Risk-on sentiment is pressuring e Swiss Franc and, to a lesser extent, Yen and Dollar today. DAX soared to new record highs, undeterred by the latest weak German consumer sentiment data, while CAC and FTSE are also marking gains. Similarly, the CAC and FTSE indices are registering gains, with U.S. futures indicating a positive start to trading.

Commodity currencies are seeing a broad upticks, led by New Zealand Dollar as it begins to recover from its recent setbacks. Euro also shows strength, while Sterling’s progress appears slightly more tempered. Despite these movements, most currencies remain within the trading ranges established last week, with Swiss Franc being the only exception.

Australian monthly CPI data is poised to a focal point for the Asian markets. Analysts are forecasting a slight increase to 3.5% in March, attributed in part to the cessation of government energy rebates. It’s important to note that the monthly CPI report offers only a partial update, with a comprehensive overview delayed until the quarterly release. Still, any downside surprise in the report could fuel speculation that RBA may start considering rate reductions sooner, placing Aussie under short-term pressure.

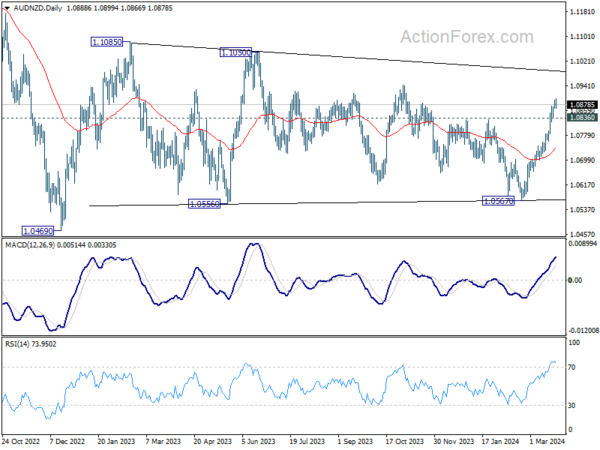

Technically, AUD/NZD is seen as extending the triangle pattern from 1.1085. After extending the rebound from 1.0567, AUD/NZD is starting to enter a zone where it could top and end this rebound. Break of 1.0836 support would be the first sign of topping and bring deeper pullback towards 55 D EMA (now at 1.0739).

In Europe, at the time of writing, FTSE is up 0.18%. DAX is up 0.76%. CAC is up 0.33%. UK 10-year yield is down -0.0235 at 3.969. Germany 10-year yield is down -0.005 at 2.371. US 10-year yield is up 0.230 at 4.269. Earlier in Asia, Nikkei fell -0.04%. Hong Kong HSI rose 0.88%. China Shanghai SSE rose 0.17%. Singapore Strait Times rose 1.10%. Japan 10-year JGB yield rose 0.0026 to 0.739.

US durable goods orders rises 1.4% mom in Feb, above exp 1.3% mom

US durable goods orders rose 1.4% mom to USD 277.9B in February, above expectation of 1.3% mom. Ex-transport orders rose 0.5% mom to USD 185.6B above expectation of 0.4% mom. Ex-defense orders rose 2.2% mom to USD 263.8B, above expectation of 1.3% mom. Transportation equipment orders rose 3.3% mom to USD 90.4B.

BoE’s Mann signals market misalignment on rate cut expectations

BoE MPC member Catherine Mann cast doubts on the financial market’s anticipation of interest rate cuts in the near term, asserting that such expectations might be overly ambitious.

Speaking to Bloomberg TV, Mann directly addressed the discrepancy, stating, “They’re pricing in too many cuts — that would be my personal view — and so in some sense, I don’t have to cut because the market already is.”

Mann further elaborated on the unique economic conditions within the UK that challenge the notion of an early rate cut, especially in comparison with the US and Eurozone.

She explained that “wage dynamics in the UK are stronger and more persistent than the wage dynamics in either the United States or the euro area. Underlying services dynamics are also stickier more persistent than either the US or the euro area.”

Thus, “it’s hard to argue that the BOE would be ahead of the other two regions, particularly the United States,” Mann added.

German GfK consumer sentiment edges up to -27.4, uncertainty overshadowing facts

In a modest uptick, Germany’s GfK Consumer Sentiment Index for April has slightly improved to -27.4 from March’s -28.8, marginally above expectation of -27.8. March’s data revealed an improvement in economic expectations and income outlooks, with the former rising to -3.1 from -6.4 and the latter to -1.5 from -4.8. However, the willingness to make purchases marginally declined from -15.0 to -15.3, and the propensity to save saw a notable drop from 17.4 to 12.4.

Rolf Bürkl, consumer expert at NIM, characterized the recovery in consumer sentiment as “slow and very sluggish.” He pointed to the fundamental pillars of real income growth and a stable job market as underpinning factors that could potentially catalyze a swift rebound in consumer sentiment.

However, the prevailing atmosphere of uncertainty and a discernible lack of future optimism among consumers is holding sentiment back. This sentiment, according to Bürkl, is stifled by the ongoing array of crises, manifesting in a pronounced reluctance to make purchases despite objectively favorable economic conditions.

“In a nutshell: The poor sentiment is overshadowing the facts,” Bürkl noted.

Australia’s Westpac consumer sentiment dips -1.8% mom, RBA triggers sharp decline

In March, Westpac Consumer Sentiment Index in Australia dropped by -1.8% mom to 84.4. This downturn is attributed to renewed concerns about the near-term economic outlook, with fears regarding inflation and interest rate hikes only easing marginally.

The survey revealed a significant shift in sentiment in responses to the RBA’s latest policy decision. Sentiment scores were markedly higher at 94.9 for those surveyed before the decision, compared to a lower 79.3 for those surveyed afterwards.

The persistence of consumer concerns, notably regarding inflation and interest rates, was evident. Many had harbored hopes for a more reassuring update from RBA on these fronts. Yet, the central bank’s governor did not entirely dismiss the prospect of additional rate hikes. This stance likely contributed to dampening consumer sentiment, as individuals grappled with the implications for personal finances and economic conditions at large.

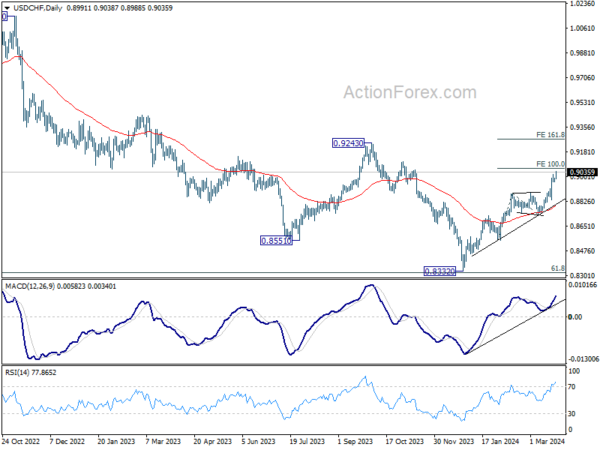

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8977; (P) 0.8986; (R1) 0.9004; More….

USD/CHF’s rally resumed after brief consolidations and intraday bias is back on the upside. Current rise from 0.8332 should target 100% projection projection of 0.8550 to 0.8884 from 0.8728 at 0.9062. Firm break there will target 0.9243 key medium term resistance next. On the downside, below 0.8964 minor support will turn intraday bias neutral and bring consolidations first. But outlook will stay bullish as long as 0.8884 resistance turned support holds.

In the bigger picture, price actions from 0.8332 medium term bottom as tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8728 support holds. But upside should be limited by 0.9243 resistance, at least on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Mar | -1.80% | 6.20% | ||

| 23:50 | JPY | Corporate Service Price Index Y/Y Feb | 2.10% | 2.00% | 2.10% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Apr | -27.4 | -27.8 | -29 | -28.8 |

| 12:30 | USD | Durable Goods Orders Feb | 1.40% | 1.30% | -6.20% | |

| 12:30 | USD | Durable Goods Orders ex-Trans Feb | 0.50% | 0.40% | -0.40% | |

| 12:30 | USD | Durable Goods Orders ex Defense Feb | 2.20% | 1.30% | -7.90% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jan | 6.60% | 6.20% | 6.10% | 6.20% |

| 13:00 | USD | Housing Price Index M/M Jan | -0.10% | 0.20% | 0.10% | |

| 14:00 | USD | Consumer Confidence Mar | 107.2 | 106.7 |