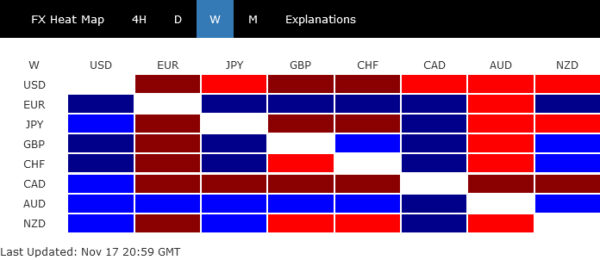

Dollar notably emerged as the weakest performer among global currencies last week. This decline was primarily driven by robust risk-on sentiment pervading global markets and noticeable dip in treasury yields, not just in the US but globally. A key factor influencing this trend is the growing belief among investors that most major central banks, including Fed, have already concluded their interest rate hiking cycles. Moreover, there is an increasing inclination among traders to place bets on rate cuts for the next year.

Canadian Dollar and Japanese Yen also experienced weakness, closing as the second and third worst performer. On the other end of the spectrum, Australian Dollar and Euro stood out as the top performers, closely followed by Sterling. Swiss Franc and New Zealand Dollar, meanwhile, demonstrated mixed results amid these market shifts.

A particularly intriguing aspect of last week’s market activity was Japanese Yen’s late surge, which coincided with a decline in global benchmark yields. This movement has sparked interest among us, particularly due to the parallel trends observed between Yen and Chinese Yuan. Should this synchronized trend continue, it could hint at a bearish turn for USD/JPY, possibly catalyzing further declines in Dollar and impacting broader market trends.

Global markets embrace optimism as interest rates seen peaked

The global financial markets last week experienced a palpable shift towards risk-on sentiment, buoyed by the growing conviction among investors that most major central banks, particularly Fed, have already reached the peak of their interest rate hiking cycles. This optimism followed the release of US CPI data, which came in below market expectations.

Despite cautionary remarks from Federal Reserve officials emphasizing the ongoing inflation fight, the central bank appears to be in a strong position to continue its pause, closely monitoring incoming data to confirm the trajectory of disinflation.

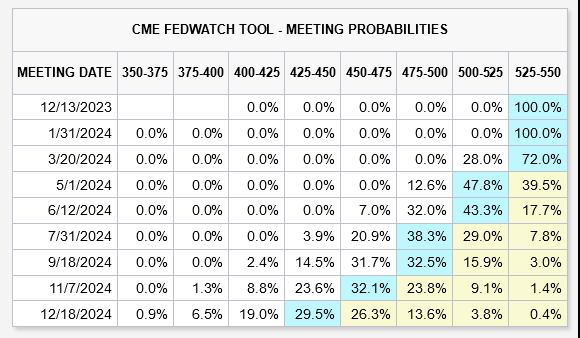

The market’s interpretation of CPI data has led to a recalibration of expectations. Fed funds futures market now almost entirely rule out the possibility of even one more rate hike by Fed. In fact, traders are increasingly betting on rate cuts, with a 60% probability of the first rate cut by May and over an 80% chance by June.

However, these market expectations may be somewhat premature, considering the “last mile” in the battle against inflation, typically the most challenging phase. Core inflation rates remain stubbornly high across major economies – 4% in the US, 4.2% in Eurozone, and 5.7% in UK, indicating that inflationary pressures are still too significant to ignore.

In the US, major stock indexes recorded impressive gains. S&P 500’s rally from 4103.78 extended to close at 4514.02. The development affirms the case the correction from 4607.07 has completed at 4103.78 already. Retest of 4607.07 should be seen next. Decisive break there will resume the whole rise from 3491.58 to retest 4818.62 high next. This will remain the favored case as long as 55 D EMA (now at 4358.28) holds.

The critical factor going forward will be market’s reaction to the resistance zone between 4818.62 and 100% projection of 3808.86 to 4607.07 from 4103.78 at 4901.99. This response will depend on various factors, including the pace of disinflation, the extent of economic deceleration, and Fed’s monetary path.

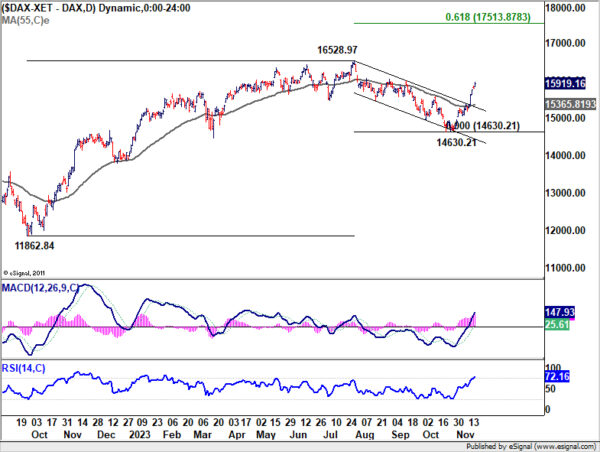

In Europe, Germany’s DAX index mirrored the upbeat mood. Current development suggests that the correction from 16528.97 has completed at 14630.21 already. Near term outlook will stay bullish as long as 55 D EMA (now at 15365.81) holds. Further rise should be seen to retest 16528.97 high next. Decisive break there will resume larger up trend to 61.8% projection of 11862.84 to 16528.97 from 14630.21 at 17513.87 next.

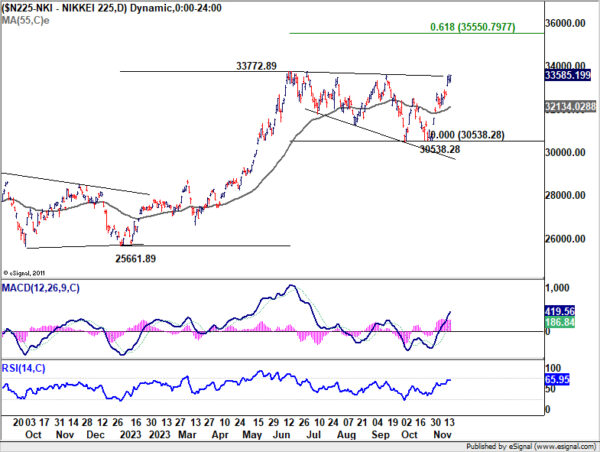

In Asia, Japan’s Nikkei index closed the week on a strong note at 33585.19, inching closer to the critical 33772.89 resistance level. Decisive break there will resume the long term up trend, and pave the way to 61.8% projection of 25661.89 to 33772.89 from 30538.28 at 35550.79. In any case, near term outlook will stay bullish as long as 55 D EMA (now at 32134.02) holds.

The pivotal question for Nikkei is whether it can sustain the necessary momentum to target 100% projection of 16358.19 to 30714.52 from 24681.74 at 39038.07 in the medium term, a level that is in proximity to the index’s record high at 39260 made in 1990

Dollar’s slide deepens amid global risk appetite and Fed expectations weigh in

US Dollar emerged as the weakest performer among major currencies, primarily influenced by the surge in risk-on sentiment, changing market expectations regarding Fed’s policy path, and the notable decline in Treasury yields. These interconnected factors have collectively exerted downward pressure on the greenback.

Dollar Index’s fall from 107.34 extended lower to close at 103.91. Near term outlook will now stay bearish as long as 55 D EMA (now at 105.29) holds. Next target is 61.8% retracement of 99.57 to 107.34 at 102.53.Strong support could emerge from there to bring rebound.

As DXY looks set to extend the near term fall even below 55 W EMA (now at 103.96), medium term outlook is turned mixed. It’s uncertain for now whether fall from 107.34 is a correction to rise from 99.57, the second leg of a range pattern above 99.57, or resuming the whole down trend from 114.77 (2022 high).

Technically, firm break of above mentioned 102.53 fibonacci level could tile the favor to the latter two bearish scenarios. That would also depend heavily on largely on how global risk sentiment plays out, including S&P 500’s reaction to the resistance between 4800/4900 as mentioned above.

Tracing the parallel paths of USD/CNH and USD/JPY

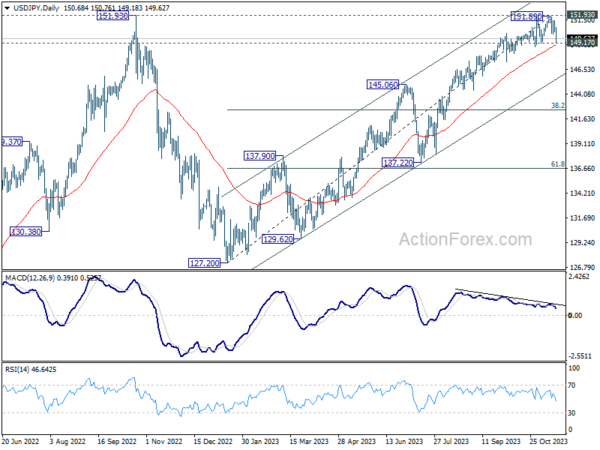

While Japanese Yen position in the weekly performance table isn’t impressive, it’s late rebound , particularly against Dollar, is an interesting development to note. The move aligned with the extended decline in global benchmark yields, including US and German 10-year treasury yields, which have reached their lowest levels in more than two months.

A comparative analysis of USD/JPY and USD/CNH reveals a striking parallel in their recent market behavior. Both currency pairs exhibited similar trends, peaking in October 2022, hitting a low in January 2023, and then showing a gradual recovery.

USD/CNH appears to have peaked already in September, after failing to break through 2022 high at 7.3745. Last week’s break of 7.2382 support should have confirmed medium term topping at 7.3679, on bearish divergence condition in D MACD. Deeper fall is now expected to 7.1154 cluster support (38.2% retracement of 6.6971 to 7.3679 at 7.1117).

If these two Asian currencies continue to mirror each other’s movements, it is plausible that USD/JPY will follow suit, breaking through the near-term support at 149.17 soon. Such a move would confirm topping at 151.89, following rejection at the crucial 151.93 resistance. The ensuing decline would then extend to 145.06 resistance-turned-support or even deeper to 38.2% retracement of 127.20 to 151.89 at 142.45.

Should this bearish scenario for USD/JPY unfold, it could exert additional downward pressure on the Dollar index, potentially accelerating its decline.

EUR/USD Weekly Outlook

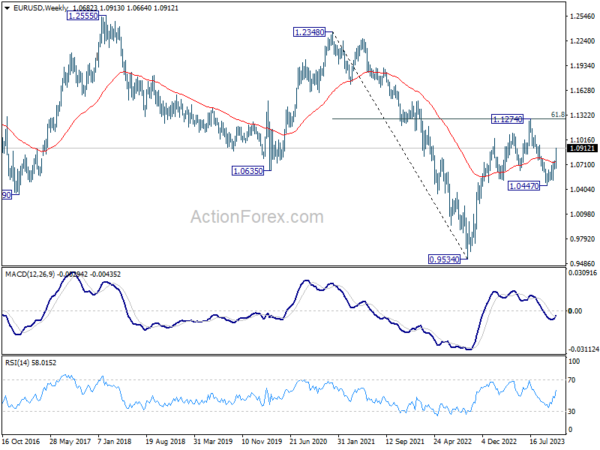

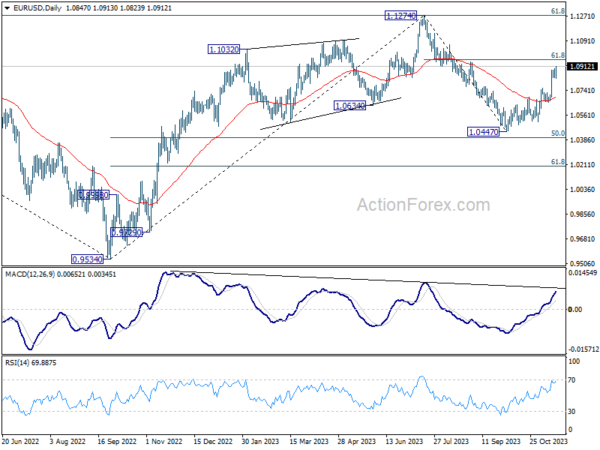

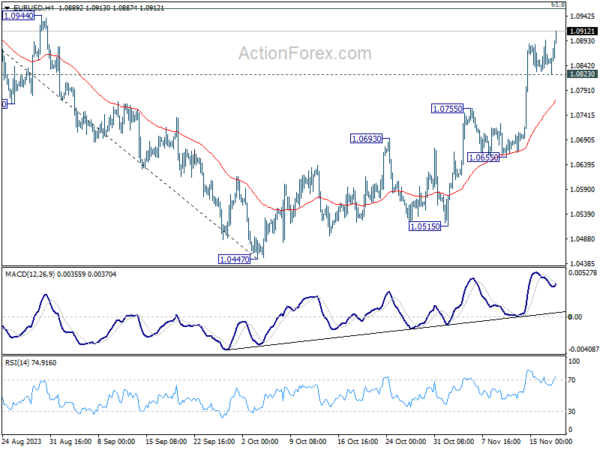

EUR/USD’s rise from 1.0447 resumed last week and hit as high as 1.0913 despite interim setback. Initial bias is now on the upside this week for 61.8% retracement of 1.1274 to 1.0447 at 1.0958 next. Firm break there will pave the way to retest 1.1274 high next. On the downside, below 1.0823 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern.

In the long term picture, a long term bottom is in place at 0.9534 on bullish convergence condition in M MACD. it still early to call for bullish trend reversal is still staying inside falling channel. Nevertheless, sustained trading above 55 M EMA (now at 1.1081) and break of 1.1274 resistance will raise the chance of reversal and target 1.2348 resistance for confirmation.