Release of Japan’s disappointing wage growth data led markets to scale back expectations of an imminent rate hike by BoJ. The continued lag in wages growth behind inflation undermines the prospects of establishing a virtuous cycle of wages and prices, which is a prerequisite to a BoJ policy shift. Although a rate hike in April by BoJ remains a possibility, the foundation for such a move is increasingly uncertain given the latest wages data. This development has resulted a broad-based weakening of Japanese Yen, although the decline has been somewhat contained. Concurrently, Nikkei capitalized on this sentiment, reaching new 33-year highs following an upside breakout from a six-month trading range this week.

Elsewhere in the currency markets, commodity currencies are showing signs of recovery, led by Australian Dollar, which seems to be largely unaffected by economic data. Australia’s monthly CPI slowed more than anticipated, reinforcing the view that RBA’s tightening cycle may have concluded. However, the decisive factor will still be Q4 CPI data, due for release at the end of January. Dollar and European major currencies are currently the weaker ones, continuing to engage in range-bound trading against each other.

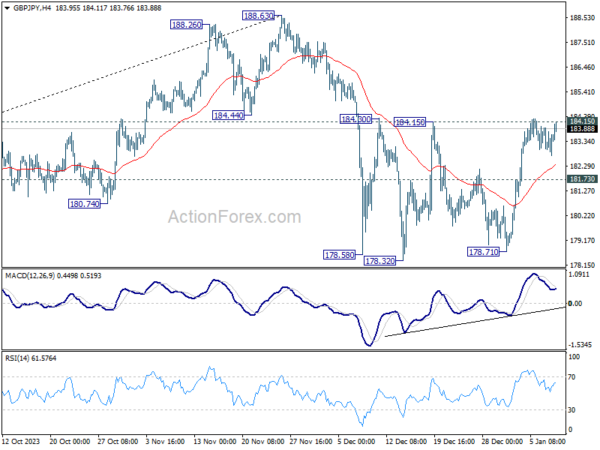

From a technical analysis standpoint, GBP/JPY is back pressing 184.15 resistance after brief retreat. Decisive break there will argue that whole corrective fall from 188.63 has completed, and bring stronger rally back to retest this high. If realized, this upside breakout could be accompanied by break of 158.97 temporary top in EUR/USD, as well as 145.97 resistance in USD/JPY.

In Asia, at the time of writing, Nikkei is up 2.17%. Hong Kong HSI is down -0.45%. China Shanghai SSE is down -0.27%. Singapore Strait Times is down -1.04%. Japan 10-year JGB yield is down -0.0019 at 0.585. Overnight, DOW fell -0.42%. S&P 500 fell -0.15. NASDAQ rose 0.09%. 10-year yield rose 0.017 to 4.019.

ECB’s Villeroy advocates for caution over haste or rigidity

ECB Governing Council member Francois Villeroy de Galhau, in an address to France’s financial sector overnight, stated, “We will cut rates this year when the inflation outlook is solidly anchored at 2% with effective and durable data.”

However, Villeroy did not specify a timeline for these potential rate cuts, emphasizing instead the ECB’s reliance on economic data to guide their decisions. He asserted, “Our decisions will not be guided by a calendar, but by data.”

Villeroy’s statement, “We must demonstrate neither obstinateness nor haste,” further highlights the ECB’s approach as the central bank is keen on avoiding premature actions that could destabilize the disinflation process.

Japan’s labor cash earnings rises only 0.2% yoy, real wages down for 20th month

Japan’s labor market showed a notable slowdown in nominal cash earnings growth in November, increasing by only 0.2% yoy, which was significantly below market expectation of 1.5% yoy. This rate marks the slowest growth in nearly two years and represents a considerable decrease compared to 1.5% yoy growth in October.

A closer look at the components of earnings reveals mixed trends. Regular or base salaries saw modest increase of 1.2% yoy, slightly down from previous month’s 1.3% yoy. Overtime pay, which had been declining, showed a positive shift with 0.9% yoy increase, marking the first rise in three months. However, special payments, such as bonuses, experienced a significant drop of -13.2% yoy.

More concerning that real wages fell sharply by -3.0% yoy in November, exceeding expectations of -2.0% yoy decline. This drop marks the 20th consecutive month of contraction.

Australia’s monthly CPI eases to 4.3% yoy, lowest since Jan 2022

Australia’s monthly CPI saw notable deceleration in November, dropping from 4.9% yoy to 4.3% yoy, which was below expectation of 4.5% yoy. This represents the lowest reading since January 2022, as easing of the inflationary pressures continued

CPI excluding volatile items and holiday travel also slowed from 5.1% yoy to 4.8% yoy. Additionally, Trimmed Mean CPI, which removes the most volatile components to provide a clearer picture of underlying inflation trends, decelerated from 5.3% yoy to 4.6% yoy.

The primary drivers of the annual increase in November were in housing , which witnessed a significant rise of 6.6. Food and non-alcoholic beverages also saw a notable increase of 4.6%, Insurance and financial services recorded an 8.8% increase, and Alcohol and tobacco category experienced a 6.4% rise.

Looking ahead

France industrial production and Italy retail sales will be released in European session. Later in the day, US will release wholesale inventories final and crude oil inventories.

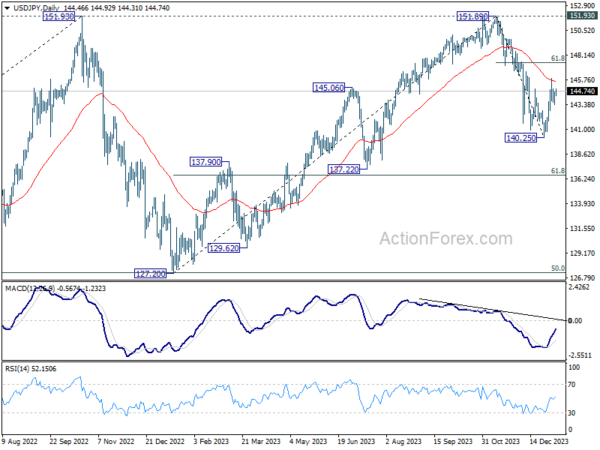

USD/JPY Daily Outlook

Daily Pivots: (S1) 143.73; (P) 144.17; (R1) 144.93; More…

USD/JPY recovered ahead of 143.17 minor support but stays well below 145.97 resistance. Intraday bias remains neutral at this point. On the upside, above 145.97 will resume the rebound from 140.25. But upside should be limited by 61.8% retracement of 151.89 to 140.25 at 147.44. On the downside, below 143.17 minor support will turn bias back to the downside for retesting 140.25 low.

In the bigger picture, for now, fall from 151.89 is still seen as the third leg of the corrective pattern from 151.89. Another decline through 140.25 will target 61.8% retracement of 127.20 to 151.89 at 136.63. Sustained break there will pave the way to 127.20 support (2022 low). However, firm break of 147.44 fibonacci resistance will dampen this view and bring retest of 151.89 instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | 0.20% | 1.50% | 1.50% | |

| 00:30 | AUD | Monthly CPI Y/Y Nov | 4.30% | 4.50% | 4.90% | |

| 07:45 | EUR | France Industrial Output M/M Nov | 0.00% | -0.30% | ||

| 15:00 | USD | Wholesale Inventories Nov F | -0.20% | -0.20% | ||

| 15:30 | USD | Crude Oil Inventories | -0.2M | -5.5M |