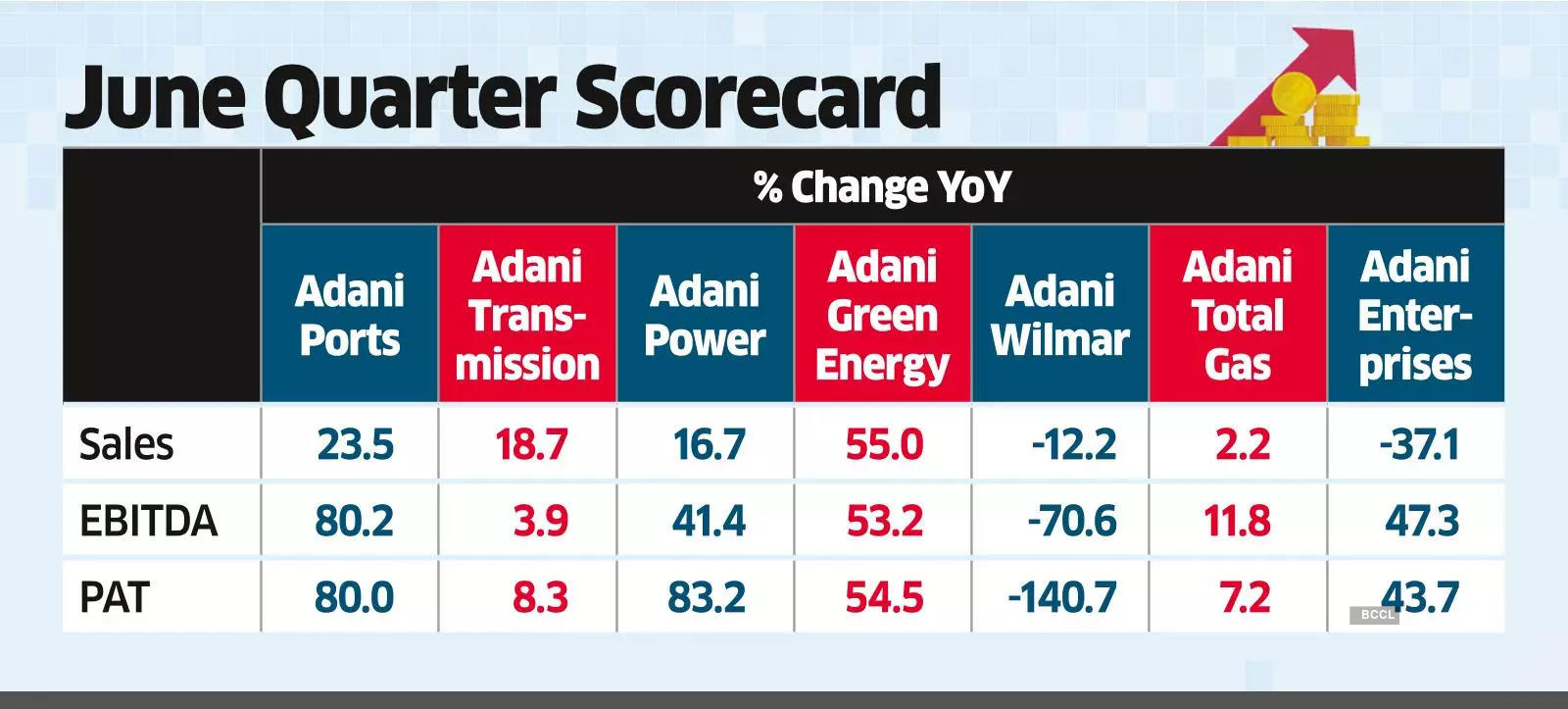

Adani group companies have seen their combined net profit surge nearly 70% on year in the June quarter, helped by robust performance in the ports, power and green energy businesses.

Strong operational performance helped boost the group’s net profit, although overall sales saw a decline during the quarter. The comparative performance excludes the group’s cement entities acquired after the first quarter of FY23.

Combined profits of the Gautam Adani group surged to ₹12,854 crore, while earnings before interest, tax, depreciation and amortization jumped nearly 42% on year to ₹20,980 crore, data compiled by ET showed. Sales of the companies included in the comparison set were nearly a seventh lower at ₹69,911 crore.

The comparative earnings include the performance of Adani Ports and Special Economic Zone, Adani Power, Adani Green Energy, Adani Wilmar, Adani Total Gas, Adani Enterprises and Adani Transmission. ACC and Ambuja Cements, the group’s consumer-facing building-material businesses, were not included in these comparisons because their merger was completed only in September last year.

While Adani Enterprises had the highest revenue among the group companies, Adani Power’s profit was the highest, with an 83% year-on-year growth, helped by higher installed capacity and an improvement in the plant load factor.Adani Power, along with Adani Ports, Adani Transmission and Adani Green Energy saw a double-digit growth in sales on a year-on-year basis. While sales growth was the sharpest in Adani Green, it was on a relatively lower base.

Adani Enterprises and Adani Wilmar, meanwhile, were the only two companies that saw their toplines decrease, largely on account of lower prices of coal and edible oil. While Adani Enterprises managed profit growth despite the weakness in sales, Adani Wilmar slipped into the red.

Adani Ports, one of the key businesses of the group, clocked in its strongest operating performance during the quarter with cargo volumes, operating profit and sales at all-time highs. It also reported a 2 percentage point gain in cargo market share.

Earlier this year, US-based Hindenburg Research had made allegations against the Adani group, including those of accounting “malpractices and lapses in corporate governance.”

Adani Group has steadfastly denied the charges.

To be sure, these allegations severely dented sentiment for the group, with shares tumbling and wiping out as much as $153 billion in market value for the companies at one point.

Most group shares had hit lows in the aftermath of these allegations. All the group companies have recovered, and shares of Adani Ports, Adani Power, Adani Green Energy and Adani Enterprises have more than doubled from these lows. The share prices of most of the companies, though, are yet to recover to the levels seen before the report’s publication.

Last week, the resignation of Deloitte Haskins & Sells LLP as the auditors of Adani Ports had soured sentiment for the shares, but US-based GQG Investments bought a stake worth more than $1 billion in Adani Power, helping lift the group’s stocks.