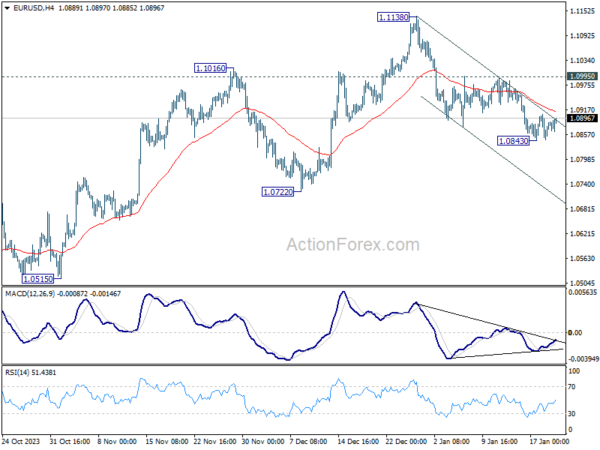

EUR/USD’s fall from 1.1138 resumed to 1.0843 last week, then recovered. Initial bias stays neutral this week for some consolidations. But further decline is expected as long as 1.0995 resistance holds. Below 1.0843 will target 1.0722 support next. Decisive break there will argue that whole rise from 1.0447 has completed, and target this low.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

In the long term picture, a long term bottom is in place at 0.9534 on bullish convergence condition in M MACD. It’s still early to call for bullish trend reversal with the pair staying inside falling channel in the monthly chart. Nevertheless, sustained trading above 55 M EMA (now at 1.1078) and break of 1.1274 resistance will raise the chance of reversal and target 1.2348 resistance for confirmation.