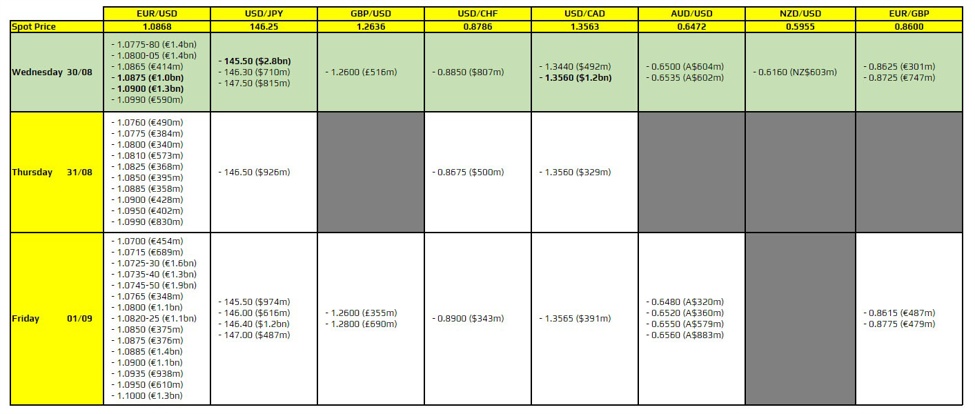

There are a couple of large ones to take note of for the day, as highlighted in bold.

The first few being for EUR/USD at 1.0875 and 1.0900 but both levels don’t really hold much technical significance. The charts are showing that price action has room to roam between its 200-day moving average at 1.0810 and 100-day moving average at 1.0925. But perhaps the large expiries might keep price action more contained between 1.0875 to 1.0900 before rolling off later in the day.

That said, we do have German CPI data and ADP employment data to factor in and they could result in bigger reactions to price action later on.

Then, there is a rather big one for USD/JPY at 145.50 but that is not likely to be a significant pull unless bond yields see reason to drop during the day.

Besides that, there is one for USD/CAD at 1.3560 which could act as a bit of a magnet in keeping price action more sticky in the session ahead at least.

For more information on how to use this data, you may refer to this post here.