USDJPY fell on Tuesday after BoJ kept ultra-low rates unchanged, as yen strengthened on growing hopes that the central bank will start tightening policy soon.

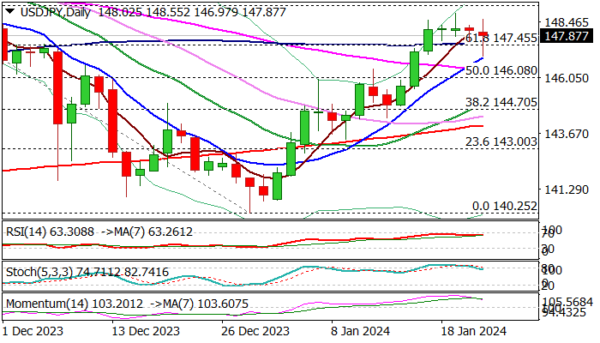

Fresh dip comes after a triple daily Doji candle, which signaled strong indecision and generating an initial signal that larger uptrend is stalling, and reversal may follow.

Fading bullish momentum on daily chart and stochastic emerging from overbought territory, add to negative signals, though verification of initial signal will require close below cracked pivotal supports at 147.54/45 (100DMA / broken Fibo 61.8% of 151.90/140.25).

In such scenario, fresh bears will face more tough supports at 146.78/73 (Fibo 23.6% of 140.25/148.80 / daily Ichimoku cloud top), violation of which will further weaken near-term structure and expose next pivotal supports at 145.53/32 (Fibo 38.2% / daily cloud base).

Caution on failure to sustain break below 100 DMA which would keep the price action in extended sideways mode, but biased lower as long as the price stays below 149.00 resistance zone.

Res: 146.97; 148.80; 149.15; 149.70

Sup: 147.45; 146.92; 146.78; 146.43