The year 2024 is expected to see both headwinds and tailwinds impacting business growth. While increased government spending on infrastructure and logistics and easing of inflationary pressure indicate positive factors for growth, geopolitical tensions remain an emerging issue.

It is in this context that Aon released its 29th edition Annual Salary Increase and Turnover Survey 2023-24 India. At the event, Roopank Chaudhary, Partner, Talent Solutions at Aon, and Jang Bahadur Singh, Director, Talent Solutions at Aon, highlighted the learnings from their survey across 1,400 organisations in 45 sectors.

Understanding the growth parameters

Overall, the report estimates moderate optimism in business growth this year.

Based on the projections for 2024, 16% of the companies surveyed expect high annual revenue growth of over 20%. This estimate has fallen slightly from similar revenue expectations of companies last year. However, the companies that expect a moderate annual revenue growth from 5-20% this year have increased from 46% in 2023 to 53%, according to the 2024 projections. This shows a more cautious outlook for growth among companies.

Expected salary increase and dispersion

Overall salary increase is expected to be 9.5% for 2023-24. This is marginally lower than the figure of 9.7% last year, and it is inching closer to pre-pandemic levels. One notable factor about the salary prediction is that companies are expecting a much higher dispersion.

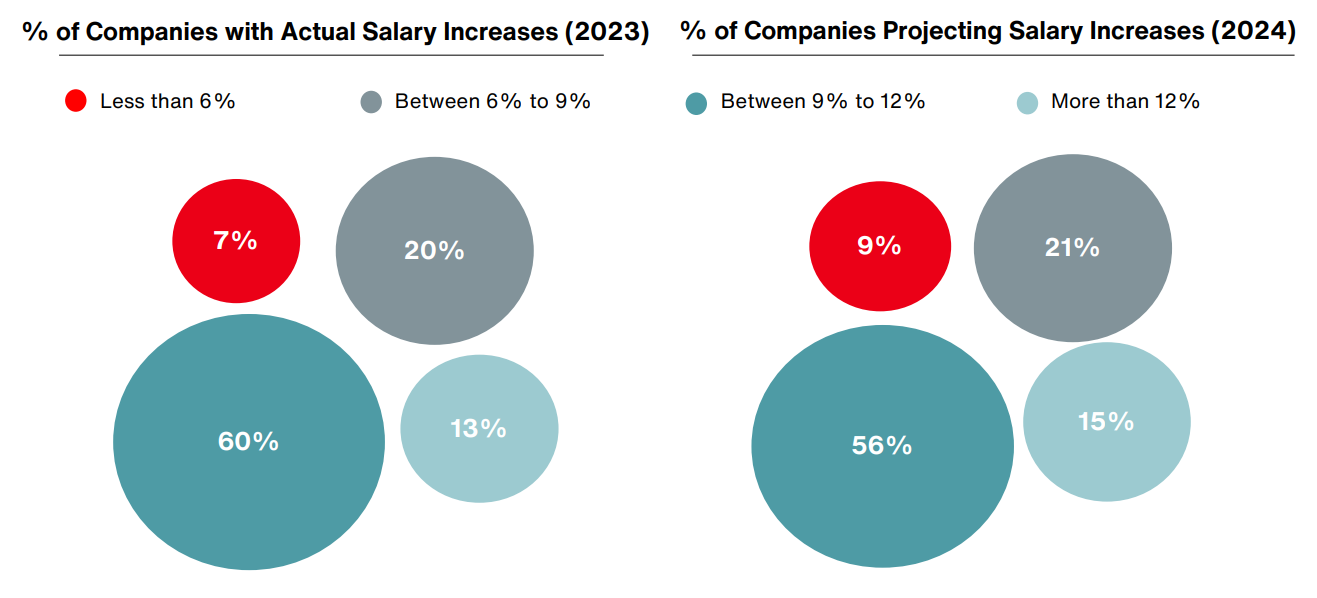

Companies that are expected to be providing an average salary increase of more than 12% have increased from 13% of the responders last year to 15% of the responders this year. However, at the lower end of salary shifts, companies that said they estimated a less than 6% increase this year have increased from 7% last year to 9% this year.At a broader level, 75% of the organisations are expected to give over 9% increase in salary in 2024.

In terms of regional benchmarks, though, India is leading on salary growth projections with average expectations for Asia-Pacific countries being at 4.1%.

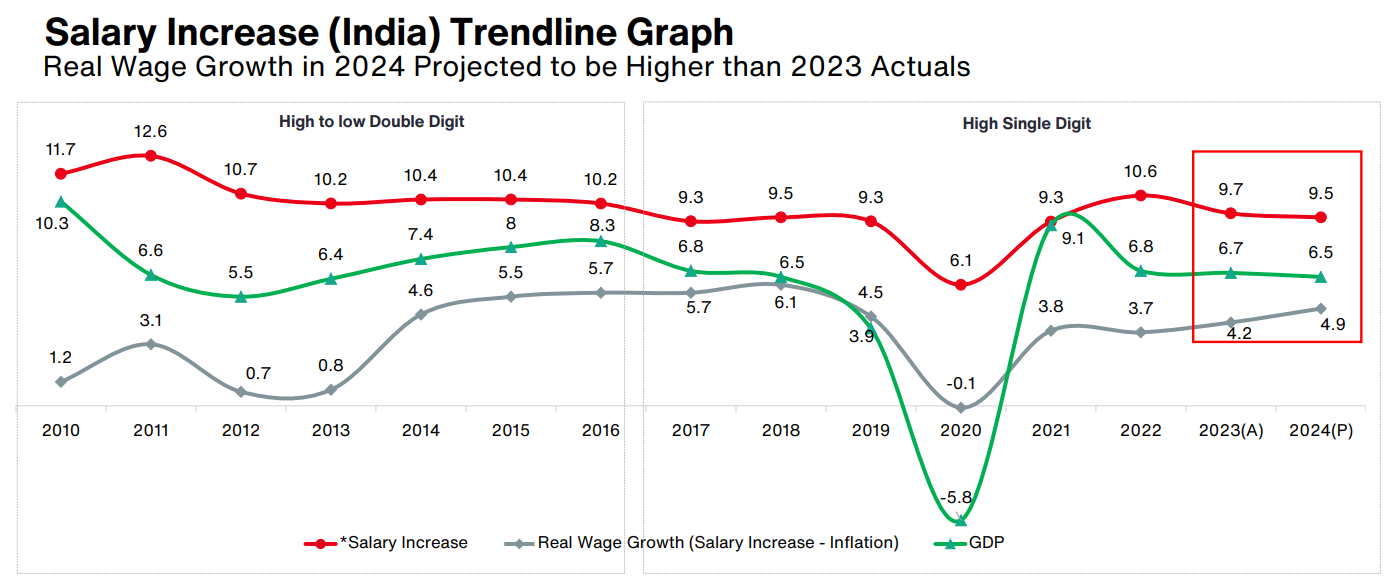

A longer term view of salary growth provided some interesting insights. From a decade-plus look at yearly salary growth, the numbers show that the percentage increase in salary growth dropped to 6.1% during the pandemic but then it sharply increased to 10.6% in 2022. These sudden highs and lows seem to have stabilised now as this year’s number is seen to be stabilising at high single digits, at a more steady level, in line with the numbers seen in 2018-2019. Meanwhile, with inflation projected to ease down, the real wage growth is expected to be higher compared with 2023.

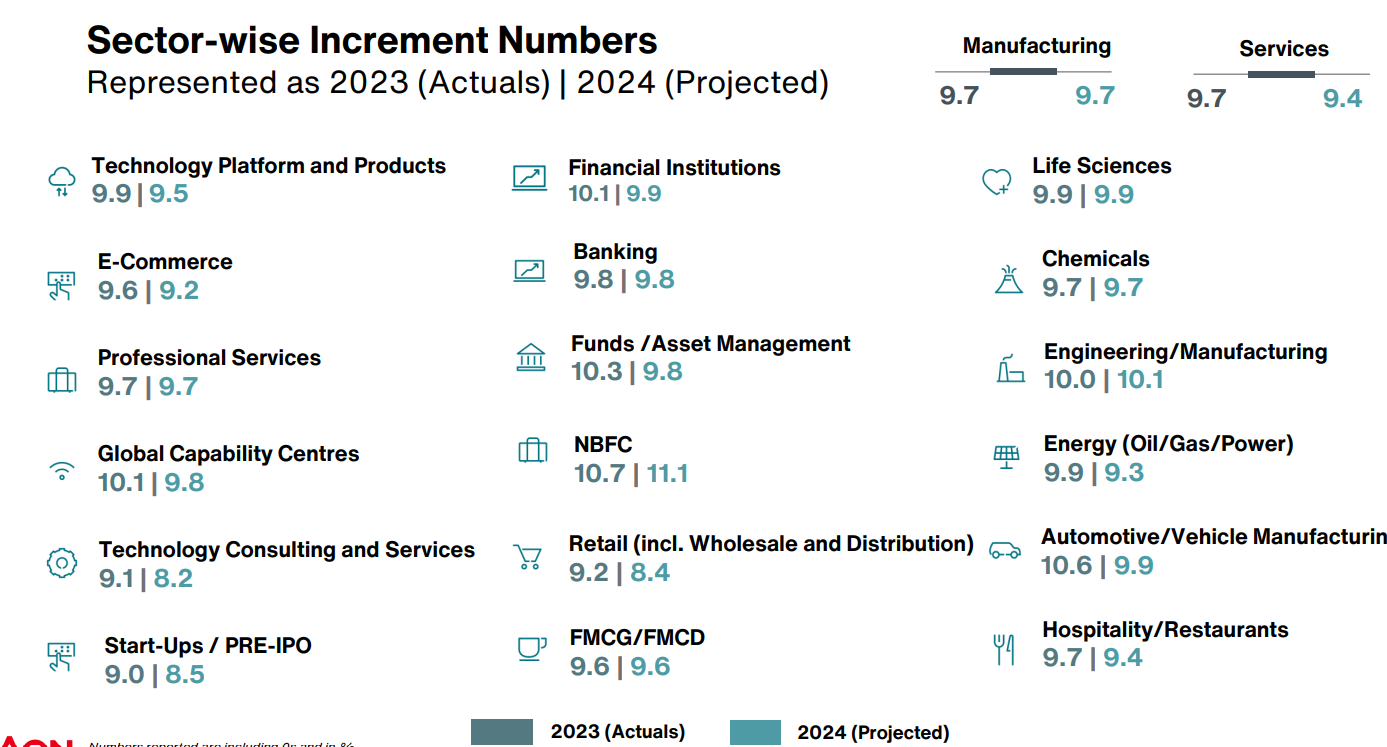

There has also been a clear divide between the salary expectations for years across manufacturing and services business. Salary projections for the year for services decreased from 9.7% last year to 9.4% this year. But, the manufacturing sector’s salary growth expectations stayed steady at 9.7% since last year.

This highlights the fact that the companies driven by manufacturing and domestic demand — such as life sciences, engineering, auto and FMCG — are expecting salary growth levels at the same level as last year or higher. Meanwhile, with possibilities of global recession and other headwinds, sectors like IT, asset management, GCCs, retail and hospitality are less optimistic about salary growth this year.

Even among financial services, one sector that is expecting high salary growth at 11.1% this year is the NBFC sector, which is driven by domestic demand and loans.

Another way to look at the salary shifts is to understand the allocations for merit and non-merit increases. While merit increases are the budgeted increases, non-merit increases are used for corrective actions through the year. The data showed that merit increases moved from 8.1% to 8.2% from 2018 to 2024.

On the other hand, for non-merit increases, which companies often use to fight off unforeseen attrition, etc, the number is very close to the 2018 number — 1.4% in 2018 and 1.3% in 2024. 2021 and 2022 had seen a major spike in these numbers. Given the fact that the budgets have reduced and attrition numbers and talent mobility have stabilised, firms today seem to be more confident that the non-merit part of the budget they may not need higher allocations.

The salary allocations show a clear trend across levels of management as well. The maximum increase is at the junior levels, at 9.9% overall this year, with 8.4% for merit increases. For middle management, those figures are 9.4% and 8.1% and for top management, the figures stand at 9.1% overall and 8.9% merit. This underscores the fact that at the higher levels of management, salary is not only a component of compensation. There are other structures such as equity that come into play here.

Attrition trends

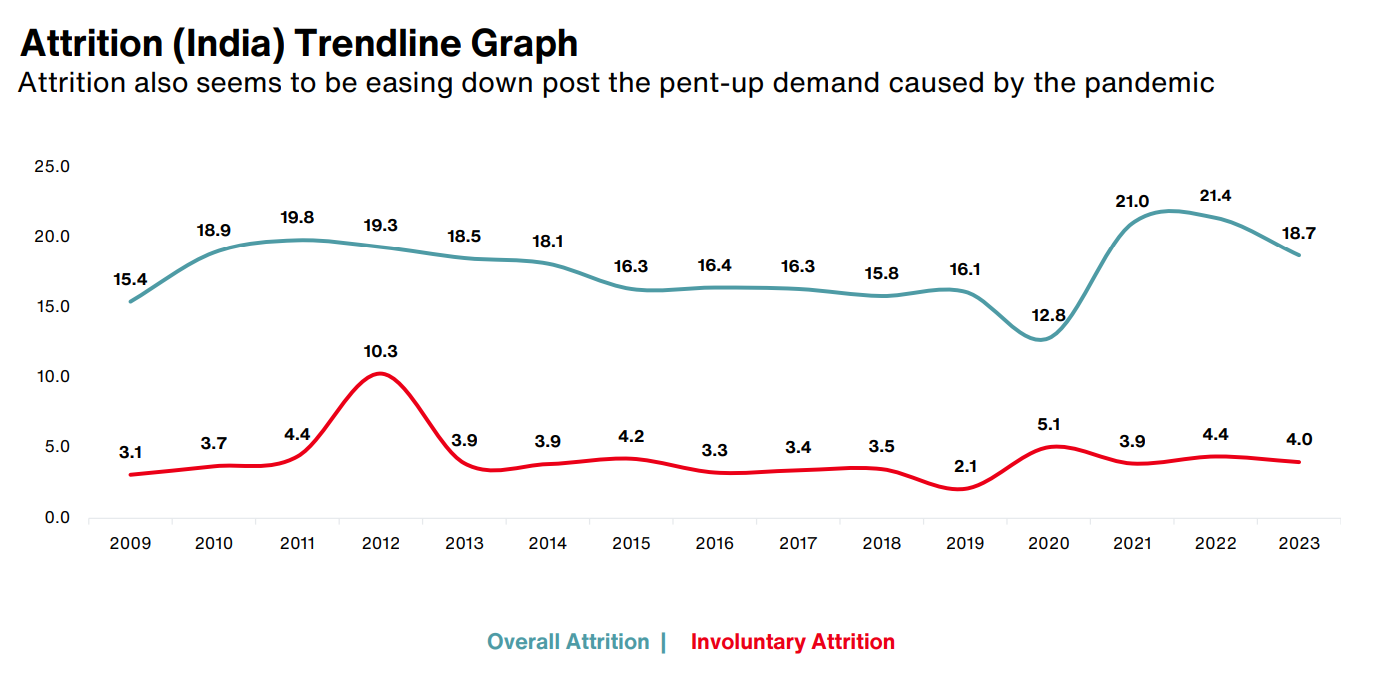

Changes in salary figures are closely correlated with attrition. The overall attrition (voluntary and involuntary) is at 18.7%. This comes after attrition had reduced to 12.8% during 2020 and reached a high of 21% during 2021 when people were talking about a resignation wave after the pandemic.

Within attrition, involuntary attrition is a critical factor given the current news around layoffs. However, the survey data shows that at overall India level, this number was largely unchanged at 4% today versus 3.1% in 2009.

At a broader level, there could be indications for softening of mass demand for talent explaining the attrition numbers. This decline in overall attrition could also mean that both employees and organisations are maintaining a watch and watch approach.

Upcoming trends

Given that we are at the cusp of disruption from AI/ML, today there is a need for newer models that allow enough room for creativity and governance. Companies need to curate people strategies to build resilience and agility and revamp talent supply to match changing demand patterns. India could play a key role in this upcoming talent disruption, according to the survey. The new workforce is looking beyond salary; experience and learning are relevant for them. Companies need to adapt to more flexible models that allow for talent mobility. Some examples include offering health benefits as part of packages and rethinking freelance composition of the workforce for both semi-skilled and highly skilled work.