Out of eleven sessions so far this year, the S&P 500

SPX

has managed to close higher in three (and one just barely). But of course, the year is young.

As for the bond market, the last two years haven’t been amazing for investors, but some are predicting 2024 to be the year of the bond, partly because the asset class tends to shift into favor when the Fed’s rate hiking cycle is over.

Bonds over stocks this year is the way to go, says our call of the day from Nadège Dufossé, global head of multiasset at Candriam, an asset-management company and subsidiary of New York Life.

With stocks, “you are not paid for the risks you take. In the bond market, you have an expected return that is not very high, but you have a lower risk level and certainly your bonds will edge your equity if you have both in a diversified portfolio,” Dufossé told MarketWatch in an interview on Wednesday.

Unlike some, she doesn’t expect six or seven Fed rate cuts this year. Such a path “would mean that the economic growth would be weaker than expected. So if you have some positive surprise on the bond side because you have yields decreasing, you will have negative surprises on the equity side because [earnings per share] growth will be negative and the equity market will go down,” said Dufossé.

In a separate note, she laid out their preference for government debt, such as dollar-denominated debt with currency hedging, and investment grade corporate credit in euros and dollars, as well as emerging-market debt, which should do okay in a world of slowing yet positive growth and a weak dollar.

But the firm is staying invested in equities, where it suggests investors remain nimble enough to catch some entry points and hopefully get their timing right. In 2023, she said the firm began more positive than consensus on stocks, which paid off “because markets were strong at the beginning of the year.”

“But I would say like many investors, we underestimated the upside on equity markets,” going neutral in the second quarter, which was too early said the manager. That was especially true for U.S. tech, where it went overweight early in the year, but then shifted negative too soon, before ending the year at overweight, where it now stands.

“On the bond side, we were OK because we increased the duration at the end of the year,” she said, adding that it also positive on credit, which worked out well.

In terms of EPS growth expectations, she expects U.S. tech stocks will likely keep outperforming, adding that the interest-rate environment shouldn’t be an obstacle for valuations. She also likes defensives, such as healthcare, which was a bet that didn’t work out for them last year, but which is already doing better this year.

It also went positive early on Chinese and European equities, but timed an exit out of those in April and May of 2023, which proved a savvy, she said, but note she’s still not ready to move on China.

“And we are also trying to find an entry point on small caps, but it’s more a matter of timing right because we consider that small-cap valuation is really attractive,” said the manager, of the asset class that suffered “sometimes forced and undifferentiated selling” last year, both in the U.S. and Europe.

“And when all the weakening of economic growth will be integrated in markets, it will be the right time to really buy small-caps,” she said.

Dufossé says for a diversified portfolio, rising inflation “would be the worst-case scenario,” putting bonds and equities at risk for a downturn such as seen in 2022. “In this case, liquidity and exposure to certain commodities such as gold or energy (oil) should be favored to limit the decline,” she said in a separate note to clients earlier this month.

The markets

Stock futures

ES00,

NQ00,

are rising, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

lower.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,739.21 | -0.92% | 0.87% | -0.64% | 20.63% |

| Nasdaq Composite | 14,855.62 | -0.76% | 0.53% | -1.04% | 35.58% |

| 10 year Treasury | 4.087 | 11.59 | 20.02 | 20.65 | 68.78 |

| Gold | 2,014.60 | -0.91% | -2.09% | -2.76% | 4.18% |

| Oil | 73.2 | 0.48% | -0.99% | 2.62% | -9.45% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

Weekly jobless claims fell 16,000 to 187,000, while the Philly Fed manufacturing survey rose to a negative 10.6 in January and housing starts fall 4.3% in December. Atlanta Fed Pres. Raphael Bostic will speak at 12:05 p.m.

Earnings: Northern Trust

NTRS,

reported a revenue rise and declining income, Truist Financial

TFC,

swung to a loss, KeyCorp

KEY,

also posted a revenue fall and Fastenal

FAST,

a rise in sales.

Discover shares

DFS,

are sliding on profit disappointment as the credit-card giant also sets aside another $1 billion to guard against souring credit.

Following a spate of downbeat news, Apple shares

AAPL,

are up in premarket after Bank of America lifted shares to buy from neutral.

Chip maker TSMC

2330,

TSM,

reported a 19% profit drop in the fourth quarter, but beat forecasts. U.S.-listed shares are climbing.

M.D.C. Holdings

MDC,

and Japanese house manufacturer Sekisui House

1928,

announced plans to merge in an all-cash, $4.9 billion deal.

Earnings preview: Netflix’s ad model and sharing crackdown are paying dividends

The U.S. Treasury will auction $18 billion of 10-year TIPS, or inflation-protected securities, at 1 p.m.

Best of the web

Can AI and a supercomputer beat the markets? This is one of the hedge funds trying to find out.

How China crypto traders are skirting the rules.

Why one of most gifted fund managers of his generation made huge bets on a notorious financier.

The chart

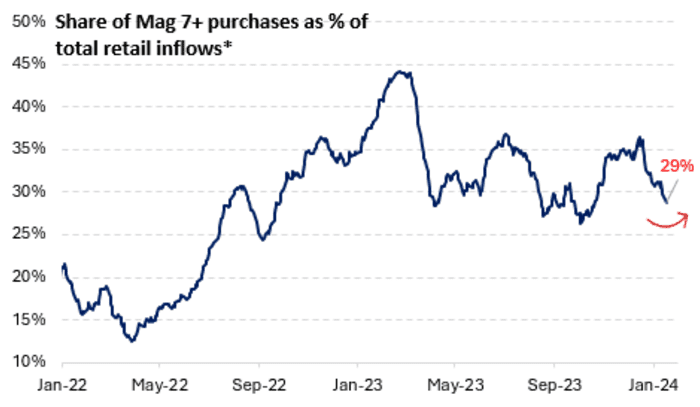

As big tech earnings will start rolling out over the next two weeks, investors are likely to start putting money back into those names, predict Vanda Research analysts, who offer this chart:

*Mag 7+ include AAPL, AMD, AMZN, GOOG/L, META, MSFT, NFLX, NVDA, TSLA

Source: VandaTrack, Vanda Research

They note that data will matter as a worsening risk backdrop could mean more tech stock buying, and in-line data will mean moderate inflows to the sector.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

TSM, |

Taiwan Semiconductor Manufacturing |

|

NIO, |

Nio |

|

AMD, |

Advanced Micro Devices |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

PLUG, |

Plug Power |

|

MSFT, |

Microsoft |

Random reads

Kanye pays $850,000 for Bond-like titanium dentures

Dairy company will pay $10,000 if you ditch your phone for a month.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.