Sterling and Euro jumped sharply following the decisions by BoE and ECB to leave interest rates unchanged, in line with market expectations. Notably, both central banks diverged from Fed’s recent dovish turn, with explicit statements pushing back on the speculation of rate cuts.

Bank of England Governor Andrew Bailey, speaking after the rate announcement, emphasized the premature nature of speculating about cutting interest rates. He stated, “We’ve got to see more progress.” Similarly, ECB President Christine Lagarde, in her post-meeting press conference, made it clear that the governing council did not discuss a rate cut in their meeting. She underlined the ECB’s vigilance, asserting the need to “keep our guard up” and closely monitor data to ascertain if the recent decline in inflation is sustainable.

Swiss Franc, however, faced pressure against its European peers following SNB’s downward revision of its inflation forecasts, which are now expected to stay close to the target over the forecast horizon. SNB Chair Thomas Jordan indicated no immediate need for further tightening of monetary policy and stated that the central bank is shifting its focus away from foreign currency sales.

Meanwhile, Dollar’s post-FOMC weakness continued, and even better-than-expected retail sales data failed to lend support. Yen, while retreating against the European currencies, remains the strongest performer for the week. In contrast, commodity currencies have been overshadowed by the strength displayed by Euro and Sterling.

In Europe, at the time of writing, FTSE is up 1.48%. DAX is up 0.44%. CAC is up 0.95%. Germany 10-year yield is down -0.0391 at 2.138. UK 10-year yield is down -0.069 at 3.765. Earlier in Asia, Nikkei closed down -0.73%. Hong Kong HSI rose 1.07%. China Shanghai SSE fell -0.33%. Singapore Strait Times rose 0.60%. Japan 10-year JGB yield fell -0.0138 to 0.676.

US retail sales rises 0.3% mom in Nov, ex-auto sales up 0.2% mom

US retail sales rose 0.3% mom to USD 705.7B in November, better than expectation of -0.1% mom decline. Ex-auto sales rose 0.2% mom to USD 571.2B, above expectation of -0.1% mom. Ex-gasoline sales rose 0.6% mom to USD 651.2B. Ex-auto, gasoline sales rose 0.6% mom to USD 516.7B.

For the 12 months period, retail sales was up 4.1% yoy. Total sales for September through November period were up 3.4% yoy.

US initial jobless claims falls to 202k, vs exp 221k

US initial jobless claims fell -19k to 202k in the week ending December 9, below expectation of 221k. Four-week moving average of initial claims fell -7.75k to 213k.

Continuing claims rose 20k to 1876k in the week ending December 2. Four-week moving average of continuing claims rose 3.5k to 1875k, highest since December 11, 2021.

ECB maintains interest rates, lowers inflation forecasts

ECB kept interest rates unchanged, maintaining the main refinancing rate at 4.50% and the deposit rate at 4.00%, as was widely anticipated. In a significant update, ECB substantially lowered its headline inflation forecast for 2024 from 3.2% to 2.7%. Additionally, core inflation forecasts for 2024 were slightly revised downward from 2.9% to 2.7%.

The new economic forecasts paint a picture of moderating inflation and subdued growth in the coming years. Headline inflation is expected to average 5.4% in 2023, then decrease to 2.7% in 2024, 2.1% in 2025, and 1.9% in 2026. These projections mark a notable adjustment from the September forecasts, which anticipated 5.6% in 2023 and 3.2% in 2024.

Core inflation is also expected to follow a similar downward trajectory, averaging 5.0% in 2023, 2.7% in 2024, 2.3% in 2025, and 2.1% in 2026, comparing to previous forecasts of 5.1% in 2023, 2.9% in 2024, and 2.2% in 2025

On the growth front, ECB’s projections indicate modest economic performance, with growth averaging 0.6% for 2023, 0.8% for 2024, and 1.5% for both 2025 and 2026. These figures represent a downward revision from September forecasts, which predicted 0.7% growth in 2023 and 1.0% in 2024, but 2025 was unchanged at 1.5%.

The central bank reiterated that the current interest rates are positioned to substantially contribute to bringing inflation back to its target, provided they are “maintained for a sufficiently long duration.” The ECB plans to continue following a “data-dependent approach” to determine the “level and duration” of policy restrictions.

BoE stands pat, three hawks vote for another hike

BoE kept Bank Rate unchanged at 5.25%, aligning with market expectations. The decision was not unanimous, with a 6-3 vote where Megan Greene, Jonathan Haskel, and Catherine Mann favored a 25 bps hike to 5.50%. This split decision reflects that the hawks remained persistent in their push more tighter monetary policy.

The central bank reiterated its stance that “monetary policy is likely to need to be restrictive for an extended period of time.” This suggests continued cautious approach towards easing monetary conditions, likely due to persistent inflationary pressures. The Bank further emphasized that “Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures,” indicating readiness to adjust policy should inflation not moderate as expected.

Regarding inflation, BoE forecasts that CPI inflation rate will hover near its current rate around the turn of the year, before gradually declining thereafter. On the growth front, BoE anticipates that GDP growth will be “broadly flat in Q4 and over the coming quarters.”

SNB stands pat, downgrades inflation forecasts

SNB maintained its policy rate at 1.75%, aligning with widespread market expectations. This decision comes alongside a notable downgrade in inflation forecasts, which SNB now expects to remain “within the range of price stability” throughout the forecast period.

In terms of specific figures, or 2023, average inflation rate is now projected at 2.1%, a reduction from September’s forecast of 2.2%. 2024 forecast has been adjusted to 1.9%, down from the previous estimate of 2.2%. Additionally, 2025 inflation prediction has been lowered to 1.6% from the earlier 1.9% projection.

The details of the forecast indicate that inflation is expected to peak in Q2 2024, which is lower than previously anticipated peak at 2.2%. Following this, inflation is projected to decline to 1.6% in Q2 of 2025 and maintain this level until Q3 of 2026.

SNB attributes this downward revision primarily to “recent lower-than-expected inflation” readings. In the medium term, the bank anticipates reduced inflationary pressure from international sources and somewhat weaker second-round effects.

On the growth front, SNB foresees a period of weak economic performance in the upcoming quarters. This outlook is influenced by subdued demand from international markets and tighter financing conditions. The bank’s projections for GDP growth are set around 1% for 2023 and between 0.5% and 1% for 2024.

New Zealand’s Q3 GDP falls unexpectedly by -0.3%, manufacturing sector leads decline

New Zealand’s GDP unexpectedly contracted by -0.3% qoq in Q3, a significant deviation from the anticipated 0.2% qoq growth. Notably, GDP per capita saw a more pronounced decrease of -0.9%. This downturn in economic activity was primarily led by -2.6% decline in the goods-producing industries. However, there were some positive aspects, with service industries experiencing growth of 0.4%, and primary industries seeing rise of 0.6%.

Ruvani Ratnayake, national accounts industry and production senior manager, pointed out, “All goods producing industries were down this quarter, led by a fall in manufacturing.”

Despite the general decline in GDP, there was a silver lining as 8 out of 11 service industries recorded growth during the quarter. The most substantial improvements were observed in healthcare and social assistance, along with rental, hiring, and real estate services.

On the consumer front, household spending decreased by -0.6% during the quarter. This reduction was across all categories, with notable decline in durable goods. The fall in spending on motor vehicles, which came after a period of higher spending, was a significant factor in this overall decrease.

Australia’s employment rises 61.5k in Nov, unemployment rate ticks up

Australia’s employment sector grew significant by 61.5k in November substantially surpassing the expected 10.0k. This growth was primarily in full-time employment, which saw an increase of 47k, while part-time employment also rose by 14.5k.

Despite these positive developments in job creation, the unemployment rate edged up slightly to 3.9%, against expectations of remaining at 3.8%. Participation rate increased by 0.2% to reach 67.2%, and monthly hours worked were flat at 0.0%.

Bjorn Jarvis, ABS head of labour statistics, stated, “The combination of strong growth in both employment and unemployment in November saw the employment-to-population ratio return to a record high of 64.6 percent and the participation rate reach a new high of 67.2 percent.”

Jarvis also noted that the slowing in hours worked suggests that the overall growth rates in employment and hours worked have become more aligned over the past 18 months. This convergence indicates a “less tight” labor market than previously experienced.

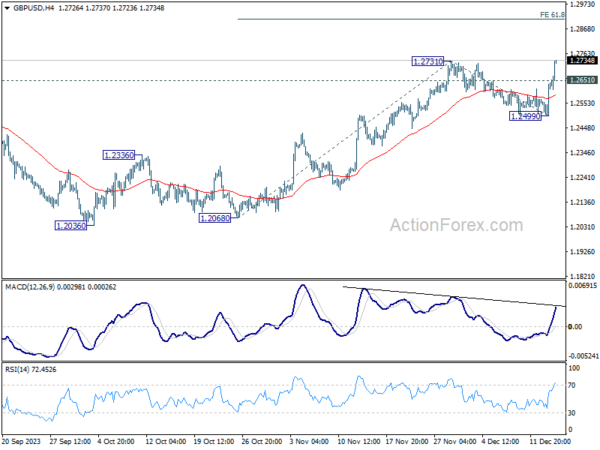

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2534; (P) 1.2585; (R1) 1.2669; More…

Intraday bias in GBP/USD remains on the upside at this point. Sustained break of 1.2731 will confirm resumption of whole rally from 1.2036. Next target is 61.8% projection of 1.2068 to 1.2731 from 1.2499 at 1.2909. On the downside, below 1.2651 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 1.2499 support holds.

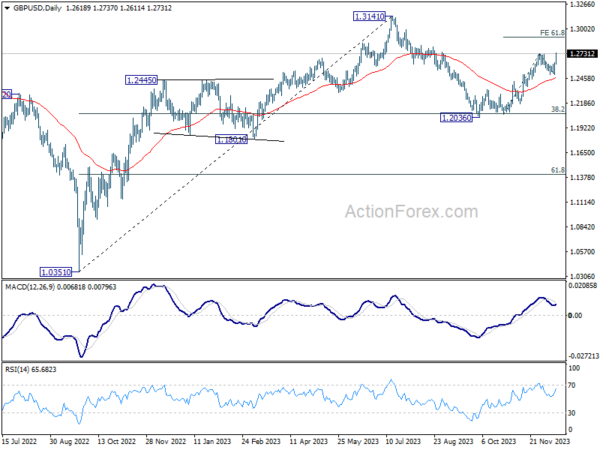

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to rise from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, that could still extend through 1.2731. But upside should be limited by 1.3141 o bring the third leg of the pattern. Meanwhile, sustained trading below 55 EMA will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again, and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q3 | -0.30% | 0.20% | 0.90% | 0.50% |

| 23:50 | JPY | Machinery Orders M/M Oct | 0.70% | -0.50% | 1.40% | |

| 00:00 | AUD | Consumer Inflation Expectations Dec | 4.50% | 4.90% | ||

| 00:01 | GBP | RICS Housing Price Balance Nov | -43% | -58% | -63% | |

| 00:30 | AUD | Employment Change Nov | 61.5K | 10.0K | 55.0K | 42.7K |

| 00:30 | AUD | Unemployment Rate Nov | 3.90% | 3.80% | 3.70% | 3.80% |

| 04:30 | JPY | Industrial Production M/M Oct F | 1.30% | 1.00% | 1.00% | |

| 07:30 | CHF | Producer and Import Prices M/M Nov | -0.90% | 0.10% | 0.20% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Nov | -1.30% | -0.90% | ||

| 08:30 | CHF | SNB Interest Rate Decision | 1.75% | 1.75% | 1.75% | |

| 09:00 | CHF | SNB Press Conference | ||||

| 12:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | 5.25% | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 3–0–6 | 2–0–7 | 3–0–6 | |

| 13:15 | EUR | ECB Interest Rate Decision | 4.50% | 4.50% | 4.50% | |

| 13:30 | CAD | Manufacturing Sales M/M Oct | -2.80% | 0.30% | 0.40% | |

| 13:30 | USD | Initial Jobless Claims (Dec 8) | 202K | 221K | 220K | 221K |

| 13:30 | USD | Retail Sales M/M Nov | 0.30% | -0.10% | -0.10% | -0.20% |

| 13:30 | USD | Retail Sales ex Autos M/M Nov | 0.20% | -0.10% | 0.10% | 0.00% |

| 13:30 | USD | Import Price Index M/M Nov | -0.40% | -0.80% | -0.80% | |

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | Business Inventories Oct | 0.00% | 0.40% | ||

| 15:30 | USD | Natural Gas Storage | -60B | -117B |