A shift in market sentiment rattled investors as the optimism spurred by Nvidia was short-lived. DOW experienced its most severe daily slump since March overnight, while S&P 500 and NASDAQ posted their largest one-day drops since early August. This change in market dynamics played into the hands of Dollar, which surged, hitting weekly highs against major European currencies due to heightened risk aversion.

Attention is now pivoting to Jackson Hole Symposium, where Fed Chair Jerome Powell’s introductory remarks are eagerly anticipated. While no explicit insights are expected concerning Fed’s upcoming September meeting, stakeholders are keen on gauging how Powell will straddle discussions about diverging trends in easing prices and wages, versus strong consumer spending and services inflation. Following Powell’s address, the financial community will be tuning into ECB President Christine Lagarde’s luncheon address, as well as the panel discussion that features luminaries like BoE Deputy Governor Ben Broadbent and BoJ Governor Kazuo Ueda.

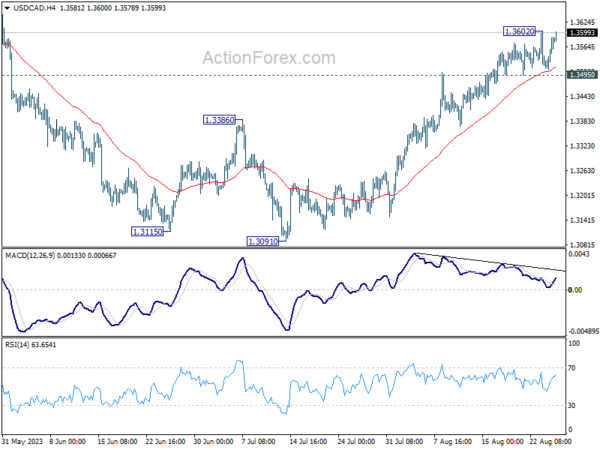

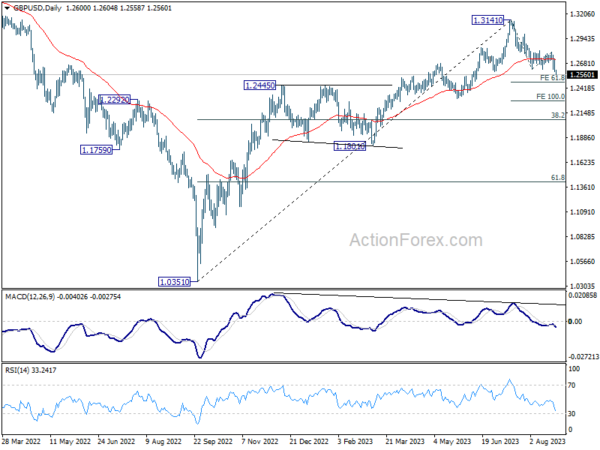

Technically, Dollar displayed notable strength in breaking firmly through 1.0801 temporary low in EUR/USD and 1.2613 temporary low in GBP/USD. Now, focuses will be on 146.55 temporary top in USD/JPY, 1.3602 temporary top in USD/CAD, and 0.6363 support in AUD/USD. Decisive break of there level will confirm the underlying bullish momentum in the greenback.

In Asia, at the time of writing, Nikkei is down -1.97%. Hong Kong HSI is down -1.12%. China Shanghai SSE is down -0.45%. Singapore Strait Times is up 0.04%. Japan 10-year JGB yield is down -0.0284 at 0.649. Overnight, DOW dropped -1.08%. S&P 500 dropped -1.35%. NASDAQ dropped -1.87%. 10-year yield rose 0.037 to 4.235.

Fed Collins: Be patient and not get ahead of data

Boston Fed President, Susan Collins, offered a cautionary stance on the current monetary policy trajectory in her latest remarks. Addressing the possibility of further rate hikes, Collins noted yesterday, “We may be near, we could even be at a place where we would hold” and not lift rates further.

While not ruling out the possibility of future hikes, Collins emphasized a measured approach, stating, “But certainly additional increments are possible, and we need to look holistically and be really patient right now and not try to get ahead of what the data will tell us as it unfolds.”

On the topic of inflation, Collins expressed her confidence in the Federal Reserve’s capabilities, saying she is “hopeful Fed can bring inflation back to 2% in a reasonable amount of time.”

However, she cautioned against making premature judgments about potential rate cuts, remarking it’s “premature to send a clear signal about the timing of rate cuts.”

Fed Harker: We’ve probably done enough

Philadelphia Fed President, Patrick Harker, shared his insights on the current stance of Fed’s monetary policy. Addressing the topic of monetary tightening, Harker said yesterday, “Right now, I think that we’ve probably done enough because we have two things going on.”

Elaborating further, Harker mentioned the twin pillars that have influenced his perspective: “The Fed funds rate increases — they are at a restrictive level, so let’s keep them there for a while. And also we are continuing to shrink our balance sheet that is also removing accommodation.”

Looking to the future, Harker emphasized a data-driven approach, noting, “I see us staying steady throughout the rest of this year, next year is data driven.” When prompted about the potential timing of a rate cut, he candidly stated, “Can’t predict when Fed will cut rates.”

ECB’s Nagel: Too early to think about a pause

ECB Governing Council member Joachim Nagel, in remarks made yesterday, reinforced his stance on the ongoing monetary tightening efforts of the central bank. Addressing speculations around a potential pause, he firmly stated, “It’s for me much too early to think about a pause,” emphasizing the significant gap between the current inflation rate and ECB’s target.

Nagel pointed out the glaring disparity between the present inflation situation and ECB’s benchmark, saying, “We shouldn’t forget inflation is still around 5%. So this is much too high. Our target is 2%. So there’s some way to go.”

Despite the overarching concern regarding a slowdown in economic activity in Eurozone, Nagel highlighted the persistence of core inflation and characterized the labor market as being “really pretty good.”

Dismissing prevalent narratives surrounding Germany’s economic health, he countered, “I hear a lot of talk about Germany, the sick man of Europe. This is definitely not the case.” Concluding on an optimistic note, Nagel added, “I’m still pretty optimistic that we will have a soft landing.”

ECB’s Vujcic: Whether we are in a restrictive-enough territory remains to be seen

ECB Governing Council member Boris Vujcic acknowledged the restrictive nature of the ECB’s present stance. However, he tempered this by highlighting the uncertainty that remains, suggesting that the real test of the bank’s approach lies ahead.

“Whether we are in a restrictive-enough territory remains to be seen. And this is something that you will only see from the inflation data that will come in the next prints,” he emphasized.

Despite indications of a cooling economic activity, Vujcic pointed out that this deceleration is not as evident in the current inflation rates. The upcoming months, according to him, will be crucial in discerning the direction of services inflation and in understanding “whether we will feel the consequences of the slowdown in the labor market.”

While ECB expects to reach its 2% inflation target in 2025, Vujcic said that “by spring next year, we will have a clearer picture of whether we are firmly on the path toward achieving that or we will have to do more.”

ECB’s Centeno: Downside risks have materialized

ECB Governing Council member Mario Centeno, indicated yesterday that the transmission of ECB’s policy is “up and running” and pointed out the rapidity with which inflation has decelerated, noting its descent has outpaced its ascent.

However, he urged prudence, stating, “We have to be cautious this time around because downside risks that we identified in June in our forecast have materialized.” This marks a shift from the pattern observed throughout the pandemic recovery, where, as Centeno highlighted, “usually we have been surprised on the upside.”

Centeno also hinted at the uncertainty ahead, observing, “There’s plenty of data still to be made available until the September decision.” He further emphasized the significance of the upcoming forecast, mentioning, “We have a new forecast. That forecast will tell us precisely how we see this transmission of our decisions into inflation and the economy.”

On the data front

Japan Tokyo CPI core slowed from 3.0% yoy to 2.8% yoy in August, below expectation of 2.9% yoy. Corporate services price index rose 1.7% yoy in July, above expectation of 1.2% yoy.

Looking ahead, Germany GDP final will be released in European session. Ifo business climate will also be published too.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2551; (P) 1.2640; (R1) 1.2689; More…

GBP/USD’s fall from 1.3141 resumed and intraday bias is back on the downside. Next target is 61.8% projection of 1.3141 to 1.2618 from 1.2799 at 1.2476. Firm break there could prompt downside acceleration to 100% projection at 1.2276. On the upside, break of 1.2799 resistance is needed to confirm completion of the decline. Otherwise, near term outlook will stay bearish in case of recovery.

In the bigger picture, for now, fall from 1.3141 medium term top is seen as a correction to up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3141 at 1.2075. Strong support would be seen there to bring rebound on first attempt. But outlook will be neutral at best as long as 1.3141 resistance holds, and consolidation from there is set to extend, until further development.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Aug | 2.90% | 3.00% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Aug | 2.80% | 2.90% | 3.00% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Aug | 4.00% | 4.00% | ||

| 23:50 | JPY | Corporate Service Price Index Y/Y Jul | 1.70% | 1.20% | 1.20% | 1.40% |

| 06:00 | EUR | Germany GDP Q/Q Q2 F | 0.00% | 0.00% | ||

| 08:00 | EUR | Germany IFO Business Climate Aug | 86.6 | 87.3 | ||

| 08:00 | EUR | Germany IFO Current Assessment Aug | 89.8 | 91.3 | ||

| 08:00 | EUR | Germany IFO Expectations Aug | 83.8 | 83.5 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Aug F | 71.2 | 71.2 |