Australian Dollar is facing heavy downward pressure, emerging as the most underperforming currency this week so far. The weak under tone is maintained following RBA’s decision to hold interest rates steady. Both Aussie and Kiwi have relinquished the gains made the previous week, a reversal exacerbated by an evident risk aversion in Asia.

Significant decline is seen in Hong Kong stocks post-long weekend. Despite a dramatic over 40% surge in China Evergrande as trading of its shares resumed from last week’s halt, the overall market sentiment remained uninspired. The embattled property developer’s spike did little to alleviate the prevailing bearish outlook.

Contrarily, Dollar has emerged robust, spearheading the near-term rally against Euro and Sterling. The buoyancy can be attributed to a “relatively” upbeat ISM manufacturing data that has incrementally heightened the prospects of another Fed hike, now hovering around 45% likelihood in December. This positive data concurrently propelled 10-year yield and the greenback upwards. However, impending ISM services and non-farm payroll data are anticipated to be crucial determinants in Dollar’s continued ascendancy.

Elsewhere in the currency markets, Yen is tailing Dollar as the second strongest, keeping market participants and analysts vigilant due to potential interventions by Japan close to the 150 handle against Dollar. Among European majors, Sterling is the laggard.

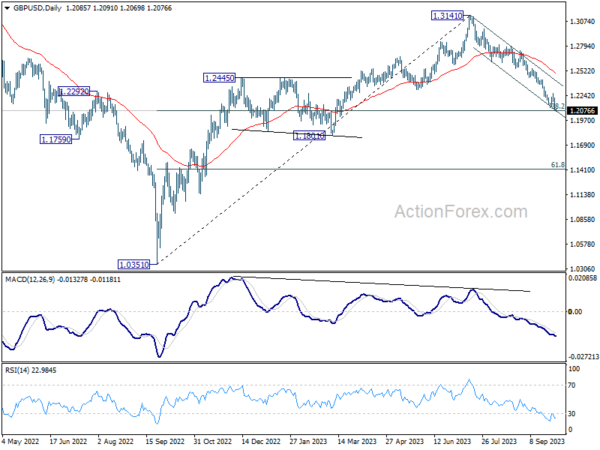

On the technical front, GBP/USD is now pressing an important fibonacci level at 38.2% retracement of 1.0351 to 1.3141 at 1.2075 Sustained break there will align the outlook will EUR/USD. That is, fall from 1.3141 in GBP/USD, whether it’s a correction or reversing whole trend form 1.0351, would target 61.8% retracement at 1.1417.

In Asia, at the time of writing, Nikkei is down -1.43%. Hong Kong HSI is down -3.03%. Singapore Strait Times is down -0.81%. Japan 10-year JGB yield is down -0.0123 at 0.764. China is on holiday. Overnight, DOW dropped -0.22%. S&P 500 rose 0.01%. NASDAQ rose 0.67%. 10-year yield rose 0.110 to 4.683, after hitting as high as 4.703.

RBA holds rates steady, maintains hawkish bias

In what was Michelle Bullock’s inaugural meeting as Governor, RBA opted to maintain its cash rate target at 4.10%, aligning with broad market expectations. The central bank’s statement carried a hawkish tone, noting that “some further tightening of monetary policy may be required. The exact course of such adjustments, however, would be determined by “the data and the evolving assessment of risks.”

While RBA acknowledged that inflation had passed its pinnacle, the levels remain uncomfortably elevated. It observed a decline in goods price inflation but pointed out the brisk rise in service prices, as well as notable increases in fuel and rent prices.

The central bank projects a gradual return of CPI inflation to its 2-3% target range by the end of 2025. This aligns with their prediction of sustained below-trend growth for the economy, expecting this trend to persist. Consequently, they anticipate the unemployment rate to inch up, reaching approximately 4.5% towards the end of the following year.

Outlook is shrouded in “significant uncertainties.” These encompass variables like service price inflation, delays in monetary policy transmission monetary policy, and businesses’ reactions in terms of pricing and wages. Consumer behavior, particularly household consumption patterns, also remains an unpredictable factor.

On a global scale, RBA expressed concerns over China’s economy, especially given the prevalent disturbances in its property market.

NZ NZIER survey shows mild recovery in business sentiment

NZIER Quarterly Survey of Business Opinion reveals a modest improvement in business confidence for the September quarter, climbing to -52.7 from its previous position at -60.3. However, it’s evident that overall sentiment within the business community remains pessimistic. Trading activity for the next three months improved from -16.6 to -14.2.

One major positive shift observed was the pronounced decrease in reported labour shortages. Fewer businesses now list the challenge of finding labour as their principal operational bottleneck, shifting their concerns instead to a softer demand environment. This transition in concerns implies that the recent hikes in interest rates may be suppressing economic demand in the country.

On the flip side, the easing of capacity pressures hasn’t provided much respite to businesses in terms of costs. A significant 68.2% of respondents noted a rise in their operating costs over the past three months, only a minor reduction from the prior quarter’s 67.1%. Moreover, the inclination to transfer these cost pressures to consumers has subsided, with 57.3% of businesses raising output prices in the recent quarter, down from a previous 68.8%.

Fed’s Barr eyes restrictive policy duration over rate height

Fed Vice Chair Michael Barr advocated for a cautious approach to monetary policy adjustments during his speech yesterday. While discussions surrounding interest rate hikes are paramount, Barr’s concern is primarily anchored on the duration for which these elevated rates should be maintained.

Speaking on the current tightening cycle, Barr highlighted the progress made and expressed that it’s a juncture where meticulous decision-making is essential. He stated, “Given how far we have come, we are now at a point where we can proceed carefully as we determine the extent of monetary policy restriction that is needed.”

Perhaps most notably, he reframed the ongoing debate on rate adjustments by remarking, “The most important question at this point is not whether an additional rate increase is needed this year or not, but rather how long we will need to hold rates at a sufficiently restrictive level.” This perspective places a clear emphasis on policy duration, suggesting a prolonged period of elevated rates may be more impactful than further substantial hikes in the near term.

On the economy, Barr’s baseline is for real GDP growth to “moderate to somewhat below its potential rate over the next year” as restrictive monetary policy and tighter financial conditions restrain economic activity.” He anticipates this deceleration in growth to be concomitant with “some further softening in the labor market”.

Fed’s Bowman flags energy as potential setback to disinflation progress; advocates more hike

Fed Michelle Bowman has made her hawkish stance clear on the pressing issue of inflation that continues to grip the US economy. In a speech yesterday, Bowman emphasized the persistence of inflationary pressures, signaling the need for a more restrictive monetary policy to anchor inflation back to the Fed’s 2% target.

“Inflation continues to be too high, and I expect it will likely be appropriate for the Committee to raise rates further and hold them at a restrictive level for some time to return inflation to our 2 percent goal in a timely way,” Bowman stated.

Bowman pointed to the latest inflation reading based on the PCE index, noting a rise in overall inflation driven, in part, by escalating oil prices. “I see a continued risk that high energy prices could reverse some of the progress we have seen on inflation in recent months,” she warned.

Also, Bowman cited the Summary of Economic Projections released during the September FOMC meeting, where “the median participant expects inflation to stay above 2 percent at least until the end of 2025.” This expectation of prolonged inflationary pressures aligns with Bowman’s perspective that “further policy tightening” will be instrumental in steering inflation back towards target.

Fed’s Mester suggests another rate hike needed

Cleveland Fed President Loretta Mester acknowledged in a speech yesterday the robust state of the economy with a cautious stance on inflation and interest rates. She signaled the possibility of another rate hike this year.

“I suspect we may well need to raise the fed funds rate once more this year and then hold it there for some time,” she said.

However, Mester also underscored the contingent nature of future monetary policy decisions, stating, “whether the fed funds rate needs to go higher than its current level and for how long policy needs to remain restrictive will depend on how the economy evolves relative to the outlook.”

Inflation, according to Mester, continues to pose a significant challenge. She plainly remarked that inflation remains “too high”. Though she expects some easing of price pressures, she cautioned that “the risks to the inflation forecast remain tilted to the upside.”

On a positive note, Mester expressed optimism about the broader economic picture. “The economy is on a good path,” she observed. Delving into labor market dynamics, she pointed out that while conditions remain robust, the disparity between labor demand and supply is shrinking, indicating that “firms are finding it easier to find the workers they need.”

Looking ahead

The economic calendar is ultra-light today with only Swiss CPI featured.

AUD/USD Daily Report

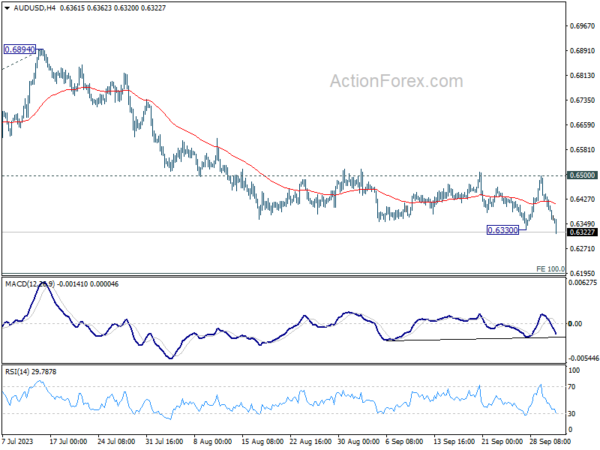

Daily Pivots: (S1) 0.6336; (P) 0.6390; (R1) 0.6419; More…

AUD/USD’s breach of 0.6330 support indicates resumption of recent down trend. Intraday bias is back on the downside. Current fall from 0.7156 should target 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195. On the upside, break of 0.6500 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

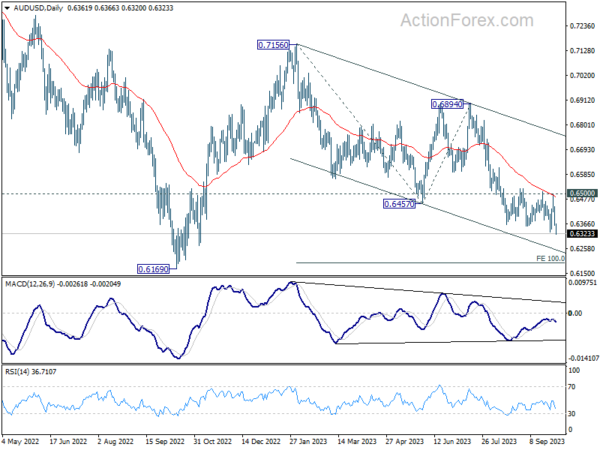

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q3 | -52 | -63 | ||

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | 6.20% | 6.90% | ||

| 00:30 | AUD | Building Permits M/M Aug | 7.00% | 3.30% | -8.10% | |

| 03:30 | AUD | RBA Interest Rate Decision | 4.10% | 4.10% | 4.10% | |

| 06:30 | CHF | CPI M/M Sep | 0.00% | 0.20% | ||

| 06:30 | CHF | CPI Y/Y Sep | 1.80% | 1.60% |