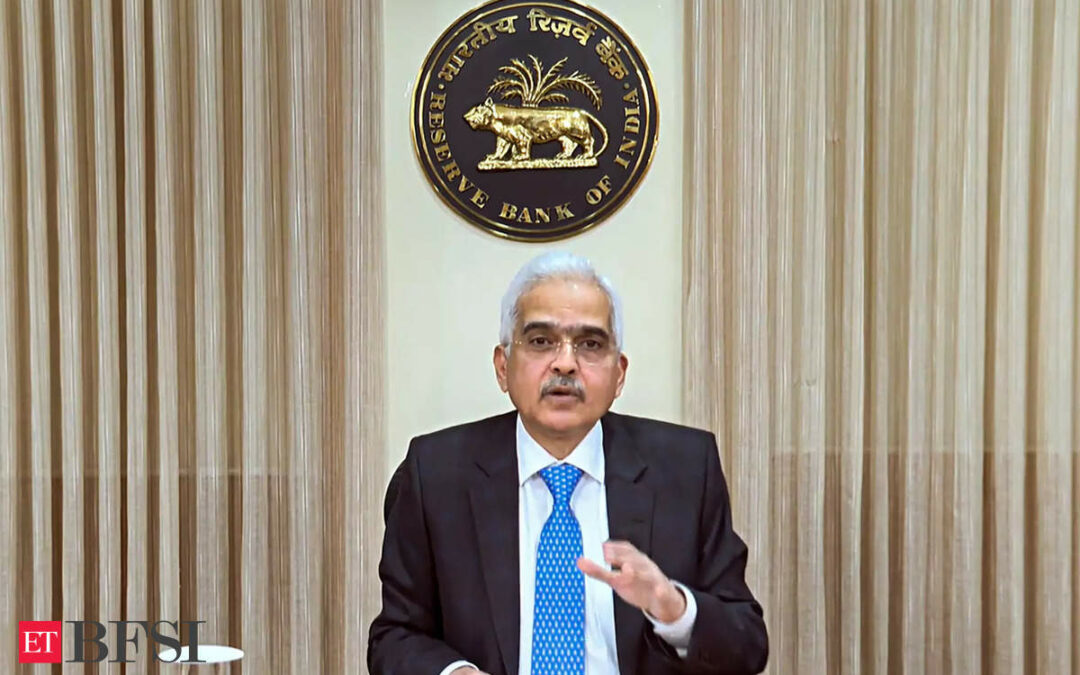

RBI Monetary Policy October 2023: Reserve Bank of India (RBI) decided to keep the repo rates unchanged at the fourth Monetary Policy Committee meeting on Friday. The decision comes after three consecutive pauses by the six-member committee.

The primary focus of the central bank was on controlling inflation amidst rising oil prices and the Federal Reserve’s efforts to strengthen the rupee.

The three-day bi-monthly monetary policy committee (MPC) meeting, which began on Wednesday, is closely watched by financial market participants.

We have identified high inflation rates as the major risk for the economy, Das said.

“We have identified high inflation as a major risk to macroeconomic stability and sustainable growth. After detailed assessment of the evolving macroeconomic and financial developments and outlook it decided unanimously to keep the policy repo rate unchanged at 6.5 per cent. The SDF rate remains at 6.25 per cent and the MSF rate and bank rate at 6.7 per cent,” he announced.

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent. The repo rate is the interest rate at which the RBI lends to other banks.

The MPC also decided by a majority of 5 out of 6 members to remain focussed at withdrawal of accommodation to ensure inflation aligns to the target by supporting growth.

We expect headline inflation to further ease in September.

“The overall inflation outlook is clouded by uncertainties by fall in kharif sowing, lower reserve oil levels and volatile global food and energy prices,” said Das.

In contrast to global traits, domestic economic activity exhibits resilience on the back of strong domestic demand. Real GDP Growth for the current financial year is projected at 6.5 per cent with Q2 at 6.5 per cent, Q3 at 6 per cent and Q4 at 5.7 per cent, Governor said.

Real GDP growth for the first quarter of next financial year (FY24-25) is projected at 6.6 per cent.

“As evident from our survey, there is further progress in anchoring of inflation expectations which entered single digit zone for the first time since Covid19 Pandemic,” Das mentioned.

CPI Inflation for the current financial year is projected at 5.4 per cent which is same as projected earlier, with Q2 at 6.4 per cent, Q3 at 5.6 per cent and Q4 at 5.2 per cent, the risks are evenly balanced. Inflation for first quarter of next financial year is projected at 5.2 per cent.

Shaktikanta Das also said a comprehensive regulatory framework applicable for all regulated entities is now proposed to be issued. A detailed draft guidelines in this context will be released soon by the regulator.