Shares of Ansys Inc. soared 18% in trading Friday on reports the company is in discussions to be acquired by Synopsys Inc. in a deal that would create a design-software behemoth.

The potential deal would kick off 2024 with a mega-merger, even as the Federal Trade Commission attempts to crack down on such transactions. Talks remain fluid and a third party might still emerge as a possible suitor of Ansys, according to a Wall Street Journal report, which cited people familiar with the situation.

Ansys

ANSS,

which has a market value of nearly $26.3 billion, makes software that helps predict how products in aerospace, healthcare and automotive applications will work in the real world. A deal could be struck early in 2024, according to people familiar with the matter. Ansys reported revenue of $2.1 billion in 2022.

Synopsys

SNPS,

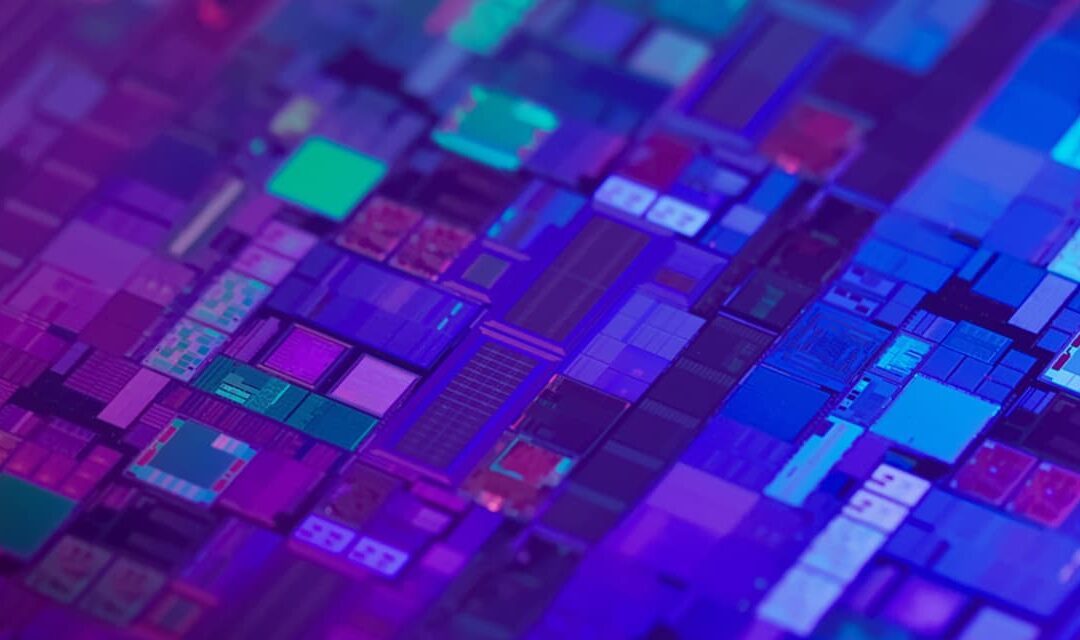

with a market value of $85.1 billion, makes software that engineers use to design and test silicon chips used in smartphones, self-driving cars and other forms of artificial intelligence. Its stock has climbed 65% this year as investors have hopped on the AI bandwagon boom. Shares of Synopsys dipped 6% in late trading Friday.

Synopsys’s customers include Nvidia Corp.

NVDA,

Intel Corp.

INTC,

and Advanced Micro Devices Inc.

AMD,

Representatives from Synopsys and Ansys were not immediately available for comment.

Should the companies strike a merger, it would offer a fresh test for the FTC and its chair, Lina Khan, who have opposed large tech mergers and acquisitions. The agency unsuccessfully sued Facebook parent Meta Platforms Inc.

META,

in its pursuit of VR developer Within, as well as Microsoft Corp.’s

MSFT,

$69 billion purchase of Activision Blizzard Inc.