By RoboForex Analytical Department

The USD/JPY pair stabilised around 151.35 by Tuesday, not far from its recent peaks, as the weakness of the Japanese yen has prompted verbal interventions from Japanese authorities.

Japan’s Finance Minister, Shunichi Suzuki, mentioned that measures to normalise the yen are quite likely. He cited excessive volatility as increasing uncertainty for the country’s trading partners and creating adverse conditions for business operations.

Monetary policy official Masato Kanda remarked that the yen’s current weakness does not reflect fundamental factors, labelling recent depreciation waves as speculative. Kanda stated that authorities are closely monitoring currency movements and feel the need to “keep a finger on the pulse” of the market. Japan is ready to respond to yen volatility appropriately, though decisions are yet to be made.

The yen’s decline gained momentum last week when the Bank of Japan raised its interest rate for the first time in 17 years, ending eight years of negative interest rates. The capital market was prepared for this move, as the BoJ had meticulously laid the groundwork for such a step.

The Bank of Japan intends to maintain an accommodative monetary policy for an extended period, which acts against the yen’s value.

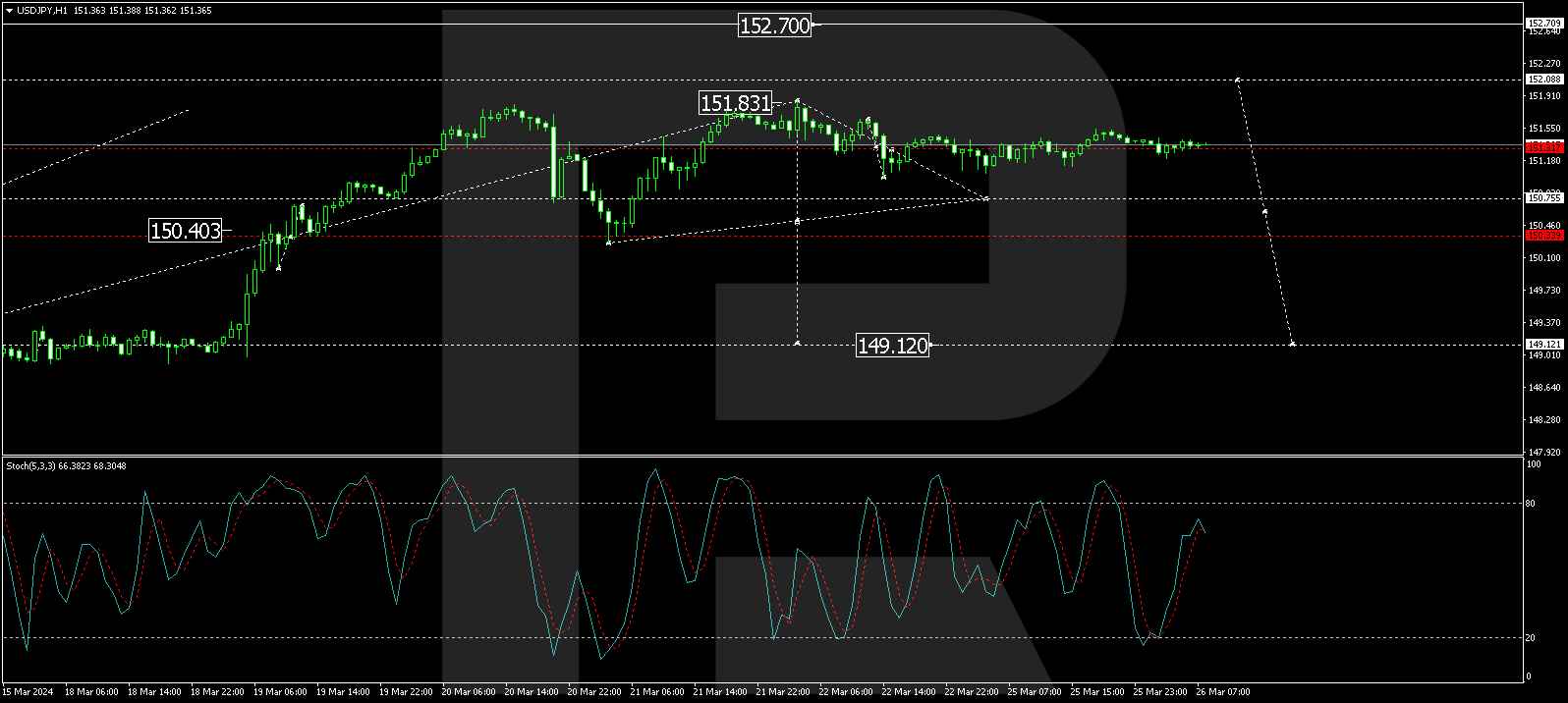

Technical analysis of USD/JPY

On the H4 chart of USD/JPY, a growth wave to 151.85 has been completed. This target is local and estimated. The market is currently forming a consolidation range below this level. With a downward breakout from this range, a correction to 149.12 is possible, after which a new growth wave to 152.70 is anticipated. The MACD oscillator supports this scenario, with its signal line directed downwards towards the zero line.

On the H1 chart of USD/JPY, a narrow consolidation range has formed around 151.31. A downward breakout and continuation of the correction to 150.75 are expected. Breaking through this level would open potential towards reaching 149.20, followed by an increase to 151.85. The Stochastic oscillator confirms this scenario, with its signal line below 80 and preparing for a decline to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Japanese Yen Awaits Intervention Amid Weakness Mar 26, 2024

- NETH25 index chasing new record highs! Mar 26, 2024

- Stocks: What to Make of All This Insider Selling Mar 25, 2024

- Inflationary pressures are rising in Singapore and Malaysia. Japan’s currency policymakers are again talking about intervention Mar 25, 2024

- Trade Of The Week: CN50 flirts with critical resistance Mar 25, 2024

- Gold’s Prospects Look Promising Mar 25, 2024

- COT Bonds Charts: Speculator Bets led by 5-Year Bonds & 2-Year Bonds Mar 23, 2024

- COT Soft Commodities Charts: Speculator Positions led by Corn & Soybeans Mar 23, 2024

- COT Stock Market Charts: Speculator Bets led by S&P 500 & EAFE Mar 23, 2024

- COT Metals Charts: Speculator Bets led by Copper & Silver Mar 22, 2024