- It’s a packed week ahead with key central bank decisions and big data releases

- Will the Fed (Wednesday) and Bank of England (Thursday) signal rate cuts?

- US jobs report, Eurozone GDP & CPI will also be crucial

- Plus, Aussie inflation and an OPEC meeting

Fed meets: more pushback or a cautious green light?

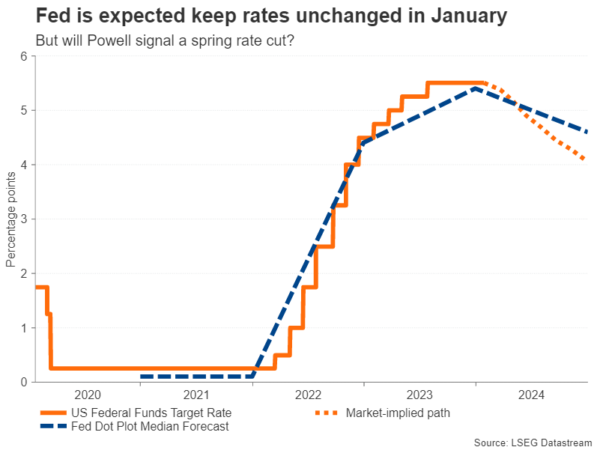

The Federal Reserve’s January policy meeting will undoubtedly be the highlight of the coming week as investors remain convinced a dovish pivot is drawing closer. Speculation about the timing and scale of rate cuts by the Fed have been the dominant market theme for some time now. The soundbites from Fed officials in the run up to Wednesday’s decision have been on the hawkish side and market pricing has become better aligned with the Fed’s guidance, but nevertheless, there is still a significant gap that needs to be closed.

With no change in policy anticipated and no dot plot to dissect, investors will be watching for any fresh hints on the timing of the first rate reduction by Chair Powell in his press conference. Powell will probably steer away from giving a precise timeline for cutting rates, while attempting to dampen expectations for a policy shift as early as March. However, it’s also unlikely that Powell will want to completely rule out a cut in the first half of the year and this would be supportive of risk assets and possibly negative for the US dollar.

Will Powell and jobs data be on the same page?

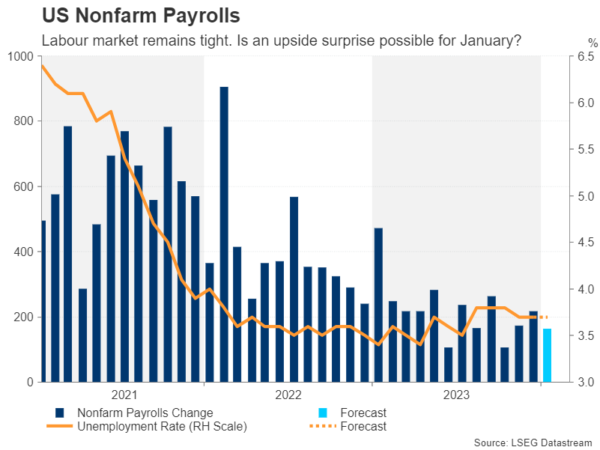

But the Fed will not have the final say on the dollar’s direction as the latest nonfarm payrolls report is due on Friday. Despite fears that higher rates would lead to a massive jobs cull, everything for now seems to point to a soft landing in the labour market, which would almost certainly translate to the same for the US economy.

After unexpectedly heating up in December, the jobs market likely cooled in January. Employment is projected to have risen by 162k versus 216k in the prior month. The unemployment rate is forecast to stay unchanged at 3.7%, while average hourly earnings are expected to maintain a moderate pace, growing by 0.3% month-on-month in January.

Aside from the NFP report, there’s a raft of other releases to keep an eye on. The home price index by S&P CoreLogic Case-Shiller will kick things off on Tuesday and the latest consumer confidence gauge is also due the same day as well as the JOLTS job openings for December. The Chicago PMI and the ADP private employment survey will follow on Wednesday. On Thursday, the closely watched ISM manufacturing PMI is expected to hold steady at 47.4 in January, and finally on Friday, factory orders for December will wrap up the week.

Another upside surprise in the headline payrolls print would not bode well for those betting on an early rate cut and the dollar could spike up in a knee-jerk reaction in such a case. However, unless there’s a very large beat, a solid number would probably not sway rate cut expectations dramatically if the other data aren’t as equally strong and more importantly, if Powell strikes a balanced tone.

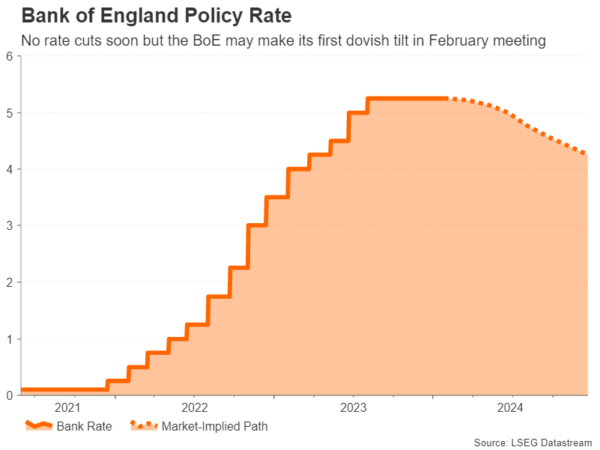

Bank of England to take a dovish turn

The Bank of England meets on Thursday to set policy for the first time in 2024. Like the Fed and ECB before it, the BoE is widely expected to keep interest rates on hold as inflation in the UK, whilst falling, remains far above the BoE’s 2% target. Nevertheless, the February meeting could mark a turning point for the central bank’s fight against inflation as the BoE may drop its tightening bias and the three MPC members that had continued to vote for a hike even after the pause in September may end their dissent.

Such a move would signal the first step towards an eventual rate cut and comes after the tumble in headline CPI in October and November. The pound could weaken in the immediate aftermath, but a neutral stance would not alter much the view that the BoE won’t be as aggressive as the Fed and ECB in slashing rates this year.

Yet, despite Governor Andrew Bailey being somewhat firmer than his counterparts lately in reinforcing the message that rates would have to stay higher for longer, there is a small possibility of a dovish surprise. Should the Bank’s updated economic forecasts point to inflation falling towards 2% quicker than earlier anticipated, policymakers may remove the emphasis on keeping policy restrictive “for an extended period of time”.

Moreover, if Bailey opens the door to a rate cut in his press briefing, sterling could come under more substantial pressure.

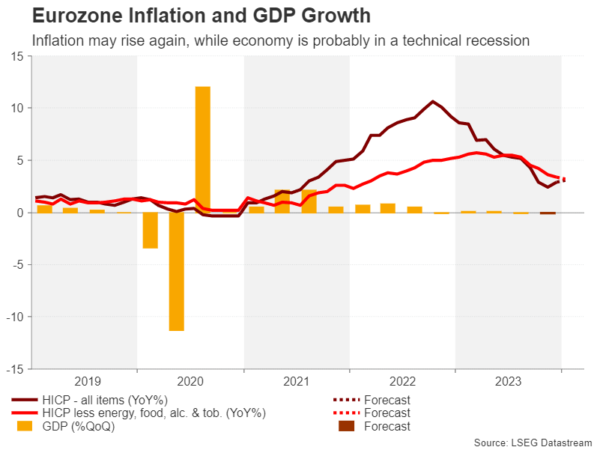

Eurozone economy probably in recession

The flash estimate of fourth quarter GDP growth in the euro area is out on Tuesday and may confirm what many suspect already. The Eurozone economy is expected to have contracted by 0.1% in the final three months of 2023, having shrunk by a similar proportion in the third quarter. This would put it in a technical recession, though the overall picture is one of stagnation rather than a full-blown downturn.

A worse-than-expected reading would likely hurt the euro and would place the currency on a negative footing whichever way rate cut expectations evolve after that. This is because a hawkish ECB would rekindle overtightening concerns against a weaker economic backdrop, while a dovish shift would only fuel all the rate cut speculation.

Just as critical for the euro will be Thursday’s flash CPI numbers. Headline inflation in the bloc edged up from 2.4% to 2.9% y/y in December as the effect of lower energy prices dropped out of the calculations. A further increase is forecast for January, with CPI predicted to climb to 3.1% y/y.

However, this might not necessarily prompt investors to reassess their bets of ECB policy easing as the uptick is expected to be temporary, hence, any boost for the euro could be limited.

Aussie eyes CPI data and Chinese PMIs

Moving to the Asia-Pacific region, the Australian dollar will be keeping tabs on some domestic and Chinese indicators. There’s been some good news for China-sensitive currencies like the aussie in the past week as Beijing has stepped up efforts to support the economy via more lending as well as boost the local stock market.

Chinese releases in the coming week will mainly comprise the manufacturing surveys for January due on Wednesday (official PMI) and Thursday (Caixin PMI). But for aussie traders, the quarterly CPI figures out of Australia on Wednesday will be a bigger priority.

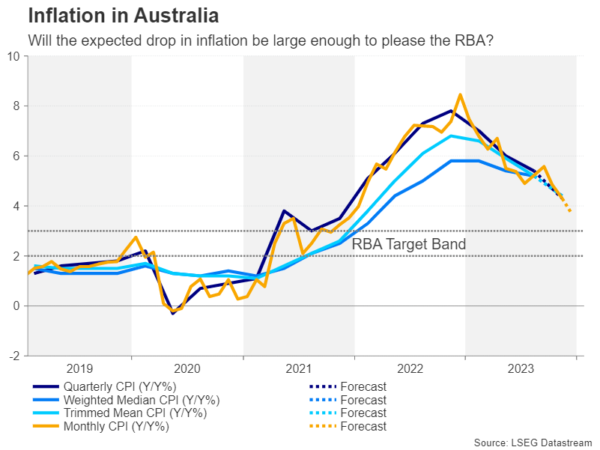

The RBA meets on February 6 so the CPI data could provide vital clues as to whether or not Governor Michele Bullock will tone down her hawkish rhetoric. Australia’s inflation rate stood at 5.4% y/y in the third quarter and analysts are looking for a decline to 4.3% in Q4. A larger-than-forecast fall would be negative for the aussie.

Will BoJ Summary reveal anything new?

In Japan, the latest stats on unemployment (Tuesday), industrial production and retail sales (Wednesday) are on the agenda. But for the yen, the focus will be on the Bank of Japan’s Summary of Opinions of the January meeting, which is published on Wednesday.

Governor Ueda sounded more upbeat about the prospect for higher wages and hitting the 2% inflation goal after the meeting. Any further hints in the summary about policymakers edging closer to exiting negative interest rates could bolster the yen.

OPEC+ to stay the course

Lastly, OPEC and non-OPEC countries are scheduled to hold an online meeting on Thursday to discuss production quotas. It will be the cartel’s first gathering after Angola’s departure in December. OPEC+ members are unlikely to announce any changes to output in February as the production cuts of 900,000 barrels a day agreed last November only came into effect in January.

But any signs of disagreements or difficulty by some countries in meeting the quotas could raise further doubts about additional cuts later in the year, weighing on oil prices.