Today’s economic data releases are steering the markets, though it is uncertain how sustained their influence will be. Dollar emerges as the day’s strongest performer, buoyed by robust retail sales figures. Australian Dollar trails as the initial lift from RBA minutes dissipates, leaving it in the second spot. Euro is firmer after German economic sentiment data showed Eurozone has passed the lowest point.

Meanwhile, Yen experienced a brief surge following reports suggesting an upward revision of inflation forecasts by BoJ. Despite the initial excitement, the currency’s climb receded once it became evident that this was not fresh news. Nonetheless, Yen still retains a portion of its gains, displaying a mixed performance.

Conversely, New Zealand Dollar plummeted earlier in Asia following the release of softer-than-anticipated inflation figures. Sterling faced pressure due to uninspiring wage growth data, and Canadian Dollar was not spared either, experiencing a downturn due to a faster cooling in inflation than anticipated. These statistics bolster the argument for the central banks of these nations to hit the pause button again on any imminent policy shifts.

In the technical arena, all eyes are on EUR/GBP over the next 24 hours, especially with the release of UK CPI data looming. Prior strong rebound from 55 D EMA affirms near term bullishness. Firm break of 0.8700/4 resistance zone will resume the rebound from 0.8491. More importantly, that would strengthen the case the it’s reversing whole down trend from 0.9267. Next near term target will be 61.8% projection of 0.8491 to 0.8704 from 0.8614 at 0.8746.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is down -0.53%. CAC is down -0.41%. Germany 10-year yield is up 0.0782 at 2.867. Earlier in Asia, Nikkei rose 1.20%. Hong Kong HSI rose 0.75%. China Shanghai SSE rose 0.32%. Singapore Strait Times rose 0.25%. Japan 10-year JGB yield rose 0.0295 to 0.785.

US retail sales rose 0.7% mom in Sep, ex-auto sales up 0.6% mom

US retail sales rose 0.7% mom to USD 704.9B in September, above expectation of 0.3% mom. Ex-auto sales rose 0.6% mom to USD 469.7B, above expectation of 0.2% mom. Ex-gasoline sales rose 0.7% mom to USD 648.2B. Ex-auto, gasoline sales rose 0.7% mom to USD 513.0B.

Total sales for July through September period were up 3.1% from the same period a year ago.

Canada’s inflation cools more than expected in Sep

In September, Canada’s CPI deceleration surpassed expectations. The annual inflation rate receded to 3.8% yoy, falling short of the anticipated 4.0% and marking a downtick from August’s 4.0% yoy. Gasoline prices, affected by the base-year effect, showed an escalation, recording a 7.5% yoy ascent compared to August’s 0.8% yoy . Nevertheless, when gasoline was excluded, CPI realized a slowdown to 3.7% yoy from the previous month’s 4.1% yoy.

On a monthly basis, CPI was down by -0.1% mom, contradicting the expected 0.1% mom incline. A -1.3% monthly decline in gasoline prices significantly influenced this downturn.

In the examination of the core inflation measures, which BoC meticulously observes, all three – CPI median, CPI common, and CPI trimmed – fell short of expectations. CPI median receded from 4.1% to 3.8% yoy, against the projected 4.0% yoy. CPI common retreated from 3.9% yoy to 3.7% yoy, not meeting 3.8% yoy expectation. Similarly, CPI trimmed dwindled from 4.8% yoy to 4.4% yoy, undermining the anticipated 4.7% yoy rate.

German ZEW rose to -1.1, passed the lowest points

German and Eurozone economic sentiments are seeing a revival, as indicated by the notable improvement in ZEW Economic Sentiment Indicators for October. In Germany, Economic Sentiment rose significantly from -11.4 to -1.1, outperforming the anticipated -9.5. Despite this uplift in sentiment, Current Situation Index experienced a minor decline, moving from -79.4 to -79.9, although it still exceeded the expected -80.5.

Eurozone isn’t lagging, either. The region’s ZEW Economic Sentiment rebounded from negative terrain, ascending from -8.9 to 2.3 and surpassing -8 forecast. Concurrently, Current Situation Index experienced a dip of -9.8 points, resting at -52.4.

ZEW President Professor Achim Wambach expressed optimism, indicating a potential turnaround in economic sentiment. “It seems that we have passed the lowest point,” Wambach noted, highlighting a positive shift in expectations, driven partly by anticipation of declining inflation rates.

More than three-quarters of survey participants expect short-term interest rates in Eurozone to stabilize, reinforcing optimistic economic outlook. Despite concerns related to negative factors influencing growth forecasts, such as the Israel conflict, their impact appears limited, ensuring the overall economic perspective remains tilted towards optimism.

UK regular pay growth matches expectations at 7.8%

UK’s annual growth in regular pay, excluding bonuses, stood in line with market expectations, clocking in at 7.8% in the three months to August. However, when accounting for bonuses, the total pay’s annual growth was slightly tepid at 8.1%, missing the market forecast of 8.3%.

When adjusted for inflation using CPI including owner occupiers’ housing costs (CPIH) – the real terms annual growth showcased a rise of 1.3% for total pay from June to August. Similarly, the regular pay’s real terms annual growth registered a 1.1% increase.

A sector-wise dissection revealed that finance and business services led the pack with the most robust annual regular growth rate at 9.6%. Manufacturing sector followed closely with an impressive 8.0% growth rate. This surge in the manufacturing sector’s pay growth is noteworthy, marking one of its highest annual regular growth rates since the inception of comparable records in 2001.

RBA minutes reveal hawkish tilt, another hike in Nov?

Minutes of RBA’s October meeting surprised market participants with a more hawkish tone than anticipated. The board seriously contemplated a rate hike at the meeting, but opted to hold due to a lack of “sufficient new information.

Additionally, the central bank underscored its “low tolerance” for a delayed return of inflation to target. It suggested that “some further tightening” might be imminent if inflation proves to be more persistent than current expectations.

As RBA steers ahead, its forthcoming November meeting is expected to be crucial. The board will be equipped with additional economic data on factors such as inflation, labour market dynamics, and overall economic activity. Additionally, they will have at their disposal revised staff forecasts

The minutes highlighted, “members considered two options for monetary policy at this meeting: raising the cash rate target by a further 25 basis points; or holding the cash rate target steady.” However, the decision to maintain the status quo was reached as “members agreed that the case to leave the cash rate target unchanged at this meeting was the stronger one.” This consensus was influenced by the absence of “sufficient new information over the preceding month from economic data or financial markets to necessitate an adjustment in the stance of monetary policy.”

However, the upcoming November meeting might paint a different picture. The board is set to receive “additional data on economic activity, inflation and the labour market, as well as a set of revised staff forecasts.”

“In reaching their decision, members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected,” the minutes detailed.

New Zealand CPI slowed to 5.6% yoy in Q3, dimming prospects of RBNZ hike

New Zealand’s CPI recorded a decline in its annual inflation rate, dropping from 6.0% yoy to 5.6% yoy in Q3. This figure not only fell short of the anticipated 5.9% yoy but was also well below RBNZ’s own forecast of 6.0% yoy for the quarter. Such a deceleration would curb the likelihood of another interest rate hike in November.

A breakdown of the inflation contributors indicates that food prices played a dominant role in driving the annual inflation rate. Following closely were the costs associated with housing and household utilities, with the inflation in this sector being attributed to escalating expenses of construction and rental services.

Nicola Growden, the senior manager of consumer prices, stated, “Prices are still increasing, but are increasing at rates lower than we have seen in the previous few quarters.”

On a quarterly perspective, Q3 CPI reflected a growth of 1.8% qoq, marking an upturn from Q2’s 1.1% qoq. However, it missed the estimated rise of 1.9% qoq. An analysis of sector-wise performance shows that the transport sector experienced significant inflationary pressures. Specifically, the costs of petrol and new motor vehicles surged by 16.5% and 4.6%, respectively.

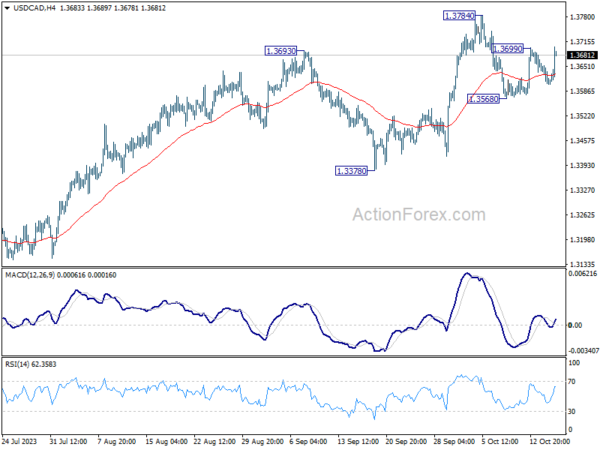

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3589; (P) 1.3627; (R1) 1.3648; More….

USD/CAD rebounds notably today and focus is back on 1.3699 resistance. Firm break there will target 1.3784 first. Break there will resume larger rise from 1.3091 to retest 1.3976 high. On the downside, below 1.3568 will bring another falling leg to extend the near term corrective pattern from 1.3784 instead.

In the bigger picture, current development revives the case that corrective pattern from 1.3976 (2022 high) has completed with three waves down to 1.3091. Decisive break of 1.3976 high will confirm resumption of up trend from 1.2005 (2021 low). Next target will be 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. This will now remain the favored case as long as 1.3378 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 1.80% | 1.90% | 1.10% | |

| 00:30 | AUD | RBA Minutes | ||||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Aug | 8.10% | 8.30% | 8.50% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 7.80% | 7.80% | 7.80% | 7.90% |

| 09:00 | EUR | Germany ZEW Economic Sentiment Oct | -1.1 | -9.5 | -11.4 | |

| 09:00 | EUR | Germany ZEW Current Situation Oct | -79.9 | -80.5 | -79.4 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | 2.3 | -8 | -8.9 | |

| 12:30 | CAD | CPI M/M Sep | -0.10% | 0.10% | 0.40% | |

| 12:30 | CAD | CPI Y/Y Sep | 3.80% | 4.00% | 4.00% | |

| 12:30 | CAD | CPI Median Y/Y Sep | 3.80% | 4.00% | 4.10% | |

| 12:30 | CAD | CPI Common Y/Y Sep | 3.70% | 3.80% | 3.90% | |

| 12:30 | CAD | CPI Trimmed Y/Y Sep | 4.40% | 4.70% | 4.80% | |

| 12:30 | USD | Retail Sales M/M Sep | 0.70% | 0.30% | 0.60% | |

| 12:30 | USD | Retail Sales ex Autos M/M Sep | 0.60% | 0.20% | 0.60% | |

| 13:15 | USD | Industrial Production M/M Sep | -0.10% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Sep | 79.60% | 79.70% | ||

| 14:00 | USD | Business Inventories Aug | 0.30% | 0.00% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 45 | 45 |