Tentative risk-on sentiment is perceptible in Asian session, as Japan’s Nikkei rallied with energy shares lifted by rally in oil prices. Concurrently, stock markets Hong Kong are continuing their near-term rebound, reflecting cautious optimism in the region. Nevertheless, this momentum has not translated into significant activity in the forex markets, which are showing a slow start to the week. Australian and New Zealand Dollars are seeing mild gains, while Dollar, Euro, and Sterling are softening.

Trading activity is expected to remain subdued for the remainder of the day, considering the lack of significant economic data releases scheduled. However, the coming week promises to be exceedingly eventful, with Fed and BoE rate decisions, alongside a flurry of high-impact economic data including US Non-Farm Payrolls and Eurozone GDP and CPI figures. These events are poised to inject significant volatility and potentially redefine market trends.

NZD/USD weakened slightly after data from New Zealand showed sharp contraction in both exports and imports. Technically, for now, further decline is expected for 61.8% retracement of 0.5771 to 0.6368 at 0.5999. Decisive break there will solidify the case that corrective pattern from 0.6537 has already started the third leg. Deeper fall would then be seen to 0.5771 support and possibly below. Nevertheless, sustained trading above 55 D EMA (now at 0.6137) will neutralize the bearish view and bring stronger rebound instead.

In Asia, at the time of writing, Nikkei is up 0.80%. Hong Kong HSI is up 0.65%. China Shanghai SSE is down -0.29%. Singapore Strait Times is down -0.04%. Japan 10-year JGB yield is up 0.0089 at 0.729.

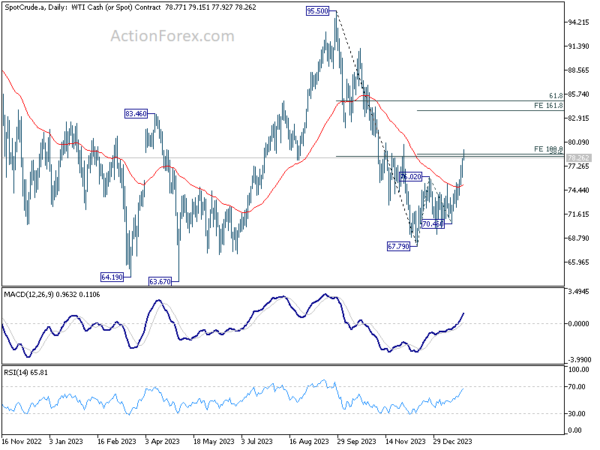

WTI oil edges closer to 80 following escalation in Middle East and US troop fatalities

Notable rally is seen in oil markets as the week commences, with WTI crude oil marching towards 80 handle. This rise is largely driven by escalating tensions in the Middle East. Over the past weekend, a drone strike in Jordan, which has been linked to Iran, resulted in death of three US troops and injuries to as many as 34. Adding to regional instability, ongoing aggressive maritime attacks by Yemen’s Houthi rebels in the Red Sea continue to disrupt traffic and heighten geopolitical tensions.

Technically, WTI is now pressing an important near term cluster resistance at 38.2% retracement of 95.50 to 67.79 at 78.37, and 100% projection of 67.79 to 76.02 from 70.46 at 78.69. Sustained break of this level will solidify the case that fall from 95.50 has completed at 67.79.

In this bullish scenario, rise from 67.79 is at least a correction to fall from 95.50, with prospect of being the third leg of the pattern from 63.67 low. In either case, next target will be 161.8% projection at 83.77.

Nevertheless, rejection by 78.37/69, followed by 75.93 will argue that rebound from 67.79 has completed already, and keep near term outlook neutral at best.

New Zealand’s goods exports down -8.7% yoy in Dec, imports fall -13% yoy

The New Zealand economy had a significant downturn in international trade during December, with goods exports dropping by -8.7% yoy, amounting to a decrease of NZD 568B, resulting in exports totaling NZD 5.9B. Concurrently, goods imports saw a more pronounced fall of -13%yoy, which translates to a reduction of NZD 896m, culminating in imports of NZD 6.3B. This overall downturn in trade activities led to a monthly trade deficit of NZD 323m, which, while substantial, was less severe than the anticipated deficit of NZD 975m.

A notable aspect of this trade activity is the geographical distribution of these declines. Among New Zealand’s key trading partners, China marked the most significant decrease in exports, with a reduction of NZD 295m, indicating a -16% drop. This was followed by declines in exports to EU (-20% drop, NZD 75m), Japan (-17% drop, NZD 54m), US (-4.6% drop, NZD 38m), and Australia (-0.8% drop, NZD 6m).

On the import side, US led the fall with a dramatic -40% reduction, amounting to NZD 390m less in imports. Other significant decreases in imports were observed from China (-12% drop, NZD 185m), the European Union (-14% drop, NZD 152m), and Australia (-9.8% drop, NZD 79m). However, South Korea bucked this trend with a striking 113% increase in imports to New Zealand, totaling an additional NZD 356m.

ECB’s Knot: Wage growth a missing piece in cooling inflation to target

ECB Governing Council member Klaas Knot expressed confidence in inflation reverting to 2% target in 2025, but pointed out a crucial element that remains uncertain: the alignment of wage growth with this lower inflation expectation.

In an interview with the Dutch TV program Buitenhof on Sunday, Knot noted he “credible prospect” of it returning to the 2% target in 2025. However, “the only piece that’s missing is the conviction that wage growth will adapt to that lower inflation”.

Knot highlighted the current disparity between wage growth, at 5%, and the desirable rate of around 2.5% for sustainable price stability. He stressed that a gradual shift to this lower wage growth rate is essential for ECB to consider lowering interest rates.

He also anticipated “a couple of years” where wage growth may exceed inflation, “allowing a restoration of purchasing power,” However, he assured that this scenario would not hinder the trajectory towards the 2% inflation target.

Nevertheless, he suggested that this scenario wouldn’t necessarily impede the achievement of 2% inflation target. He argued that there’s sufficient leeway in profit margins to accommodate these higher salaries without triggering a significant secondary surge in prices. However, Knot cautioned that this is a “narrow path,” requiring careful navigation.

A week of high stakes

This upcoming week is set to be exceptionally active in the financial world, with a multitude of high-profile events scheduled. Central to focus is FOMC rate decision while US ISM and Non-Farm payrolls are Equally significant. BoE is also in the spotlight, as it prepares to unveil a new set of economic projections. For the Eurozone, GDP and CPI flash data are set to be pivotal for the timing of ECB rate cut. Additionally, Australia CPI, Canada’s GDP, BoJ Summary of Opinions, and China’s PMIs are also on the radar, each carrying the potential to impact market dynamics in their respective regions.

Expectations are set for Fed to maintain the interest rate at 5.25%-5.50%. The critical question at the forefront is when Fed will initiate interest rate cuts this year and the pace at which they will proceed.

If Fed adheres to the projections outlined in its December dot plot, which suggested three rate cuts of 25 basis points each throughout the year, the most likely timing for the initial reduction appears to be June. However, market dynamics, as reflected in fed fund futures, suggest a nearly 90% probability of the first cut occurring as early as May, indicating a more aggressive stance by traders, albeit slightly tempered recently.

Chair Jerome Powell is unlikely to provide explicit guidance on these speculations during the upcoming FOMC meeting and press conference. This restraint may render the event less impactful than anticipated.

Instead, the market’s attention might pivot towards key economic indicators like US consumer confidence, ISM manufacturing index, and Non-Farm Payrolls report. Resurgence in the manufacturing sector, coupled with persistently tight job market and robust wage growth, could potentially influence Fed’s decision, leading them to delay rate cuts to ensure continuous progress in disinflation.

BoE is set to hold its course and keep interest rate unchanged at 5.25%. Tightening bias could be dropped finally. However, after stronger than expected December inflation data, it’s unlikely for the central bank to openly commit to a pathway of policy loosening, not yet.

A key aspect of the BoE meeting will be the unveiling of the latest set of quarterly economic projections. These projections will offer valuable insights into the bank’s view around inflation and growth. Market participants will closely scrutinize these projections for clues about the timing and scale of future rate cuts. Additionally, the vote split among policymakers could emerge as a significant wild card, and inject volatility into the market.

For Eurozone, the spotlight is on GDP and CPI flash data, providing insights on understanding the effectiveness of the transmission of monetary policy and their influence on growth and inflation. Market participants could be particularly attuned to any downside surprises in these data releases. A weaker-than-expected GDP or CPI figure could tilt market sentiment towards a more dovish stance, intensify discussions bets that ECB will pull ahead its first rate cut.

Australia’s Q4 CPI data is also a potential market move. This data is anticipated to show continued moderation in inflation in Australia, but the central question remains: Will this be a sufficient catalyst for RBA to shift away from tightening bias at the meeting on February 6? Additionally, Aussie is also poised for volatility in response to China’s latest PMI data.

Here are some highlights for the week:

- Monday: New Zealand trade balance.

- Tuesday: Japan unemployment rate; Australia retail sales; France consumer spending, GDP; Swiss Trade balance, KOF economic barometer; Italy GDP; Germany GDP; UK M4 money supply, mortgage approvals; Eurozone GDP; US house price index, consumer confidence.

- Wednesday: BoJ summary of opinions, Japan industrial production, retail sales, consumer confidence, housing starts; New Zealand ANZ business confidence; Australia CPI; China PMIs; Germany import prices, reail sales, CPI flash, unemployment; Swiss retail sales, Credit Suisse economic expectations; US ADP employment, employment cost index, Chicago PMI, Fed rate decisions.

- Thursday: Australia building approvals, import prices, NAB business confidence; Japan PMI manufacturing final; China Caixi PMI manufacturing; Swiss PMI manufacturing; Eurozone PMI manufacturing final, CPI flash, unemployment rate; UK PMI manufacturing final, BoE rate decision; US jobless claims, non-farm productivity, ISM manufacturing, construction spending.

- Friday: New Zealand building permits; Australia PPI; France industrial production; US non-farm payrolls, factory orders.

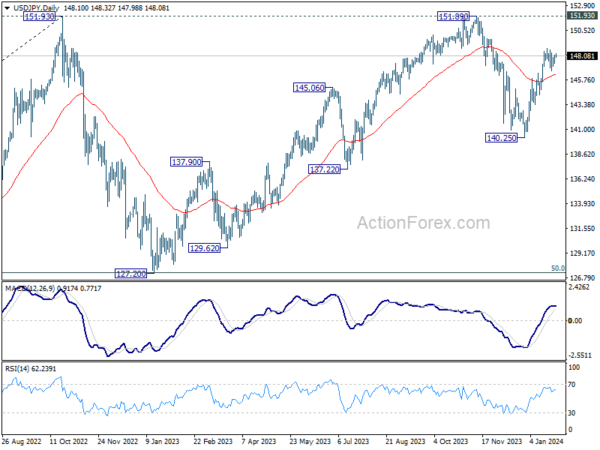

USD/JPY Daily Outlook

Daily Pivots: (S1) 147.65; (P) 147.93; (R1) 148.45; More…

Intraday bias in USD/JPY remains neutral for the moment, as consolidation continues below 148.79. With 145.97 resistance turned support intact, further rally is in favor. As noted before, corrective fall from 151.89 should have completed at 140.25 already. Break of 148.79 will resume the rise from there for retesting 151.89/93 key resistance zone.

In the bigger picture, stronger than expected rebound from 140.25 dampened the original bearish review. Strong support from 55 W EMA (now at 142.33) is also a medium term bullish sign. Fall from 151.89 could be a correction to rise from 127.20 only. Decisive break of 151.89/93 will confirm resumption of long term up trend. This will now be the favored case as long as 140.25 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | -323M | -975M | -1234M | -1250M |