The forex market displayed relative tranquility in Asian session, with major currencies confined to tight ranges. This subdued atmosphere reflects a degree of stabilization in investor sentiment, mirrored in the performance of major Asian stock indexes which are either experiencing mild recoveries or registering only slight losses. A notable exception to this picture is China’s Shanghai SSE, which is extending its recent decline. This persistent downturn in the Chinese market is fueled by deep-rooted pessimism about the economy after this week’s economic data, and subdued expectations for any significant stimulus measures from the government.

In addition, broader investor sentiment is also showing signs of change, particularly in response to the evolving expectation of major central banks on interest rate cuts. There’s a growing realization among investors that rate cuts might not occur as early or as rapidly as previously anticipated, dampening some of the earlier optimism in the markets.

Dollar, although seeing a slight retreat, continues to hold its position as the strongest currency for the week. Euro follows as the second strongest currency, bolstered by a chorus of comments from ECB officials who have pushed back against expectations of aggressive monetary easing. Sterling ranks as the third strongest, continues to ride on yesterday’s CPI data, and it may have the potential to surpass the Euro, especially if tomorrow’s UK retail sales data proves supportive. Conversely, Swiss Franc is lagging among European currencies, impacted by SNB President Thomas Jordan’s warnings about the real appreciation of Franc and its negative impact on the Swiss economy.

Japanese Yen is lingering at the bottom, with New Zealand Dollar and Australian Dollar also underperforming. Aussie’s recovery is being capped by poor job data, though the significant job loss in December might be attributable to a change in hiring patterns in the last quarter only, as noted by the ABS. Canadian Dollar, on the other hand, is faring relatively better among commodity currencies, supported by CPI data released earlier in the week.

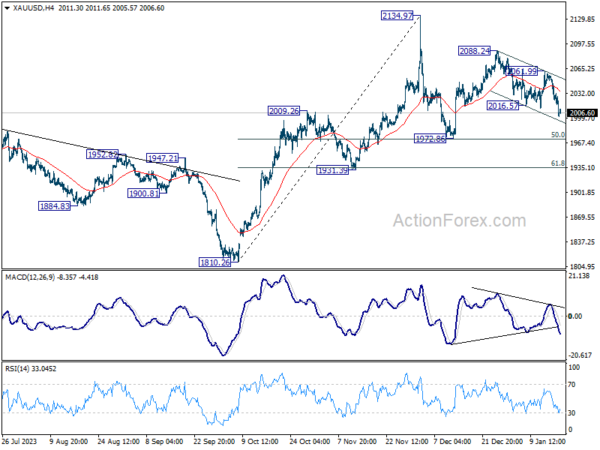

Technically Gold’s fall from 2088.24 resumed on Dollar strength, and it’s now eyeing 2000 psychological support. Current development argues that price actions from 2134.97 spike is correcting whole rise from 1810.26, with decline from 2088.24 as the third leg. Deeper fall is expected as long as 55 4H EMA (now at 2036.57) holds, to 1972.86 cluster support (50% retracement of 1810.26 to 2134.97 at 1972.61. Firm break there will target 1931.39 cluster (61.8% retracement at 1934.29) next.

In Asia, at the time of writing, Nikkei is down -0.10%. Hong Kong HSI is up 0.23%. China Shanghai SSE is down -1.94%. Singapore Strait Times is down -0.38%. Japan 10-year JGB yield is up 0.0356 at 0.644. Overnight, DOW fell-0.25%. S&P 500 fell -0.56%. NASDAQ fell -0.59%. 10-year yield rose 0.040 to 4.106.

Fed’s Beige Book: Widespread signs of slowing job market

Fed’s Beige Book noted a majority of the 12 Districts observed “little to no change in economic activity”. Of the districts that reported varying trends, three experienced “modest growth”, while one district encountered a “moderate decline”.

The Beige Book also noted positive consumer activity during the holiday season. Most districts met retail expectations, with three districts exceeding them.

In terms of employment, the report presents a mixed picture. Seven districts reported “little or no net change” in employment levels, while four districts experienced “modest to moderate” job growth. Importantly, “nearly all districts” cited signs of a “cooling labor market”, signaling a potential shift or slowdown in hiring and employment growth across the country.

Price dynamics also varied among the districts. Six districts noted “slight or modest price increases”, and two reported “moderate increases”. Five districts observed that the rate of price increases had “subsided” somewhat compared to the previous period. Three other districts did not report any significant change in price pressures.

Australia’s employment drops by 65.1K in Dec, following two months of robust growth

Australia had an unexpected contraction in employment in December, with a decrease of -65.1k jobs, significantly deviating from expectation of 15.4k. This decline was marked by a substantial drop in full-time employment by -106.6k, which was only partially offset by 41.4k increase in part-time jobs.

Despite this downturn in job creation, unemployment rate remained steady at 3.9%, aligning with expectations. Participation rate declined -0.4% to 66.8%. Additionally, there was -0.5% mom decrease in the total monthly hours worked.

David Taylor, ABS head of labour statistics, noted combined strong growth of 117k in October and November, and the fall in large contraction in December, “reflected changes in the timing of employment growth in the last few months of 2023, compared with earlier years.”

Over the past twelve months, employment grew an average of 32k. Also, both the unemployment and underemployment rates remained relatively low and the participation rate and employment-to-population ratio relatively high. Taylor noted that suggests “the labour market remains tight.”

Japan’s core machinery orders decline -4.9% mom in Nov

Japan’s core private-sector machinery orders fell notably by -4.9% mom in November, significantly below expectation of -0.8% mom. This decline marks the first downturn in three months and points to a potential slowdown in business investment. On a year-on-year basis, core machinery orders decreased -4.0% yoy, falling short of the anticipated 0.2% yoy increase.

The Japanese government has maintained its assessment that machinery orders have “stalled” for 13 consecutive months. This continued stagnation in machinery orders is particularly concerning as they are often regarded as a leading indicator of capital spending over the next six to nine months. The implication is that businesses might be exercising caution in their investment decisions, possibly due to uncertainty in the economic outlook or other external factors impacting their spending plans.

Breaking down the orders by sector, manufacturing industry saw substantial reduction in orders, with -7.8% mom drop. Service sector also recorded a slip in orders, down -0.4% mom.

Looking ahead

ECB’s meeting account is the main focus in Euroepan session. Later in the day, US will release jobless claims, building permits and housing starts, Philly Fed survey.

AUD/USD Daily Report

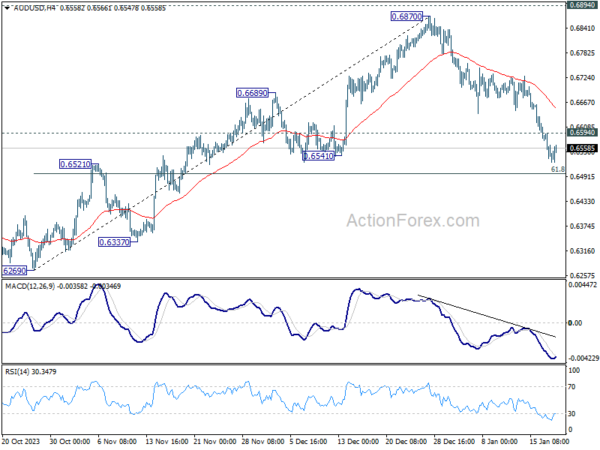

Daily Pivots: (S1) 0.6520; (P) 0.6557; (R1) 0.6590; More…

Intraday bias in AUD/USD remains on the downside at this point. Current fall from 0.6870 should target 61.8% retracement of 0.6269 to 0.6870 at 0.6497. Sustained break there will argue that whole rebound from 0.6269 has completed, and bring deeper fall to this support. On the upside, above 0.6594 minor resistance will turn intraday bias neutral first.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Nov | -4.90% | -0.80% | 0.70% | |

| 00:00 | AUD | Consumer Inflation Expectations Jan | 4.50% | 4.50% | ||

| 00:01 | GBP | RICS Housing Price Balance Dec | -30% | -43% | -41% | |

| 00:30 | AUD | Employment Change Dec | -65.1K | 15.4K | 61.5K | 72.6K |

| 00:30 | AUD | Unemployment Rate Dec | 3.90% | 3.90% | 3.90% | |

| 04:30 | JPY | Industrial Production M/M Nov F | -0.90% | -0.90% | -0.90% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Nov | 30.9B | 33.8B | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Initial Jobless Claims (Jan 12) | 207K | 202K | ||

| 13:30 | USD | Housing Starts Dec | 1.43M | 1.56M | ||

| 13:30 | USD | Building Permits Dec | 1.47M | 1.47M | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | -6.9 | -10.5 | ||

| 15:30 | USD | Natural Gas Storage | -166B | -140B | ||

| 16:00 | USD | Crude Oil Inventories | -0.6M | 1.3M |