Ethereum, often hailed as the pioneer of blockchain technology and decentralized applications (DApps), has faced numerous challenges due to its scalability limitations. With high gas fees and network congestion becoming major pain points for users and developers, Ethereum is advancing its scalability natively. This shift is marked by Ethereum’s detailed roadmap following its transition to a proof-of-stake (PoS) consensus mechanism, often referred to as “the Merge.” However, meanwhile, the Ethereum community has been actively exploring Layer-2 scaling solutions. two prominent contenders in this space are Optimism and Arbitrum, both aiming to address Ethereum’s scalability woes and improve the overall user experience.

In this blog, we will delve into the details of Optimism and Arbitrum layer2 solutions, comparing their features, benefits, and use cases.

Understanding Layer-2 Scaling

Layer-2 solutions are designed to alleviate the Ethereum scalability issues by creating secondary layers, or “off-chain” environments, where a significant portion of transactions and computational work can be processed. These layers operate independently but are anchored to the Ethereum mainnet, to ensure the security and decentralization of the entire network.

Optimism and Arbitrum both fall under the category of Layer-2 rollups, a specific type of Layer-2 solution. Rollups achieve their scaling goals by summarizing multiple transactions into a single one, which is then added to the primary blockchain. This way, they allow for the transfer of Ether or ERC-20 tokens with a throughput ranging from approximately 2,000 to 4,000 transactions per second (TPS), all while incurring significantly lower gas fees compared to the Ethereum mainnet baseline. This approach significantly reduces the computational load on the mainnet while preserving the integrity of the transactions and data, ensuring that Layer-2 users can interact with the blockchain in a secure and decentralized manner.

A Brief Overview of Optimism

Here’s everything to know about Optimism in brief. Basically, it operates as an auxiliary protocol built on Ethereum’s layer-1 mainnet, effectively streamlining transaction processing. This technique involves aggregating multiple transactions into a batch off-chain and then transmitting a summary to the mainnet, lightening the computational load on the primary network. The result is quicker and more cost-effective transactions.

Optimism takes compatibility seriously. It introduces the Optimism Virtual Machine (OVM), which mirrors the functionality of the Ethereum Virtual Machine (EVM). This ensures that smart contracts deployed on Optimism behave in a manner similar to those on the Ethereum mainnet. This compatibility minimizes migration efforts for developers, who can leverage their existing knowledge and infrastructure to deploy and interact with contracts on Optimism seamlessly.

Furthermore, Optimism has developed unique features such as the Optimism Bridge, leading to quick and straightforward asset transfers between Ethereum and Optimism. It provides users with increased flexibility in managing their assets across these networks.

A Brief Overview of Arbitrum

Arbitrum, like Optimism, is dedicated to maintaining a developer-friendly ecosystem while enhancing Ethereum’s scalability. It accomplishes this by extending existing Ethereum software, ensuring that Ethereum developers can comfortably transition to the Arbitrum platform and efficiently engage in activities like Arbitrum crypto token development.

Arbitrum’s strength lies in its proprietary technology stack, Nitro, which serves as a blockchain network-powered solution. Nitro is purpose-built to augment scalability and throughput, providing a smoother experience for users and developers. Like Optimism, Arbitrum employs a rollup architecture, aggregating and processing transactions off-chain, thus effectively alleviating congestion on the Ethereum mainnet.

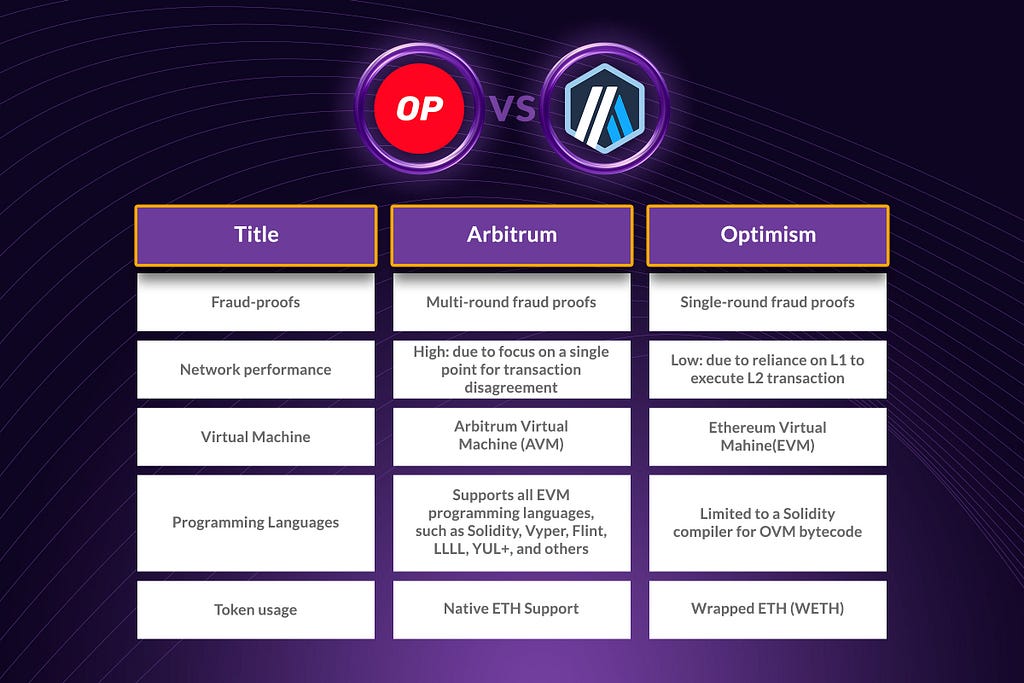

Fraud-Proof Mechanisms

Primarily, Optimism and Arbitrum differ in how they approach fraud-proof mechanisms. Optimism rollup protocols employ a single-round fraud-proof mechanism that verifies transaction validity on Ethereum’s mainnet. This approach is known for its quick transaction finality, ensuring that users experience faster confirmation times. However, it’s important to note that this approach may result in slightly higher gas fees due to the necessity of on-chain computation.

On the other hand, Arbitrum takes a different path by utilizing a multi-round fraud-proof mechanism, which involves multiple verification rounds that occur off-chain. This approach, while potentially introducing slightly longer confirmation times, provides enhanced security and cost-effectiveness. It does so by reducing the on-chain computational load and associated fees, thus offering an intriguing alternative for users and developers.

In simpler words, Optimism is quicker but might cost more as it relies on Ethereum’s main network (L1). Arbitrum takes a bit longer but is a more economical choice.

Programming Language Support

When it comes to programming language support, Optimism and Arbitrum take different routes, offering distinct advantages for developers.

Optimism utilizes the Ethereum Virtual Machine (EVM) and Arbitrum features its proprietary Arbitrum Virtual Machine (AVM). This distinction means that Optimism’s programming language options are somewhat limited to Solidity, Ethereum’s native programming language.

In contrast, Arbitrum supports all Ethereum Virtual Machine (EVM) programming languages, broadening its appeal and ease of adoption for developers with diverse language preferences and expertise. For instance, it introduces a versatile feature called Stylus, which empowers developers to deploy programs written in popular languages such as Rust, C, C++, and more. This expanded language support enhances flexibility and interoperability, enabling developers to tap into existing codebases and seamlessly integrate a variety of technologies within the Arbitrum ecosystem.

Comparing Ecosystem

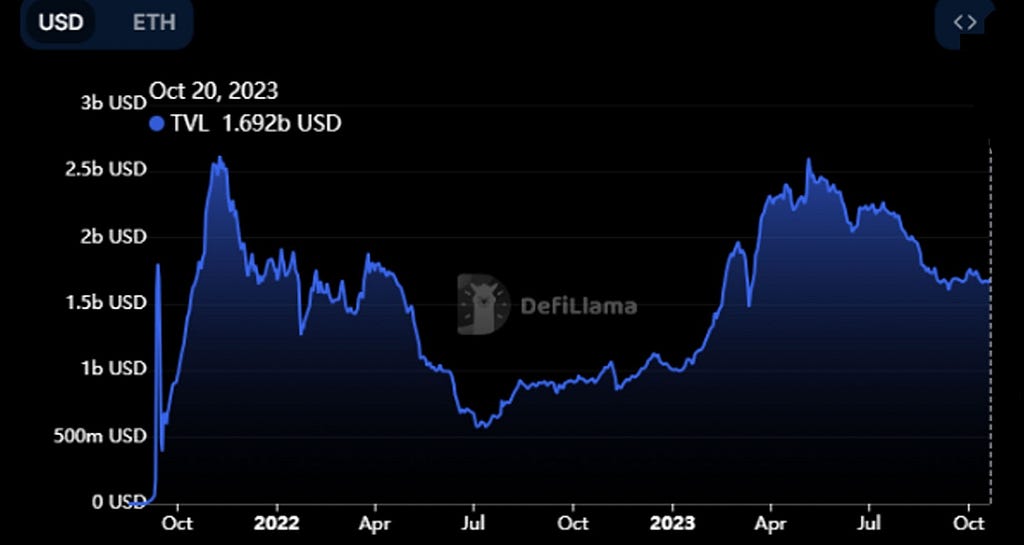

When we look at the ecosystems of Arbitrum and Optimism, various metrics illustrate differences in their growth and composition.

One key metric to consider is Total Value Locked (TVL), a measure of the total value of assets locked within a platform. According to Defillama, as of writing this, Arbitrum boasts a TVL of USD 1.69 billion, significantly surpassing Optimism’s TVL of USD 600 million. This substantial gap indicates that more capital and assets are being deployed and actively utilized on the Arbitrum platform.

otocol Activity

When we examine the activity within the ecosystems of Arbitrum and Optimism, it becomes evident that Arbitrum takes the lead in multiple key metrics, demonstrating robust growth and heightened user engagement.

In terms of the number of supported protocols, Arbitrum impressively hosts 405, significantly outpacing Optimism’s 164. This signifies a broader array of choices for developers and users within the Arbitrum network.

Arbitrum also excels in daily active addresses and daily transactions when compared to Optimism, indicating a higher level of user participation and overall network activity. The recent Arbitrum airdrop notably contributed to an increase in transaction and address counts, though these are expected to stabilize over time.

Furthermore, in a notable comparison between etherscan.io and arbiscan.io, Arbitrum has been processing more daily transactions than even the Ethereum mainnet itself. This underscores Arbitrum’s capacity to efficiently manage substantial transaction volumes. These combined metrics underscore Arbitrum’s strong position in terms of adoption, network activity, and ongoing growth within the Layer-2 ecosystem.

Gas Fees

Gas fees play a crucial role in determining the cost and efficiency of transactions on both Optimism and Arbitrum. Let’s explore how these fees are structured on each platform:

Optimism Gas Fees

Optimism’s gas fees consist of two components:

Layer-1 Data/Security Fee: Unlike Ethereum, all transactions on Optimism are also published to the Ethereum network to ensure security and data availability for syncing an Optimism node. This incurs a layer-1 data/security fee, which includes factors such as the current Ethereum gas price, the gas cost of publishing the transaction, a fixed overhead cost, and a dynamic overhead cost. This fee maintains the connection between Optimism and Ethereum.

Layer-2 Execution Fee: Similar to Ethereum’s gas fees, this fee is incurred when executing transactions on the Optimism network. It is calculated based on the gas used by the transaction multiplied by the attached gas price, covering computational and storage resources.

Optimism plans to reduce gas fees through the Bedrock upgrade, which optimizes data compression and aims for a 40% reduction in gas fees and a 90% reduction in deposit confirmation times.

Arbitrum Gas Fees

Gas fees on Arbitrum chains comprise both layer-1 and layer-2 components:

Layer-1 Component: This compensates the Sequencer for posting transactions on layer-1 Ethereum. The fee is calculated based on compressed transaction data size and the current layer-1 data price on Arbitrum.

Layer-2 Component: This covers the costs of operating the layer-2 chain, including computation and storage charges, as well as fees for running layer-2-specific precompiles based on resource usage.

Arbitrum sets a gas price floor to prevent the layer-2 gas price from falling too low, with varying thresholds depending on the Arbitrum chain. Notably, Arbitrum processes transactions on a first-come, first-served basis, eliminating the need for priority fees.

Roadmap and Upcoming Initiatives

Both Arbitrum and Optimism have exciting plans for the future, as they strive to improve their technology and grow their user base. Here are some of the key initiatives that each chain is working on:

Optimism

- OP Stack and Optimism Bedrock: These are components that enable scalability and interoperability for various Layer-2 solutions, not just optimistic rollups. Optimism Bedrock is the first release, which will improve the modularity, performance, and future-proofing of the chain. It will also reduce transaction fees, optimize deposits and withdrawals, and improve node syncing.

- Base Layer-2 Blockchain with Coinbase: Optimism is collaborating with Coinbase to develop a new blockchain that will use the OP Stack to create a network of interoperable rollups. This will allow seamless communication and infrastructure sharing between different Layer-2 networks. This partnership could lead to increased adoption and growth for Optimistic rollup solutions.

Arbitrum

- ARB Token Drop: Arbitrum distributed the ARB token to decentralize its ecosystem and incentivize more users to join the network.

- Arbitrum Nova: Arbitrum launched Arbitrum Nova, a sidechain that offers up to 90% lower gas fees than the main Arbitrum chain. It has lower security guarantees, but it is ideal for high-bandwidth applications like gaming and social platforms. Some prominent marketplaces like OpenSea and TreasureDAO have already deployed on Nova, providing critical infrastructure for future projects.

- Arbitrum Orbit and Stylus Upgrade: Arbitrum Orbit allows developers to launch Layer-3 solutions on top of Arbitrum without permission, leveraging its technology. The upcoming Stylus upgrade will introduce “EVM+”, which will enable contracts written in languages like Rust, C, and C++ to interact synchronously with existing Solidity-based contracts. This will open doors to a wider developer community, improve network performance, and reduce fees.

These initiatives show the ongoing efforts of both chains to advance their technology and attract more users and developers to their ecosystems.

Conclusion

Both Optimism and Arbitrum emerge as promising solutions to Ethereum’s scalability challenges. Their unique approaches cater to a diverse range of users and developers, promising an improved user experience on the Ethereum network. As the blockchain landscape continues to evolve, these Layer-2 solutions are poised to play a pivotal role in shaping the future of decentralized applications and digital assets. However, the choice between Optimism and Arbitrum hinges on specific use cases, developer preferences, and the evolving needs of the Ethereum ecosystem.

Participants in the Ethereum community can make informed decisions by closely monitoring the progress and advancements of these solutions. By doing so, they actively contribute to the evolution of decentralized finance and blockchain technology, helping to build a more scalable, efficient, and user-friendly blockchain future.

Original Source — https://www.codezeros.com/optimism-vs-arbitrum-comparing-the-two-popular-ethereum-layer2-rollups

Optimism Vs. Arbitrum: Comparing the Two Popular Ethereum Layer-2 Rollups was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.