ET Wealth collaborates with Value Research to analyse top mutual funds. We examine the key fundamentals of the fund, its portfolio and performance to help you make an informed investment decision.

BASIC FACTS

DATE OF LAUNCH

17 SEPTEMBER 2004

CATEGORY

EQUITY

TYPE

FLEXI CAP

AUM*

Rs.8,689 crore

BENCHMARK

NIFTY 500 TOTAL

RETURN INDEX

WHAT IT COSTS

NAV**

GROWTH OPTION

Rs.178.68

IDCW**

Rs.23.99

MINIMUM INVESTMENT

Rs.100

MINIMUM SIP AMOUNT

Rs.100

EXPENSE RATIO# (%)

1.75

EXIT LOAD

1% for redemption within 365 days

*AS ON 31 DEC 2023

**AS ON 6 FEB 2024

#AS ON 31 DEC 2023

FUND MANAGER

DHRUV MUCHHAL/ROSHI JAIN (PIC)

7 MONTHS / 2 YEARS

Recent portfolio changes

New entrants

Piramal Pharma (Nov). Avalon Technologies, Sapphire Foods India (Dec).

Complete exits

Bank of Baroda, Larsen & Toubro, SBI Cards & Payments Services (Nov). Infosys (Dec).

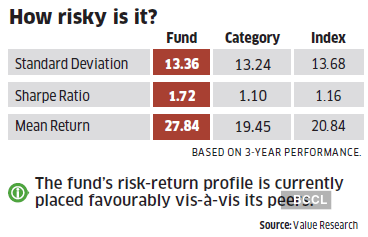

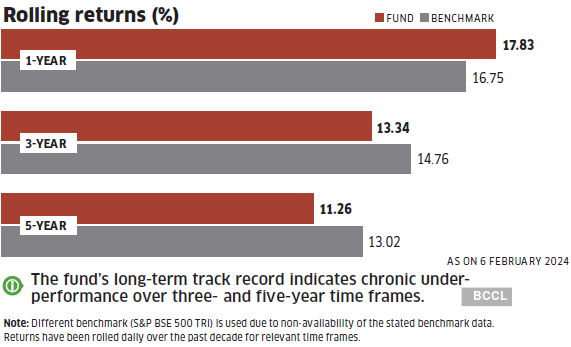

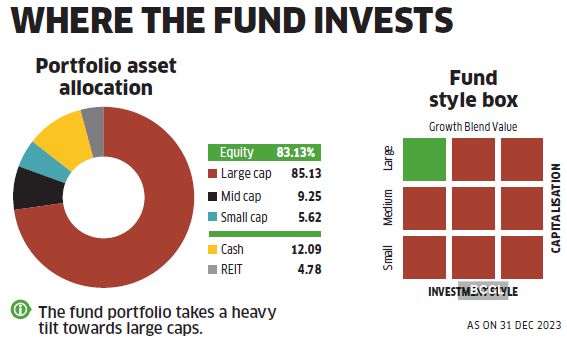

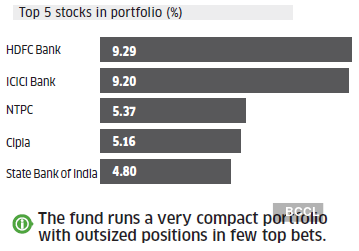

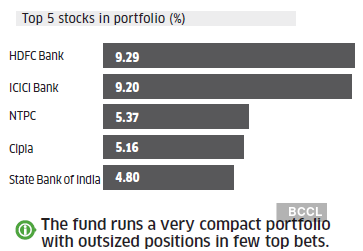

Should You Buy

This fund was earlier run as HDFC Core & Satellite, and adopted the focused mandate in 2018. While running a compact portfolio, it takes a sector-agnostic approach to provide diversification. Like many of its peers, it has a large-cap bias. It prefers fundamentally strong businesses, competitively placed in an industry with good prospects. The fund takes a long-term view and uses near-term volatility to reinforce conviction ideas. The fund’s long-term track record has shown erratic outcomes. However, it has managed a turnaround in return profile since 2021, outperforming the index consistently. A continued momentum in performance will make it a compelling offering.