In the spotlight today are the developments within the treasury markets. US 10-year yields have soared, reaching their highest point since 2007. This surge is largely attributed to expectations that Fed will keep high interest rates for longer, if not push them even higher. Fed hawks have been vocal this week, indicating the plausible scenario of an additional rate hike this year. Meanwhile, Germany’s 10-year yield is also experiencing a significant uptick, heading back towards a 12-year peak.

In contrast, Japan’s 10-year JGB yield has seen a decline. This comes in the wake of BoJ’s announcement to purchase bonds with five to ten-year maturities on Wednesday. This move by the BoJ clearly illustrates its commitment to “manage” the ascension of 10-year JGB yield. However, this control measure is likely to exert pressure on Yen due to the widening yield gap with US and Europe. This also offset impacts of repeated verbal intervention by Japanese Finance Minister Shunichi Suzuki.

Amid this backdrop, the US Dollar emerges as the unequivocal leader in the currency markets, trailed distantly by Euro and Yen. Aussie and Kiwi languish at the tail end, burdened by a pervasive risk aversion sentiment in Asia and plummeting copper prices. The Swiss Franc is not faring any better, grappling with the repercussions of disappointing CPI data, while Canadian Dollar and Sterling present a mixed picture.

From a technical standpoint, Copper falls sharply this week and breaks through 3.6008 support. Prior rejection by 55 D EMA also retains near term bearishness. Current decline form 4.0145 is probably resuming whole fall from 4.3556. Next target is 3.5387 support. Decisive break there will confirm this bearish case, and potentially exacerbating the woes of the already beleaguered Aussie.

In Europe, at the time of writing, FTSE is down -0.24%. DAX is down -0.83%. CAC is down -0.86%. Germany 10-year yield is up 0.0176 at 2.945. Earlier in Asia, Nikkei dropped -1.64%. Hong Kong HSI dropped -2.69%. Singapore Strait Times dropped -0.51%. Japan 10-year JGB yield fell -0.0125 to 0.764.

ECB’s Lane: There is still work to be done

ECB’s Chief Economist Philip Lane voiced his ongoing concerns regarding the elevated inflation levels in the Eurozone during a conference. Despite a drop in inflation in September to its lowest in two years, Lane emphasized the need for continued efforts to steer price increases back towards the 2% target.

Lane stated, “Price increases are still well above 2%, we are not at the inflation target yet and therefore there is still work to be done in terms of bringing inflation down.”

While wage inflation is anticipated to decline, Lane cautioned that this process would be gradual, as “it’s going to take months, it will take time”. Lane’s focus appears to be more on services inflation data. “I think we will be looking at services inflation data for quite a while,” he shared

One key area of focus for the ECB is the unpredictable nature of energy prices. “We don’t expect the current low gas price to be maintained, we do expect to see gas prices go up from where they are now,” he said. “Energy has been such a volatile component, it’s going to be very important to us to keep an eye on energy in the coming months and years.”

Swiss CPI ticks up to 1.7% yoy, core down to 1.3% yoy

Swiss CPI fell -0.1% mom in September, below expectation of 0.0% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) was down -0.1% mom. Domestic products prices dropped -0.2% mom. Imported products prices rose 0.3% mom.

For the 12-month period, CPI rose from 1.6% yoy to 1.7% yoy, below expectation of 1.8% yoy. Core CPI slowed from 1.5% yoy to 1.3% yoy. Domestic products prices slowed from 2.2% yoy to 2.1% yoy. Imported products prices turned positive from -0.3% yoy to 2.2% yoy.

RBA holds rates steady, maintains hawkish bias

In what was Michelle Bullock’s inaugural meeting as Governor, RBA opted to maintain its cash rate target at 4.10%, aligning with broad market expectations. The central bank’s statement carried a hawkish tone, noting that “some further tightening of monetary policy may be required. The exact course of such adjustments, however, would be determined by “the data and the evolving assessment of risks.”

While RBA acknowledged that inflation had passed its pinnacle, the levels remain uncomfortably elevated. It observed a decline in goods price inflation but pointed out the brisk rise in service prices, as well as notable increases in fuel and rent prices.

The central bank projects a gradual return of CPI inflation to its 2-3% target range by the end of 2025. This aligns with their prediction of sustained below-trend growth for the economy, expecting this trend to persist. Consequently, they anticipate the unemployment rate to inch up, reaching approximately 4.5% towards the end of the following year.

Outlook is shrouded in “significant uncertainties.” These encompass variables like service price inflation, delays in monetary policy transmission monetary policy, and businesses’ reactions in terms of pricing and wages. Consumer behavior, particularly household consumption patterns, also remains an unpredictable factor.

On a global scale, RBA expressed concerns over China’s economy, especially given the prevalent disturbances in its property market.

NZ NZIER survey shows mild recovery in business sentiment

NZIER Quarterly Survey of Business Opinion reveals a modest improvement in business confidence for the September quarter, climbing to -52.7 from its previous position at -60.3. However, it’s evident that overall sentiment within the business community remains pessimistic. Trading activity for the next three months improved from -16.6 to -14.2.

One major positive shift observed was the pronounced decrease in reported labour shortages. Fewer businesses now list the challenge of finding labour as their principal operational bottleneck, shifting their concerns instead to a softer demand environment. This transition in concerns implies that the recent hikes in interest rates may be suppressing economic demand in the country.

On the flip side, the easing of capacity pressures hasn’t provided much respite to businesses in terms of costs. A significant 68.2% of respondents noted a rise in their operating costs over the past three months, only a minor reduction from the prior quarter’s 67.1%. Moreover, the inclination to transfer these cost pressures to consumers has subsided, with 57.3% of businesses raising output prices in the recent quarter, down from a previous 68.8%.

USD/CHF Mid-Day Outlook

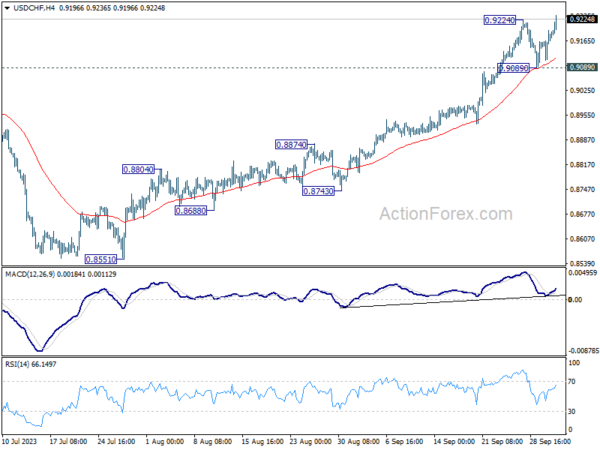

Daily Pivots: (S1) 0.9130; (P) 0.9163; (R1) 0.9215; More….

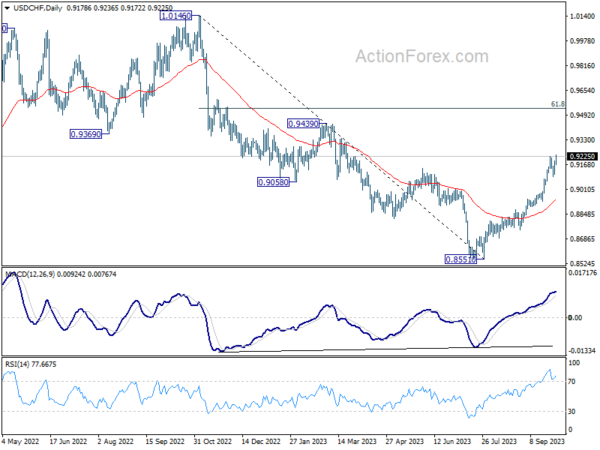

USD/CHF’s rally from 0.8551 resumed by breaking through 0.9224 resistance today. Intraday bias is back on the upside. Current rally should target 0.9439 resistance next. On the downside, break of 0.9089 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, current development indicates that rise from 0.8551 is reversing whole down trend from 1.0146. Further rally would then be seen to 61.8% retracement at 0.9537 and above. For now, this will be the favored case as long as 55 D EMA (now at 0.8942) holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q3 | -52 | -63 | ||

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | 6.20% | 6.90% | ||

| 00:30 | AUD | Building Permits M/M Aug | 7.00% | 3.30% | -8.10% | |

| 03:30 | AUD | RBA Interest Rate Decision | 4.10% | 4.10% | 4.10% | |

| 06:30 | CHF | CPI M/M Sep | -0.10% | 0.00% | 0.20% | |

| 06:30 | CHF | CPI Y/Y Sep | 1.70% | 1.80% | 1.60% |