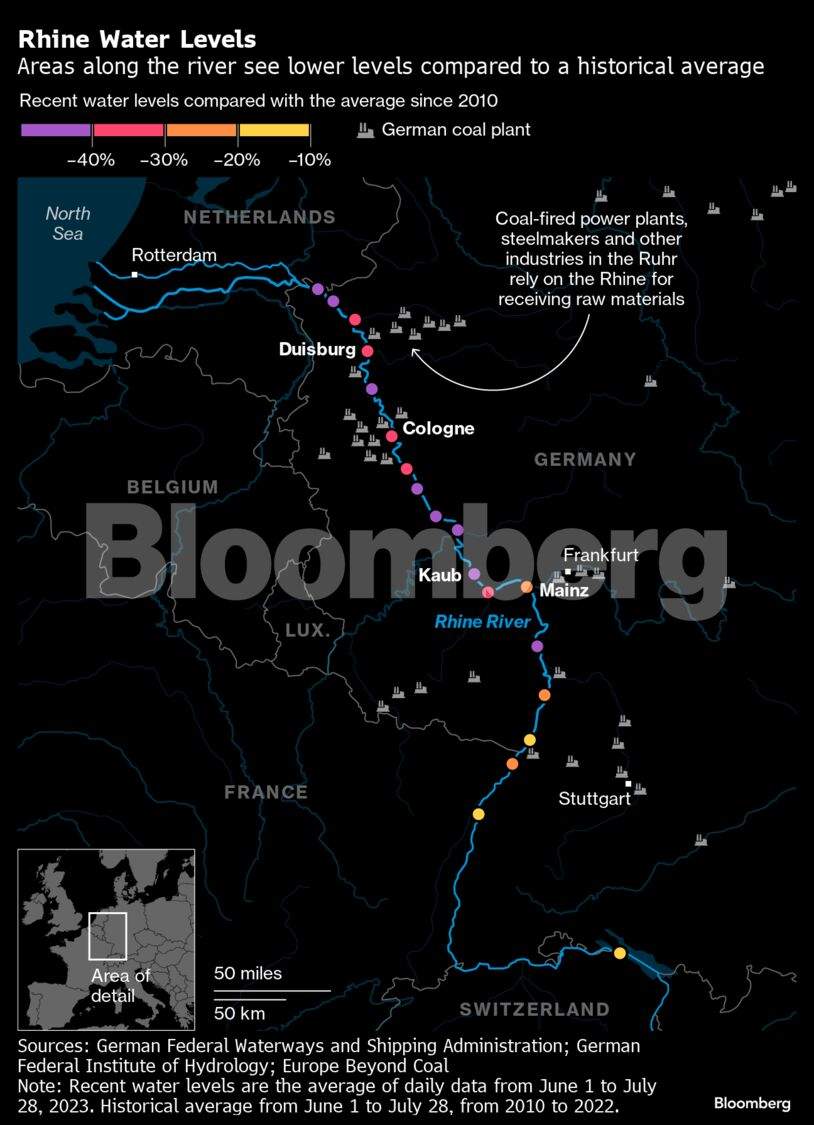

The Rhine River has been a reliable shipping lane for centuries, helping spawn industrial giants along its banks. But those days are coming to an end, and the scramble is made all the more urgent as Germany’s government fails to keep pace. With water regularly receding to levels that impede shipping from late summer through the fall, companies up and down Europe’s most important trade route are rushing to adapt. Asia

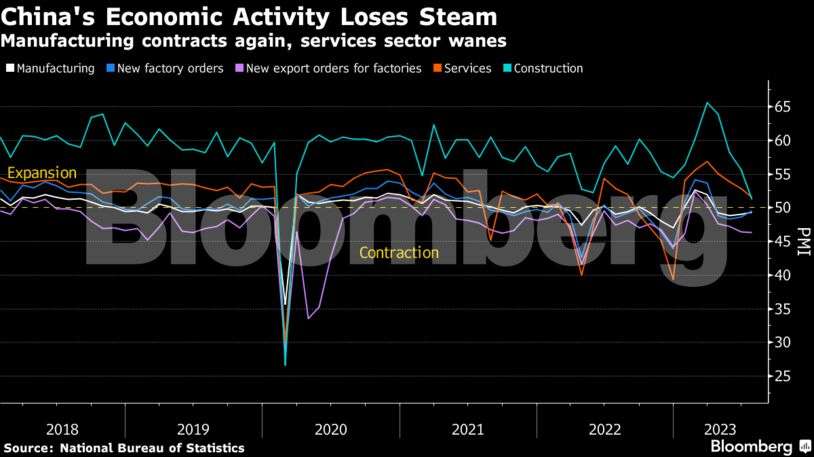

China’s economic activity lost more steam in July with manufacturing contracting again and the services sector weakening, as Beijing promises small measures of support to boost consumption. Investors are looking beyond the PMI weakness to potential economic support from the government.

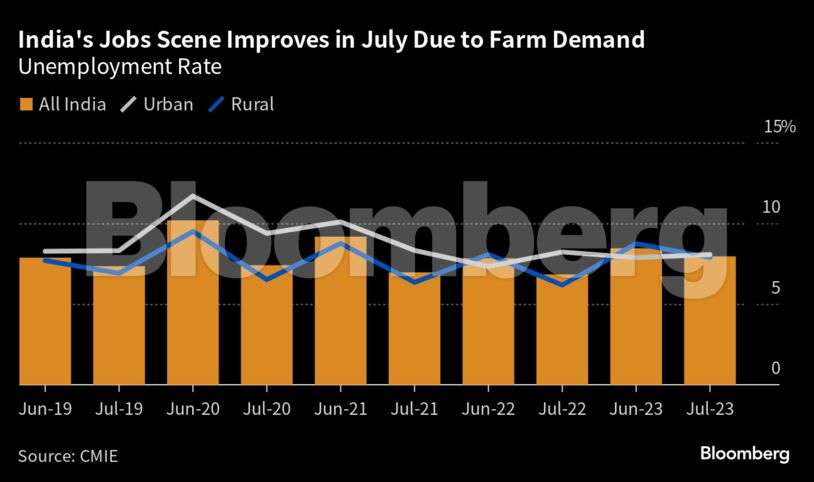

India’s overall unemployment rate fell in July as rural areas saw increased demand for agriculture labor with the onset of monsoon rains. After a slow start, monsoon rains that water nearly half of the nation’s farmlands have picked up pace, potentially bolstering the outlook for agriculture production and economic growth.Emerging Markets

Brazil’s central bank lowered its interest rate by a larger-than-expected 50 basis points and signaled more cuts of the same size are coming, cementing a dovish shift amid President Luiz Inacio Lula da Silva’s crusade for lower borrowing costs.

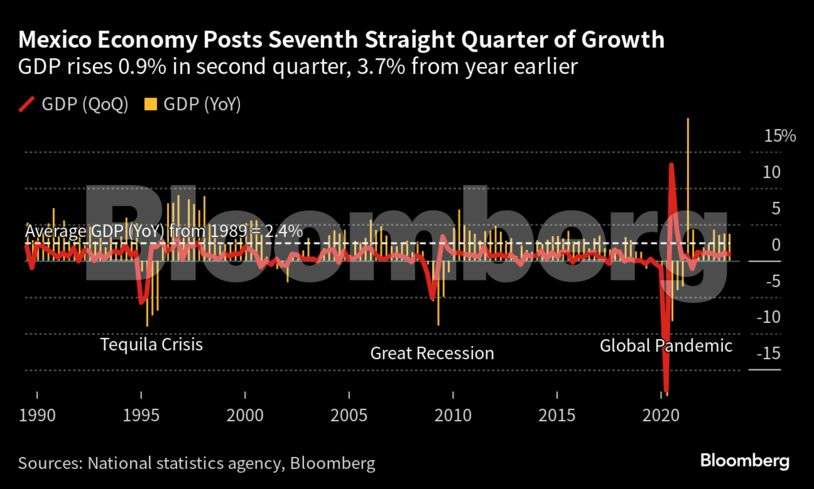

Mexico’s economy grew more than expected in the second quarter as private consumption remains robust and the country benefits from strong exports to the US, its largest trading partner

World

In addition to the Bank of England, policymakers in Thailand and Egypt also raised rates. Australia, Colombia, the Dominican Republic and Czech Republic left borrowing costs unchanged.

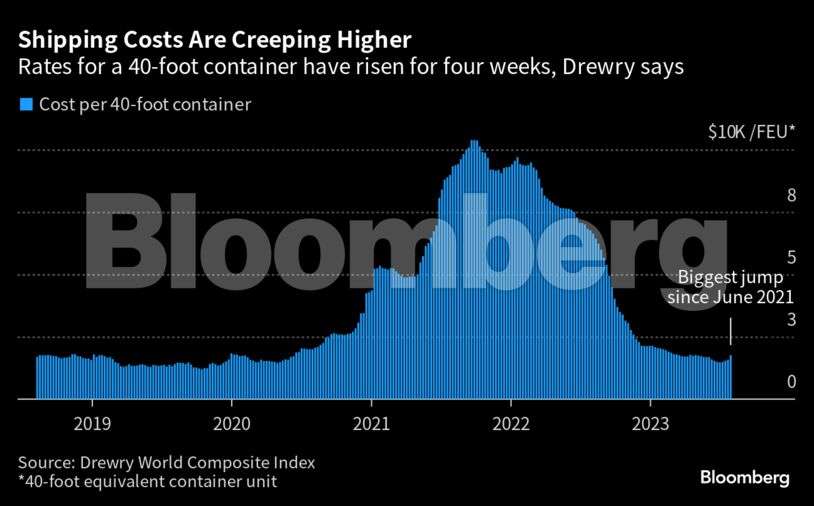

Spot rates for shipping containers jumped by the most in more than two years, a sign that a 16-month slump in ocean-freight costs that helped ease the sting of goods inflation is over. The Drewry World Container Index composite increased 11.8% to $1,761 for a 40-foot container, marking biggest weekly percentage gain since June 2021.

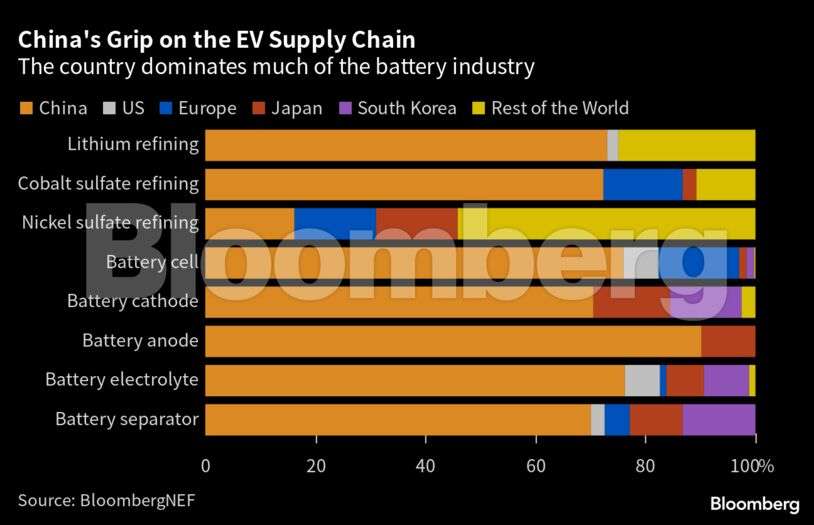

Chinese firms are lining up to invest in South Korea’s battery industry because they want to use it as a gateway to the US market, undermining the Biden administration’s efforts to limit China’s involvement in the electric car supply chain.

–With assistance from Leda Alvim, Maya Averbuch, Maria Eloisa Capurro, Gabrielle Coppola, Enda Curran, Wilfried Eckl-Dorna, Tom Hancock, Heejin Kim, John Liu, Yujing Liu, Carolynn Look, Steve Matthews, Brendan Murray, Hannah Pedone, Jana Randow, Tom Rees, Anup Roy, Augusta Saraiva, Zoe Schneeweiss, Petra Sorge and Fran Wang.