“”Fidelity Investments Options Trading Review: A Comprehensive Examination”

Introduction

Fidelity Investments, a venerable name in the realm of financial services, extends a broad array of investment services, encompassing options trading. In this meticulous analysis, we shall undertake a comprehensive evaluation of Fidelity’s options trading platform, delving into its attributes, strengths, and opportunities for refinement.

Trading platform and user experience:

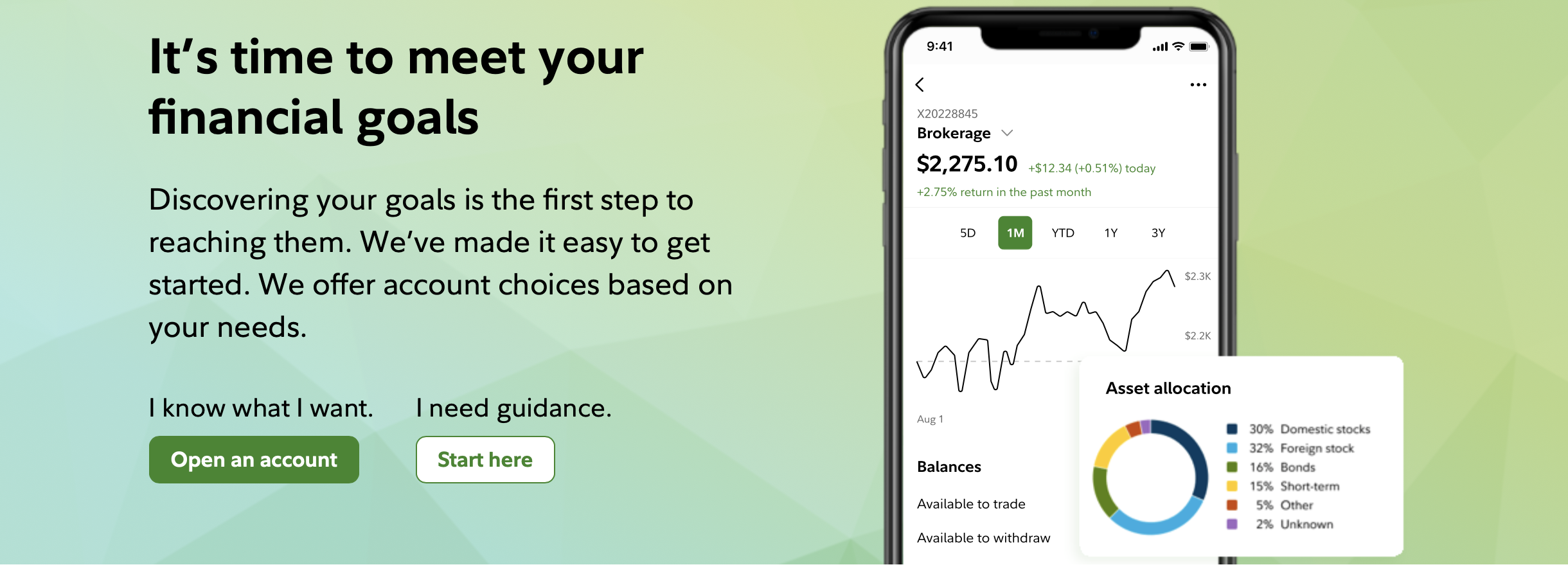

Fidelity’s options trading platform offers accessibility through both web-based and mobile applications. The web-based iteration boasts an intuitive interface, facilitating user navigation through an assortment of tools and resources. Meanwhile, the mobile application, while offering convenience, may fall slightly short in terms of feature richness compared to its web counterpart.

Array of option:

Fidelity presents an expansive spectrum of tradable assets, encompassing equities, exchange-traded funds (ETFs), mutual funds, bonds, and options contracts. The availability of this diversified asset portfolio caters to the diverse needs of traders, enabling the construction of well-rounded portfolios and the exploration of varied strategies. Consequently, Fidelity is poised to accommodate both neophytes and seasoned investors alike.

Option Trading Tools:

Research and Analysis:

Fees and Commission:

Costumer Support:

Fidelity maintains a generally responsive customer support infrastructure, rendering assistance through multiple channels, including telephonic, electronic mail, and live chat interfaces. Although reliability characterizes their support services, isolated incidents of latency during peak service hours have been reported. Augmented responsiveness during periods of heightened demand could further enhance the customer experience.

Educational Resources:

Fidelity distinguishes itself through its generous provision of educational resources to its clientele. An array of mediums, including webinars, articles, videos, and educational events, serve as valuable resources for individuals aspiring to augment their knowledge of options trading. However, the learning curve may appear steep, particularly for those with limited exposure to options trading.

Security Measure:

Fidelity Investments maintains an unwavering commitment to security. The platform incorporates stringent security protocols, including two-factor authentication (2FA) and encryption mechanisms, assiduously safeguarding client accounts and sensitive data. Fidelity’s dedication to the preservation of client assets and information is laudable.

Mobile Trading:

Fidelity furnishes a mobile application that facilitates the management of options trading activities while on the move. The application delivers fundamental functionalities, encompassing order placement and portfolio monitoring. Despite its convenience, some users may observe a marginally truncated feature set relative to the web-based platform.

Conclusion:

Fidelity Investments presents a comprehensive options trading platform characterized by an expansive array of assets, sophisticated trading tools, and an abundant reservoir of educational resources. Its steadfast dedication to security and research excellence positions it as a trusted ally for investors contemplating options trading. While the mobile application might benefit from additional feature enrichment, the overall experience remains largely positive, firmly establishing Fidelity Investments as a stalwart choice for options traders.

It is imperative to recognize that options trading entails inherent risks and may not be congruent with the investment objectives and risk tolerance of all individuals. Prior to embarking on options trading endeavors, it is strongly recommended to meticulously comprehend the associated risks and, if deemed necessary, seek the counsel of qualified financial professionals.