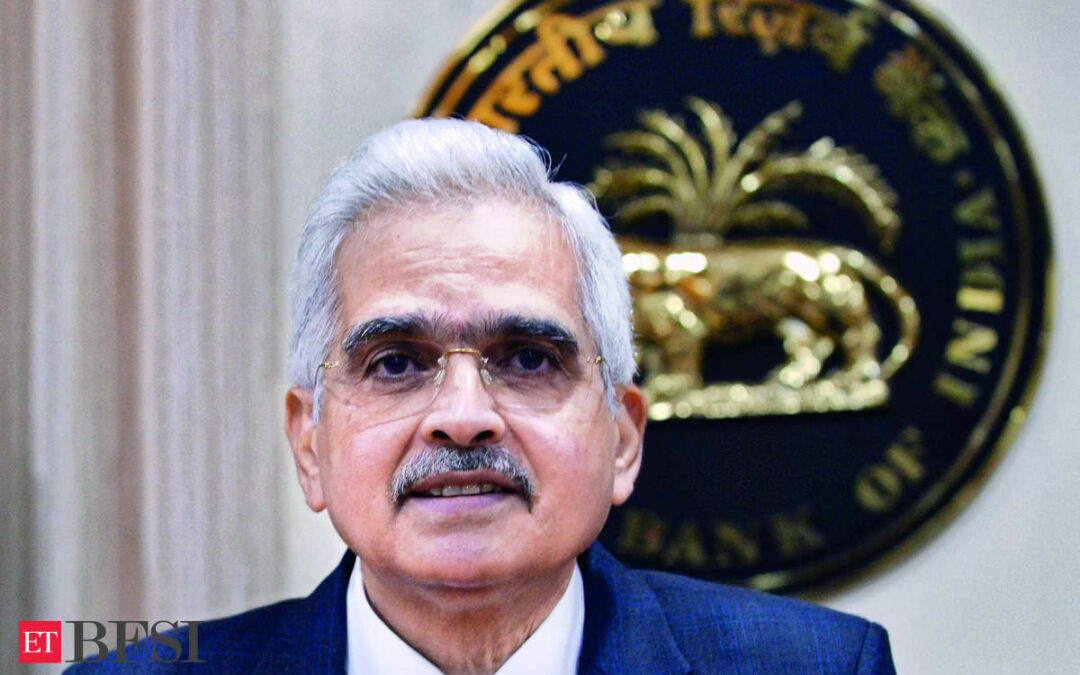

Mumbai: In the central bank’s first meeting with bank chiefs since July 2023, RBI governor Shaktikanta Das on Wednesday raised the issue of outlier growth seen in personal loans segment and the exposure to NBFCs.

In Nov 2023, RBI had hiked risk weights on unsecured personal loans and lending to NBFCs to slow down bank credit to these segments, which have been seeing runaway growth.

Das said that the domestic financial system was resilient, but there is no scope for any complacency, and banks should continue to maintain their vigil around the build-up of risks. The RBI governor, however, complimented bankers on their improved financial performance.

According to sources, RBI is also concerned about the quality of underwriting in loans, which are distributed through intermediaries, including digital players.

Das noted the issues relating to business model viability. He also said that banks must ensure that they do not relax underwriting standards when disbursing loans through co-lending arrangements with NBFCs.

Bank credit for personal loans grew 23% year-on-year as of Dec 2023 to Rs 13.3 lakh crore. Total loans in the individual loan segment (including home, consumer and auto loans) rose 28.5% to Rs 51.7 lakh crore. Bank credit to NBFCs grew 15% year-on-year to Rs 15.2 lakh crore for the same period. The overall increase in bank credit year-on-year stood at 19.9% due to the merger of HDFC with HDFC Bank. Without the merger, bank credit growth would have been 15.6%, while credit in the individual loan segment would be 17.7%.

Das’s meeting with bankers was part of RBI’s ongoing communication with the top management of the banks it oversees. Deputy governors M Rajeshwar Rao and Swaminathan J and executive directors responsible for regulation and supervision also attended the meetings. The last such meeting took place on July 11, 2023.

The RBI governor also spoke about the need for liquidity risk management given current market conditions and sought their preparedness to meet cyber security incidents.