Dollar declined broadly overnight, US Treasury’s borrowing plan for Q1 that spurred rally in the stock market, propelling it to new record highs while simultaneously exerting downward pressure on yields. Despite this shift, the greenback remains largely within its recent trading range. Market participants seem to be holding the substantial bets for now, awaiting the outcome of FOMC rate decision scheduled for tomorrow. Furthermore, the upcoming non-farm payroll data on Friday is also expected to be a key determinant in shaping the next moves.

Meanwhile, Euro remains the weakest performer this week so far, with market speculation rife about ECB possibly starting interest rate cuts as early as April. Today’s Eurozone GDP data is pivotal and could significantly shape these rate cut expectations. Sterling and Swiss Franc are also showing relative softness, trailing Dollar as the third and fourth weakest currencies, respectively.

Contrastingly, New Zealand Dollar has been outperforming, buoyed additionally by hawkish stance of RBNZ Chief Economist, who indicated a reluctance to pivot towards policy easing. Australian Dollar is tracking as the second strongest currency, although its momentum is somewhat dampened by the sharp pullback in stock markets in Hong Kong and China. Meanwhile, Japanese Yen is continuing its near-term corrective recovery, currently ranking as the third strongest.

Technically, EUR/CAD’s fall from 1.5041 finally resumed and hit as low as 1.4509. Deeper decline is now expected to 100% projection of 1.5041 to 1.4564 from 1.4733 at 1.4256, which is close to 38.2% retracement of 1.2867 (2022 low) to 1.5111 (2023 high) at 1.4254. Strong support could be seen there to completed the decline, as well as the corrective pattern from 1.5111. But still, break of 1.4733 resistance is needed to confirm short term bottoming first. Otherwise, rise will stay on the downside in case of recovery.

In Asia, at the time of writing, Nikkei is up 0.19%. Hong Kong HSI is down -2.10%. China Shanghai SSE is down -0.87%. Singapore Strait Times is up 0.31%. Japan 10-year JGB yield is down -0.0094 at 0.716. Overnight, DOW rose 0.59%. S&P 500 rose 0.76%. NASDAQ rose 1.12%. 10-year yield fell -0.069 to 4.091.

US stocks hit new records amid reduced Treasury borrowing forecast

US stock markets rose strongly overnight, with both DOW and S&P 500 reaching new record highs. This coincided with a mild dip in 10-year yield as bonds rebounded. A key factor influencing this movement was Treasury’s announcement of a reduction in its borrowing forecast for Q1. The Treasury indicated plans to borrow USD 760B, which is USD 55B less than its previous estimate in October. This adjustment is attributed to “projections of higher net fiscal flows and a higher beginning of quarter cash balance,” as per the Treasury’s statement.

Technically, strong resistance could still be seen from 100% projection of 28660.94 to 34712.28 from 32327.20 at 38378.54 to bring a near term pull back. Break of 37796.71 support will indicate the start of a correction back to 55 D EMA (now at 36737.49).

Conversely, decisive break of 38378.54 could trigger reacceleration to 138.2% projection at 40690.15, which is slightly above 40k psychological level, before topping.

RBNZ’s Conway: We still have a way to go on inflation

RBNZ Chief Economist Paul Conway struck a hawkish tone in a speech today, tempering market expectations for imminent policy easing. Conway acknowledged the effectiveness of current monetary policy in slowing the economy and reducing inflation. But he emphasized noted that the journey to achieving the target midpoint is far from over. His remarks also indicated that recent weaker GDP data would not automatically lead to a dovish shift in RBNZ’s approach.

Conway stated, “Monetary policy is working, with the economy slowing and inflation falling. But we still have a way to go to get inflation back to the target midpoint.” He added that the upcoming February Statement would offer more insights, grounded in comprehensive data analysis.

Furthermore, Conway pointed out recent GDP revisions don’t necessarily imply a significant reduction in the economy’s capacity pressures. He highlighted that private demand, which is more responsive to interest rate changes, has seen upward revisions, particularly in consumption and business investment.

Conway also pointed out that annual non-tradable inflation at 5.9% was higher than RBNZ’s forecasts, even though headline CPI slowed to 4.7% in Q4 while core inflation have also fallen.

Australia’s retail sales falls -2.7% mom, spending remains subdued

Australia retail sales turnover fell -2.7% mom to AUD 35.19B in December, worst than expectation of -1.9% mom. Annually, sales fell -0.8% yoy.

Ben Dorber, ABS head of retail statistics, said: “The large fall in retail turnover in December was caused by a fall in discretionary spending. Consumers brought forward some of their usual December spending to November to take advantage of Black Friday sales.

“While there was a large seasonally adjusted fall in December, retail turnover rose 0.1 per cent in trend terms. This shows that underlying retail spending remains subdued when we look through the volatile movements over recent months in the lead up to Christmas.”

Looking ahead

Eurozone Q4 GDP is the main focus in European session, while GDP from France, Italy, and Germany will also be published. Swiss will release trade balance and KOF. UK will release M4 money supply and mortgage approvals. Later in the day, US will release consumer confidence and house price index.

EUR/USD Daily Outlook

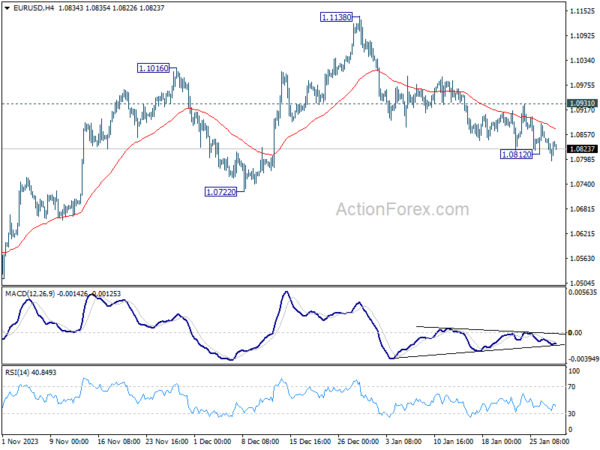

Daily Pivots: (S1) 1.0803; (P) 1.0827; (R1) 1.0858; More…

EUR/USD’s decline from 1.1138 is resuming by breaching 1.0812 and intraday bias is back on the downside. Current fall should target 1.0722 support next. Decisive break there will argue that whole rise from 1.0447 has completed, and target this low. However, on the upside, break of 1.0931 will turn bias back to the upside for stronger rebound instead.

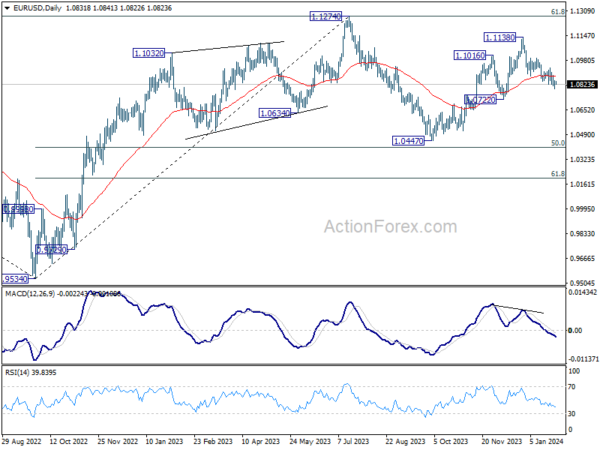

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Dec | 2.40% | 2.50% | 2.50% | |

| 00:30 | AUD | Retail Sales M/M Dec | -2.70% | -1.90% | 2.00% | 1.60% |

| 06:30 | EUR | France Consumer Spending M/M Dec | 0.00% | 0.70% | ||

| 06:30 | EUR | France GDP Q/Q Q4 P | 0.00% | -0.10% | ||

| 07:00 | CHF | Trade Balance (CHF) Dec | 2.55B | 3.71B | ||

| 08:00 | CHF | KOF Leading Indicator Jan | 98.2 | 97.8 | ||

| 09:00 | EUR | Italy GDP Q/Q Q4 P | 0.00% | 0.10% | ||

| 09:00 | EUR | Germany GDP Q/Q Q4 P | -0.30% | -0.10% | ||

| 09:30 | GBP | M4 Money Supply M/M Dec | 0.20% | -0.10% | ||

| 09:30 | GBP | Mortgage Approvals Dec | 53K | 50K | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | -0.10% | -0.10% | ||

| 10:00 | EUR | Eurozone Economic Sentiment Jan | 96.2 | 96.4 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Jan | -9 | -9.2 | ||

| 10:00 | EUR | Eurozone Services Sentiment Jan | 8 | 8.4 | ||

| 14:00 | USD | S&P/CS Composite-20 HPI Y/Y Nov | 4.80% | 4.90% | ||

| 14:00 | USD | Housing Price Index M/M Nov | 0.20% | 0.30% | ||

| 15:00 | USD | Consumer Confidence Jan | 113.2 | 110.7 |