Ahead of the G20 meeting, World Bank has released findings included in it’s G20 document saying India has achieved financial inclusion targets in just 6 years which would otherwise have taken at least 47 long years.

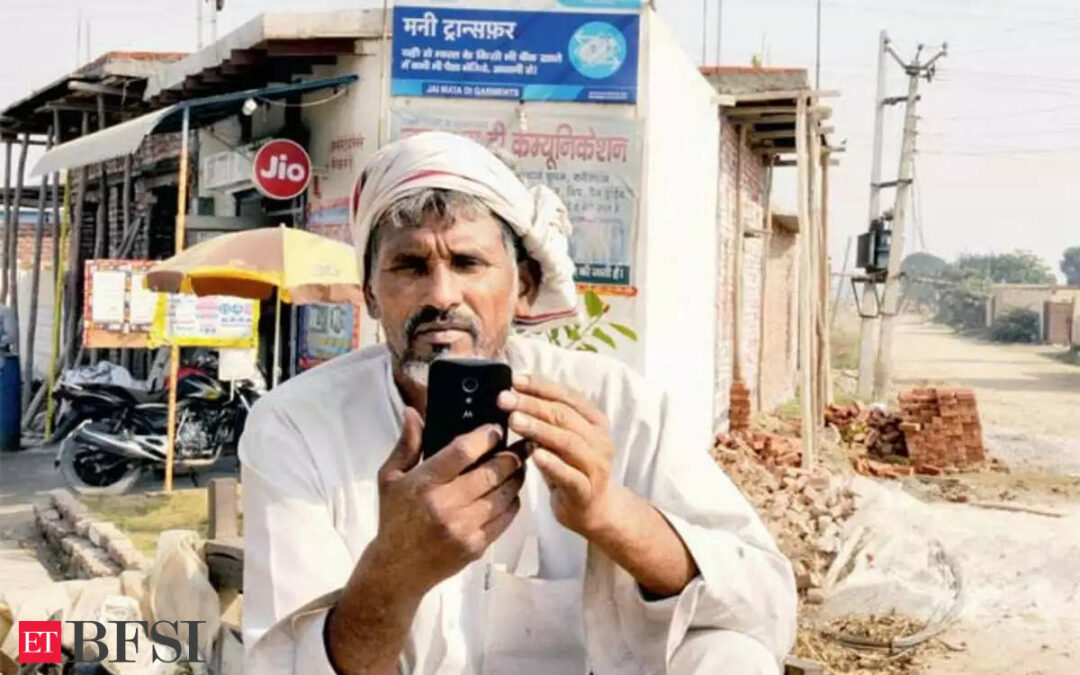

The policy document prepared by the World Bank said without Digital Payment Infrastructure (DPI) such as Jan Dhan Bank accounts, Aadhaar, and Mobile phones (the JAM trinity), India may have taken 47 years to achieve financial inclusion rate of 80% which the country has achieved in just six years.

Prime Minister Narendra Modi shared World Bank’s findings over social media platform X, saying, “Compliments to our robust digital payment infrastructure and the spirit of our people. It is equally a testament to rapid progress and innovation.”

— narendramodi (@narendramodi)

The World Bank document highlighted that the India Stack exemplifies DPI approach by combining digital ID, interoperable payments, a digital credentials ledger, and account aggregation.

The total value of UPI transactions last financial year was nearly 50% of India’s nominal GDP.

“Banks’ costs of onboarding customers in India decreased from $23 to $0.1 with the use of DPI. As of March 2022, India did total savings of $33 billion, equivalent to nearly 1.14% of GDP, due to Direct Benefit Transfer (DBT),” the document said.

According to the report, since its launch, the number of Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts opened tripled from 147.2 million in March 2015 to 462 million by June 2022.

Out of these, women own 56% are the accountholders comprising more than 260 million.

The report highlighted that while DPIs’ role in this ‘leapfrogging is undoubtable’, other ecosystem variables and policies that build on the availability of DPIs were critical.

“These included interventions to create a more enabling legal and regulatory framework, national policies to expand account ownership, and leveraging Aadhaar for identity verification,” the report says.

The report also mentioned how in the last decade, India built one of the world’s largest digital Government-to-People architectures leveraging DPI.

“This approach has supported transfers amounting to about $361 billion directly to beneficiaries from 53 central ministries through 312 key schemes. As of March 2022, this resulted in a total savings of $33 billion, equivalent to nearly 1.14% of GDP,” it said.

The report also highlighted that the India Stack has digitised and simplified KYC procedures, lowering costs; banks that use e-KYC lowered their cost of compliance from $0.12 to $0.06.

“The decrease in costs made lower-income clients more attractive to service and generated profits to develop new products,” it added.