Roughly 74,000 student loan borrowers will receive $4.9 billion in debt cancellation, the Biden administration announced Friday.

The borrowers who are part of this announcement have either been in repayment on their loans for at least 20 years or are public servants who have been working for the government or certain nonprofits for at least 10 years and been paying on their loans during that period.

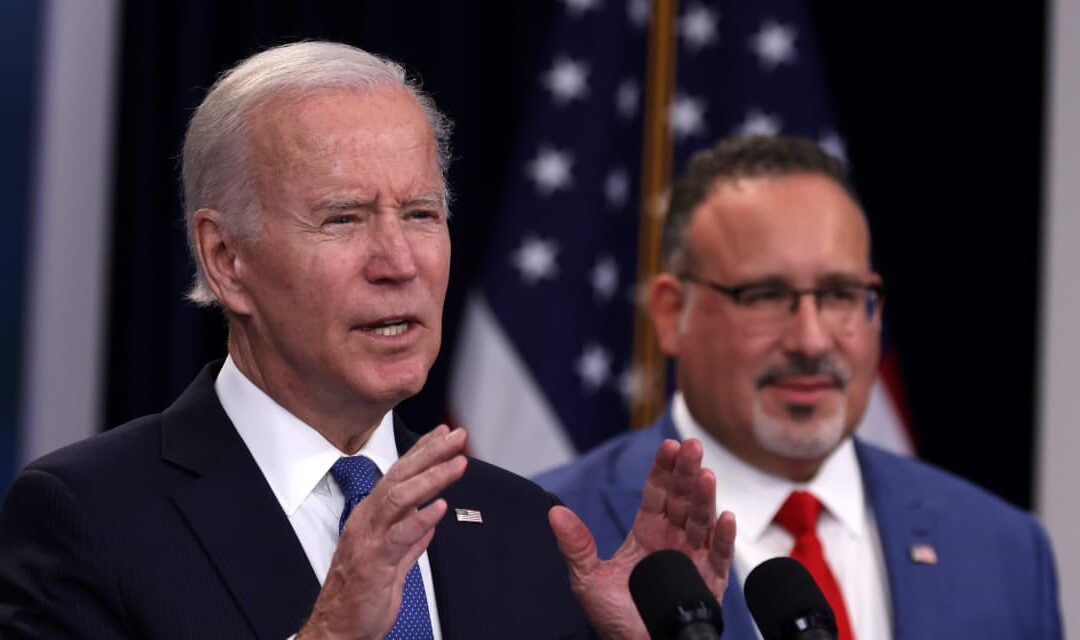

“From Day One of my Administration, I vowed to improve the student loan system so that a higher education provides Americans with opportunity and prosperity – not unmanageable burdens of student loan debt,” President Joe Biden said in a statement announcing the relief. “I won’t back down from using every tool at our disposal to get student loan borrowers the relief they need to reach their dreams.”

Friday’s announcement is part of a broader suite of Biden administration initiatives aimed at streamlining borrowers’ path to relief under existing forgiveness programs. So far, the administration has approved $136.6 billion in debt cancellation for more than 3.7 million borrowers through these efforts.

Fixes to PSLF, income-driven repayment

Nearly 44,000 borrowers who are part of Friday’s announcement are receiving relief through the Public Service Loan Forgiveness program. Under that initiative borrowers who have worked for the government and certain nonprofits for at least 10 years and paid on their loans during that time are eligible to have their remaining debt cancelled.

But for years, borrowers, stymied by paperwork issues and technicalities, struggled to actually access relief under the program. In 2021, the Biden administration took steps aimed at eliminating some of these obstacles in the way of borrowers receiving forgiveness through PSLF.

The other 29,700 borrowers who are part of Friday’s announcement have been paying on their loans for at least 20 years. A suite of programs called income-driven repayment, allow borrowers to pay their debt as a percentage of their income and have the remainder forgiven after at least two decades of payments.

Despite this promise of cancellation, in the period before the pandemic millions of borrowers who had been in repayment for at least 20 years were still paying on their loans. That was in part because servicers steered struggling borrowers towards forbearance instead of enrolling them in income-driven repayment plans that allowed them to build credit towards forgiveness, according to advocates and lawsuits.

In 2022, the Biden administration announced it would review borrowers’ accounts and adjust them so that borrowers’ credit towards forgiveness was actually reflected. The 29,700 borrowers are receiving cancellation through this initiative.

Separate from mass debt forgiveness

Friday’s announcement is separate from a plan the Biden administration shared earlier in January to speed up the timeline for some borrowers who have been in repayment for at least 10 years to receive forgiveness.

Through SAVE, an income-driven repayment plan the Department of Education launched last year, borrowers who have debts of $12,000 or less are eligible to have their loans forgiven after 10 years of payments. Originally officials said they would launch this benefit in July. But last week, the Biden administration announced that it would start cancelling debt through this program in February.

The $4.9 billion in debt forgiveness announced Friday is also separate from the Biden administration’s mass student debt relief plan that the Supreme Court knocked down last year. The Department of Education is currently in the process of developing a new plan and is under pressure from advocates to prioritize recent graduates, low-income borrowers and others as part of the plan.

The headlines surrounding forgiveness come as borrowers and the student loan system are working through the kinks of returning to repayment after a more than three year pause. Borrowers have struggled to get ahold of their loan servicers and get accurate and timely billing information. The Department said that roughly 40% of borrowers with a student loan bill due in October, the month payments resumed, didn’t make a payment.