Germany’s economy is struggling to emerge from a downturn in manufacturing, which is weighing on growth overall.

Gross domestic product will probably eke out a small gain this year before stronger momentum takes hold in 2025, according to the government’s estimates. Even so, stronger services activity across the rest of the continent propelled a euro-area gauge of private-sector activity to an eight-month high in February.

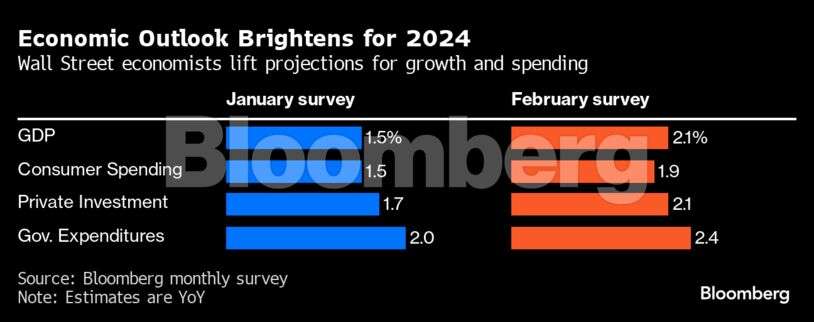

Meantime, economists are much more optimistic about US growth in the next two years, per the latest Bloomberg survey. While forecasters largely expect the US economy to lose some steam after a blockbuster 2023, a still-robust labour market and receding inflation continue to support mostly solid household demand.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, geopolitics and markets:

Europe

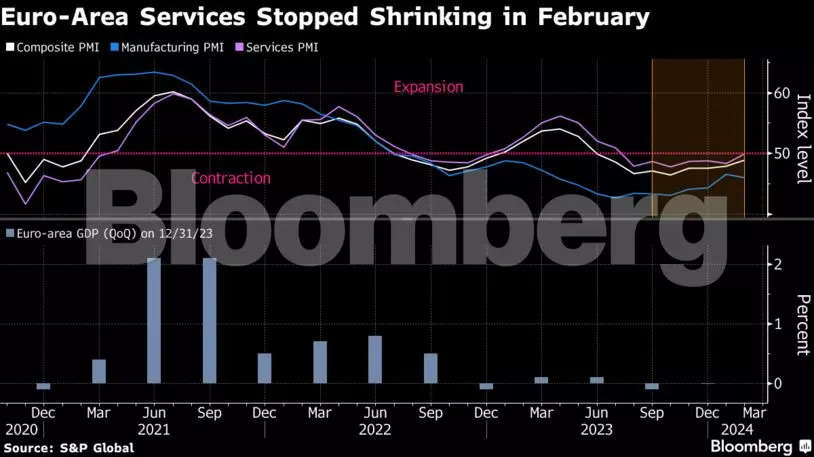

Germany sees its faltering economy expanding by just 0.2% this year — a much flatter rebound than the 1.3% that Chancellor Olaf Scholz’s government was predicting as recently as the fall. Geopolitical tensions and high interest rates are weighing on the recovery, though rising real wages and a robust labor market should help over the course of 2024, the nation’s economy minister said.

Euro-area private-sector activity hit an eight-month high, with services and stabilizing numbers across most of the region making up for an increasingly dire situation in German manufacturing. The factory gauge for the region’s biggest economy slumped to the lowest since October, revealing a decline in output alongside plummeting new orders at home and abroad.

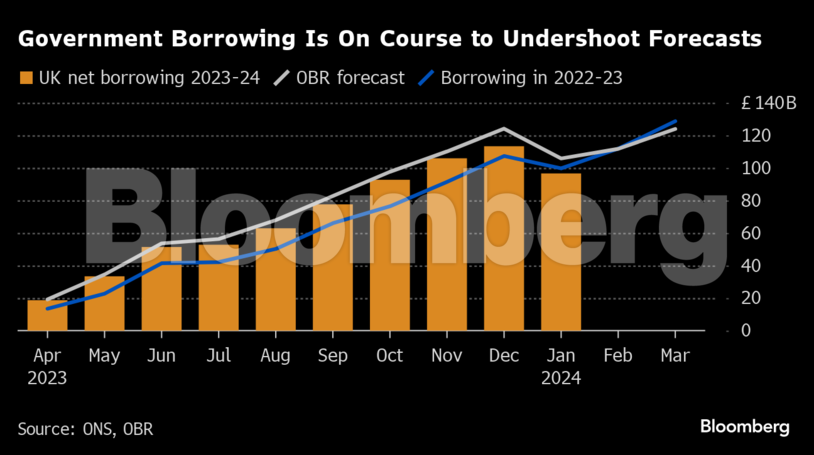

Britain delivered the biggest budget surplus on record in January, a boost for Chancellor Jeremy Hunt two weeks before he is due to announce what could be the last fiscal statement before a general election. The undershoot raises the prospect of tax cuts in the March 6 budget as Hunt comes under pressure from grassroots Conservatives to rescue their political fortunes ahead of a general election expected later this year.

US

Economists again marked down their US recession forecasts on expectations that a firm job market and sturdy consumer spending will support stronger economic growth in the near term. The economy is seen expanding at a 2.1% annualized rate this year — up from the 1.5% expected last month — amid stronger household demand and government spending, according to the latest Bloomberg monthly survey of economists.

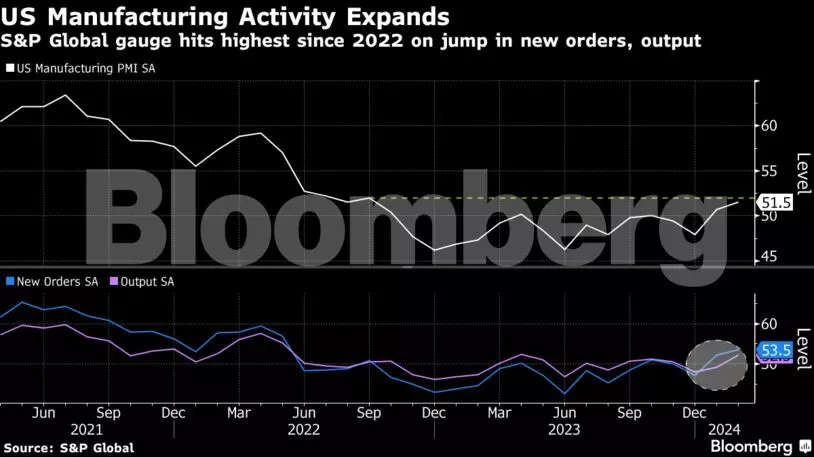

US manufacturing activity expanded at the fastest pace since September 2022, powered by stronger orders growth and suggesting producers are breaking out of an extended slump. While only modest, the gauge has shown growth in consecutive months for the first time in over a year.

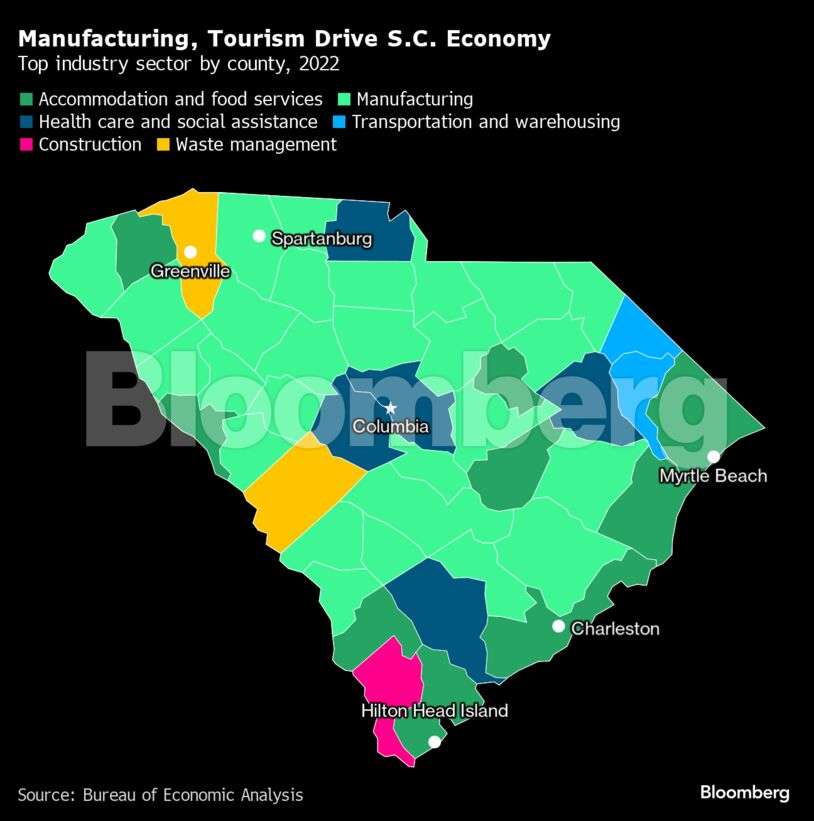

Donald Trump says he wants to bring the factories back. Nikki Haley did just that in South Carolina when she was governor. It may not save her from a home-state defeat in Saturday’s Republican primary.

Asia

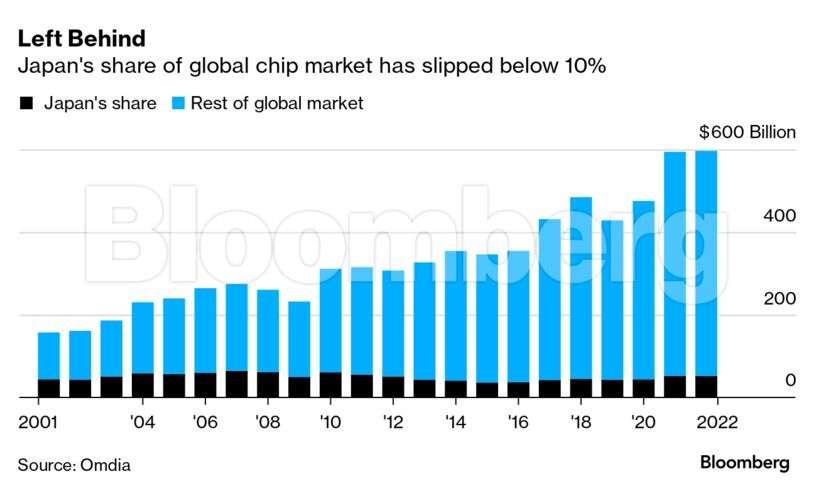

Deep in the snowy northern island of Hokkaido, Japan is pouring billions of dollars into a long-shot bet to revive its chip-making prowess and insulate its economy from growing US-China tensions. With the US and China sparring over access to the latest chipmaking expertise and equipment, Japan’s government has sensed an opportunity to leverage Washington’s concern over supply chain security to get back into a game it once dominated.

Emerging Markets

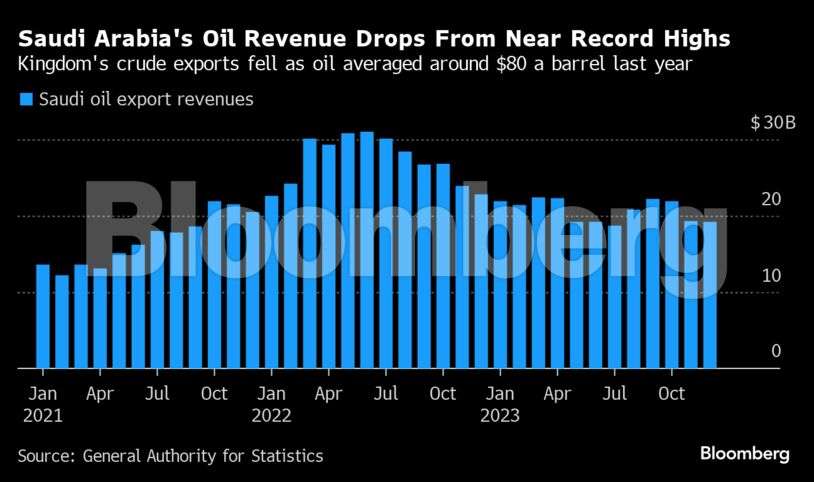

Saudi Arabia’s oil export revenues sank to $248 billion last year, a decrease of nearly $80 billion that pulled the budget back into deficit and offered a reminder of the kingdom’s dependence on high energy prices. It’s a stark reversal from a near-record haul in 2022, caused in large part by cutbacks in Saudi oil output and an average price for Brent crude that was down by almost a fifth at just over $80 a barrel in 2023.

World

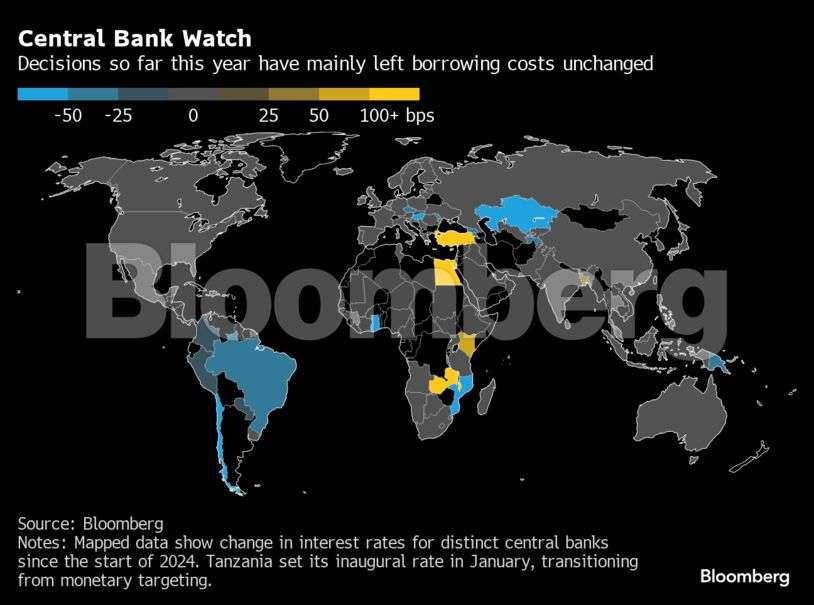

Indonesia’s central bank left its benchmark interest rate unchanged for a fourth straight month and reiterated that it would be on an extended pause to support a still vulnerable currency. The Turkish central bank shifted to more hawkish guidance after keeping interest rates on hold for the first time since May, as it moves forward under a new governor who took over earlier this month. Elsewhere, Paraguay cut rates.

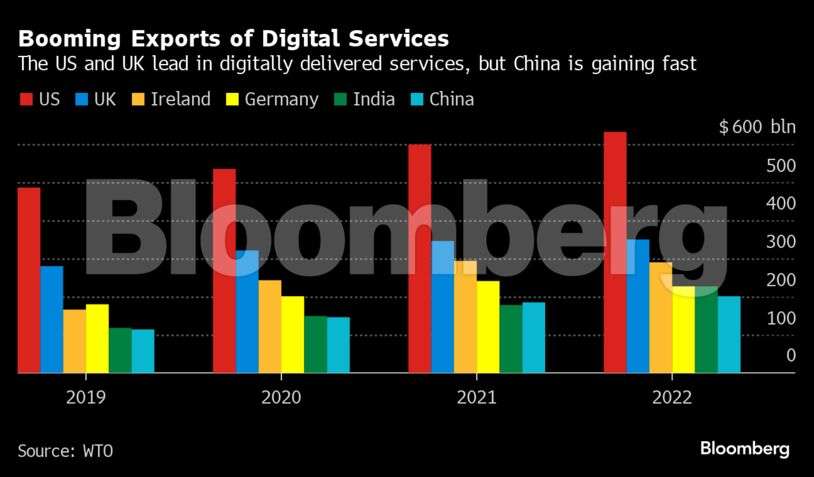

The decades-old global consensus that’s allowed e-commerce and a growing tidal wave of data to cross borders without tolls is at risk of falling apart. Emerging economies cite concerns about the dominance of US-based Big Tech – and other worries including risks from artificial intelligence, the need to protect data privacy, and the loss of customs revenue into the ether of the digital economy.