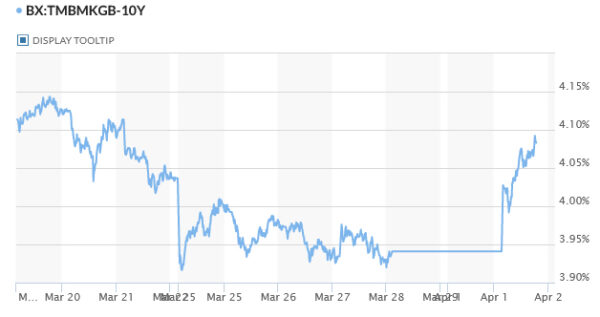

Currency markets shifted their attention towards the sell-off in Swiss Franc today, a reaction to the substantial rally observed in European and US treasury yields. With the 10-year yields in Germany and UK climbing back above 2.4% and towards 4.1% respectively, and US 10-year yield setting sights on 4.4%.

The surge in yields comes on the heels of unexpectedly strong manufacturing data from UK today and US yesterday, suggesting a resurgence in the sector globally. This development may provide some relief for global central banks, easing the imperative for continued rate cuts and offering a more nuanced approach to monetary policy adjustments.

Overall in the forex markets, Yen and Dollar are also under mild scrutiny, shedding gains against European majors and ranking as the next weakest currencies after Swiss Franc so far. In contrast, Australian Dollar is trading as the strongest currency of the day, with Sterling and New Zealand Dollar trailing behind. Euro and Canadian Dollar find themselves positioned in the middle of the pack.

Technically, Silver’s near term pull back could have completed at 24.31 already with this week’s strong rally. Immediate focus is now on 25.91/26.12 resistance zone. Decisive break there will confirm resumption of whole medium term rebound from 17.54. Next target will be 61.8% projection of 17.54 to 26.12 from 21.92 at 27.22.

In Europe, at the time of writing, FTSE is up 0.30%. DAX is down -0.12%. CAC is down -0.10%. UK 10-eyar yield is up 0.1541 at 4.095. Germany 10-year yield is up 0.121 at 2.425. Earlier in Asia, Nikkei rose 0.09%. Hong Kong HSI rose 2.36%. China Shanghai SSE fell -0.08%. Singapore Strait Times rose 0.40%. Japan 10-year JGB yield rose 0.0104 to 0.752.

ECB consumer survey reveals 1-yr inflation expectations drop to 3.1%, a two-year low

ECB’s Consumer Expectations Survey for February indicated continuing decline in consumers’ median inflation perceptions over the past 12 months, marking a fifth consecutive month of decrease, settling at 5.5% down from 6.0% in January.

Furthermore, median expectations for inflation over the next 12 months have dipped to 3.1% from 3.3%. This level is the lowest recorded since the onset of Russia’s conflict with Ukraine in February 2022.

Expectations for inflation three years ahead remained stable at 2.5%.

Eurozone PMI manufacturing finalized at 46.1, two largest cylinders out of action

Eurozone PMI Manufacturing was finalized at 46.1 in March, down from February’s 46.5. Disparities across member countries continued, with Greece achieving a 25-month high at 56.9, Italy at 12-month high at 50.4, and Spain dipped slightly to 5.1.4. Meanwhile, Germany recorded a 5-month low at 41.9, and France fell to 46.2.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, provided a grim outlook based on the latest PMI figures, suggesting that the recession in Eurozone’s manufacturing sector is likely to persist.

De la Rubia noted that Eurozone’s manufacturing industry, heavily reliant on the collective output of Germany, France, Italy, and Spain—known as the Euro-4 countries—faces significant challenges as Germany and France experience notable downturns. While Italy and Spain showed signs of recovery in March and February, respectively, their improvements have yet to offset the overall sector’s decline.

While that the pace of decrease in incoming orders has slowed in the first quarter, yet the industry still records a net loss in orders compared to the previous months. This trend raises concerns that the sector may soon exceed the longest contraction spell for incoming new orders recorded during the euro crisis from 2011 to 2013. Such a scenario underscores the difficulties facing a swift reversal in manufacturing activity across Eurozone.

UK PMI manufacturing finalized at 50.3, signaling first growth since July 2022

UK PMI Manufacturing was finalized at 50.3 in March, climbing from February’s 47.5 to mark a 20-month high. This development represents the sector’s first move above the critical 50.0 threshold since July 2022, indicating a tentative resurgence in manufacturing activity.

Rob Dobson, Director at S&P Global Market Intelligence, highlighted, “The end of the first quarter saw UK manufacturing recover from its recent doldrums.” This recovery is attributed primarily to revival in production and new orders, spurred by strengthening domestic demand. Despite the growth being characterized as hesitant, following year-long downturns, the shift towards expansion signals a turning point for the sector.

The resurgence in demand has also buoyed manufacturers’ confidence, with positive sentiment reaching an 11-month peak. Remarkably, 58% of companies surveyed anticipate increase in their output over the coming year.

However, challenges persist, including “weak export performance and supply chain stresses,” which continue to hinder the sector’s full recovery potential. The EU market, in particular, has been identified as the “main drag” on overseas demand, compounded by ongoing issues in the Red Sea impacting supply chains.

RBA minutes: No rate hike discussed, focus on preserving labor market gains

RBA’s minutes from March 18-19 meeting revealed no explicit discussion on rate hikes, marking a departure from previous communications that outlined the board’s considered options.

The board assessed that it would require more time to gain “sufficient confidence” in inflation’s return to target range within a foreseeable timeframe. At the same time, it emphasized on the priority to “preserve as many of the gains in the labor market as possible.”

These considerations led to the characterization of the policy outlook as ambiguous, with the board finding it “difficult to either rule in or out future changes” in the cash rate target.

Inflation remains elevated, albeit on a gradual decline towards the target, while labor market is approaching conditions synonymous with full employment. In light of these observations, maintaining the cash rate target unchanged was deemed the most suitable course of action.

The board also recognized that risks had become little more even”, noting that recent data did not suggest “materialisation of upside risks to inflation” and confirmed an anticipated slowdown in economic output.

RBNZ’s Orr asserts laser-focused commitment to inflation control

RBNZ Governor Adrian Orr articulated a firm stance today and emphasized that the committee is “laser-focused” on steering inflation back to its target range.

Orr’s acknowledged the progress and RBNZ is “on track” getting inflation back to targets. Yet he also tempers expectations by noting that the journey is far from complete with the admission that they are “not there yet.”

A critical element highlighted by Orr concerns inflation expectations, which he identifies as a significant challenge in the battle against rising He pointed out the cyclical nature of inflation expectations, stating, “the more people think inflation will rise next year, the more inflation will rise next year.”

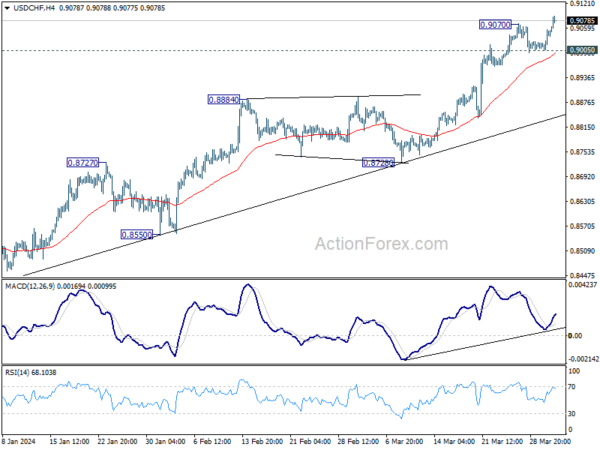

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9014; (P) 0.9036; (R1) 0.9066; More….

USD/CHF’s rally resumed by breaking through 0.9070 temporary top and intraday bias is back on the upside. Current rally is in progress for 0.9243 key resistance next. On the downside, break of 0.9005 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, price actions from 0.8332 medium term bottom as tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8728 support holds. But upside should be limited by 0.9243 resistance, at least on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Feb | 1.30% | 2.20% | 2.50% | |

| 23:50 | JPY | Monetary Base Y/Y Mar | 1.60% | 2.50% | 2.40% | |

| 00:00 | AUD | TD Securities Inflation M/M Mar | 0.10% | -0.10% | ||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 06:30 | CHF | Real Retail Sales Y/Y Feb | -0.20% | 0.40% | 0.30% | |

| 07:30 | CHF | Manufacturing PMI Mar | 45.2 | 44.9 | 44 | |

| 07:45 | EUR | Italy Manufacturing PMI Mar | 50.4 | 48.8 | 48.7 | |

| 07:50 | EUR | France Manufacturing PMI Mar F | 46.2 | 45.8 | 45.8 | |

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 41.9 | 41.6 | 41.6 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 46.1 | 45.7 | 45.7 | |

| 08:30 | GBP | Manufacturing PMI Mar F | 50.3 | 49.9 | 49.9 | |

| 08:30 | GBP | Mortgage Approvals Feb | 60K | 57K | 55K | |

| 08:30 | GBP | M4 Money Supply M/M Feb | 0.50% | 0.20% | -0.10% | |

| 12:00 | EUR | Germany CPI M/M Mar P | 0.40% | 0.40% | 0.40% | |

| 12:00 | EUR | Germany CPI Y/Y Mar P | 2.20% | 2.40% | 2.70% | |

| 14:00 | USD | Factory Orders M/M Feb | 1.00% | -3.60% |