It must be the “worst economic time in American history.” The prices of cars and homes are “worse than 1930.” How is anybody “affording life right now”?

By most traditional measures, the U.S. economy is in a decent place right now: employers are still hiring; GDP is growing; and though it might not always feel like it, price increases have eased.

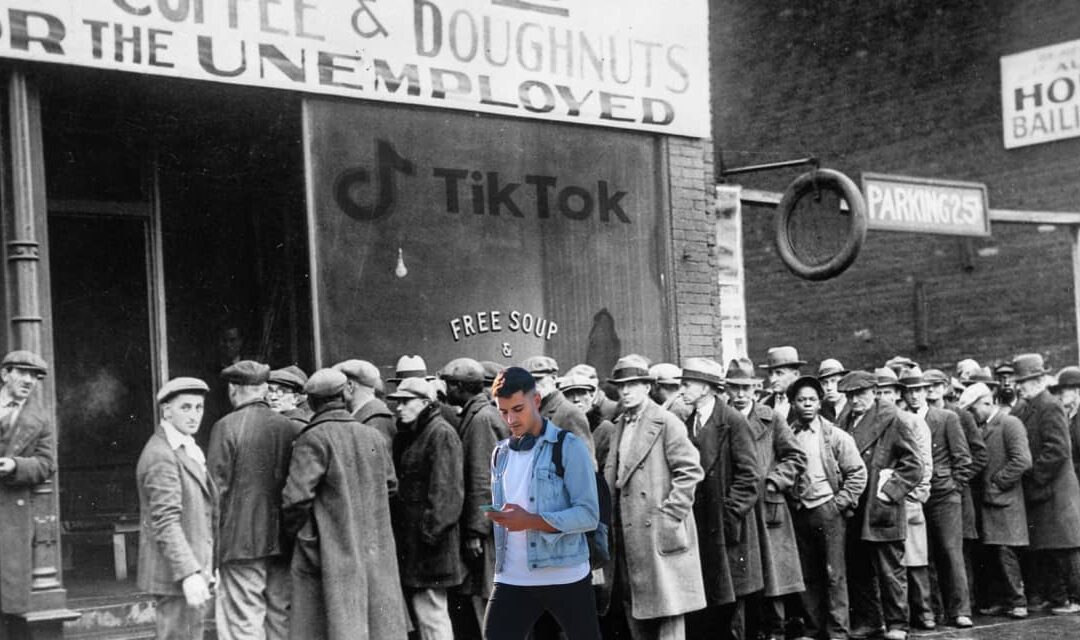

You wouldn’t necessarily know that from scrolling through TikTok, where dozens of viral videos bemoan high prices and housing costs and expressions of economic angst abound.

Some users have gone a step beyond just lamenting the current cost of living. Instead, their videos argue, the country is suffering from something much worse: a “silent depression” that’s placing levels of economic strain on Americans comparable to — or even worse than — those seen during the Great Depression.

“Americans are being gaslit into thinking we’re just getting lazier,” one user says, in a video that’s received more than 13 million views and two million likes on the app. “We’re in the worst economic time in American history. We have the lowest purchasing power we have ever had.”

“The point that I make in (my) video is that we are facing a new kind of challenge today,” Freddie Smith, whose video describing the “silent depression” has nearly 9 million views, told MarketWatch in an email. “People are working longer hours, but keeping less of their money, due to the high cost of housing, daycare, student debt and consumer debt.”

But while the frustration those videos address is real, historians and economists told MarketWatch, many of them are missing some key context. Here’s a closer look at whether claims of a “silent depression” stand up to scrutiny — and what they do get right about today’s economy.

Is the U.S. really in a ‘silent depression’? Or any kind of depression?

A “depression” is usually defined by economists as a sharp, sustained downturn in economic activity, featuring high rates of joblessness and declines in stock markets.

Does that definition match the current state of the U.S. economy? “Absolutely and emphatically no, not by any definition of those words,” said Christopher Clarke, an assistant professor of economics at Washington State University. He’s made his own TikToks responding to videos making the claims.

In several ways, the economy is in “the exact opposite” of a depression, he said. To fall into a recession or depression, the economy has to contract, meaning economic growth has to decline, for a prolonged period.

But the American economy grew 5.2% in the third quarter, according to revised estimates. In 2021 and 2022, real GDP increased 5.7% and 2.1%, respectively.

By contrast, U.S. GDP contracted by about 25% from 1929 to 1933, said Phil Powell, a professor of business economics and public policy at the Indiana University Kelley School of Business.

“The economy we have right now in no large way is parallel to the economy that we saw in 1929,” he said. “The reality is that the U.S. economy (right now) is much more resilient than it feels.”

Powell also pointed to the job market. The US unemployment rate has hovered near historic lows for about two years now, and currently sits at around 3.7%, after dipping slightly in November.

By contrast, in 1933, about a quarter of Americans were out of work.

There are other key differences between 2023 and 1929, said John Moser. He’s a history professor at Ashland University and the author of the book “The Global Great Depression and the Coming of World War II.”

The Great Depression also fueled bank failures, and millions lost their life savings overnight. Foreclosures — on homes and the family farms where many Americans still grew their own food — were widespread.

Households faced all these challenges without any of the federal assistance consumers don’t have access to today, Moser noted. Programs like unemployment benefits, food stamps or deposit insurance from the FDIC didn’t exist during the Great Depression.

The size and the scale of the resulting devastation would be difficult for most Americans today to imagine, he said.

“I can’t see how anybody who has studied the history of the Great Depression could think that what’s happening today is comparable,” he said.

Did Americans have more purchasing power in 1930 than they do now?

Some TikToks have claimed that Americans in the trough of the Great Depression, during the year 1930, earned more in real terms — or could afford more with an average income — than they do today.

The most widely viewed, from a TikTok user who calls himself “Average Joe,” claimed that in 1930, the average net yearly income in the U.S. was $4,887. When adjusted for inflation, that comes to about $88,000 in today’s dollars.

The video compared that salary to the median U.S. income in 2019, which was $31,133, arguing that the typical American had more real income and purchasing power than those today.

The creator of the original video did not respond to a request for comment.

But, according to Clarke, comparing an average from one year to the median of another can be misleading. He also noted that the data cited in that video may not reflect the most accurate picture of the typical American’s income in 1930.

He explained that the $4,887 number comes from IRS estimates — but in the early 20th century, far fewer American families filed federal income taxes. Those that did were wealthier, Clarke said.

According to data from the St. Louis Federal Reserve, wage and salary accruals per full-time equivalent employee totaled $1,392 in 1930 — about $25,000 in today’s dollars.

In 2022, full-time equivalent workers took home $78,465, according to the St. Louis Fed.

“Silent depression” videos also tend to cite old prices for a house or a car, arguing these expenses were more affordable for the average family 90 years ago.

Clarke said those comparisons also leave out some important context. At the start of the 1930s, only 1 in 5.5 Americans owned a car. Houses had less insulation and lacked conveniences that are common today, such as air conditioning or indoor plumbing.

“The real standard of living is four times better,” he said.

Economic data can be finicky, Clarke said, especially when looking back as far as the Depression era. He found that a lot of “silent depression” videos on TikTok misinterpret that data.

“I do think a lot of these people are being genuine, and I want to encourage exploration,” he said. “My review of (these examples) from a technical perspective is that they’re relying on comparing apples with oranges, and claiming everything is the same.”

Why do Americans feel like they’re in a depression?

So if claims of a so-called silent depression don’t hold up, why have they resonated so widely on TikTok? And why do so many Americans still feel so bad in an economy that — at least judging by traditional markers — looks so good?

The diminishing affordability of housing is one concern often cited in TikTok users’ complaints. That’s a very real problem, and one that is probably weighing heavily on the minds of many Americans, Powell said.

One of the only pieces of the economy that seems comparable from 1930 to 2023 is income inequality, Clarke said. The share of income going to the top 10% of earners in the U.S. has been steadily rising for four decades.

“That affects peoples’ feelings: You feel like you can’t keep up with your neighbors, you can’t keep up with those who are doing well. You don’t have the same opportunities that you thought you should,” he said. “That’s a real sentiment.”

Clarke suspects viewers are hungry for a narrative that validates the financial pinch they may be feeling right now.

“Viral misinformation that confirms our feelings goes way more viral than the complicated truth,” Clarke said. “And none of us are getting tens of millions of views when we correct it.”

TikTok is especially popular among young adults, 32% of whom say they regularly get their news from the app.

If those young people are comparing their economic reality to that of their parents, it’s completely understandable that they may feel that certain pieces of the American dream have stretched further out of their reach, Mose said.

“I could see how the generation coming of age could look to their parents’ generation and say ‘It’s harder now,’” he said. “It is harder now than it was.”

But these days, Americans can be sure their money is safe in the bank. Their houses are likely to have AC and a refrigerator and an indoor toilet. With more than one position open for every job seeker in the market, the odds skew in their favor if they’re looking for work. And if they fall on hard times, they can claim unemployment benefits, or qualify for Medicaid, or apply for food stamps.

None of those things guarantee financial security for everyone — but their existence almost certainly means most Americans are better off today than those who lived 90 years ago, Moser said.

“I look back at the struggles that our ancestors had to endure, and I feel so fortunate,” he said. “It doesn’t mean there aren’t problems in the economy, but come on — the Great Depression? Let’s get real.”