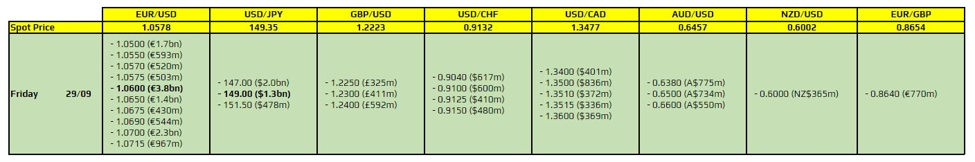

There are a couple to take note of, as highlighted in bold. But for a month-end and quarter-end date, there aren’t too many significant option expiries to be wary about.

The first for EUR/USD is at 1.0600 and is a relatively large one, so it adds to a defensive layer at the figure level alongside offers to keep sellers interested amid the recent bounce. There is also the ones at 1.0500 which could help to keep price action more in tact as per the range this week, before rolling off later in the day.

Then, there is the one for USD/JPY at 149.00 which will give buyers an additional layer to work with in trying to keep up with higher Treasury yields. But intervention fears will continue to persist regardless, so there’s that to consider.

For more information on how to use this data, you may refer to this post here.