The forex markets roared back to life from holiday lull in early US session, Dollar surges broadly as buoyed by unexpectedly strong ISM manufacturing data. This report marks a pivotal shift for the sector, which has transitioned back into expansion after 16 months of contraction. Additionally, the prices component of the report soared to its highest level since mid-2022. This resurgence poses the question of whether the greenback can sustain its newfound momentum, with further scrutiny from upcoming ISM Services and Non-Farm Payroll data anticipated later in the week.

On the day, New Zealand Dollar emerged as the weakest link, followed by Euro and Sterling. The Canadian Dollar, meanwhile, found itself as the second strongest performer, albeit at a considerable distance behind the surging greenback, with Yen not far behind. Aussie and Swiss Franc occupy the middle ground.

Looking ahead to the Asian session, two critical developments are anticipated. First, with Yen nearing the 152 handle against Dollar once more, market participants are on high alert for verbal (or actual?) intervention from Japan. Second, Australian Dollar is set to face scrutiny as traders digest RBA’s minutes, seeking clarity on the central bank’s stance of “not ruling anything in or out.”

Technically, NZD/USD’s decline resumes today and hits as low as 0.5949 so far. Near term outlook will stay bearish as long as 0.6037 support turned resistance holds. Next target is 100% projection of 0.63368 to 0.6037 from 0.6215 at 0.5884. Decisive break there will strengthen the case that whole decline from 0.6537 (2023 high) is resuming through 0.5771 low.

US ISM manufacturing rises to 50.3, first expansion in 16 mth, prices surge

US ISM Manufacturing PMI rose from 47.8 to 50.3 in March, above expectation of 48.5. The sector is now back in expectation for the first time since September 2022.

Looking at some details, new orders rose from 49.2 to 51.4. Production jumped from 48.4 to 54.6. Employment rose from 45.9 to 47.4. Prices rose from 52.5 to 55.8, highest since July 2022.

ISM said: “The past relationship between the Manufacturing PMI and the overall economy indicates that the March reading (50.3 percent) corresponds to a change of plus-2.2 percent in real gross domestic product (GDP) on an annualized basis,” says Fiore.

Japan’s Tankan survey: Service sector’s optimism at highest since 1991

Japan’s Q1 quarterly Tankan survey unveils mixed economic sentiment among the nation’s large businesses. Service sector expressed their highest levels of optimism in over three decades, contrasting with a slight decline in confidence among manufacturers.

Large manufacturing index dropped from 13 to 11, still surpassing expectation of 10. However, outlook for large manufacturing firms saw modest increase from 8 to 10, slightly below forecasted 11.

On the brighter side, non-manufacturing index climbed from 32 to 34, exceeding expectations of 31 and marking the highest level since 1991. Despite this, non-manufacturing outlook remained steady at 27, falling short of anticipated 30.

Additionally, large all-industry Capex gauge, which measures capital expenditure plans across industries, is projected to grow by 4% in the new fiscal year. This figure, though positive, falls significantly below the anticipated 9.2% growth.

Japan’s PMI manufacturing finalized at 48.2, worst of weakness has passed

Japan’s PMI Manufacturing was finalized at 48.2 in March, up from February’s 47.2, highest in four months.

Usamah Bhatti of S&P Global Market Intelligence noted that while the sector’s performance remained “downbeat,” there were emerging signs that the “worst of the weakness had passed”. This observation is based on softer reductions observed in both output and new orders inflows.

However, it’s important to highlight that the average PMI reading for Q1 stood at 47.8, indicating the weakest quarterly performance since Q3 2020, when it was 46.7.

Inflationary pressures “remained marked” Although the rate of input price inflation has moderated to its weakest in over three years, the challenge of high costs persists. In response to these pressures, selling price inflation has intensified to a three-month high, reflecting manufacturers’ efforts to safeguard profit margins by transferring higher expenses onto their customers.

China’s NBS PMI manufacturing rises to 50.8, first expansion in six months

China’s official NBS PMI Manufacturing climbed from 49.1 to 50.8 in March, surpassing expectations of 50.1. This uptick not only marks the sector’s first expansion in six months but also represents its highest reading in a year

Details showed notable increases in manufacturing production, which leaped from 49.8 to 52.2, and new orders, which surged from 49.0 to 53.0. Furthermore, new export orders rose from 46.3 to 51.3.

PMI Non-Manufacturing also showed positive momentum, climbing from 51.4 to 53.0, slightly above anticipated figure of 51.3. PMI Composite index, which encompasses both manufacturing and non-manufacturing activities, improved from 50.9 to 52.7,

Zhao Qinghe, senior statistician at NBS, attributed the March surge to increased production resumption efforts following Lunar New Year holiday, alongside improvement in market vitality.

China’s Caixin PMI manufacturing ticks up to 51.1

China’s Caixin PMI Manufacturing rose from 50.9 to 51.1 in March, above expectation of 51.0, marking the highest level in 13 months.

Wang Zhe, Senior Economist at Caixin Insight Group, noted acceleration in both supply and demand within sector with “overseas demand picking up”.

Despite the overall improvement, employment continued “contraction. Additionally, “depressed price level worsened”.

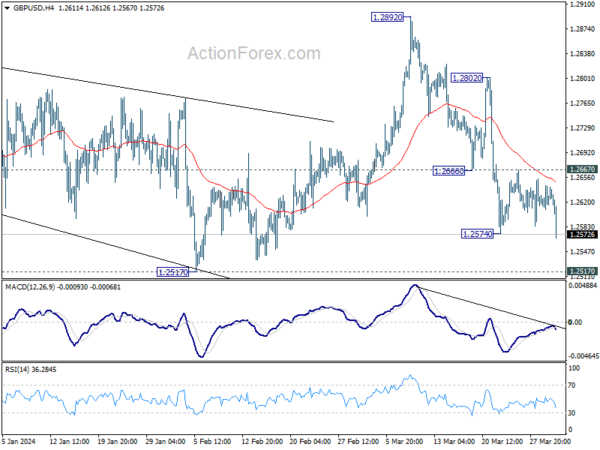

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2608; (P) 1.2626; (R1) 1.2643; More…

GBP/USD’s fall from 1.2892 resumed by breaking 1.2574 support. Intraday bias is back on the downside for 1.2517 structural support first. Decisive break there will suggest that rise from 1.2036 has completed at 1.2892 already, and turn near term outlook bearish. For now, risk will stay on the downside as long as 1.2667 resistance holds, in case of recovery.

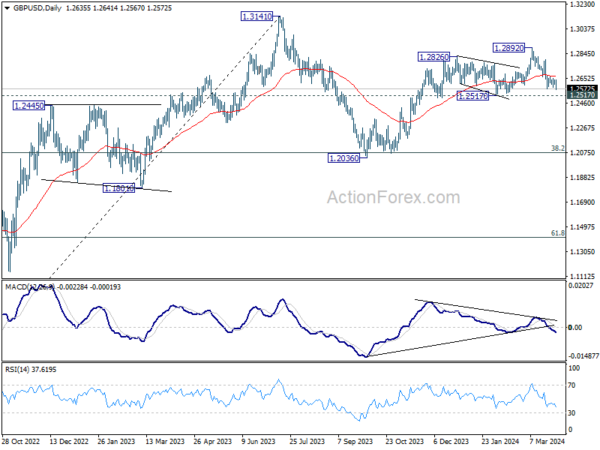

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which might still be in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 11 | 10 | 12 | 13 |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 34 | 31 | 30 | 32 |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | 10 | 11 | 8 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | 27 | 30 | 24 | 27 |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 4.00% | 9.20% | 13.50% | |

| 00:30 | JPY | Manufacturing PMI Mar F | 48.2 | 48.2 | 48.2 | |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 51.1 | 51 | 50.9 | |

| 13:30 | CAD | Manufacturing PMI Mar | 49.8 | 49.7 | ||

| 13:45 | USD | Manufacturing PMI Mar F | 51.9 | 52.5 | 52.5 | |

| 14:00 | USD | ISM Manufacturing PMI Mar | 50.3 | 48.5 | 47.8 | |

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 55.8 | 52.8 | 52.5 | |

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 47.4 | 45.9 | ||

| 14:00 | USD | Construction Spending M/M Feb | -0.30% | 0.50% | -0.20% | |

| 14:30 | CAD | BoC Business Outlook Survey |