Dollar is making slight gains in early US session, buoyed by slightly better-than-expected PPI data release. Adding to its strength are mild risk aversion sentiments and continued rebound in Treasury yields. If this buying momentum sustains, the greenback could well close out the week as the top performer. The remaining question is whether its momentum is strong enough to break out from the near term range against European majors.

Speaking of European currencies, British Pound is the standout, drawing strength from an upbeat UK GDP data report released earlier in the day. However, the enthusiasm seems to be waning, with no evident sustained buying. Yen, meanwhile, is on track to finish at the bottom of the performance chart, showing no signs of a rebound. Commodity-linked currencies are trailing closely behind Yen, while Euro and Swiss Franc are managing to hold firmer ground.

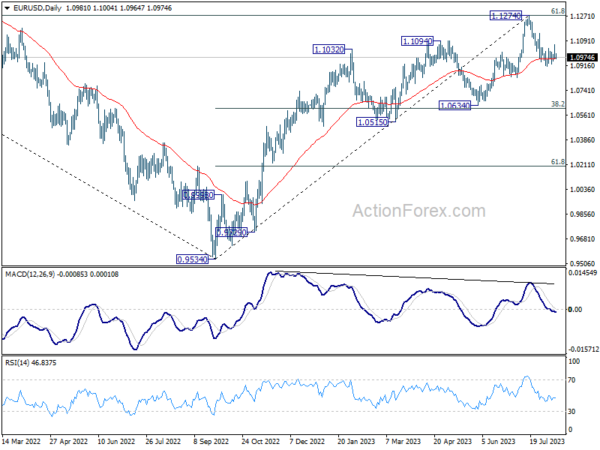

Technically, the support from 55 D EMA looks insufficient to prompt a stronger rebound in EUR/USD. Break of last week’s low at 1.0911, and sustained trading below the EMA will set up deeper fall to 1.0634 support, even as a correction to the up trend from 0.9534. Let’s see if we’ll know the answer today, or next week.

In Europe, at the time of writing, FTSE is down -1.40%. DAX -1.10%. CAC is down -1.47%. Germany 10-year yield is up 0.0091 at 2.619. Earlier in Asia, Nikkei rose 0.84%. Hong Kong HSI fell -0.90%. China Shanghai SSE dropped 2.01%. Singapore Strait Times lost -0.86%. Japan 10-year JGB yield rose 0.0241 to 0.589.

US PPI up 0.3% mom in Jul, services rose 0.5% mom, goods rose 0.1% mom

US PPI for final demand rose 0.3% mom in July, above expectation of 0.2% mom. PPI services rose 0.5% mom while PPI goods edged up 0.1% mom. PPI ex-food, energy, and trade services rose 0.2% mom.

For the 12 months ended in July, PPI rose 0.8% yoy, above expectation of 0.7% yoy. PPI ex-foods, energy and trade services rose 2.7% yoy.

UK GDP rose 0.5% mom in Jun, up 0.2% qoq in Q2

UK GDP grew 0.5% mom in June, well above expectation of 0.2% mom. Production grew 1.8% mom. Services was up 0.2% mom. Construction also rose 1.6% mom.

For Q1, GDP grew 0.2% qoq, above expectation of 0.0% qoq. But the level of quarterly GDP was -0.2% below its pre-pandemic level in Q4 2019. Services grew 0.1% on the quarter. Production grew by 0.7% with 1.6% growth in manufacturing. Construction rose 0.3%.

The implied price of GDP rose by 2.1% in Q2, which was primarily driven by higher price pressures for household consumption (1.5%) and government consumption (3.1%).

Also released, industrial production was up 1.8% mom, 0.7% yoy in June. Manufacturing production was up 2.4% mom, 3.1% yoy. Goods trade deficit narrowed to GBP -15.5B.

RBA Lowe: Possible that some further tightening will be required

Addressing the House of Representatives Standing Committee on Economics today, outgoing RBA Governor, Philip Lowe stated that the purpose behind the pauses in July and August was “to provide time to assess the impact of the (rates) increases to date and the economic outlook and the associated risks.”

He reiterated that “it is possible that some further tightening of monetary policy will be required”. But the decision would be largely based on incoming data and the Board’s evolving analysis of economic forecast and potential risks.

Lowe expressed optimism about recent economic data, remarking, “It is encouraging that the recent data are consistent with inflation returning to target over the next couple of years.”

But he also pinpointed two risks that RBA is closely monitoring. “The first is the outlook for household consumption,” he said, attributing this concern to the myriad of factors currently influencing household finances and expenditures.

The second risk highlighted was the potential persistence of high services price inflation which could lead to “prolonging the period of inflation being above target.”

Lowe emphasized the RBA’s forecast, which assumes a resurgence in productivity rates, aligning with levels seen pre-pandemic. Such growth, he suggested, would help in moderating the unit labour costs and subsequently, inflation. Yet, he cautioned, “If this pick-up in productivity does not occur, all else constant, high inflation is likely to persist, which would be problematic.”

New Zealand BNZ manufacturing slumps to Post-GFC low in July

New Zealand’s BusinessNZ Performance of Manufacturing Index has experienced a drop in July, declining from 47.4 to 46.3. Digging into the details, there was a notable dip in Production, which plummeted from 47.3 to 42.9, and Employment wasn’t far behind, decreasing from 46.8 to 44.3. On a slightly brighter note, New Orders saw a modest increase, moving from 43.8 to 45.0, and Finished Stocks slightly ticked up from 52.3 to 52.6. However, Deliveries took a sharp hit, falling from 49.9 to 42.3.

Feedback from the manufacturing sector portrayed a gloomy picture. Negative comments in July stood at 72%, a slight decrease from June’s 74.5%, but higher than May’s 66.7% and April’s 70.3%. The core concerns cited by manufacturers revolved around general market uncertainty, escalating costs, and inclement weather affecting demand, particularly during July.

Catherine Beard, BusinessNZ’s Director of Advocacy, remarked on the PMI’s July figures, indicating that they “showed very little signs of potential improvements for the sector as a whole.” Echoing this sentiment, BNZ Senior Economist, Doug Steel, highlighted the gravity of the situation, noting that “the July result was the fifth consecutive monthly sub-50 reading and, outside of Covid lockdown periods, the lowest reading since the GFC days back in June 2009.”

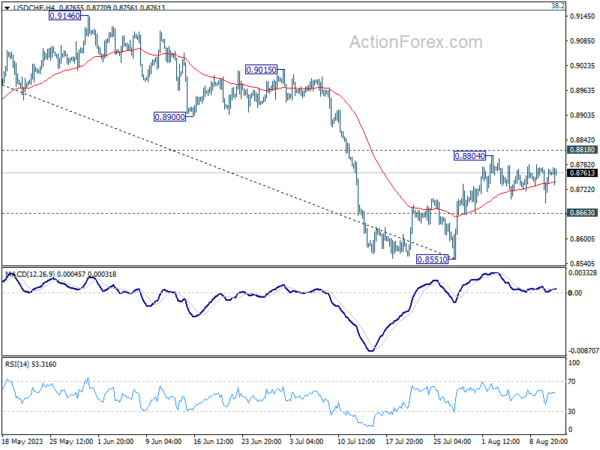

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8713; (P) 0.8746; (R1) 0.8800; More….

Sideway trading continues in USD/CHF and intraday bias stays neutral. On the downside break of 0.8663 minor support should confirm rejection by 0.8818 and turn intraday bias back to the downside for retesting 0.8551 first. Nevertheless, decisive break of 0.8818 will carry larger bullish implication, and target 0.9146 cluster resistance next.

In the bigger picture, down trend from 1.0146 is seen as in progress as long as 0.8188 support turned resistance holds. Next target is 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317. However, sustained break of 0.8818 should indicate medium term bottoming, and bring stronger rise back to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160), even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Jul | 46.3 | 47.5 | 47.4 | |

| 06:00 | GBP | GDP Q/Q Q2 P | 0.20% | 0.00% | 0.10% | |

| 06:00 | GBP | GDP M/M Jun | 0.50% | 0.20% | -0.10% | |

| 06:00 | GBP | Industrial Production M/M Jun | 1.80% | -0.10% | -0.60% | |

| 06:00 | GBP | Industrial Production Y/Y Jun | 0.70% | -2.10% | -2.30% | -2.10% |

| 06:00 | GBP | Manufacturing Production M/M Jun | 2.40% | 0.10% | -0.20% | -0.10% |

| 06:00 | GBP | Manufacturing Production Y/Y Jun | 3.10% | -1.00% | -1.20% | -0.60% |

| 06:00 | GBP | Goods Trade Balance (GBP) Jun | -15.5B | -16.2B | -18.7B | -18.4B |

| 08:00 | EUR | Italy Trade Balance (EUR) Jun | 7.72B | 4.23B | 4.71B | 4.77B |

| 11:00 | GBP | NIESR GDP Estimate (3M) Jul | 0.30% | 0.00% | ||

| 12:30 | USD | PPI M/M Jul | 0.30% | 0.20% | 0.10% | 0.00% |

| 12:30 | USD | PPI Y/Y Jul | 0.80% | 0.70% | 0.10% | 0.20% |

| 12:30 | USD | PPI Core M/M Jul | 0.30% | 0.20% | 0.10% | -0.10% |

| 12:30 | USD | PPI Core Y/Y Jul | 2.40% | 2.30% | 2.40% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Aug P | 70.9 | 71.6 |