WeWork Inc. has refused the offer of Embassy Group-owned WeWork India to buy back its 27 percent stake owned in the local business, although sources said they expect talks between the majority owner of the local unit and WeWork Inc to lead to a different outcome.

WeWork India had offered to buy back the stake held by the parent company after the global counterpart sought insolvency protection under Chapter 11 of the US Bankruptcy Code earlier last month.

“WeWork India is a profitable venture and the Embassy Group is in discussion with WeWork Inc for buyback. They expect the talks to progress further and the buyback should close in the next one to two quarters if everything moves as per plan,” said a person aware of the discussions.

WeWork India, in which WeWork Inc. owns about 27%, has been one of the company’s fastest-growing affiliates outside of the US. The remaining 73% is owned by Embassy Group. The joint venture with WeWork Inc allows it to use the international coworking brand name and operate as a separate entity.

WeWork India could not be reached for comment.

In 2020, We Work India was valued at more than $500 mn, when WeWork Inc picked up a 27% stake in the company for $100 mn. The money was used to grab market share and maintain leadership in an increasingly competitive co-working market in India.

WeWork India had said earlier this month that it is not part of the strategic reorganization process.

SoftBank Group-backed startup WeWork, whose rapid ascent and subsequent decline had a profound impact on the global office sector, filed for US bankruptcy protection earlier this month. The move came after its investments in companies utilizing its office-sharing spaces turned sour.

As per the bankruptcy filing, the company disclosed estimated assets and liabilities ranging from $10 billion to $50 billion.

WeWork India is targeting a revenue of Rs 1,800 crore in FY24. For April-September 2023, the company reported Rs 831 crore revenue, up 40% from a year ago, while EBITDA for the period stood at Rs 532 crore, up 90% from the same period last year.

WeWork India plans to add 1.5 million sq ft to 2 million sq ft of office space annually. The office space provider operates across seven cities and 50 locations. It claims to have more than 70,000 members and 90,000-plus desks totalling to 6.5 million sq ft. Its member base includes around 80% enterprises with 20% clients coming from SMB, entrepreneurs and the startups segments.

Flex spaces continue to gain larger ground with occupiers as they focus on building operational efficiencies through a distributed work model. For this sector, the second half of 2023 has started on a promising note with the resurgence in demand across geographies.

According to industry estimates, enterprises expanded their office space leasing significantly in FY23, going from 92,400 seats in FY22 to 139,000 seats across major cities in the country. The growth was particularly prominent in cities such as Bengaluru, Pune and Delhi NCR.

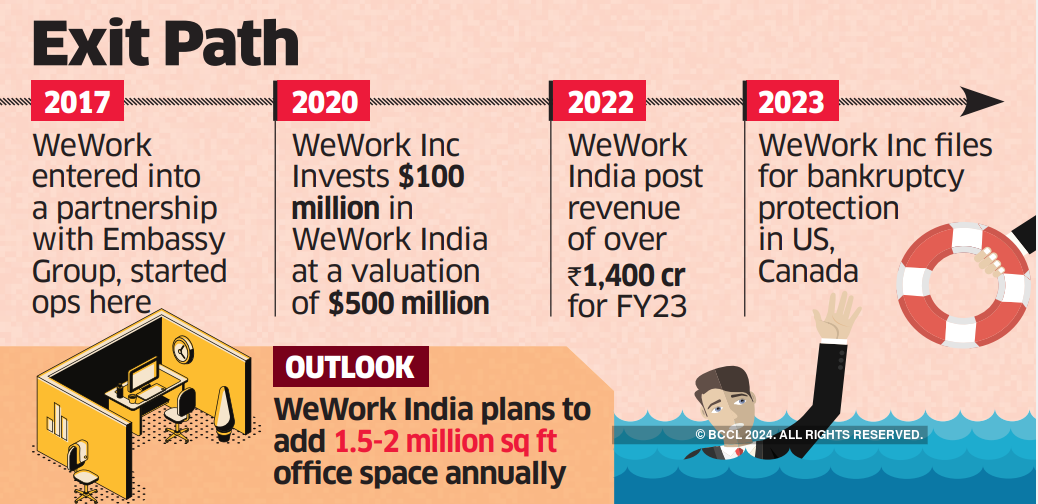

- 2017-WeWork entered into a partnership with Embassy Group, started operations in the Indian market.

- 2020- WeWork Inc Invests $100 million in WeWork India at a valuation of $500 million, picks up 27% stake.

- 2022-WeWork India cuts its losses, post revenue of over Rs 1400 crore for FY2023

- 2023- WeWork Inc files for bankruptcy protection in US and Canada

WeWork India plans to add 1.5 million sq ft to 2 million sq ft of office space annually.