- Tokyo CPI report kicks off a very interesting period for the BoJ

- Earnings data under the microscope until we get wage news

- Yen’s recent gains against the euro are under threat if data releases turn negative

- Tokyo CPI released on Tuesday; average earnings data on Wednesday

Strong start of 2024 with Tokyo CPI and earnings data

With the market digesting the upside surprises seen in last week’s US labour market statistics, yen traders are preparing for a strong start to the week. Last week ended on a high note as Japanese consumer confidence jumped higher, and the Japan’s Services PMI survey managed to remain comfortably in expanding territory.

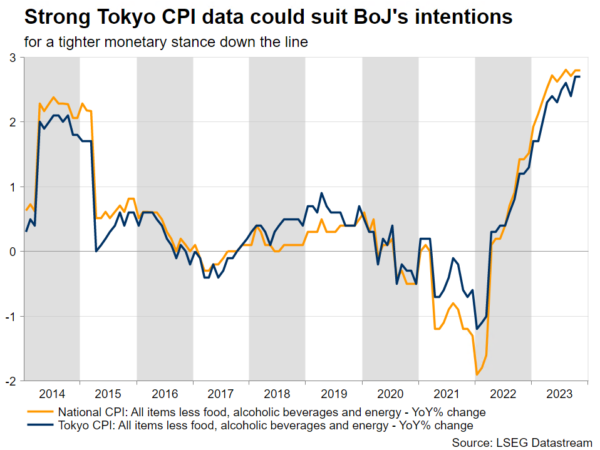

This week the market will be updated on the December Tokyo inflation report and November average earnings data. The Bank of Japan will anxiously scrutinize these results, hoping that there is momentum in domestic price pressure, thus allowing it to finally consider some degree of policy tightening down the line.

In this context, the headline Tokyo CPI could edge slightly lower from the 2.6% growth recorded in November, despite the recent higher oil prices due to the Middle East developments. More crucially, the CPI component excluding food and energy prices will probably remain around the 2.5% area, a tad below November’s 2.7% print. This is a level that could bring smiles to the BoJ members’ faces.

Last BoJ meeting proved uninteresting; wages remain the key input

The last BoJ gathering of 2023 turned out to be a non-event with the post-meeting rhetoric from Governor Ueda mostly focusing on the importance of wages. This argument has been at the forefront of BoJ’s efforts for some time, but we are now getting closer to April 2024 when it could be decision time for the BoJ. Interestingly, the early indications for the 2024 wage round appear positive as a big retailer recently proposed a 7% pay increase for its part-time staff.

Market participants are trying to gather enough evidence to support expectations for a monetary policy tightening move at the January meeting. However, the odds of such a move taking place look very slim despite Ueda’s comments that a policy change could involve an element of surprise. In addition, pushing its interest rate back in positive territory could be a gamble for the BoJ at this stage when so many pieces of the economic puzzle are still missing.

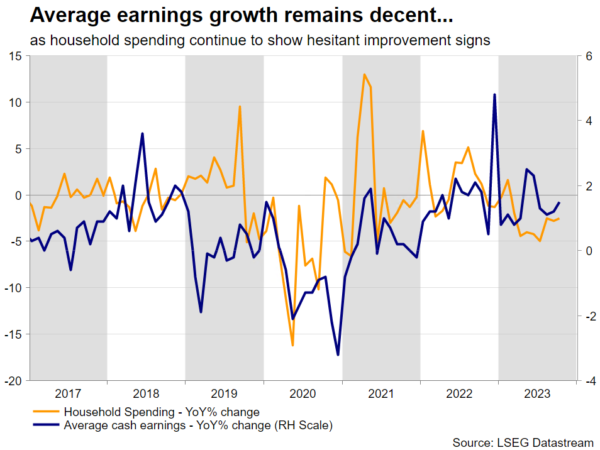

Until we get more concrete details on the 2024 wage round, both the BoJ and the market would have to be content with the earnings and spending data. On Tuesday, the November household spending details could show another negative yearly print but confirm the recent improvement seen in this indicator. Similarly, on Wednesday we will get earnings details for the month of November. This data set is slightly out of date, but important conclusions could be reached especially if the yearly figure heads again north towards its recent peak of 2.9%.

Yen to suffer from weak data releases

The bearish move recorded in euro/yen after the November 2023 high, which resulted in a new 5-month low, appears to have ended. This pair is currently hovering at the busy 157.90-158.61 area and this week’s data could make it easier for euro bulls to regain market control. A series of downside surprises could open the door for a move above the 159.32-159.64 region with intervention rumours then gradually and hesitantly reappearing.

Should data releases surprise on the upside, especially the core Tokyo inflation figure, there could be an opening for the yen bulls to push euro-yen lower and test the lower boundary of the recent range at 154.35.