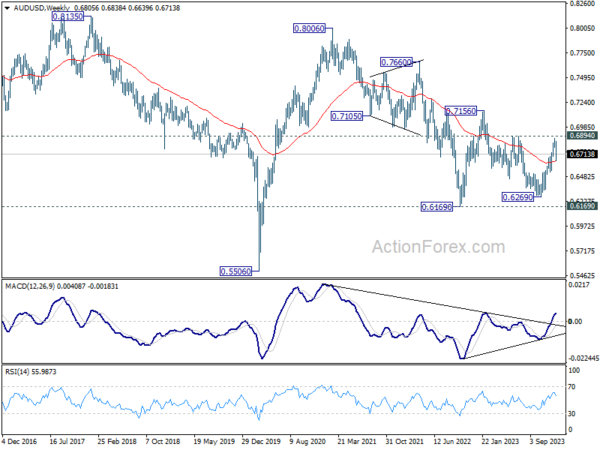

AUD/USD’s decline last week indicates short term topping at 0.6870, on bearish divergence condition in 4H MACD. Further decline will remain mildly in favor as long as 0.6759 minor resistance holds, to 55 D EMA (now at 0.6612). Nevertheless, break of 0.6759 will turn bias back to the upside for retesting 0.6870 instead.

In the bigger picture, price actions from 0.6169 (2022 low) could be just a medium term corrective pattern to the down trend from 0.8006 (2021 high). Rise from 0.6269 is seen as the third leg of the pattern that could target 0.7156 on break of 0.6894 resistance. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

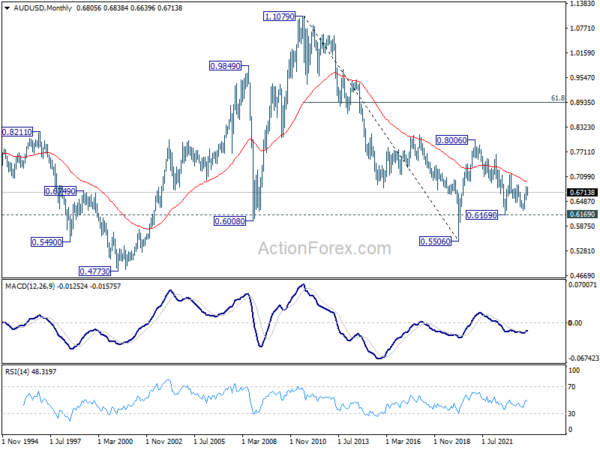

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, downside strong support should emerge above 0.5506 to bring reversal.