- US 500 index is in the red again today

- Correction underway since touching the 4,796 high

- Momentum indicators support the current bearish move

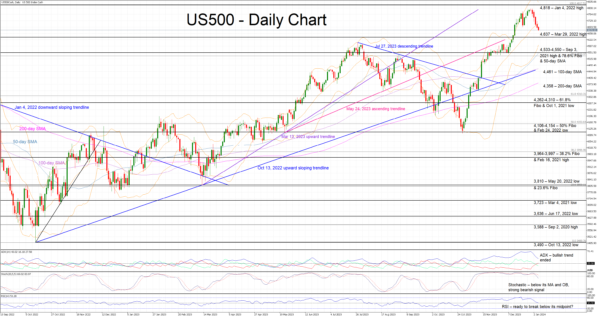

The US 500 cash index is trying to record its sixth consecutive red candle, starting 2024 in a rather negative note. The current correction could gain further traction if the data releases on Friday disappoint market participants. Having said that the US 500 index remains around 14% higher than the October 27, 2023 low of 4,100.

The recent bullish trend is still assumed to be in place, but the momentum indicators have turned firmly in favour of the bears’ side at this stage. The Average Directional Movement Index (ADX) is edging aggressively towards its 25-midpoint, signaling the end of the recent bullish trend. Similarly, the RSI is preparing to break below its 50-midpoint for the first time in two months. More importantly, the stochastic oscillator has finally broken below both its moving average and overbought territory. This move is usually seen as a strong bearish signal.

The bears are trying to regain the upper hand and are keen to push the US 500 index below the March 29, 2022 high at 4,637. If successful, they could have a go at testing the support set by the 4,533-4,550 area, which is populated by the September 3, 2021 high, the 78.6% Fibonacci retracement level of the January 4, 2022 – October 12, 2022 downtrend and the 50-day simple moving average (SMA). Even lower, the 100-day SMA at 4,461 could prove tougher to crack than currently envisaged.

On the flip side, the bulls could first try to keep the US 500 index above the 4,637 level. They could then stage a move towards the 2023 high and eventually test the resistance set by the January 4, 2022 high at 4,818. Even higher, the 4,900 level looks like the plausible next target.

To conclude, the impressive rally in the US 500 index from the October lows has been followed by a correction that could get further traction on the back of bearish momentum indicators.