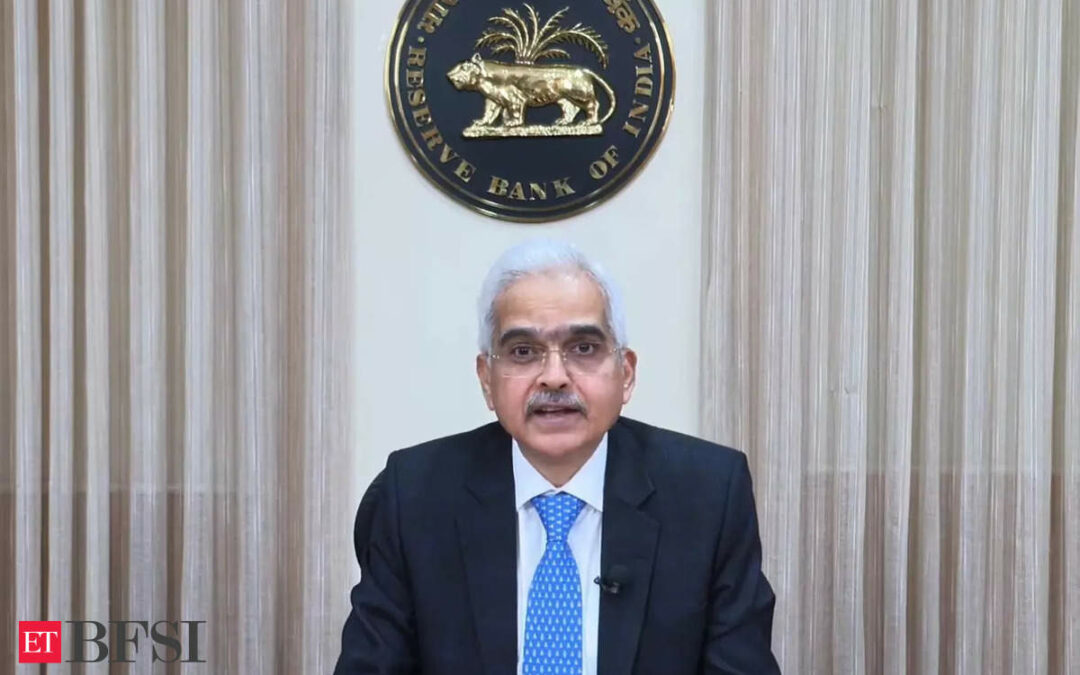

Flagging increasing connectivity between banks and NBFCs, Reserve Bank of India’s Governor, Shaktikanta Das on Wednesday said banks must constantly evaluate their exposure to NBFCs and exposure of individual NBFCs to multiple banks.

“Given the increasing importance of NBFCs (Non-Banking Financial Company), the increasing interconnectivity between banks and non-banks merits close attention. NBFCs are large net borrowers of funds with exposure from banks being the highest,” said Das at the inaugural address at FIBAC 2023. He said such concentrated linkages may create “contagion risks.”

NBFCs should focus on broad basing funding sources and reducing overdependence on banks for funding, Das said.

Credit growth is accelerating, banks and NBFCs need to take due care to ensure that credit growth remains sustainable, all forms of exuberance needs to be avoided, he said. “Banks and NBFCs need to strengthen asset-liability management,” according to Das.

ALSO READ: Headline inflation remains vulnerable to recurring and overlapping shocks, says RBI Guv

The RBI Guv said, “New risks are emerging from time to time, new sources of risks are also coming up. New opportunities are also knocking on the doors, it is for us to take advantage of them. International confidence on India’s prospects is at an all-time high.”

Moreover, Das said financial stability is the backbone for any country’s growth. Price stability also impacts a variety of factors, including financial stability, both are essential, he added.

“Indian Rupee has exhibited low volatility despite elevated US treasury yield and strong USD,” he said.