Investors have driving quite a bounceback for stocks during 2023, and the trend for gains that started late in October has been gaining steam. Below is a list of the favorite stocks for 2024 among analysts working for brokerage firms.

For perspective, take a look at the S&P 500’s return since the end of 2021:

The S&P 500 has returned nearly 26% this year, but it is up only 3.1% since the end of 2021.

FactSet

All returns in this article include reinvested dividends. The chart incorporates the 25.9% increase for the S&P 500

SPX

this year, which has followed an 18.1% decline in 2022. So the index is up only 3.1% since the end of 2021. The action in 2022 tracked the Federal Reserve’s change in policy to raise the federal-funds rate repeatedly and push long-term rates higher by shrinking its bond portfolio.

And now that investors are convinced the Fed is finished raising rates, with the central bank’s projections even baking-in three cuts to the federal-funds rate in 2024, the S&P 500’s upward path has accelerated since late October.

Here is a summary of how the 11 sectors of the S&P 500 have performed, along with forward price-to-earnings ratios. The full index is at the bottom:

| Healthcare | 2023 return | 2022 return | Return since end of 2021 | Forward P/E | Current P/E to 5-year average | Current P/E to 10-year average | Current P/E to 15-year average |

| Information Technology | 57% | -28% | 13% | 26.6 | 117% | 141% | 159% |

| Communication Services | 56% | -40% | -6% | 17.4 | 92% | 92% | 100% |

| Consumer Discretionary | 43% | -37% | -10% | 26.2 | 86% | 102% | 118% |

| Industrials | 17% | -5% | 11% | 19.9 | 96% | 107% | 117% |

| Materials | 13% | -12% | -1% | 19.4 | 113% | 118% | 126% |

| Real Estate | 11% | -26% | -18% | 18.0 | 91% | 95% | 96% |

| Financials | 11% | -11% | 0% | 14.5 | 98% | 102% | 109% |

| Health Care | 1% | -2% | -1% | 18.1 | 109% | 110% | 122% |

| Energy | 0% | 66% | 66% | 11.0 | 100% | 59% | 68% |

| Consumer Staples | -1% | -1% | -1% | 19.2 | 96% | 99% | 108% |

| Utilities | -8% | 2% | -7% | 15.7 | 86% | 90% | 99% |

| S&P 500 | 26% | -18% | 3% | 19.6 | 102% | 109% | 121% |

| Source: FactSet | |||||||

You will see dire warnings that stocks are overvalued at all times, especially at year-end. So the current forward price-to-earnings ratios are compared with average levels over the past 5, 10 and 15 years. Forward P/E ratios in the table are based on rolling weighted consensus earnings-per-share estimates among analysts polled by FactSet.

Seven sectors are trading at weighted aggregate forward P/E ratios that are below their five-year averages, with utilities cheapest by this measure. That may not be a surprise, as utility stocks are generally relied upon by investors to pay dividends, and valuations for income-producing securities fell as interest rates rose. If we go out to 10 years, five sectors trade below average P/E, while only three sectors trade below their 15-year average P/E levels.

Analysts’ favorite stocks

Sell-side analysts (those who work for brokerage firms) typically set 12-month price targets for stocks. For this screen we began with the S&P 500 and tossed the one company with less than five ratings among analysts polled by FactSet (Lowes Corp.

L,

an insurer). Then we narrowed the list to 92 companies with at least 75% “buy” or equivalent ratings.

Among these 92 companies, here are the 20 with the most upside potential for 2024 implied by consensus price targets:

| Corteva Inc. | Ticker | Share “buy” ratings | Dec. 22 price | Consensus price target | Implied upside potential | Forward P/E |

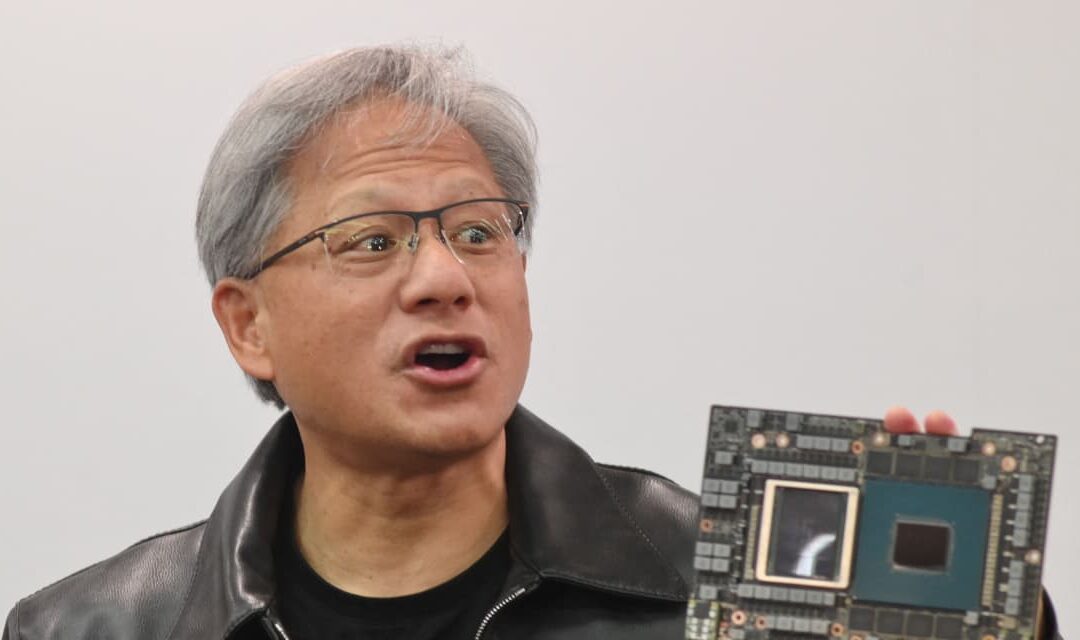

| Nvidia Corp. |

NVDA, |

94% | $488.30 | $668.11 | 37% | 24.5 |

| First Solar Inc. |

FSLR, |

83% | $170.39 | $231.56 | 36% | 13.1 |

| Halliburton Co. |

HAL, |

87% | $36.59 | $49.04 | 34% | 10.6 |

| Bunge Global SA |

BG, |

77% | $101.64 | $135.33 | 33% | 8.8 |

| Bio-Rad Laboratories Inc. Class A |

BIO, |

75% | $320.74 | $424.00 | 32% | 27.5 |

| Las Vegas Sands Corp. |

LVS, |

83% | $48.92 | $64.45 | 32% | 16.4 |

| Schlumberger N.V. |

SLB, |

93% | $53.08 | $69.72 | 31% | 14.8 |

| LKQ Corp. |

LKQ, |

75% | $47.80 | $61.89 | 29% | 11.4 |

| Aptiv PLC |

APTV, |

85% | $89.02 | $113.96 | 28% | 15.1 |

| Delta Air Lines Inc. |

DAL, |

96% | $41.13 | $52.40 | 27% | 6.3 |

| Targa Resources Corp. |

TRGP, |

95% | $86.71 | $107.96 | 25% | 14.5 |

| Corteva Inc |

CTVA, |

78% | $47.46 | $58.53 | 23% | 15.7 |

| Constellation Brands Inc. Class A |

STZ, |

83% | $237.88 | $292.37 | 23% | 18.0 |

| Biogen Inc. |

BIIB, |

82% | $257.97 | $315.48 | 22% | 16.3 |

| Baker Hughes Co. Class A |

BKR, |

79% | $34.12 | $41.58 | 22% | 16.6 |

| Live Nation Entertainment Inc. |

LYV, |

80% | $91.43 | $111.17 | 22% | 41.6 |

| MGM Resorts International |

MGM, |

79% | $44.38 | $53.74 | 21% | 18.6 |

| Elevance Health Inc. |

ELV, |

86% | $466.59 | $563.67 | 21% | 12.6 |

| Jacobs Solutions Inc. |

J, |

88% | $128.07 | $153.17 | 20% | 15.4 |

| Synopsys Inc. |

SNPS, |

88% | $524.46 | $624.57 | 19% | 38.1 |

| Source: FactSet | ||||||

Click on the tickers for more about each company.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Nvidia tops the list, as analysts expect the company to maintain its leading position providing graphics processing units (GPU) to data centers building up their capability to support corporate clients rolling out artificial intelligence technology.

Here’s a sampling of recent coverage of Nvidia:

A focus on value: 13 stocks that are down for 2023 but may bounce back in 2024 or beyond