So far this year, the healthcare sector of the S&P 500 has performed well, after being left behind last year. Here’s how the 11 sectors of the S&P 500 have been performing, with dividends reinvested:

Any discussion of “recent” returns really needs to look back to the end of 2021, because of the seesaw pattern of an 18% decline for the S&P 500

SPX

in 2022 and a 26% return in 2023.

On Wednesday, Joseph Andinolfi shared comments from Jonathan Krinsky, the chief market technician at BTIG, who called the healthcare sector his “highest conviction idea.”

When that article was published, the healthcare sector was the best performer of 2024 among the sectors of the S&P 500. That changed Thursday when shares of Humana Inc.

HUM,

fell 8% after reporting disappointing results from its Medicare Advantage business, holding the sector back as the S&P 500 rose 1% for the day.

So much for one day’s action in the stock market.

What might back Krinsky’s idea about the opportunity in the healthcare sector is that it is expected to show the second-highest compound annual growth rate from 2023 through 2025, based on weighted consensus estimates among analysts polled by FactSet:

| Sector or index | Two-year estimated EPS CAGR through 2025 | Two-year estimated sales CAGR through 2025 |

| Information Technology | 16.6% | 9.3% |

| Healthcare | 15.1% | 6.2% |

| Consumer Discretionary | 14.9% | 7.2% |

| Communication Services | 14.9% | 5.8% |

| Industrials | 12.8% | 5.3% |

| Financials | 10.8% | 5.7% |

| Materials | 8.2% | 2.2% |

| Utilities | 7.8% | 3.3% |

| Consumer Staples | 7.1% | 3.3% |

| Real Estate | 5.2% | 5.9% |

| Energy | 3.0% | -0.4% |

| S&P 500 | 12.4% | 5.3% |

| Source: FactSet | ||

The healthcare sector is expected to show the third-highest sales CAGR through 2025 among the S&P 500 sectors. One simple way to spread your risk and invest in the entire sector is the healthcare Select Sector SPDR exchange-traded fund

XLV,

which holds all 64 stocks in the sector, weighted by market capitalization.

Commodities-market news

New ETFs make it easy to bet on the price of bitcoin. This may affect gold’s status as a vehicle for hedging.

Getty Images

Myra P. Saefong explains how U.S. oil producers are achieving record output even as the total number of domestic rigs declines.

She also explains how the advent of bitcoin

BTCUSD,

ETFs threatens the market for gold

GC00,

More on commodities: ‘The squeeze is on.’ Uranium prices hit record and industry watchers see further to go

Time is running out

Interest rates will move lower, which means savers who want the highest rates should consider committing to longer-term CDs.

Getty Images

If you are pleased to be earning more than 4% in a savings account right now, don’t get too comfortable: Those rates will plunge when the Federal Reserve reverses course and begins to lower the target range for the federal-funds rate, which is currently at 5.25% to 5.50%, as part of the central bank’s efforts to fight inflation.

With inflation coming down, the Fed may begin a policy switch later this year. And that means savers had better think about locking in high CD rates. Beth Pinsker looks at how savers can lock in the best interest rates and overcome a common reluctance to make a commitment.

More from Beth Pinsker: Your employer is now allowed to match your emergency savings

A wonderful trend for long-term investors

Jeremy Owens has good news: He has rolled out the first episode of On Watch, a podcast from MarketWatch. He also wrote a companion piece that underlines a long-term trend of operating improvement for U.S. companies that is expected to continue.

Will artificial intelligence make it harder for you to move on with your career?

Getty Images

For years, job applicants have tried to include the right key words in their résumés to help them pass through employers’ simple automated screens. But now artificial intelligence is being put to greater use in the hiring process. Weston Blasi describes the new role of AI in hiring, while busting common myths about the process.

More on careers:

More on AI:

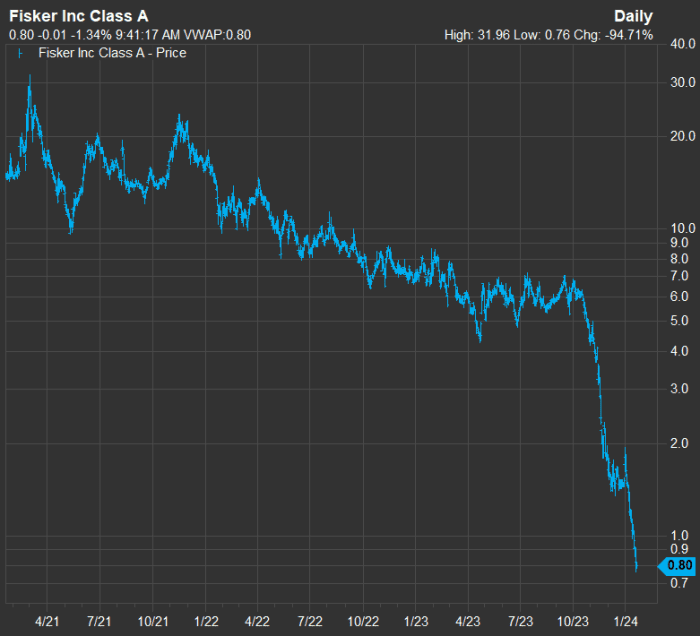

Fisker shorts had better cover

Fisker’s stock has tanked, and short sellers are being warned that it is time to close out their positions.

Fisker Inc.

When an investor or trader shorts a stock, it means they borrow the shares, sell them immediately and hope the price drops so they can buy them back, return them to the lender and pocket the difference.

If the share price falls as the trader expects, the trader will have to decide when to “cover” the position, which means to buy back the shares. If the stock price rises, the trader is looking at a paper loss, and if the price rises above a certain level, the trader’s broker will require collateral to be delivered to protect the broker from a loss. A short squeeze is when a large group of investors races to cover short positions all at once, causing the share price to rise quickly.

According to the most recent available data from FactSet, more than 47% of Fisker Inc.’s

FSR,

shares have been shorted. This means that if you want to place a new short bet against this stock, you may have some difficulty doing so. You will have to pay the lender for the privilege of borrowing the shares.

Now look at this three-year chart for Fisker’s share price:

The time is ripe for Fisker shorts to cover.

That is quite a fall to a price below a dollar from a peak of just under $32 in March 2021.

Early Friday, shares of Fisker bounced a bit after CFRA analyst Garrett Nelson warned traders with short positions that it was time to cover.

Other company news

Regulators appear to believe it would be risky to consumers for Amazon to have a corner on the market for vacuuming robots.

Getty Images

Shares of iRobot Corp.

IRBT,

sank 40% early Friday after the Wall Street Journal reported that European regulators were likely to block the company’s deal to be acquired by Amazon.com Inc.

AMZN,

On Thursday, the iShares Semiconductor ETF

SOXX

rose more than 3%, driven by stronger-than-expected sales guidance from Taiwan Semiconductor Manufacturing Co.

TSM,

whose American depositary receipts rose 10% that day.

Apple Inc.

AAPL,

made an unusual move this week, with discount pricing for iPhones in China.

After a federal judge blocked JetBlue Corp.’s

JBLU,

planned acquisition of Spirit Airlines Inc.

SAVE,

on Tuesday, Spirit’s shares fell 47% to close at $7.92. Then it fell another 22% on Wednesday to close at $6.14, and another 7% on Thursday to close at $5.70.

J.P. Morgan analyst Jamie Baker wrote on Tuesday that the judge’s decision was actually a good outcome for JetBlue.

Spirit may have difficulty finding other suitors unless it restructures its debt or comes up with a viable plan to improve its operations.

Then again, Spirit’s shares reversed direction Friday morning, with a 24% gain to $7.08, after the airline provided investors with an update on its financial position.

Consider buying a smaller house

Aarthi Swaminathan writes the Big Move column. This week she helps a reader who is thinking about buying a house Florida. There are many factors to consider, especially insurance.

More from Aarthi Swaminathan: These Americans are struggling to pay their bills on time: ‘Financial stress appears to have risen,’ New York Fed says

A dose of sense for investors and traders

Mark Hulbert analyzes market data to help investors take a logical approach to financial decisions. Here are three of his most recent articles:

The Moneyist navigates rough financial waters

MarketWatch illustration

Quentin Fottrell — the Moneyist — tackles difficult money matters that are often related to disagreements within families. Here are some of his recent responses to readers’ questions:

Good stocks at good prices

Getty Images/iStockphoto

Mark Phillips, an equity strategist at Ned Davis Research, published a list of 31 “wonderful European companies at a fair price” on Tuesday, based on historical data and current share prices. Here’s a further pruning of his list to 10 companies, based on estimates through 2025.

Michael Brush: A huge trading opportunity could be coming if the Biden administration reforms marijuana laws

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.