Dollar is facing renewed selling pressure in the early US session, as fresh economic data points to a further cooling in the job market. A significant uptick in continuing jobless claims, reaching their highest level in nearly two years, suggests a softening labor environment.

Adding to this, deeper-than-expected decline in import prices, influenced by both fuel and non-fuel components, indicates easing price pressures. Concurrently, Philadelphia Fed manufacturing survey underscores ongoing industry challenges, marking the 16th month of contraction in the last 18 months.

These economic indicators collectively bolster the argument that Fed may have reached the end of its current tightening cycle. This perspective aligns with growing market sentiment that anticipates no more rate hike by Fed. Instead, loosening would probably start in the first half of next year.

Elsewhere in the currency markets, Japanese Yen and Euro emerge as the day’s strongest performers, with Swiss Franc also gaining ground. On the other hand, commodity-linked currencies, along with British pound, are facing challenges. Their performance throughout the remainder of the session is likely to hinge on shifts in global risk sentiment.

From a technical standpoint, EUR/CAD marches on as rise from 1.4155 is extending. As noted in previous reports, correction from 1.5111 should have completed with three waves down to 1.4155. Retest of 1.5111 high should be seen next. Firm break there will resume larger up trend from 1.2867. This will now remain the favored case as long as 1.4705 support holds.

In Europe, at the time of writing, FTSE is down -0.56%. DAX is up 0.67%. CAC is down -0.15%. Germany 10-year yield is down -0.0405 at 2.604. Earlier in Asia, Nikkei dropped -0.28%. Hong Kong HSI fell -1.36%. China Shanghai SSE fell -0.71%. Singapore Strait Times rose 0.03%. Japan 10-year JGB yield fell -0.0065 to 0.791.

US import price fell -0.8% mom in Oct

US import price index fell -0.8% mom in October, larger decline than expectation of -0.3% mom. That’s the first monthly drop since June, and the largest since March.

Prices for import fuel declined -6.3% mom, after advancing 6.3% mom the previous month. The October drop was the first 1-month decrease since May and the largest monthly decline since September 2022.

Nonfuel import prices declined -0.2% mom for the third consecutive month. Prices for nonfuel imports have not recorded a monthly advance since February.

US initial jobless claims rose to 231k, continuing claims highest in nearly two years

US initial jobless claims rose 13k to 231k in the week ending November 11, above expectation of 222k. Four week moving average of initial claims rose 8k to 220k.

Continuing claims rose 32k to 1865k in the week ending November 4. That’s the highest level since November 27, 2021. Four-week moving average of continuing claims rose 34.5k to 1823k.

BoE’s Greene: Incredibly high wage growth remains a concern

BoE monetary policymaker Megan Greene expressed cautious optimism in a recent interview with Bloomberg TV, acknowledging the positive signs of declining inflation in the UK.

Greene noted that the recent data, which showed a drop in inflation to 4.6% and a weakening in wage growth, was indeed “good news.” However, she voiced concerns about the persistence of inflation, particularly in the services component of CPI. Besides, her apprehension primarily stems from the still elevated wage growth, which she described as “incredibly high.”

She emphasized the challenges posed by this situation, stating, “If we have an economy with fairly low productivity growth and really high wage growth, it’s going to be hard to hit the (2% inflation) target.”

Australia’s employment grows 55k, yet signs of cooling emerge

Australia’s labor market displayed stronger-than-anticipated performance in October, with employment figures surpassing expectations. The economy added 55k jobs, well above forecasted growth of 22.8k. This increase was driven by both full-time and part-time employment, which rose by 17k and 37.9k respectively.

Despite this robust job growth, unemployment rate edged up slightly from 3.6% to 3.7%, aligning with market expectations. Participation rate also saw an uptick, rising by 0.2% to 67.0%. Additionally, month-over-month hours worked in the economy increased by 0.5%.

Bjorn Jarvis, ABS head of labour statistics, noted that over the past two months, this equates to an average monthly employment growth of approximately 31k people, slightly lower than average growth of 35k people a month since October 2022.

He also highlighted that annual growth rate in hours worked has slowed to 1.7%, down from around 5% mid-year, and lower than annual employment growth of 3.0%. This slowdown may suggest that “the labour market is starting to slow, following a particularly strong period of growth.”

Japan’s exports increase for second month, despite persistent decline in China shipments

In October, Japan experienced a mixed bag in its trade sector. Exports saw a modest rise of 1.6% yoy to JPY 9167B, marking the second consecutive month of growth, albeit at a slower pace compared to September’s 4.3% yoy increase.

One notable aspect was the continued decline in shipments to China, which fell by -4.0% yoy. This marks the eleventh consecutive month of decline, underscoring the strained trade relations and potentially shifting economic alliances in the region.

Conversely, exports to the US surged by 8.4% yoy, buoyed by robust demand for hybrid vehicles and mining and construction machinery. This surge propelled the value of U.S.-bound shipments to record levels. Similarly, exports to Europe experienced a healthy increase of 8.9% yoy, indicating diversified trade relations.

On the import front, Japan witnessed a significant drop of -12.5% yoy to JPY 9810B. The trade balance resulted in a deficit of JPY -663B.

Looking at seasonally adjusted terms, both exports and imports saw month-on-month declines, with exports decreasing by -1.2% mom to JPY 8800B and imports falling by -0.7% mom to JPY 9262B. Consequently, trade deficit widened from September’s JPY -420B to JPY -462B.

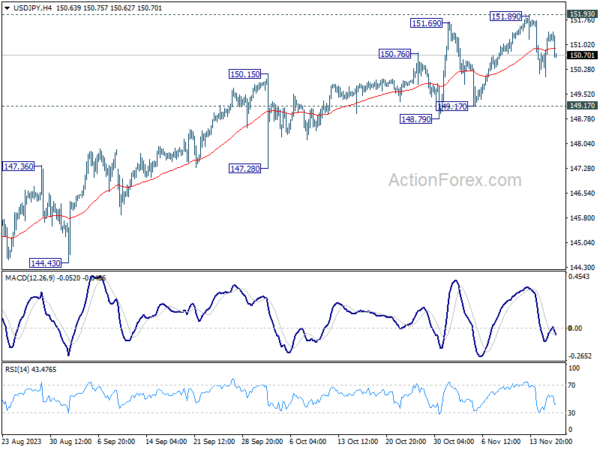

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 150.49; (P) 150.95; (R1) 151.86; More…

USD/JPY dips notably in early US session but stays well inside established range of 149.17/151.89. Intraday bias stays neutral for the moment. Further rally is in favor as long as 149.17 support holds. On the upside, decisive break of 151.93 resistance will confirm resumption of long term up trend. Next target will be 157.69 projection level. However, firm break of 149.17 will be a sign of bearish reversal and bring deeper fall to 147.28 support first.

In the bigger picture, immediate focus is now on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below. However, sustained break of 151.93 will confirm resumption of long term up trend. Next target will be 61.8% projection of 102.58 (2021 low) to 151.93 from 127.20 at 157.69.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (USD) Oct | -0.46T | -0.71T | -0.43T | |

| 23:50 | JPY | Machinery Orders M/M Sep | 1.40% | 0.90% | -0.50% | |

| 00:00 | AUD | Consumer Inflation Expectations Nov | 4.90% | 4.80% | ||

| 00:30 | AUD | Employment Change Oct | 55.0K | 22.8K | 6.7K | |

| 00:30 | AUD | Unemployment Rate Oct | 3.70% | 3.70% | 3.60% | |

| 04:30 | JPY | Tertiary Industry Index M/M Sep | -1.00% | -0.10% | -0.10% | 0.70% |

| 13:15 | CAD | Housing Starts Y/Y Oct | 275K | 255K | 270K | |

| 13:30 | USD | Initial Jobless Claims (Nov 10) | 231K | 222K | 217K | 218K |

| 13:30 | USD | Import Price Index M/M Oct | -0.80% | -0.30% | 0.10% | 0.40% |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Nov | -5.9 | -11 | -9 | |

| 14:15 | USD | Industrial Production M/M Oct | -0.40% | 0.30% | ||

| 14:15 | USD | Capacity Utilization Oct | 79.40% | 79.70% | ||

| 15:00 | USD | Natural Gas Storage |